Almost half of US consumers see their mobile devices as essential shopping tools

According to the latest FutureBuy® research from GfK, a growing number of US shoppers would not think about starting a purchase journey without a mobile device in hand.

Just-released 2018 GfK research shows that 45% of all US consumers believe that their smartphones and/or tablets are “quickly becoming [their] most important” shopping tools. That figure is 16 points higher than the 2017 level (29%) – a leap of roughly one-third in just one year.

Click here to download more insights from FutureBuy

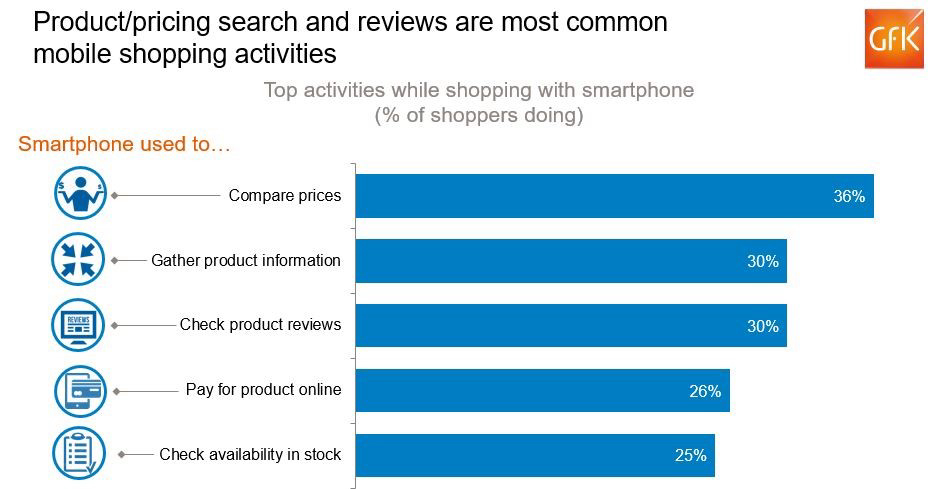

The number-one use of smartphones during the shopping process is comparing prices, cited by 36% of mobile shoppers. Other common smartphone tasks include gathering product information (30%) and checking product reviews (30%). (See Chart 1 below.)

For 2018, GfK’s global FutureBuy® research covers 35 countries and 18 product categories, from home appliances to wearables to beauty and personal care. All in all, over 35,000 consumers were interviewed worldwide.

The new study contains mixed news for brick-and-mortar stores. Showrooming – shopping in a store and then buying online – is essentially stable in the US, reported by just 23% of shoppers. But roughly half (48%) of US consumers said they can “see a future where traditional retail stores are not a big factor” in how they shop – up 11 points from 2017 (37%).

“The desire or need to shop is often spontaneous, and most consumers have their smartphones nearby at all times,” said Joe Beier, EVP of Consumer Insights at GfK. “So it is no surprise that mobile technology is playing a growing – and increasingly complex – role in shopper journeys. While shopping online overall is driven largely by a search for savings, the mobile component is often about research on-the-go. And we should not see traditional retail as somehow pitted against the mobile element; often they work together – and those who can deliver a seamless experience will be more likely to capture the sale.”

Mobile payments still stuck in neutral

Looking at the bigger picture of reasons for purchasing online versus in store, over half (52%) of those who bought online say they did so to save money. By contrast, those who bought in a store are most likely to cite “see product before buy” (45%) or “get products sooner” (44%) as reasons.

The study also shows that adoption of mobile payments in the US – and globally – remains low. Just 17% of US consumers have used their smartphone, tablet, or other mobile device to pay for a product (including payments via services like PayPal and Venmo) in the past 6 months. This compares to 29% in the Asia Pacific (APAC) region, and the global average of 19%.

Yet almost three in ten (28%) US consumers say they “look forward to … pay[ing] for more and more transactions” via mobile devices – almost double the 2017 level of 17%.

In addition to mobile shopping and payments, 2018 FutureBuy® research covers such key topics as

- the rise of omni-channel shopping

- shopper loyalty

- key touchpoints – online and in-store

- emerging trends, including click-and-collect and voice shopping

To learn more about becoming a FutureBuy client, contact Beier at joe.beier@gfk.com.