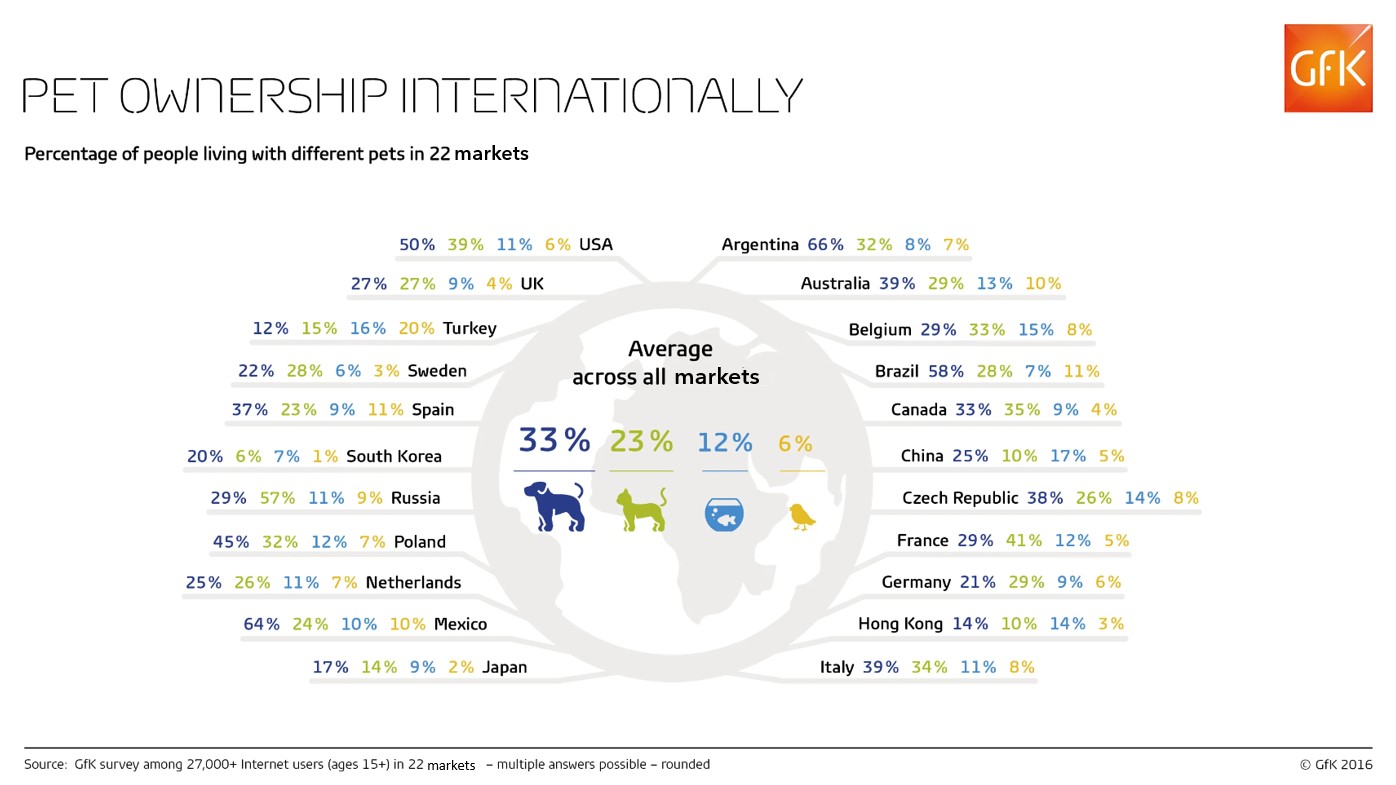

Pets are part of the family in the majority of households worldwide. More than half of people globally have a pet in their home. According to our global study, Argentina, where two in three (66%) own a dog, has the highest incidence of pet ownership, along with Mexico (64%) and Brazil (58%). In contrast, people in Asia are least likely to own a pet. In Hong Kong, for example, just 14% own a dog compared to half of Americans (50%) and more than one third (39%) of Italians.

On average, one third (33%) of households globally have a dog, making it officially man’s best friend. Cats are the second most popular choice and account for less than one quarter (23%) of pet ownership. Fish are the third most popular pet with ownership at 12%. 43% of respondents have no pets in their household.

In a further study we analyzed which flavors where popular and where. The results revealed some surprising trends about how different nationalities feed their beloved companions. Pets in the US, one of the biggest pet food markets in the world, are universally fed on a diet of chicken. Meanwhile, pets in Spain enjoy far greater variety with beef, fish and chicken flavored wet food and treats on the menu. French cats enjoy the gourmet reputation of their owners and, like Spanish pets, enjoy a variety of wet food and treats. However, when it comes to dry food, chicken dominates even in France. Consumers in the Czech Republic, Greece and China buck the tendency towards chicken, favoring beef flavored wet food for their dogs.

However, it is not only the flavors where GfK has discovered some interesting trends: Our data also show that natural pet food accounted well over half (58 percent) of the USA’s total $13 billion spend in the ‘pet specialty’ market, while grain-free came in just short of the 30 percent mark.

The growth of natural and grain-free pet food is not limited to the USA either, with the UK, the Czech Republic and Greece all showing notable demand within both product areas.

In the UK, natural pet food accounted for 38 percent of the total spend for the pet food market in 2015, while grain-free took 15 percent. For the Czech Republic, the figures were 22 percent for natural and 12 percent for grain-free. And, for Greece, it was 20 percent natural and 11 percent grain-free.

With so many households worldwide owning a pet, the pet food market is one that is both well-established and robust. There are two trends, however, that need to be taken into consideration when preparing for the future:

- While pets undoubtedly have global appeal, there are key regional trends both in pet ownership and diet that must be taken into account when considering the global market.

- There is a major trend in the pet food category towards Premiumization and Humanization. Both these trend continue from the past years without showing tailing off. A sign that pets are becoming more and more an integral part of the family. From guard dog to family member. Pet specialty foods, such as Limited Ingredients Diet, are on the rise and reflect social awareness and the wellness, health and ingredient transparency trends popular with pet owners. Also, we see a swing towards smaller package sizes which indicates a growing popularity of smaller dogs, suitable for inner-city pet owners. And for these small breeds, innovation from toys to seasonal treats are hot.