The world’s leading consumer intelligence company NielsenIQ shared its Türkiye assessment of 2022 as well as the retail and shopper trends that will shape 2023.

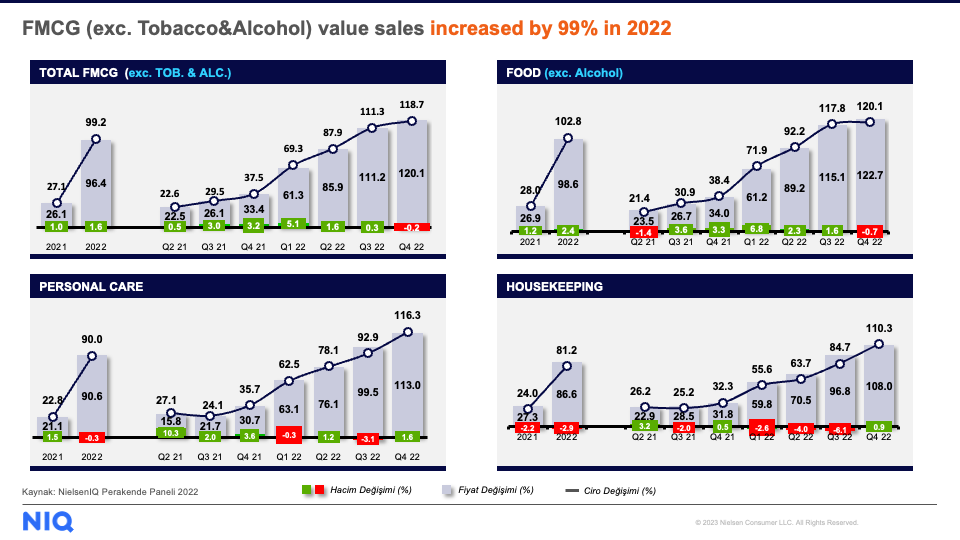

Didem Şekerel Erdoğan, NielsenIQ Türkiye General Manager and Vice President of Analytics for Africa and the Middle East, shared that FMCG retail in Türkiye has grown by 99% in 2022. Şekerel Erdoğan emphasized that when compared to the world FMCG market, which is shrinking in volume, Türkiye is positively differentiated from other countries.

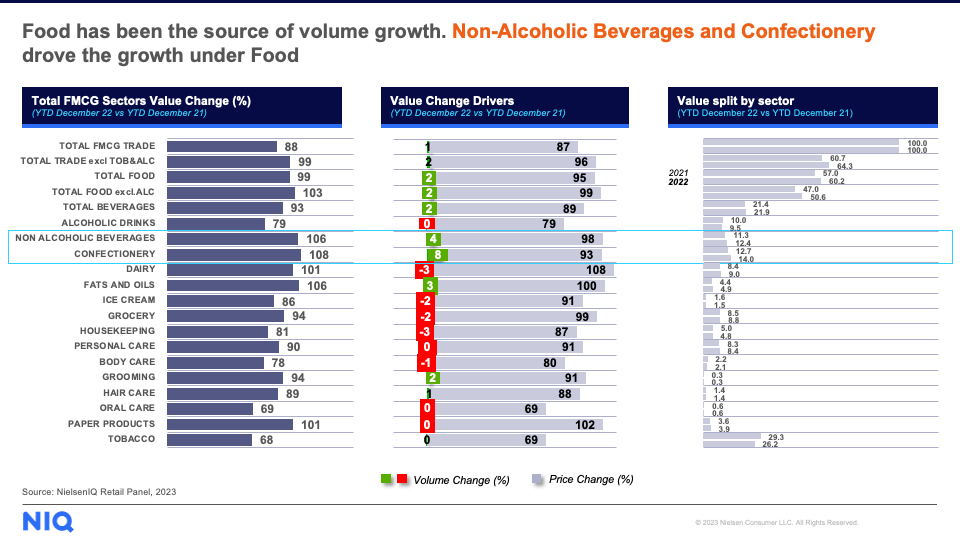

Confectionary and Beverage Groups on the Rise in Türkiye

Didem Şekerel Erdoğan emphasized that it is critical to understand the categories with growth dynamics in the market and that confectionery, beverages and grocery groups are the leading categories in global growth in this respect. Şekerel Erdoğan stated, “When we look at the FMCG growth in Türkiye, we see that especially the food category, and confectionery and beverage groups under the food, deliver growth with their strong volume and turnover performance.”

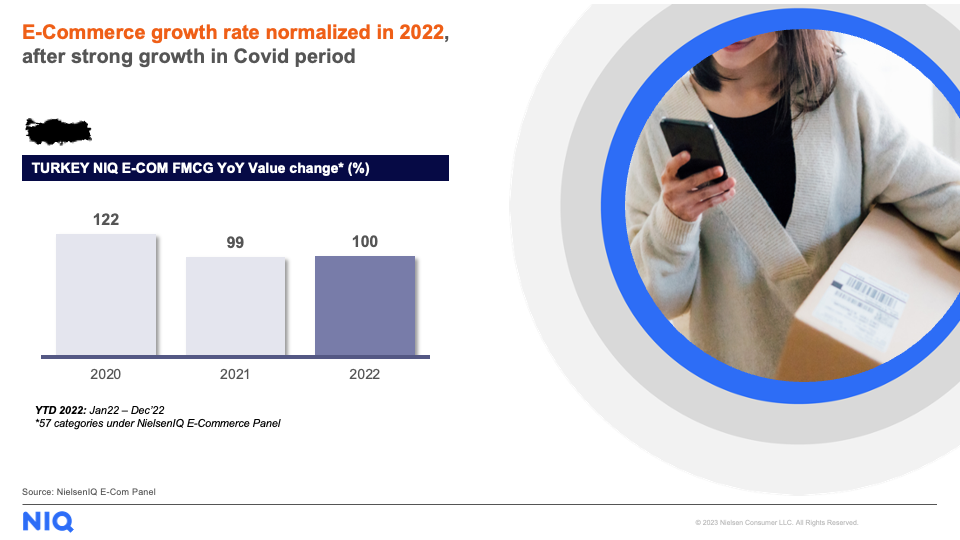

E-commerce recorded 100% turnover growth in 2022

Didem Şekerel Erdoğan, who made remarks regarding e-commerce trends, shared that e-commerce increased its weight in the total FMCG by recording strong growth throughout the world during the pandemic period, which was then normalized in 2022 and called the New Normal period.

Yankı Yalçın, NielsenIQ Türkiye Client Services and E-Commerce Director, stated that E-Commerce had achieved a turnover growth of 100% in 2022 despite this strong base and has gained momentum especially in recent months.

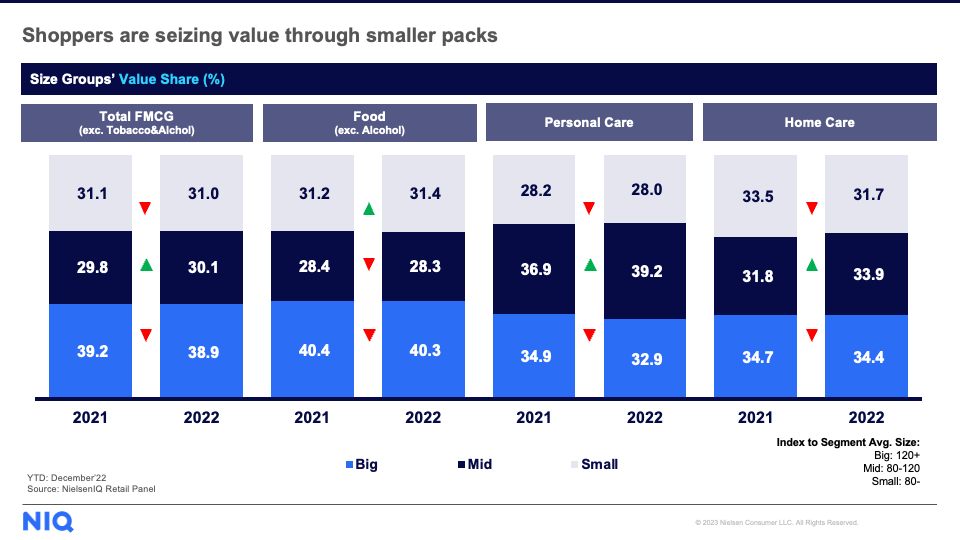

Shopper’s choice is small packages

Referring to the deteriorating price stability around the world and its reflections on consumers, Didem Şekerel Erdoğan emphasized that price increases are observed in all countries, putting pressure on the shopper’s budget and prompting all shoppers to be more cautious.

As a result of this cautious behaviour, “Shoppers buy what they need, when they need, and as much as they need.” Şekerel Erdoğan pointed out that preferences also tend towards smaller packages, adding that innovation continues to maintain its importance.

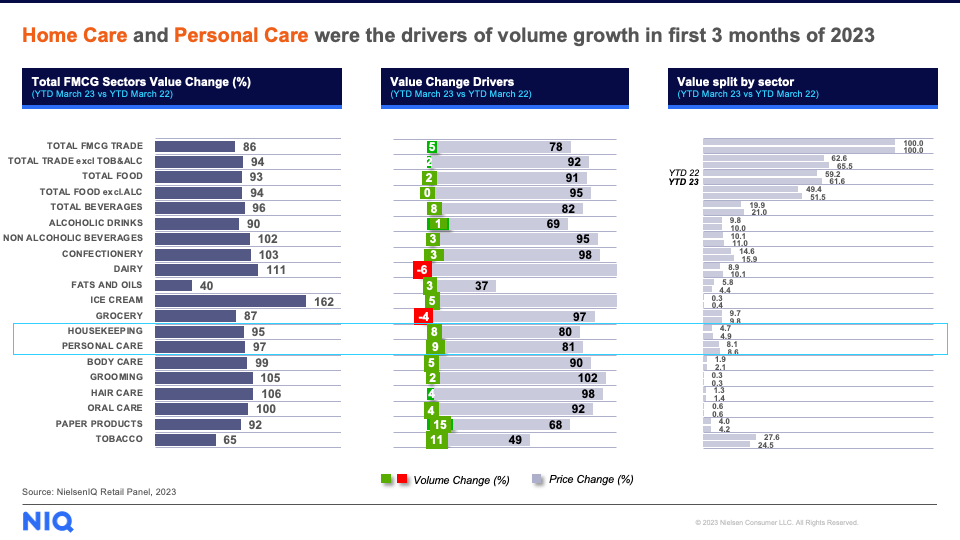

FMCG made a strong start in 2023

Didem Şekerel Erdoğan, who also shared the turnover realizations for the first 3 months of 2023, underlined that the strong growth momentum recorded in 2022 was preserved in the first 3 months.

Şekerel Erdoğan said, “We see that the FMCG market, excluding tobacco and alcohol, has grown by 94% in the first 2 months of the year compared to the same period of the previous year. Under Food, the Beverage and Confectionery groups continued their strong growth with a 3% volume increase. We witness that the Personal Care and Housekeeping categories displayed a strong performance with 9% and 8% growth in volume, respectively.”

Yankı Yalçın shared that FMCG E-Commerce sales also made a strong start to the year and recorded a 110% growth compared to the first 2 months of the previous year.

Earthquake disaster

Didem Şekerel Erdoğan, who also touched upon the effects of the tragic earthquake disaster we experienced as a country, went on to say:

“As a country, we experienced a disaster that we hope never to witness again. Once again, we express our condolences to the relatives of all those who lost their lives and wish a swift recovery.

The earthquake disaster was undoubtedly a factor affecting the entire economy. As NielsenIQ, if we look at the results of the earthquake area in the FMCG consumption structure, we see that the FMCG market, excluding tobacco and alcohol, decreased by 13% in terms of volume in February 2023 compared to the same month of the previous year, while it increased 1% by volume in Total Country level. We consider the growth in the categories of baby food, diapers, razor blades, hygienic pet and wet wipes, which show significant growth in terms of volume in Türkiye, as the impact of aid sent to the region from other provinces.”

10 Trends to Shape 2023

In addition to agriculture and sustainability, Şekerel Erdoğan also touched upon other trends that are expected to leave their mark on FMCG retail in the near future. Sharing that the year 2022, when the transition to the New Normal after the Covid-19 pandemic, was also a year in which consumers were significantly affected by some geopolitical instabilities, supply chain problems and the phenomenon of inflation around the world, Şekerel Erdoğan remarked, “As NielsenIQ, we see that 10 trends that will determine retail and shopper behaviour stand out in 2023, which has superseded the challenging legacy of 2022.”

Didem Şekerel Erdoğan shared the following 10 trends that NielsenIQ created based on the insights gained from recent consumer research and panel data:

NielsenIQ Türkiye Consumer Insights Director Nur Serenli shared the details of “New Consumer and Shopper” “Polarized Consumers” trends

New Consumer and Shopper: With the impact of the habits inherited from the pandemic and the recent price changes, we see that shoppers are more inclined towards domestic consumption. While this situation creates a need for convenience in terms of products to be consumed at home, it also points to a significant change in consumer habits with the increase in domestic activities.

Polarized Consumers: We observe that the economic conditions that affect the income of consumers in different ways during and after the pandemic, lead to the formation of consumer profiles at two different extremes. For this reason, manufacturers and retailers need to take care of the design of their product portfolios in order to meet the needs of both segments.

Didem Şekerel Erdoğan, NielsenIQ Türkiye General Manager and Vice President of Analytics for Africa and the Middle East, shared the details of “Pricing Optimization”, “Re-engineering Value Optimization”, “Healthy Eating – Price Dilemma” and “Era of Portfolio Architecture” trends as such:

Pricing Optimization: Manufacturers and retailers operating in challenging price and supply chain conditions have to manage this situation effectively and keep their prices at the optimum level. Intelligent and predictive analytical studies are critical here.

Re-engineering Value Optimization: We can predict that the price-value perception of the consumer, who is faced with difficult economic conditions, will increase, especially in the direction of promotion and “every day low pricing” (EDLP). However, at the same time premium alternatives should be evaluated by offering additional benefits, without overlooking the polarized consumer dimension.

Healthy Eating – Price Dilemma: The place of healthy eating on the shopper’s agenda is increasing day by day. Providing consumers with healthier alternatives is critical to success. In addition, making these products more accessible by using cheaper packaging methods and equivalent ingredients and offering nutritious alternatives that can replace the main meal to the shopper will also be decisive in success.

Era of Portfolio Architecture: Supply chain issues continue to impact industries across the globe. It is important for retailers to prioritize fast-moving products that bring positive sales to expand the category, and for manufacturers to manage their portfolios at the optimum number of products, not to run out of stocks and to manage cash flow effectively.

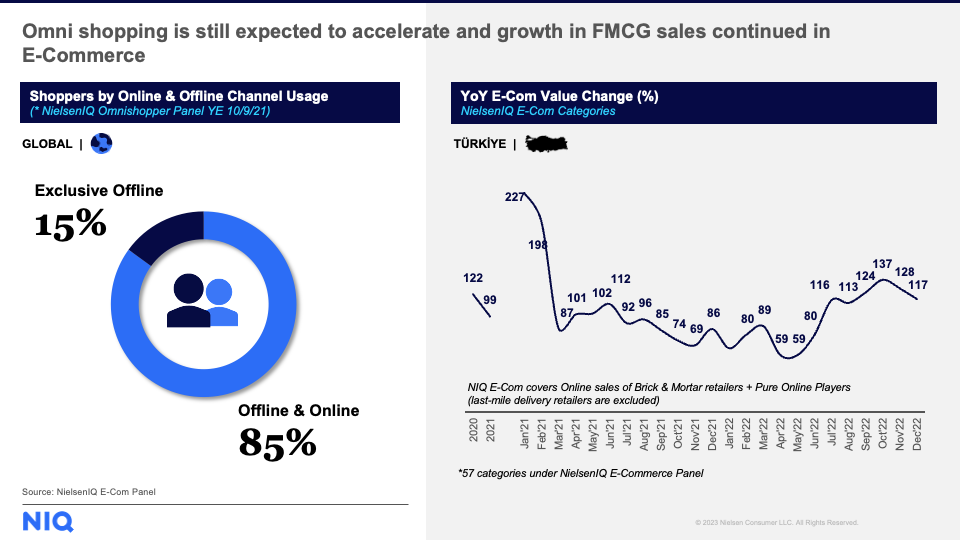

NielsenIQ Türkiye Client Services and E-Commerce Director Yankı Yalçın told about “Omni-Channel Everywhere” trend:

Omni-Channel Everywhere: The shopper, whose online shopping habit has developed with Covid-19, demands an integrated shopping experience almost all over the world. This is also a search for convenience. Manufacturers and retailers who adapt to this search in an agile manner and perform multi-channel management effectively will be the winners of 2023.

Didem Şekerel Erdoğan went on sharing the details of 10 major trends, which are based on NielsenIQ’s recent consumer surveys and retail panel data:

The Pursuit of Health and Wellness: Hygiene habits inherited from Covid-19 conditions continue to manifest themselves in consumer behaviour. In addition, maintaining physical and mental health and the pursuit of fitness are of increasing importance among consumer priorities. Developing products, services and communications that address this quest will create opportunities for companies.

Sustainability: The topic of sustainability, which has been on the agenda for a long time, is rapidly taking its place on the shopper’s agenda as the effects of global climate change are increasingly felt. To offer local and regional solutions that touch the present without waiting for the future, to use environmentally friendly-sustainable packaging and plant-based ingredients, to create an emotional bond with the consumer, to create sustainable business models and to communicate all these things are of paramount importance for retailers and manufacturers to be one step ahead in 2023.

Innovation Trends: Innovation is a phenomenon that all consumers, but especially Turkish ones, expect and are open to. Innovation should not be perceived as a luxury in times when price-value perception is prominent. On the contrary, producing creative products and solutions for changing needs, offering a different and unique product/service portfolio, and transparency are all of key importance in terms of distinguishing positively from the competition in 2023.

Make bold decisions with superior data

When it comes to pivotal business decisions, NielsenIQ has you covered. Our Retail Measurement Services (RMS) data solutions provide businesses with the tools they need to maximize their performance, improve operational efficiency, and make informed decisions.

Contact us today to learn more about how we can help you achieve your business goals