In 2019, Samsung released the Galaxy Fold – an innovative, foldable phone model that allowed one device to work as both a phone and a tablet. When fully extended, the screen was over 18cm long. The phone also featured some market-leading features, such as being able to transfer an app from phone mode to tablet mode seamlessly and run three different apps on the screen at once.

So what happened?

Despite pushing the boundaries of what was achievable in the smartphone market, the Galaxy Fold struggled to connect with consumers, highlighting the importance of addressing consumer pains and motivations as a bedrock of strategic innovation. Firstly, when the phone was folded, it became as thick as two phones and inconvenient to carry. Secondly, the folded screen proved too small to be truly useful. Additionally, the device exhibited considerable fragility. In hindsight, it’s clear that Samsung failed to resonate with consumers and justify the nearly $2,000 price tag.

This example underscores the idea that mere innovation may not be enough. While consumers do respond to novel features and capabilities, success in innovation requires a deeper understanding of consumer pain points and motivators. Brands must cultivate empathy toward these aspects to craft products that genuinely enhance the day-to-day lives of consumers and drive sales growth.

Consumer behavior is changing

There has been a seismic change in the way consumers behave over the last decade. Several disruptive trends have converged to shift the purchasing journeys many consumers take, and the considerations that go into that purchase too. While the added flexibility and convenience of multichannel retail is giving consumers more routes to purchase than ever before, stagnating global growth and high inflation are putting additional pressure on household budgets. With the lingering effects of Covid, geopolitical disruptions and growing concerns about sustainability added to the mix, it is clear that consumer sentiment has changed significantly.

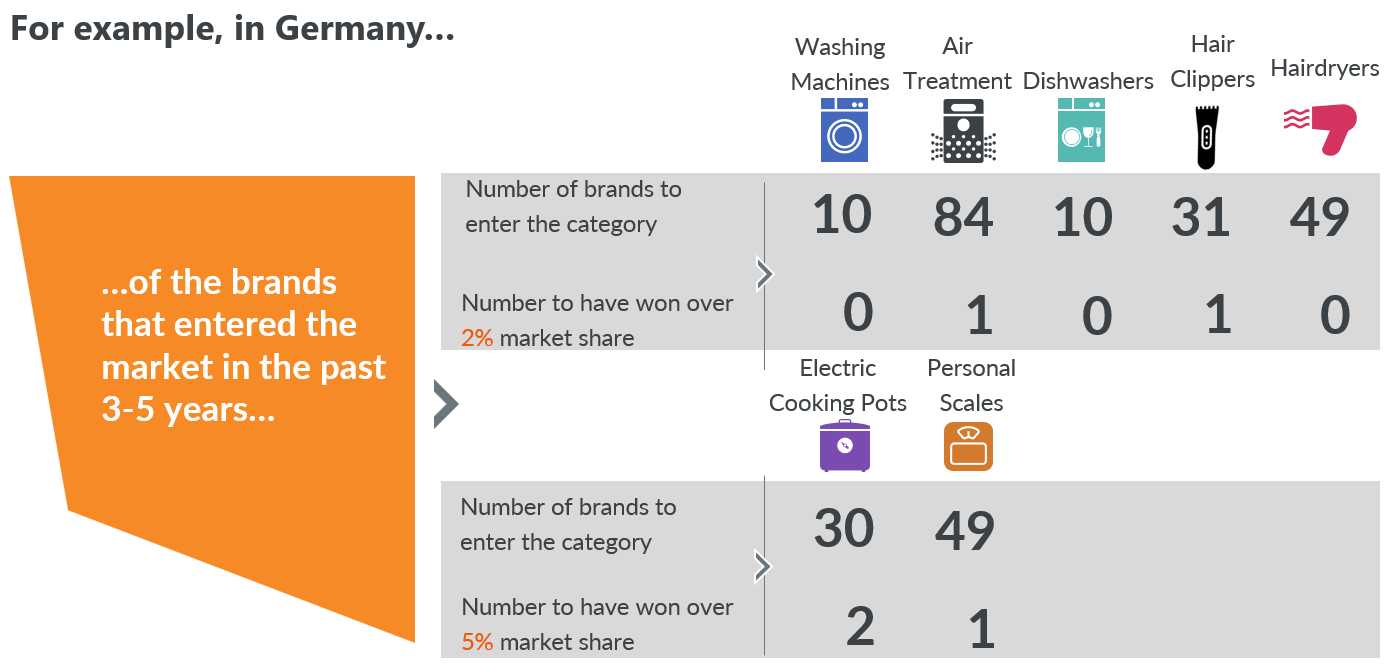

Today, 47% of consumers report a preference for owning fewer but higher quality items. When considering buying a small domestic appliance (SDA) for example, 64% of consumers consider product features as the most important factor – compared to 54% who will always look for a reliable brand. We can see this playing out in the ongoing battle between leading kitchen appliance brand Russell Hobbs with relative newcomer Ninja. While the former has a reputation for excellence, the latter is winning market share through a focus on innovative features. There is still an entrenched advantage for established brands, particularly those that have a trusted reputation, as 43% of consumers will only buy from a well-known brand. In Germany, there have been a huge number of new entrants into different categories over the last three to five years, including 84 brands marketing air treatment and 31 doing the same for hair clippers. However, only each one of these has managed to gain 2% market share. When it comes to washing machines, dishwashers or hairdryers, the picture is even tougher with none of the new entrants gaining 2% market share.

Understanding what consumers want from product innovation

Consumer confidence began to stabilize in 2023 at a low level. Many consumers have adapted to life in a poly-crisis of high inflation and stagnating growth by reducing discretionary spending in certain segments or across the board. In this environment, innovation for the sake of innovation is not going to convince cautious consumers to make a purchase. Instead, it is strategic innovation that has a direct impact on their lives that will have the biggest impact.

In 2023, four areas have emerged as the key ways for brands to target innovation investment in ways that resonate with consumers across all income groups:

- Simplifying tasks – People want products that help them optimize their time. This can be seen in the growth of air fryers and robot vacuum cleaners. People are willing to buy less often but spend more on products they view as adding value to their lives. This can be seen in the success of affordable premium product ranges.

- Allowing greater experiences – One of the most common examples of this is the trend for remote control of devices. From digital central heating to lights controlled via smartphone apps, consumers are showing a preference for products that allow them to control systems remotely through their connected devices.

- Aspirational design – Consumers still show a desire to own and identify with products that are viewed as desirable and exclusive.

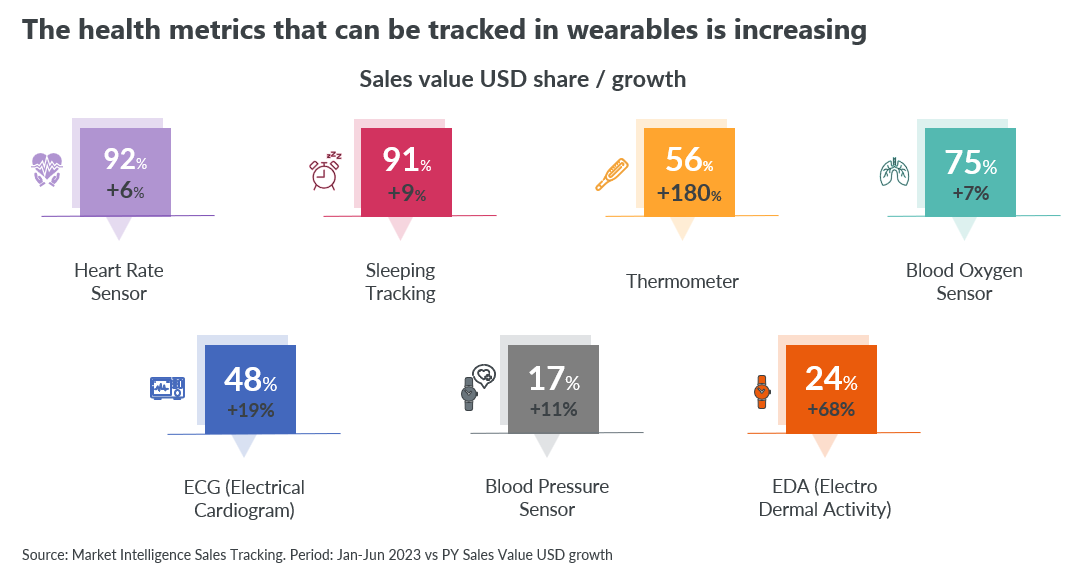

- Enabling enhanced measurability – Greater consumer focus on sustainability savings as well as health and wellbeing are driving consumers toward products that enable closer monitoring of ongoing performance. This can be seen most strongly in the wearables market, where people can now track everything from their sleep to blood pressure.

“Despite high levels of economic uncertainty, consumers still have a very clear idea of what they want from the brands they interact with. If they are not replacing or upgrading existing products, then consumers are on the lookout for products that help them lead happier and healthier lives. Brands need to understand how their products can align with those aims.”

Sheila Kurniadi, Global Consultant gfkconsult

Specific user groups are driving growth

Another way to target innovation investment in a way that can better facilitate sales growth is to focus on specific consumer groups. There are pockets of market growth coming from groups like content creators, gamers and fitness fanatics. Brands that can provide these groups with innovative new features or affordable premium price points could not only drive a growth in sales but help position their brands well for when the market recovers.

The gaming industry, for example, is huge. Every year billions of consumers purchase games, consoles and a range of accessories ranging from specialist furniture to keyboards and VR gear. The market is also expected to continue growing over the next few years, creating a big opportunity for brands that can help gamers achieve higher performance experiences or simplify their setup. The rise in content creation is also helping to stabilize sales of high-end cameras and other specialist light and sound equipment.

Knowing where and how to innovate

For brands looking to make the most of their innovation investments, it is essential to start by looking at the current market environment and how it is influencing consumer pain points and motivation. In this scenario, innovation doesn’t have to re-invent the wheel – it has to add value to people’s everyday lives. Whether it’s through tracking health metrics or helping them cook dinner for their children in minutes, consumers want products that justify their purchase on a daily basis.

Innovation requires insight. Stay ahead of your market with GfK’s consumer intelligence solutions.

![]()