Beauty Industry Trends 2025: A Growing Powerhouse

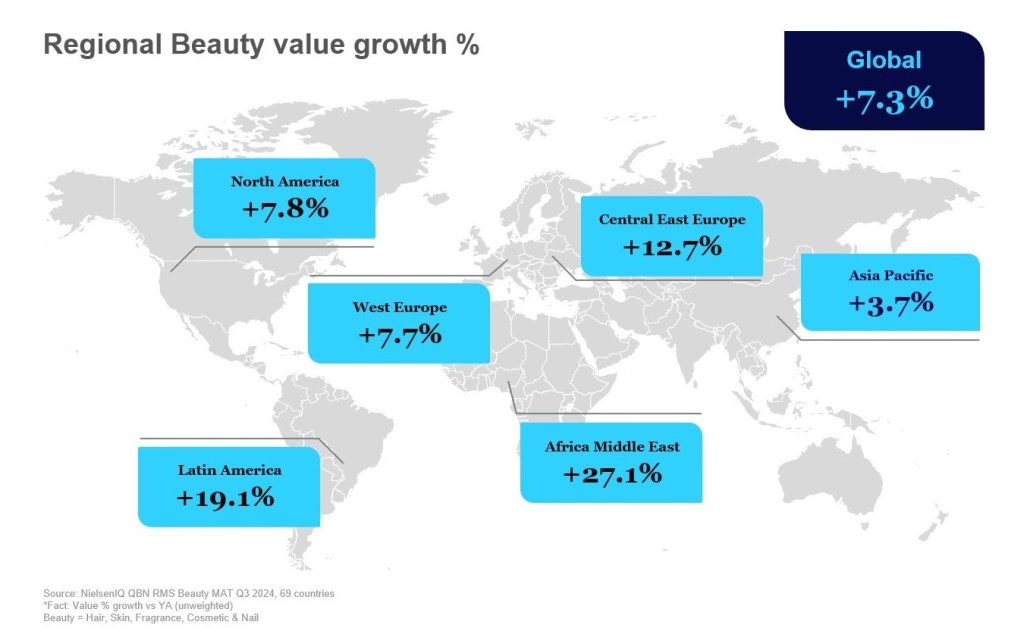

The beauty industry is a global success story, experiencing a value growth of +7.3% year-over-year. While regions like Latin America (+19.1%) and the Africa-Middle East region (+27.1%) are experiencing explosive growth, mature markets such as North America and Western Europe still show strong performances at +7.8% and +7.7% respectively. While this robust global expansion is heavily driven by inflation there are also leading optimistic indicators with rising incomes and new consumers entering the market.

Retail (R)Evolution

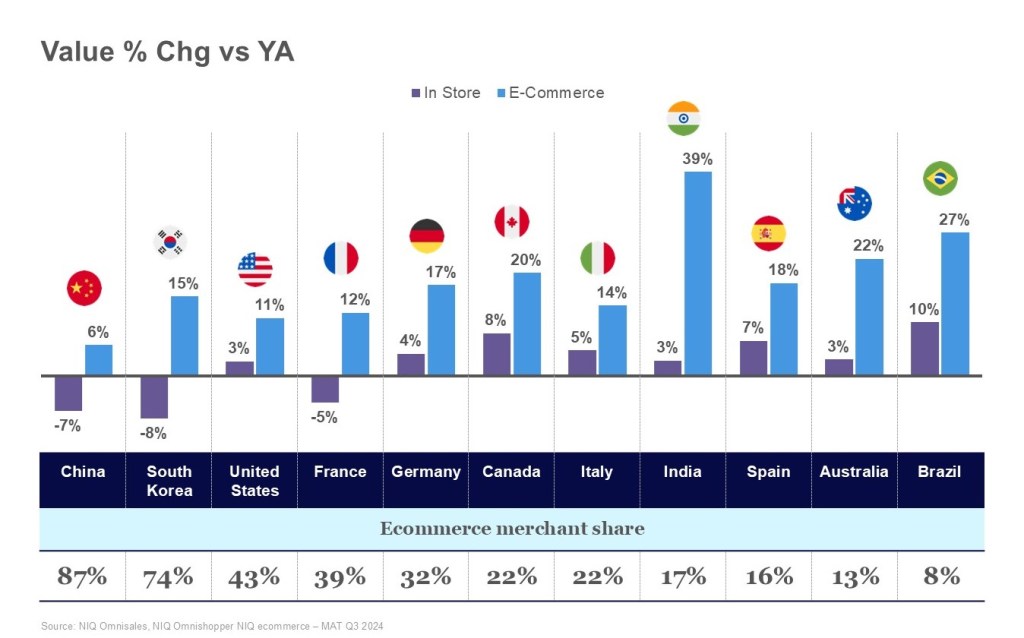

E-commerce continues to dominate the beauty space with a consistent growth trajectory across global markets. Platforms like Amazon, TikTok Shop, and Shein have redefined shopping experiences, blending convenience with discovery. Notably, TikTok Shop ranked as the top e-commerce merchant for cosmetics during Black Friday 2024, reflecting the platform’s role in fueling impulse purchases and brand discovery.

Social commerce has become a global phenomenon, with 68% of purchases on these platforms driven by impulse.

However, in-store retail is far from obsolete. Shoppers value tactile experiences and personalized consultations, particularly for high-investment products like skincare. Yet, challenges persist: theft prevention measures (e.g. locked shelves) have negatively impacted in-store experiences, with 43% of consumers less likely to return to stores with such barriers.

Retailers must balance convenience with customer satisfaction. Investing in hybrid models—seamlessly integrating online discovery with in-store experience—will be critical.

Dive deeper…

If you liked what you’ve read so far, you can download an infographic with more insights from around the globe.

E-commerce Fuels US Beauty Boom

The US beauty market continues to thrive in 2024, with a strong +6.2% dollar growth across both in-store and online channels. Ecommerce remains the powerhouse of beauty retail, now accounting for 41% of all beauty and personal care sales—a testament to the strength of social and quick commerce platforms in driving consumer engagement.

As with other markets, TikTok Shop is a rising star, generating nearly $1B in beauty sales and ranking as the 8th largest health & beauty retailer in the US. Its unique blend of entertainment and shopping has made it a hub for brand discovery and product exploration.

US category growth is led by fragrance and bath & shower, both experiencing continued momentum. The bath & shower segment benefits from a growing consumer focus on total body care, with brands like Bath & Body Works, Dove, and Native seeing significant gains. Fragrance remains a favorite among consumers, with brands such as Sol de Janeiro, Tom Ford, and Gucci driving strong sales as shoppers expand their scent wardrobes.

Innovation: Beauty Industry Trends to Watch

From K-beauty’s influence to AI-powered personalization, innovation is a constant driver in beauty. Acne patches and snail slime, which originated in Korea, have paved the way for emerging ingredients like bio-silk, lactobionic acid, and soil-based formulations. AI and AR tools, such as virtual try-ons and personalized skin analyses, are becoming essential for brands looking to enhance consumer engagement.

At the same time, sustainability is non-negotiable. Clean beauty—encompassing eco-friendly packaging, cruelty-free formulations, and ethically sourced ingredients—has moved from niche to mainstream. Consumers expect brands to be transparent and accountable.

Moreover, inclusivity remains a cornerstone. From addressing taboo topics like hair loss to offering tailored skincare solutions for diverse skin tones, consumers are demanding authenticity and representation.

Brands must balance the allure of cutting-edge innovation with sustainability, ensuring their advancements resonate with ethically conscious consumers.

Generational Shifts: One Size Does Not Fit All

Generational divides in beauty are more pronounced than ever. Gen Z and Millennials are redefining beauty norms, prioritizing skincare over cosmetics and favoring brands that align with their values. In contrast, Gen X and Boomers remain loyal to traditional beauty staples but are showing growing interest in anti-aging and wellness products.

For brands, this generational split underscores the need for tailored messaging. For example, Gen Z’s social media savviness calls for influencer partnerships and TikTok campaigns, while Boomers may respond better to value-driven marketing emphasizing product efficacy and heritage.

Brands must adopt a multi-faceted approach, leveraging data to understand these nuances and curate experiences that resonate with each demographic.

Looking Ahead: The Role of Balance in Beauty Industry Trends

The road to success in beauty lies in mastering the art of balance. Manufacturers and retailers must:

- Blend innovation with sustainability to meet the demands of conscious consumers.

- Embrace both digital and physical retail channels to deliver comprehensive shopping experiences.

- Cater to generational preferences while ensuring inclusivity and representation.

- Innovate boldly, but remain rooted in authenticity and trust.

By seeking balance in these areas, beauty brands can not only thrive but also lead the way in shaping the future of the industry.

Ready to achieve balance with your beauty strategy?

Explore even more insights to fuel your winning game plan by connecting with one of our Beauty experts.

About the author

Tara James Taylor – SVP, Global Beauty Personal Care Vertical

With 25+ years of Beauty experience within the data analytics and consumer insights industry, Tara founded the NielsenIQ US Beauty Vertical and now leads Global Beauty and highly successful teams to drive proactive insights that guide manufacturers through business challenges.