Who’s shopping Beauty?

Beauty is an industry still welcoming steady growth, with a 9.3% boost in dollar sales from 2023 to 2024. Understanding beauty trends by age group is essential for brands looking to connect with consumers on a deeper level and benefit from this growth.

As people move through different life stages, their beauty goals, habits, and product preferences evolve. A Gen Z shopper in their early twenties may be focused on skincare routines aimed at preventing acne, while a Millennial might prioritize anti-aging products as they navigate their thirties. For Boomers, concerns may center around hydration, sensitivity, and hair thinning. By recognizing these shifting needs, brands can tailor their product offerings and marketing strategies to meet consumers where they are in life, ensuring a more personalized and relevant experience.

These evolving beauty priorities are often influenced not just by age but also by lifestyle changes—such as starting a career, building a family, or entering retirement. Each generation brings its own set of behaviors and shopping preferences to the beauty market, from Gen Z’s affinity for social commerce to Boomers’ loyalty to established, trusted brands. By analyzing these trends across generations, our latest report provides insights that allow brands to create products and marketing campaigns that resonate with the unique needs of each group, helping them to capture market share and foster long-term customer loyalty.

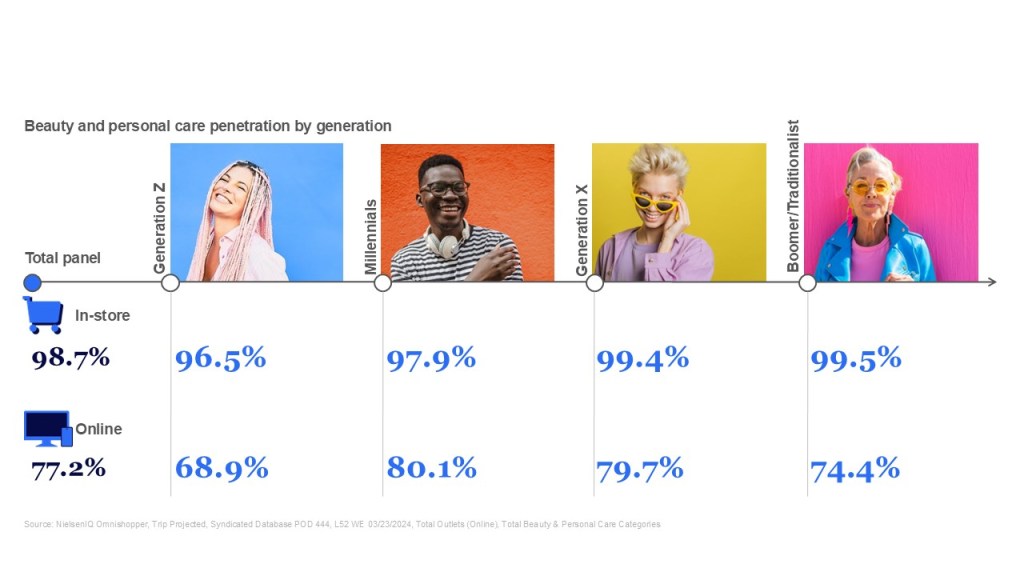

Where are they buying – and how much are they spending?

- Gen Z is making notable strides in physical retail. This generation experienced the most substantial growth in in-store beauty spending, with $4.9B spent. This 41% jump shows that Gen Z are opting for the immediate experience offered in-store.

- Millennials and Gen X lead in online beauty purchases. Millennials top the charts with the highest order frequency and annual online spending, reaching an impressive $16.7B in the 2023 to 2024 period—a significant +13.3% increase from the previous year.

- Gen X also shows strong online engagement, although their spending patterns are more balanced between digital and physical stores.

- Boomers are continuing to adapt to the online marketplace, spending an impressive $11.4B, up 9%. This shift is opening new opportunities to target the demographic through online storefronts and social networks. With the right approach, brands can tap into their significant purchasing power and drive engagement in the beauty market.

Clean and Sustainable looks different across Lifestages

Gen Z is particularly influenced by values such as animal welfare and environmental responsibility. They prefer products that are cruelty-free, reef-safe, and come from brands that demonstrate social responsibility, such as B-Corps or fairtrade practices.

Clean beauty is also a strong motivator for Gen Z, with a preference for products free from harmful ingredients like aluminum, sulfates, and parabens. Millennials share similar values but place slightly less emphasis on these factors.

In contrast, Gen X and Boomers prioritize practical considerations. For Gen X, reduced packaging matters. For Boomers, health and need states like cardiovascular health influence purchases.

For a deeper dive into how factors like social media influence, community engagement, and celebrity drive purchasing decisions across generations, get your full report here.

Spotlight on Gen Alpha

Gen Alpha, a cohort born 2010 onwards, is beginning to make a noticeable impact on the beauty market. Households with children aged 6-17 are spending more proportionally, showing the increasing involvement of Gen Alpha in beauty purchases.

Key insights:

- Skincare Growth: Facial moisturizers are experiencing a notable +36.2% increase in sales, reflecting Gen Alpha’s growing interest in skincare routines from a young age.

- Cosmetics Surge: Sales of cosmetic appliances have also jumped +80.4%, driven largely by social media trends, especially on TikTok.

Brands seeing the most growth with Gen Alpha are those with a strong online presence and significant TikTok followings. These brands are responding to Gen Alpha’s preference for trendy, higher-priced products, capitalizing on their social media-driven purchasing habits. The influencer space is also starting to welcome Gen Alpha-aged participants – a key influence on consumer spending.

Get the full report

For an even more detailed look at the data and access to the latest data and insights, visit our Beauty Inner Circle page now to access the full report, Beauty Behavior Through the Generations.