Off-premise ready to drink and ready to serve analysis

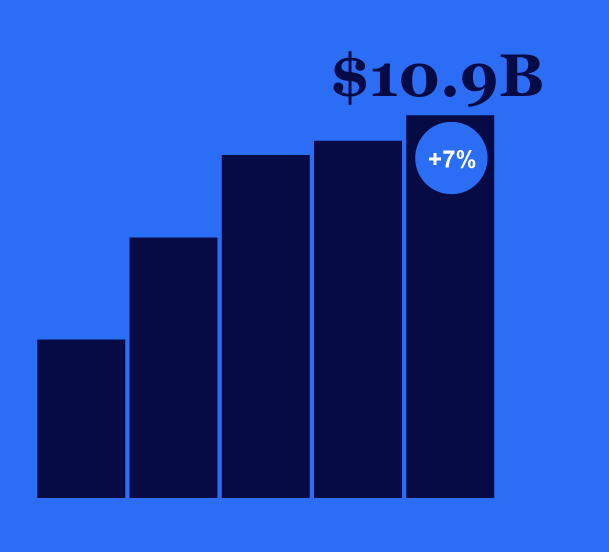

Ready to… products have swept across the US over the past handful of years, making their way into the hands of the LDA Beer, Wine, and Spirits consumer, regardless of the alcohol base. Driving the greatest overlap of consumers of all time, Ready to… products have surpassed $10 billion in the latest 52 weeks and continue to reach new highs year over year.

As the Ready to… category matures, segments face keeping up with the changes of consumer preferences. What once was a positive for Ready to… products, consumers seeking “new and exciting” is now a challenge for Hard Seltzers, as consumers turn to FMBs and Spirits-based Ready to Drink products.

The future of Ready to… products lies within the success

of innovative packaging, premium cocktail offerings,

unexpected flavors, continued recruitment of 21+ Gen Z

consumers, and adapting to the fast-paced Ready to…

innovation cycle.

What’s next for Ready to… products

As LDA consumers of Ready to… products look for the next big thing, suppliers are paying close attention to what works and what doesn’t. Strategies vary, with some leveraging existing brand equities, others creating new brands, and some investing in regional start-up brands. Ready to… brands have earned success through different market approaches, making it challenging to determine a “gold standard” for launching and maintaining these products. Nevertheless, having a go-to-market strategy and an end-of-life plan are essential in this ever-changing environment.

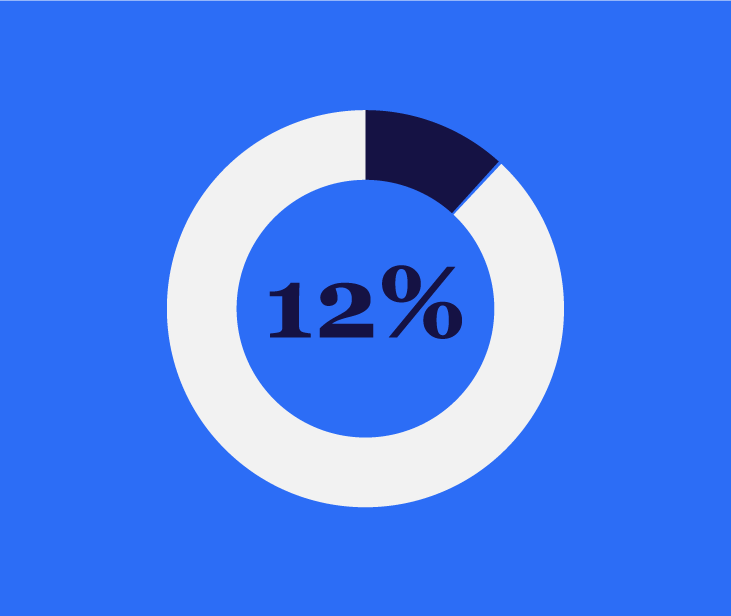

Ready to… has made its mark in the BevAl industry, holding a 12% share, primarily from RTD products. Although it is approaching maturity, there are still opportunities from a distribution perspective. Spirits-based RTDs and Ready to Serve cocktails face limitations in the crucial Convenience channel due to legal constraints. However, as legal changes occur, a multi-million-dollar opportunity opens up for these products.

Despite concerns about the longevity of Ready to… products, it is evident they are here to stay. The UPC proliferation will likely continue for a while, but over time, retailers and consumers will decide which products will withstand.

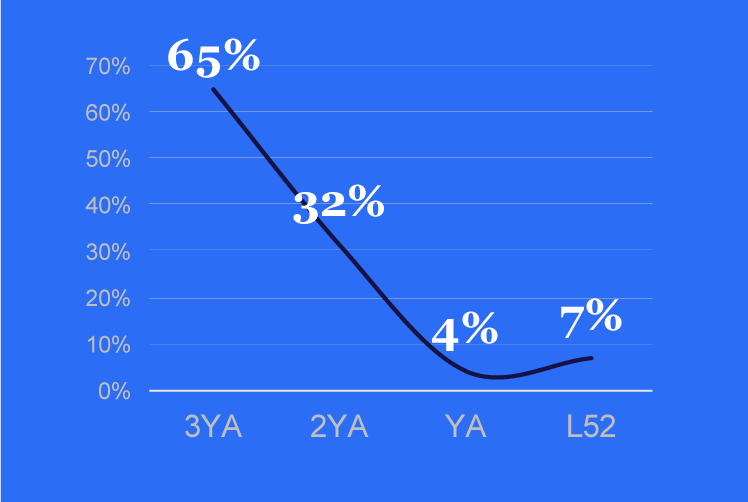

Four Year Dollar Growth Trend

Ready to… products have been booming for years, with a surge of growth during the pandemic. Since then, segments have been growing at varied rates while in different lifecycle stages. For example, Hard Seltzers are maturing, while Spirits-based RTDs are growing at double digits.

Share of Total Alcohol

Ready to Drink products represent 11.7% of total Alcohol. Since Ready to Serve products are a niche piece of total Ready to… they represent a 0.3% share of total Alcohol.