Inflation

Inflation has impacted every area of the store, and beverage alcohol is no different. This St. Patrick’s Day, consumers can expect to pay more than they did last year for their libations in the Off-Premise.

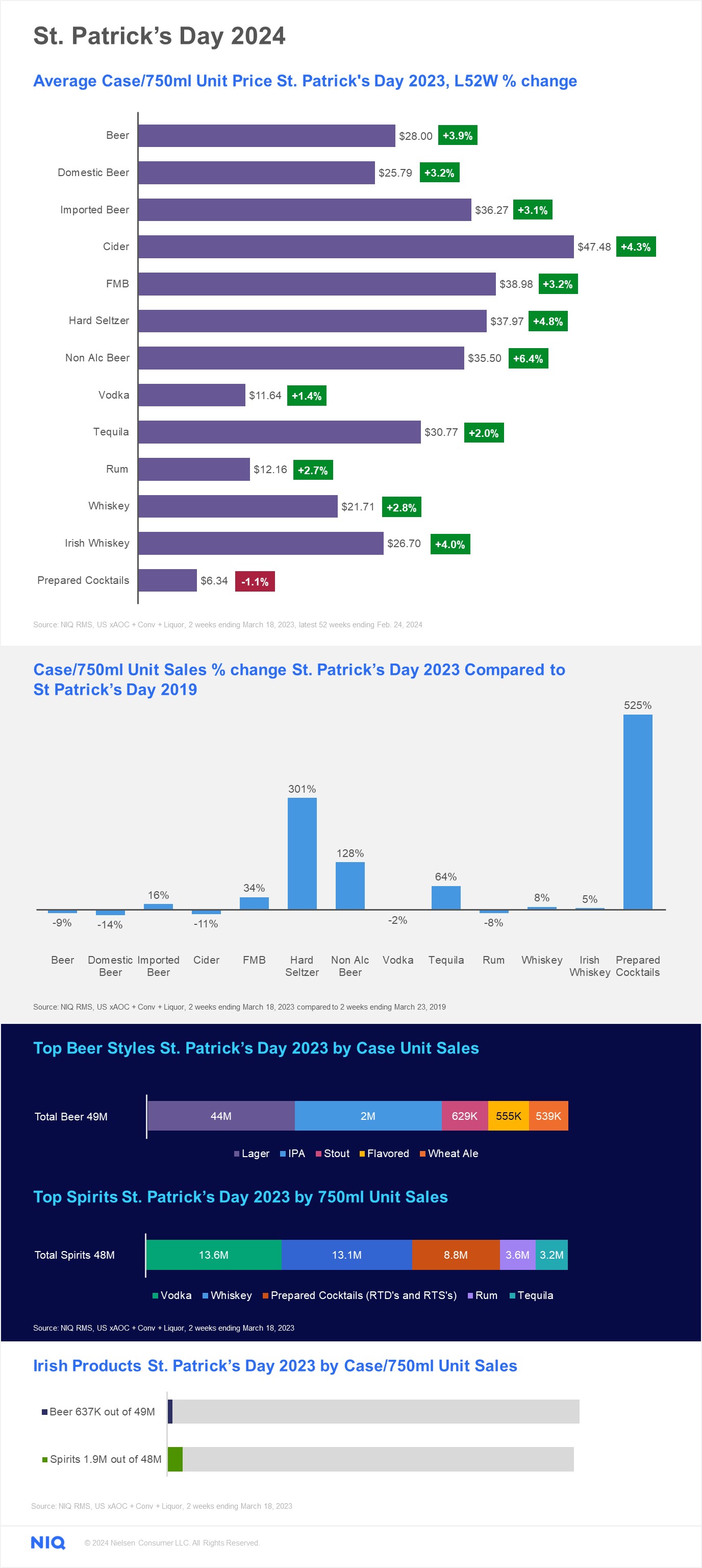

During the 2023 St. Patrick’s Day period, consumers paid $28.00 for a case of beer, a 3.9% increase in the latest 52-week period. The Spirits categories are seeing similar volume increases with vodka (+1.4%), tequila (+2.0%), whiskey (+2.8%), and rum (+2.7%) all seeing average prices increase.1

Units

With prices increasing, there is a general trend of volume decreasing as consumers look to save money, in addition to consumers’ tastes and preferences changing over the years. During the 2023 St. Patrick’s Day period, major categories such as beer (-9%), cider (-11%), vodka (-2%), and rum (-8%) saw unit sales decrease compared to the St Patrick’s Day period in 2019 in the Off-Premise. Categories newer to the market and focused on innovation did see volume sales spike including hard seltzer (+301%), and non-alcoholic beer (128%).2

“In January 2024, Dry January participation saw a rise, with various non-alcohol products achieving early success,” said Kaleigh Theriault, Associate Director of Beverage Alcohol Thought Leadership at NIQ. “ As Dry January evolves into a moderation-focused mindset, non-alc products are expected to excel during this festive occasion.”

Beer, Cider & FMB

Beer, cider, and flavored malt beverages (FMB) are typical for St. Patrick’s Day celebrations, with imported beer (+16%) and FMB’s (+34%) seeing volume sales increase in the Off-Premise during the 2023 St. Patrick’s Day period compared to same period in 2019.2

The top beer styles by volume for St. Patrick’s Day in 2023 included lagers, IPA’s, stouts, flavored beers, and wheat ales. With this, lagers made up 89% of total beer volume sales during the 2023 St. Patrick’s Day period.3

Spirits & RTD’s

Though spirits may not be the first thought on St. Patrick’s Day, many spirits categories performed well during the 2023 St. Patrick’s Day period including prepared cocktails (+525%) and tequila (+64%) when looking at volume compared with the same period in 2019.

The top spirits styles by volume for St. Patrick’s Day in 2023 included vodka, whiskey, prepared cocktails, rum, and tequila.3

Irish Products

Though St. Patrick’s Day is known to be prime time to celebrate all things Irish, Irish beverage alcohol products may not perform the way you think they would in Off-Premise volume sales. For beer, 637K out of 49M volume sales were Irish. For spirits, 1.9M out of 48M volume sales were Irish; the majority of this was made up of Irish whiskey sales, which came in at 1.2M.

What’s ahead?

Looking ahead, it’s evident that consumers are navigating a changing landscape in the beverage alcohol industry. While traditionally a time of festivity and indulgence, the economic realities of inflation are casting a shadow over celebrations.

As prices climb, volume sales are showing a corresponding decline. Consumers are opting for moderation and seeking out alternative options to stretch their budgets. With these changes in consumption patterns, innovation is proving to be a driving force in the market, indicating a shift in consumer preferences as more individuals embrace moderation and seek out alternatives to “traditional” alcoholic beverages.

“For this year, we will potentially see lower EQ volumes but also see continued premiumization across all categories,” Theriault said. “Consumers will be drinking better, but not necessarily more.”

With all these trends overlapping, it will be interesting to see how St. Patrick’s Day plays out in 2024.

- NIQ RMS, US xAOC + Conv + Liquor, 2 weeks ending March 18, 2023, latest 52 weeks ending Feb. 24, 2024

- NIQ RMS, US xAOC + Conv + Liquor, 2 weeks ending March 18, 2023 compared to 2 weeks ending March 23, 2019

- NIQ RMS, US xAOC + Conv + Liquor, 2 weeks ending March 18, 2023

- CGA by NIQ US On Premise Impact Consumer Research Sample (395 – 1598, 03/01/23 to 03/03/23)