Ultra rapid delivery, intelligent inventory management, mobile commerce, and close brand relationships all in focus

Consumer tech retailers in the Middle East, Turkey and Africa (META) are making important investments in response to their divergent challenges and opportunities.

Retail revolution: opportunities being harnessed in META

Formats

Strong expectations for mobile and shopping experience stores, as part of omnichannel

Technology

Artificial intelligence critical to inventory, and to offering consumer personalization

Operational Excellence

Focus on new methods of payment, and ultra rapid delivery in Middle East

Purpose

Growing investments in sustainability, particularly greener products and packaging

A new survey by GfK shows they are focusing on four main interconnected areas – formats, technology, operational excellence and purpose – as they target opportunities ranging from large experience stores, to tight supply chain management and ultra-fast delivery.

Many retailers in the region will invest in fresh revenue streams, new payment methods, and broader service ecosystems. Equally, they will enhance operations with new technology and improved staffing.

The global survey, involving nearly 800 retail executives in 76 countries worldwide, reveals fascinating developments in what matters most to retailers in META in 2023. The regional results encompass Saudi Arabia, United Arab Emirates, Turkey, Morocco, Algeria, Egypt and South Africa.

Across the META region, retailers have a strong belief in their relationships with manufacturers. In developed markets especially, they will nurture these partnerships through offering powerful in-store brand spaces, while developing ever more engaging online retail media networks.

4 in 5

META retail executives confident in mobile commerce

85%

say demand forecasting is core benefit of their AI investments

9 in 10

accelerating or improving delivery

65%

looking to greener products/services

Source: GfK Retail (R)evolution 2023

In the Middle East in particular, consumers have increasingly high expectations for ultra rapid delivery and for advanced products. Among retailers, major tech and workforce investments will be made to improve demand forecasting and to shorten delivery times. Some players in Saudi Arabia and UAE are already shipping products to city-based consumers within 15 minutes of ordering. Meanwhile, robotic home goods will take an increasing share of product sales – a trend also true among affluent South African consumers.

Across META, payments are a major focus – with developments including new ways to pay digitally, spread costs and, where relevant, to consume goods as a subscription.

Broader business purpose, too, is becoming more important to retailers as demand grows among consumers. Companies are investing more in greener devices, better packaging materials and repair hubs, which can all help to grow business and retain consumer loyalty.

For consumer tech retailers across META, better understanding all these changes, and investing wisely, offers the opportunity to build profitability and sharpen competitive edge.

META: most successful formats expected

78%

mobile commerce

74%

shopping experience store

74%

omnichannel

63%

internet marketplace

57%

social commerce

56%

buy online, pick up in store

Source: GfK Retail (R)evolution 2023

Formats

Consumer tech retail formats are set to evolve quickly across META.

Mobile commerce is already growing particularly rapidly as consumers increasingly check and buy products on their devices. It is perceived as the format most likely to succeed in the coming years, with 78% of retail executives confident in its potential – even if technological advancement rates vary.

In mature markets, such as in the Middle East, the dominance of traditional small stores is being eroded. But in contrast to other major markets, large bricks and mortar stores are prospering – in spite of the strength of online pure players. We expect the greatest growth for these large tech stores in Saudi Arabia, with hundreds of shopping mall constructions in train as consumer spending grows, and as the government pushes to diversify the economy.

Large chains tend to be highly focused on experience, notes Hakim Ammar, META retail director at GfK. “Such stores can offer beautiful shopping experiences, backed up by clever category management,” he explains. “It means they can focus on real value and higher priced items, not just volume.” The vast majority of META retailers see shopping experience stores as having great potential.

Growing omnichannel focus

In META, retailers also have high confidence in seamless omnichannel models. The popular mobile and shopping experience store formats will be a crucial part of this.

There is a big shift in strategies toward delivering a complete omnichanel customer journey

“Until recently, most retailers had separate divisions for offline and online, but there’s been a big shift,” Ammar explains. “Retailers are bringing those elements together and thinking of how to deliver a complete customer journey.” Such seamless cross-channel experiences will become particularly critical as a differentiator given tough competition from online pure players.

In META, successful omnichannel setups have several other key elements. Buy online and pick up in store is particularly important, and now a focus for many retailers aiming to offer consumers extra convenience and reduced costs. At the same time, the localization strategies favored by half of retailers could also be critical in supporting store strategies.

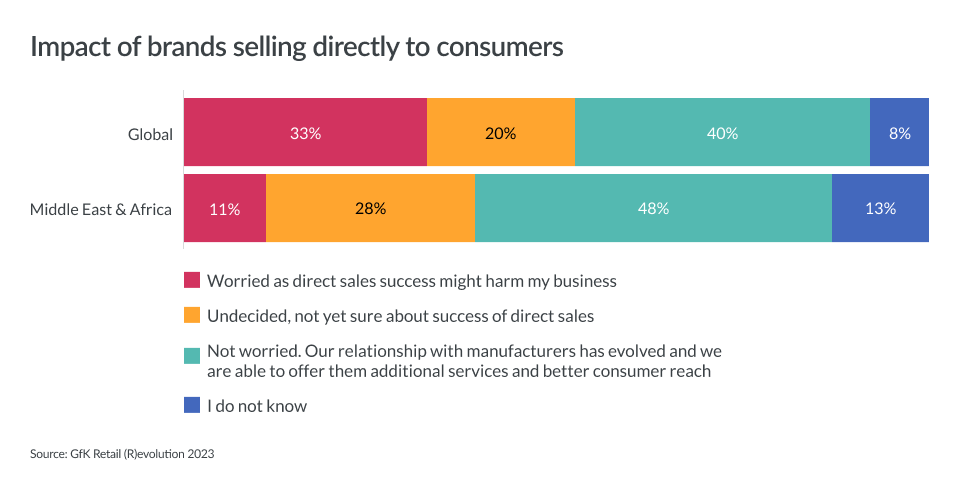

Nurturing strong brand relationships

In META, retailers also have notably high confidence in their manufacturer relationships. Only a small minority are concerned about direct sales. “Retailers here have a privileged relationship with brands,” Ammar notes. “The spirit of the region is that there’s often a very strong trust and an established relationship.”

As a key part of these close relationships, several areas of investment are expected to prosper. They include dedicated brand space online and in store. Some 56% of retailers in the region will rent out physical space to brands, making it a critical focus.

“Brands increasingly want to have a footprint by establishing their own dedicated area in retailers’ spaces, where they can offer their own identity to help establish trust and relationships with customers,” Ammar explains. Many retailers will also make store and warehouse space available for brand fulfillment.

Meanwhile, half of retailers will focus on brand spaces on their websites and apps. This will take the form of retail media networks (RMNs), which enable businesses to sell space to brands online, providing unique access to customers, alongside powerful traffic and behavioral metrics.

Emerging spaces such as internet marketplaces are also set to become critical to these relationships. Nearly two-thirds of META retailers expect growth here, with the formats allowing retailers to generate extra revenues and broaden assortment as brands host spaces online.

META: top tech focus areas

63%

AI/machine learning

33%

augmented/virtual reality

30%

robotics

Source: GfK Retail (R)evolution 2023

Technology

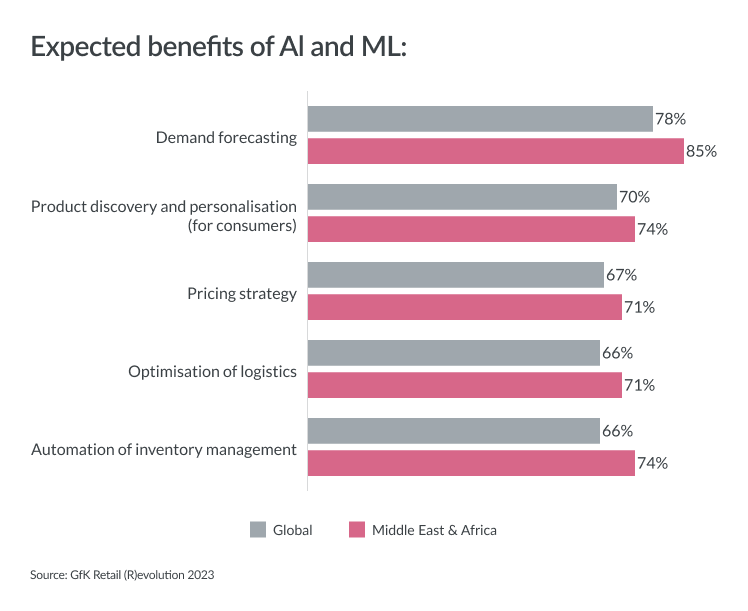

Retailers have a strong focus on artificial intelligence and machine learning (AI and ML) in META, as is the case globally. There is also a strong niche interest in augmented and virtual reality, and robotics.

These investment areas will be critical in supporting developments across the other three pillars: formats, operations and purpose.

AI to manage stock levels

The majority of META retailers are poised to invest in AI and ML as they look to transform efficiency levels and protect their profits in competitive markets.

In pursuit of those aims, AI and ML will be used widely to better manage stock levels in line with expected sales. A high 85%, well above the global average, will use the technologies to improve their demand forecasting, while three quarters will focus on automated management of inventory. “Forecasting is a big challenge,” Ammar explains. “Some retailers keep an excess of inventory due to the challenges of predicting demand, but that inventory can then be difficult to sell.” Import restrictions are deepening stock management challenges in some markets, including in Egypt where some market entrants pulled out recently due to the complexities they encountered.

We expect that smarter forecasting and inventory management, often aided by warehouse robotics, will be increasingly critical to securing efficiency gains in a number of the region’s more inflationary environments. In Turkey and Egypt, in particular, large price fluctuations are making demand more difficult to predict manually.

Intelligent personalization and pricing

META retailers will also count on the benefits of consumer-facing aspects of AI and ML. Three quarters will use the technologies to learn more about customers and present them with highly relevant, personalized products.

“Retailers are realizing the importance of being extremely specific with their customer interactions and personalizing their services,” Ammar explains.

“Pure online players in particular are finding clever ways to recommend the right things at the right moments. While people are concerned about data privacy, they are generally content to share information if it improves their shopping experiences.” Meanwhile, in a competitive space, the majority of retailers will use AI and ML to intelligently adjust pricing to clinch more sales while protecting margins.

Growth in robotics and augmented reality

GfK’s research also shows a strong niche of retailers in META will pursue other emerging technologies. These include augmented and virtual reality (AR and VR), robotics and Blockchain.

Retailers are becoming highly specific in their interactions with consumers, personalizing their services

Robotics is now in the sights of nearly a third of the region’s retailers, a tally expected to grow dramatically given workforce shortages and the scope for cost efficiencies. “The investment required here can be quite high, but interest levels are clearly growing,” says Ammar. “Some markets have been hit hard by inflation, so it’s tough to retain employees. This adds to the importance of adopting technologies like robotics.”

Meanwhile, AR and VR are growing in significance for many retailers, particularly in South Africa and Dubai, as companies aim to offer ever more memorable customer experiences and stronger differentiation among higher spending consumers. These technologies can help most notably with product tryouts and store navigation, especially within the many designated experience stores being built.

Operational Excellence

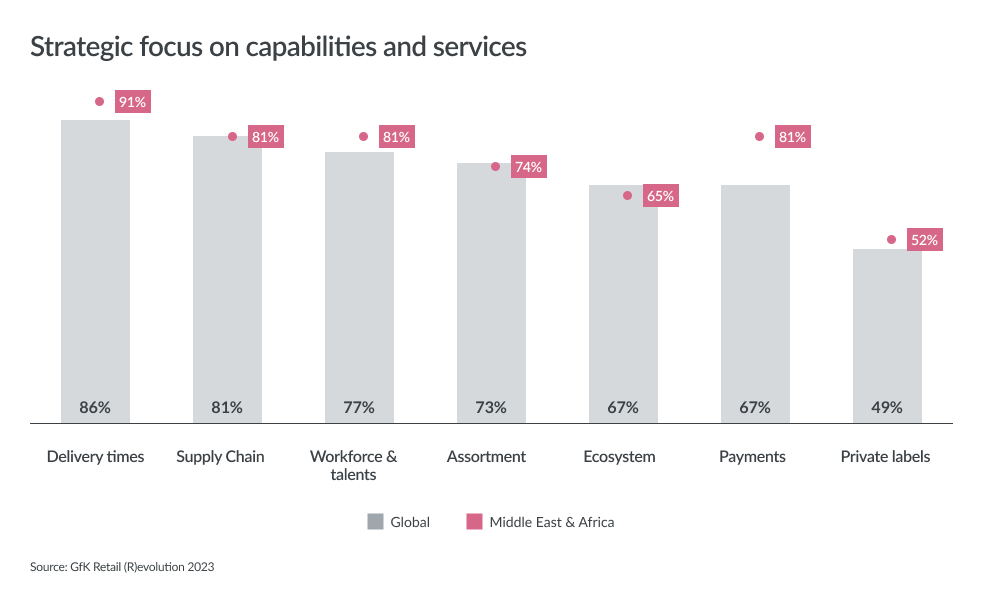

In META, consumer tech retailers are set to invest extensively in several key operational areas. Delivery speed is expected to become an essential competitive arena, particularly in the Middle East. New forms of payments and subscription services are also emerging in the region – a high priority that is well ahead of the global average.

All these advances will need to be aided by workforce and talent development, as well as by new technology.

Ultra fast delivery

Over nine in 10 META retailers plan to invest to improve their delivery processes as a matter of urgency.

The most notable change is set to be in the Middle East, where ultra fast delivery is increasingly becoming the norm for customers of some of the largest online and omnichannel businesses.

“One of the largest online pure players in the UAE and Saudi Arabia offers a 15-minute delivery guarantee,” notes Ammar. “It’s a major differentiating factor – and it works because there are large clusters of living and business, such as in the heart of Dubai, where they can build the resources to deliver such a service.”

Ultra fast, 15 minute delivery guarantees are becoming a major differentiator

At the heart of ultra fast delivery services are extensive and tightly-managed staffing operations, plus sophisticated order management, inventory and warehousing technology. “The retailers making these changes have introduced ‘flexi-warehousing’. They make sure that their teams are ready to go: as soon as an order is made, they get the items and their drivers set off,” Ammar explains.

“The whole supply chain, driving force and points of connection are tremendous. In those concentrated locations it’s a really smart meeting of demand.”

In other parts of META, improved delivery services will generally mean greater reliability. However, they will often function on timelines of several days, due to the realities of local supply and infrastructure systems.

Payments and subscriptions in focus

New payment and subscription services are also increasingly important to META retailers, as they look to meet growing customer needs and build loyalty.

Eight in 10 retailers across the region are seeking to improve and expand their payment services, We expect these will become a critical part of clinching sales and ensuring the widest possible demographics can buy from them.

Making payments easier and more accessible, with new forms of finance, is critical

“Retailers offline and online are prioritizing payments more and more. They want to offer more ways to pay, and to connect to all the banks they can,” Ammar says. “People obviously want to pay without any extra charges and it is quite an important part of the decision making process for consumers.”

In mature markets, payment changes are likely to involve connections to multiple providers as well as low interest or interest free terms over several months for higher price items. In less mature markets, the changes are expected to mean more ways to pay on mobile and to support micropayments, while also accepting payments from unbanked populations.

In the Middle East and affluent pockets of South Africa, subscription services may also become an important retail differentiator. Among the majority of retailers investing in their ecosystems, many will consider offering subscriptions. The key targeted outcomes will be creating loyalty, including through offering discounts, and developing clear profiles of customers to improve personalized assortments and promotions.

Developing the workforce

“The wide variety of sophisticated services being introduced by META retailers – and their rate of expansion in some markets – heightens the importance of workforce and talent investments.

As such, some eight in 10 retailers across the region plan to invest in growing and upskilling their workforces. These efforts will be critical across all operational areas from delivery and stock control, to product assortments and consumer experiences, and from new payment services to in store and online spaces.

META: purpose focus areas

65%

sustainable products and services

56%

sustainable internal practices

43%

repair hubs

31%

second-life products

Source: GfK Retail (R)evolution 2023

Purpose

In META, as globally, consumer expectations are rising for retailers of all types. Increasingly, people want brands and businesses to offer a clear, high level sense of purpose, particularly in relation to sustainability issues.

In more mature markets, the emphasis falls on having greener stores and more energy efficient products. Better packaging is also in focus, while demand for increased device longevity is growing too in several markets.

Focus on sustainable products and practices

A high two-thirds of retailers in META are set to invest in sustainable products and services, the GfK survey reveals. “Retailers want to understand how they can sell more energy efficient products to consumers,” Ammar explains. “Their customers want to see positive changes, and this includes a real highlighting of the energy ratings of products.” At the same time, the majority of META retailers plan to use more recycled material in their boxes, and many will reduce their packaging overall.

Retailers are anticipating growing demand around sustainability, and looking to offer greener products

Aside from selling greener products, over half of retailers in the region will also invest in their internal practices to improve sustainability. Changes are expected to involve lower energy usage in store, less waste, and more efficient supply chains.

Over time, this may also mean more efficient delivery. So far, only a third are looking at greener transport, with speeding up deliveries remaining the higher priority – but we expect this will change. A concurrent focus on more ethical supply chains is also likely to arise.

A major part of securing custom based on these purposeful factors will be education. Nearly half of META retailers will invest in educating their consumers around sustainability topics, critical to conveying internal practice changes and to securing sales of higher priced, more efficient home goods. “We can see that consumer education around sustainability has been going on for decades in markets like Europe, and there’s a feeling that the changes are also coming our way in META as demand rises,” Ammar notes. “Retailers are really trying to anticipate this and to further raise awareness of these issues.”

Increasing device longevity

While not a widespread priority, some retailers in META will focus on services that help consumers increase the lifespan of their tech devices. The leading example of such a service is repair hubs, in which a solid 43% of retailers are considering investing. These allow consumers to have their device problems tackled locally and quickly, often making items such as phones, laptops and domestic goods work for much longer.

“We’re starting to see clusters of repair hubs in places like South Africa, but in the rest of META the percentage is not as high as it could be. This is likely to change as broader sustainability demands rise,” says Ammar.

Meanwhile, a similar number of retailers will look to offer better and more extensive warranties – also critical to keeping devices working for longer. Many will also invest in helping consumers recycle used devices.

And while retailer interest in selling second life products is below global averages, nearly a third of retailers in META are considering such sales. Second life products offer the option of buying devices more cheaply, which could have a growing appeal, particularly where consumer spending power is being squeezed by persistently high inflation rates.

Conclusion

Across META, consumer tech retailers are set to make a range of significant changes. Transformations across formats, technology, operations and purpose will all be critical in capturing sales in high growth markets, particularly in Saudi Arabia and UAE. They will also underpin efforts aimed at simplifying purchases and securing increased revenues in developing markets.

While the challenges and opportunities differ significantly between markets, META retailers have a consistent and clear focus on mobile formats. These, alongside shopping experience stores in more affluent markets, will be core elements of omnichannel strategies, which will focus too on localization and buy online, pick up in store options. Ever more personalized experiences, new payment methods and subscriptions will also help grow revenues and build loyalty.

At the same time, META retailers will target strong operational improvements. Reliable delivery will be fundamental, with a particular focus on ultra fast provision in major Middle East cities. These advancements will require significant workforce expansion and training, as well as the use of new AI and ML technologies that help smooth supply chains, predict demand and manage stock.

In some META markets, consumers are looking to buy from more purposeful or ethically strong businesses. The greatest demand relates to offerings of more sustainable products and services. Significant numbers of retailers will invest in selling greener items, using more recycled packaging and offering device repair to their customers as a money saving option.

We expect all of these improvements by retailers to become critical in overcoming the supply chain and inflation-related challenges seen across the region, and to capturing new sales opportunities among consumers keen to experience the latest devices and services.

Looking ahead, the META retailers investing wisely in the four pillars of formats, tech, operations and purpose will be those best placed to succeed. Many already rely on GfK insights and consulting to understand local trends, and to make the right moves with confidence and clarity.

Authors

Namrata Gotarne

Global Strategic Insights

Ines Haaga

Global Strategic Insights

Contributers

Hakim Ammar

META retail director at GfK

Endorsed by

Michael McLaughlin

President Global Retail

Wolfgang Wanders

VP MI Product

Vishal Bali

Global VP CSM

Jamie Clarke

Head of North America Retail NIQ