In GfK global study, US ranks low in attention to “hot-button” ingredients such as sugar, fat

While healthy eating has gained plenty of news attention in recent decades, GfK research shows that US consumers lag behind global averages in putting awareness of healthy ingredients into action.

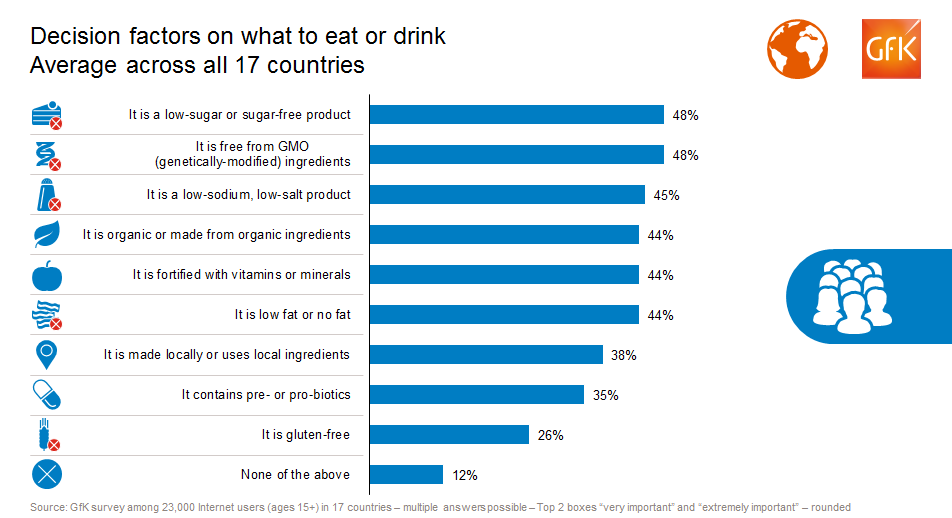

GfK asked 23,000 consumers online in 17 countries how important certain factors are, from a given list, when deciding what to eat or drink. For the top six factors, US scores ranked 6 to 13 percentage points below the global averages.

For example, nearly half (48%) of consumers worldwide report that products being low-sugar or sugar-free is “extremely” or “very” important to them, compared to 42% in the US. Globally, 48% also cited “GMO-free” -– lacking genetically modified (GMO) ingredients -– as another important factor in food and drink choices; in the US, the level was just 37%.

The study revealed similar discrepancies between global and US scores for low-salt or low-sodium (45% worldwide, versus 36% in the US), vitamins or minerals (44% versus 35%), and low-fat or no-fat (44% versus 35%).

The “organic” designation, which has drawn so much focus at higher-end supermarkets and health-focused restaurants, was a factor for only one-third (31%) of US consumers -– well below the global average of 44%.

Consumers ages 20 to 39 opt for healthy ingredients

In the US, the most selective food and drink shoppers are those in the 20-to-29 and 30-to-39 age groups. Fully half (50%) of those 30 to 39 years old consider the low-sugar or sugar-free designations when deciding what to eat or drink, for example. This age group is also highest in taking GMOs (42%), sodium or salt (43%), and other factors into account.

The 20 to 29 year olds posted the highest proportions for consideration of local production and/or ingredients (42%) and presence of vitamins or minerals (43%).

Impacts of income and gender

Because healthy foods often cost more, it is probably not surprising that higher-income households are more likely to take these factors into account when making food choices. Among those with high incomes (the top 25%), the most important factors are low sugar or sugar-free (49%), low sodium or low salt (44%), and use of local ingredients or being produced locally (42%). Among low-income households, GMO-free and low sugar or sugar-free are the top two (39% and 36% respectively).

In the US, men were more likely than women to consider key food and drink factors when making eating choices, scoring 3 to 6 percentage points higher in every case. Globally, gender was essentially a non-factor, with men and women scoring almost the same throughout.

China ranks as most selective on what to eat, drink

In eight out of the nine decision factors researched, China tops the list for having the highest percentage of consumers placing importance on that item when deciding what to eat or drink. The scrutiny is likely driven by the typically higher concerns over food safety in the market. The exception is for locally produced products, where Italy takes the lead. Other nations consistently placing in the top 3 were Brazil and Mexico.

The greatest difference between China and other nations is seen when it comes to preference for pre- or probiotic products. Here, China is 21 percentage points ahead of the next closest country, with over half of its online population placing high importance on this factor. This was also the only category where the US placed even in the top 5, with a level of 27%.

Download GfK’s complimentary report on “factors when deciding what to eat and drink” to see key demographic data for each of the 17 countries included in this survey.

GfK combines these self-reported insights with data from areas such as point of sales tracking, consumer panels and geo-marketing to help clients successfully target high-potential audiences both globally and within specific countries.

About the study

The survey question asked, “When deciding which food or beverage product to eat or drink, how important are the following in making your decision?”, with options listed as It is organic or made from organic ingredients; It is made locally or uses local ingredients; It is a low-sugar or sugar-free product; It is low fat or no fat; It is a low-sodium, low-salt product; It is fortified with vitamins or minerals; It contains pre- or probiotics; It is free from GMO (genetically-modified) ingredients; It is gluten-free.

GfK interviewed 23,000 consumers online in 17 countries in the summer 2017. Data are weighted to reflect the demographic composition of the online population aged 15+ in each market. The global average given in this release is weighted, based on the size of each country proportional to the other countries.

Countries included are Argentina, Australia, Belgium, Brazil, Canada, China, France, Germany, Italy, Japan, Mexico, Netherlands, Russia, South Korea, Spain, UK and USA