The 2023 picture – Asia Pacific

This year has seen consumers in Asia Pacific (APAC) continuing at a muted level of spending for Consumer Tech & Durables (T&D). Economic worries remain top of mind for consumers across the region, due to extended pandemic restrictions, high inflation and the increased cost of everyday living.

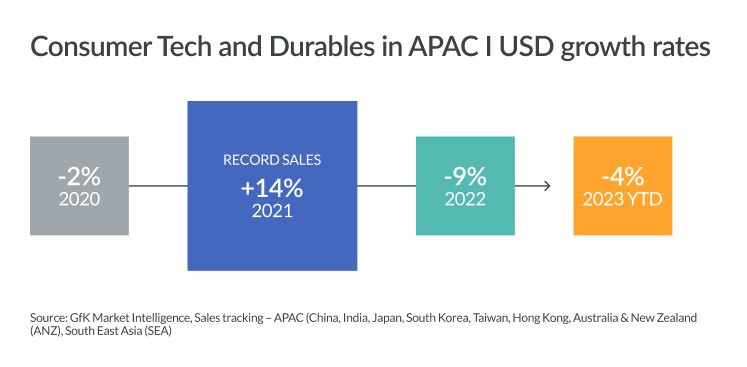

After the record sales for T&D goods seen across the region in 2021, sales in 2022 fell by a sharp 9% year on year, driven by the impacts of strict lockdowns across the region. Thailand, which is highly dependent on tourism, was one of the first Asian markets to lift travel restrictions in 2022, while Mainland China, Hong Kong and Japan were some of the last. In the first half of 2023, sales have continued to decline – showing a further 4% drop compared to 2022.

Stabilization, not normalization

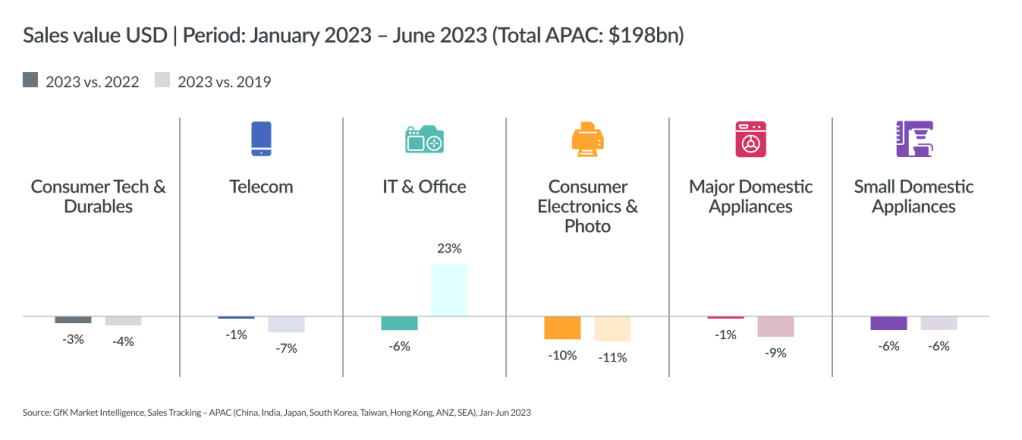

Across the full APAC region (Mainland China, Hong Kong, Taiwan, India, Japan, South Korea, Australia & New Zealand (ANZ), and South East Asia (SEA)), all sectors within T&D saw sales revenue decline in the first half of the year, compared to the same period last year.

Even when we compare sales to 2019, most sectors still show reduced revenue, with only IT & Office showing relative market strength when matched against pre-covid years.

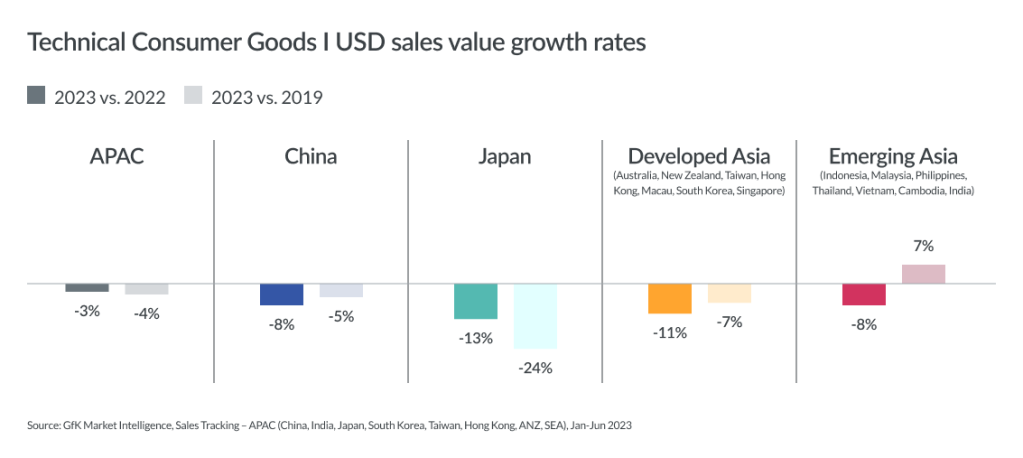

Looking at country and sub-region level within APAC, the markets vary considerably in performance – however, all show a drop in sales revenue (Jan-Jun) compared to last year. Japan has suffered the biggest decline, standing at -13%. This is followed by Developed Asia (-11%) and China and Emerging Asia (both -8%).

When we match those current sales against the pre-pandemic level seen in H1 2019, only Emerging Asia shows a comparatively strong market position, despite the very difficult current conditions.

Regional overview

Across APAC, T&D manufacturers and retailers are facing the crest of what could be termed a perfect storm. The sharp rise in sales in Q4 2021 showcasing demand recovery post pandemic was followed by sales softening towards the second half of 2022 with normalization kicking in. However, by that time, effects of Russia-Ukraine war, increasing inflation, commodity shortages and increased prices led to consumers starting to rationalize their needs vs. expenditures. Key categories, such as TVs, large appliances, smart-mobile phones etc. started to feel the heat of this cautious spending approach and need and convenience-based products like PC and small appliances due to hybrid work-life culture, still continued to grow. These macroeconomic dynamics continued to depress consumers’ urge to replace or upgrade products early, combined with extended covid restrictions in China.

On top of all this, manufacturers and retailers were faced with another concern of high levels of inventory left over from 2022, when consumers reined in their spending and demand slowed down. This posed as a big challenge.

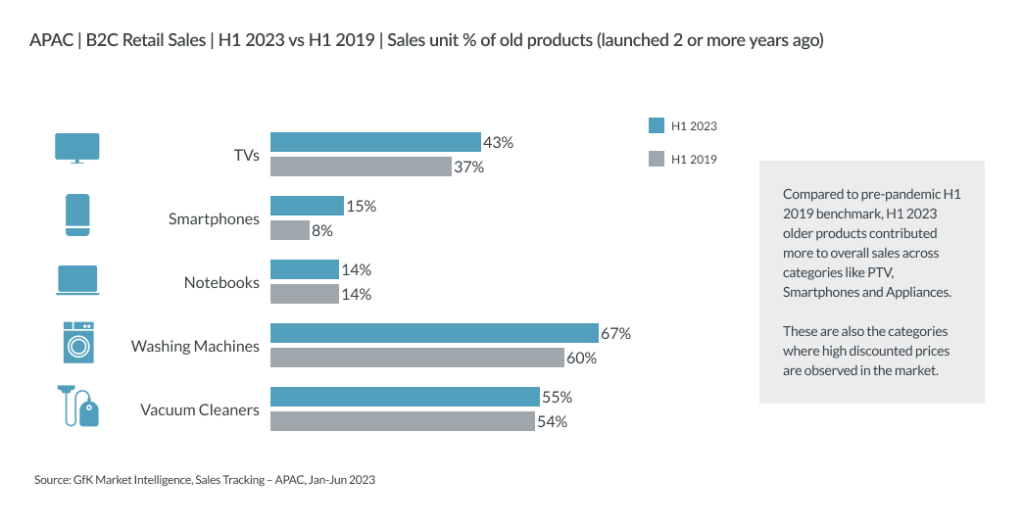

Although the share of newly launched products in categories such as TVs, smartphones-mobilephones-phablets (SMP), laptops, etc is similar to pre-covid levels, however, the liquidation of old stock started taking priority to make way for newer launches.

Across APAC, TV purchases (for example) in H1 saw 43% being of models launched two or more years ago, compared with just 37% in Q1 2019. This points towards elevated inventories at retail stores and manufacturers push to liquidate them first.

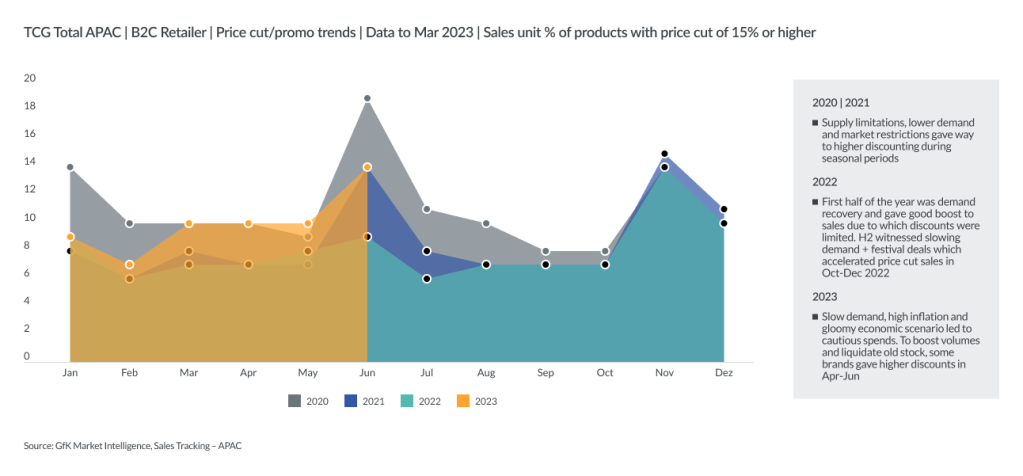

As a result, high inventories are one of the biggest reasons why significant discounts are showing up in first half of 2023, trying to motivate consumers to open their wallets. We therefore expect similar promotions will be crucial to trigger volume demand in the remainder of 2023.

There are always exceptions to the rule; In certain regions, certain brands have declared they will not be doing aggressive promotions this year. Overall, however, our expectation is that October – December 2023 will see discounts at levels beyond prior years, owing to consumers deliberately timing their purchases for these events, and retailers wanting to clear old stock more than in the past year.

What factors will drive consumer spend in 2024+?

Planning for 2024+ global recommendations

How do manufacturers and retailers capitalize on the consumer trends above to shape an ambitious but sustainable strategic plan and budget allocation for 2024+?

With budget planning for 2024 in full swing, these are our global recommendations on how to drive growth over the next few years. The local market and consumer landscape set out above will drive how best these are implemented at regional and country level.

01

Invest in targeted innovation (product & service)

Innovation continues to appeal but must deliver value that is directly relevant to the consumer’s life. Develop targeted, consumer-centric use-cases that show the benefits of upgrading to ‘affordable premium’ models.

02

Build up your brand to be a differentiator, as well as your product

The emotional connection between consumers and a brand plays a crucial role in competitive markets. Balance tactical activity with long-term, upper-funnel brand marketing that allows you to differentiate based on brand, rather than product or pricing alone.

03

Intensify manufacturer-retailer collaboration to optimize omnichannel category management

By teaming up to deliver consumer-centric planning that is unified across their respective merchandising, marketing, and supply chains, manufacturers and their retailers can optimise their mutual goal of creating a consistently personalised and enjoyable product experience at every touchpoint.

04

Planning for the upcoming shopper generation:

Gen Z will soon surpass millennials in size. Two-thirds are aged 15-24 and starting to frame opinions about brands. They consume 53% more content than the average but spend 50% less time on content than millennials. Like any generation, they include complex segments with differing demands.

05

Review regional and category footprint to capitalize regional growth opportunities and mitigate individual category risks

Each region has unique market, category, and consumer dynamics. Manufacturers and retailers must have a full view across all regions and categories, and map this against their own portfolio, to pinpoint where growth opportunities exist for their products.