The sweet spot

The highest-performing categories within celebrity beauty are cosmetics and nail and fragrance. Both hold a 2.8% share of total beauty dollar sales, delivering much of the segment’s growth.

Online channels are a powerful tool for celebrity beauty brands – 53% of sales occur online, compared to 40% for the total beauty and personal care category. These brands often tap into the power of social media to target existing fans who then become consumers.

Measuring Success

With the sheer volume of celebrity beauty brands in the category, it is critical to measure the brands against various metrics to determine what makes a celebrity brand shine through. This analysis took into account the following key metrics:

- NielsenIQ: Dollar sales and change versus a year ago, which allows us to the total size of the brand and how it is performing in market

- Dash Hudson: Instagram and TikTok entertainment scores, which measure engagement and retention rates from these platforms.

- Spate: Google search and volume data, which allows us to see how relevant the brand is by measuring how often it’s searched for.

- CreatorIQ: Earned media value data, which quantifies the estimated value of consumer engagement with digital earned media. This metric helps us benchmark the success of the brand’s marketing campaigns.

Does a celebrity founder guarantee success?

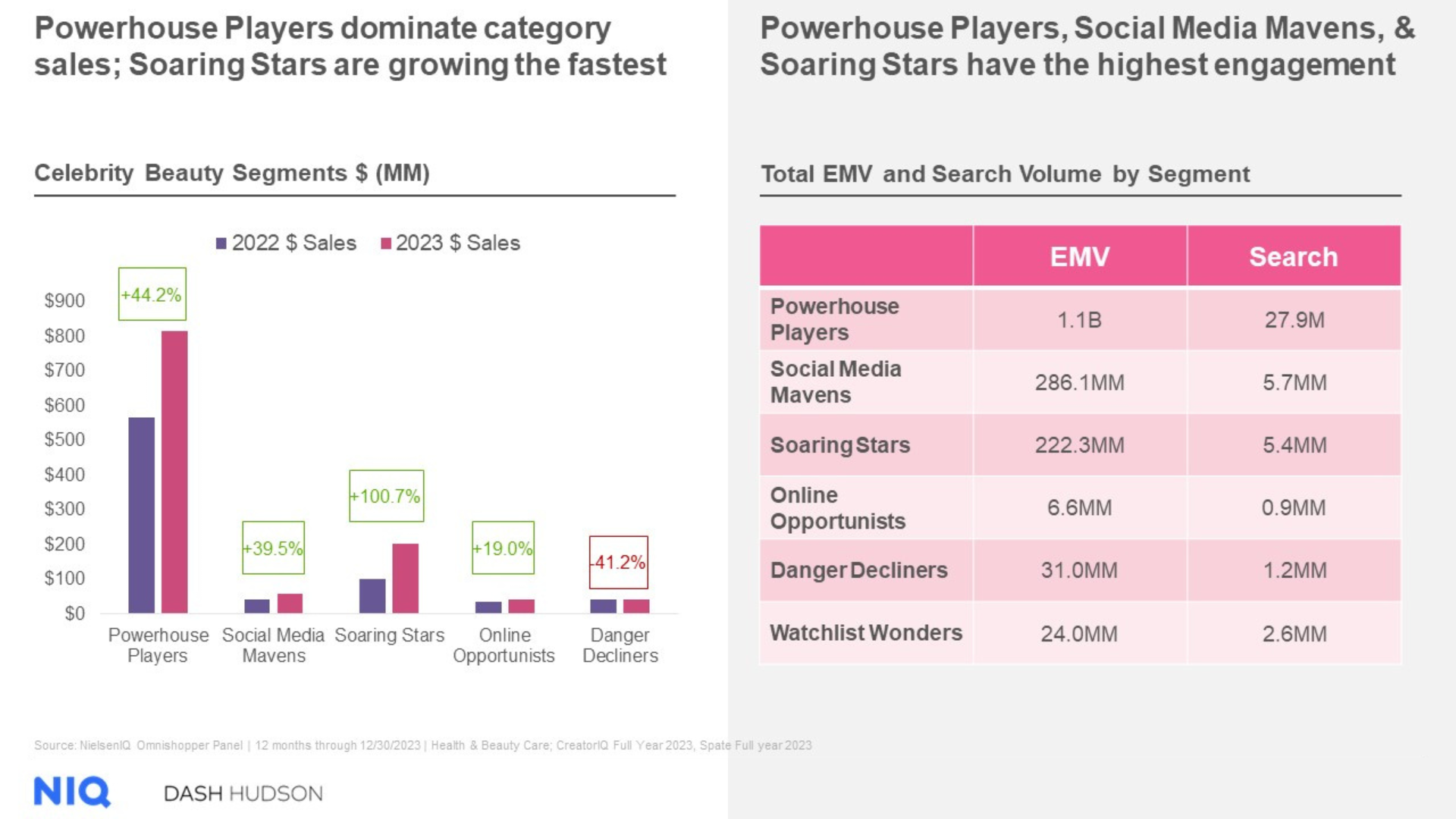

No – a celebrity founder does not equate to success for these brands. To evaluate the highest performers in the industry, NIQ has partnered with Spate, CreatorIQ, and Dash Hudson to ask – and answer – the question: What makes a celebrity beauty brand successful? Tapping into sales performance data, social media performance, search metrics, and media metrics, the analysis segments top celeb brands into the following groups:

Soaring stars

Brands where sales have doubled or tripled top the ranking with +100.7% in dollar growth

Powerhouse players

Top-ranking brands in dollar sales and number of customers who excel at social media engagement and search volume have the second highest growth, +44.2% in dollar sales

Social media mavens

Harnessing the power of social media to influence and engage followers, these digitally driven brands have grown +39.5% in sales

Online opportunists

While decent dollar sales exist, this group of brands haven’t tapped into the power of social media yet – only realizing +19.0% sales growth

Danger decliners

Brands that are struggling to secure growth, with a collective dollar decline of –41.2%

Watchlist wonders

Those with the highest earned media value and search volume, yet dollar sales are not yet tracked by NIQ

Key takeaways and considerations

Looking ahead to the remainder of 2024, celebrity beauty shows no signs of slowing down. Celebrities continue to enter the category – in fact, eight celebrities have launched in 2024 already. The landscape is fast evolving and brands will need to differentiate themselves to stand out in a saturated market. Our 2024 report explores how the current reigning queen of celebrity beauty has sustained growth, but can she continue to beat the competition?

A closer look into celebrity beauty brands

To learn more about the current state of celebrity beauty and access key insights for success, our latest report The Ultimate Guide to Celebrity Beauty Brands is available now.