Confidence in personal finances declines but consumers are in defiant mood

Joe Staton, Head of Market Dynamics at GfK, says:

“Confidence in personal finances, both looking back and ahead a year, has slipped this month but retail sales in the UK continue to grow despite non-food prices increasing at their highest rate for 25 years. Consumers appear to be in a mixed mood – with some confidence measures up and others down – yet there’s a strong note of defiance.

Many commentators expected shoppers to cut back on spending thanks to the lower purchasing power that arises from higher inflation and weak wage growth. But consumers are still spending out there, and have repeatedly defied predictions of a downturn since last year’s Brexit vote, partly by running down savings and/or borrowing more. Indeed, the major purchase indicator has crept up a second month in a row and the savings index has sagged. It’s live now, pay later. This defiant consumer mood seems to be the ‘new normal’. But how long can it last?”

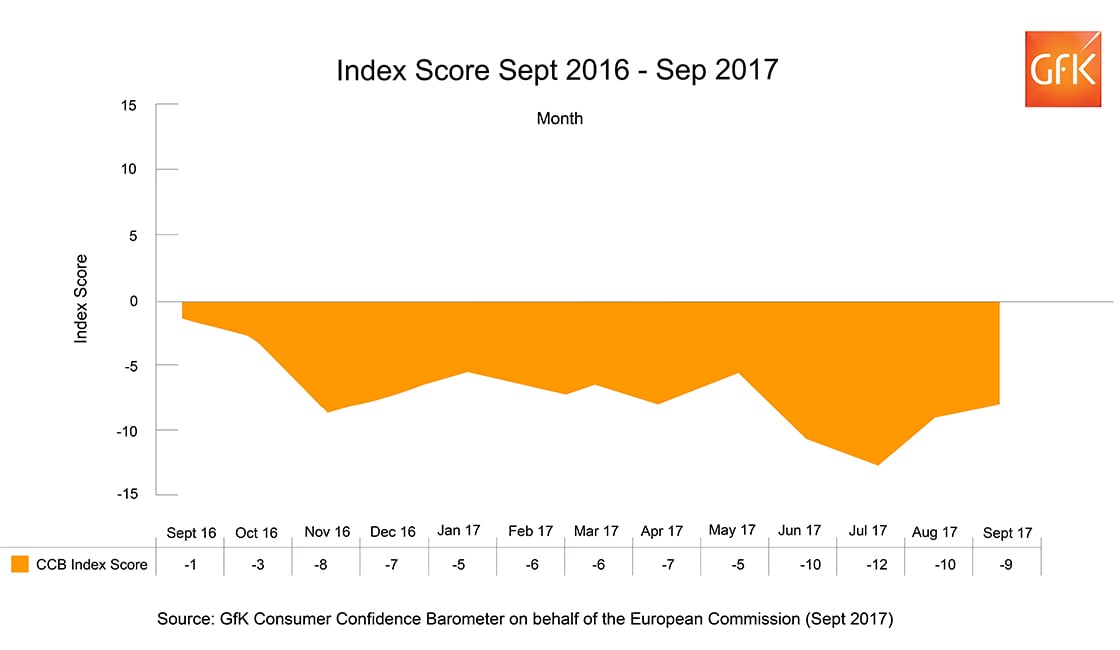

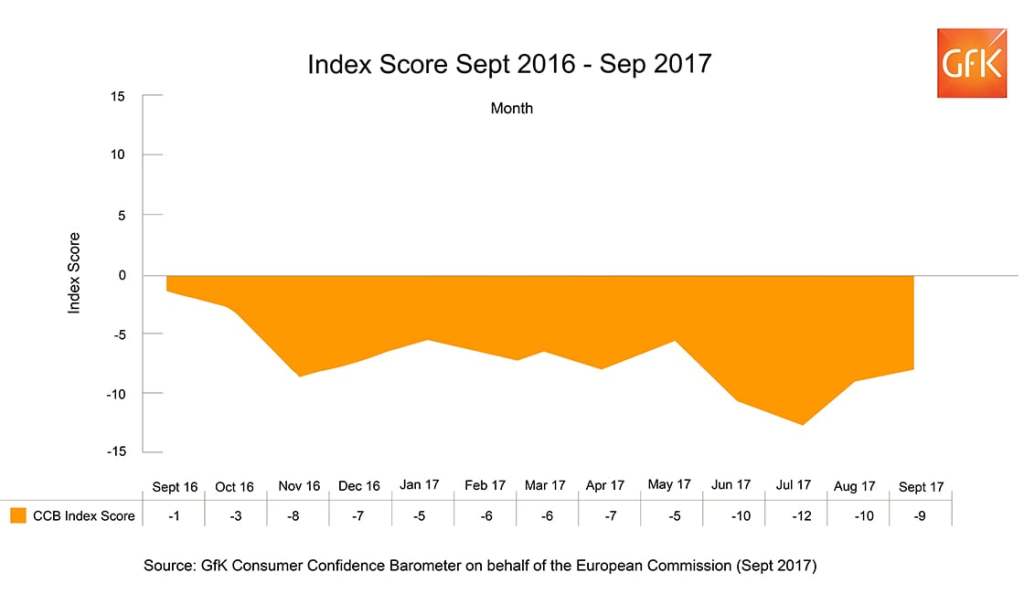

UK Consumer Confidence Measures – September 2017

The Overall Index Score in September is – 9. Both measures for Personal Financial Situation decreased, while the two measures for General Economic Situation as well as the Major Purchase Index increased.

Personal Financial Situation

The index measuring changes in personal finances during the last 12 months has decreased by three points this month to -1; this is three points lower than this time last year. The forecast for personal finances over the next 12 months has decreased one point this month to 4; this is three points lower than September 2016.

General Economic Situation

The measure for the General Economic Situation of the country during the last 12 months has increased two points to -28; this is 12 points lower than September 2016.

Expectations for the General Economic Situation over the next 12 months have increased three points this month to -24; this is 15 points lower than this time last year.

Major Purchase Index

The Major Purchase Index has increased one point this month to +1; this is eight points lower than September 2016.

Savings Index

The Savings Index has decreased three points to +3; this is 12 points higher than September 2016.