Good Health is top of mind for the consumer

Good health is at the forefront of consumers’ minds. Post-pandemic, the word “health” has remained prominent in the zeitgeist of our lives, continuing to shape the purchasing behavior of consumers in India. According to GfK Consumer Life Study 2022, “good health” is the top priority for 72% of surveyed urban Indian consumers seeking a fulfilling life.

Today’s consumers are increasingly health-conscious, actively tracking their daily activities and sleep patterns. They are constantly on the lookout for products and services that can help them achieve an active and healthy lifestyle.

Wearables as a means for tracking health

Wearable technology, which initially served as a phone accessory, is now seen as a crucial means to fulfill this wellness trend. Its “on the go” usage and seamless “connectivity” make these tech products a perfect fit for consumers.

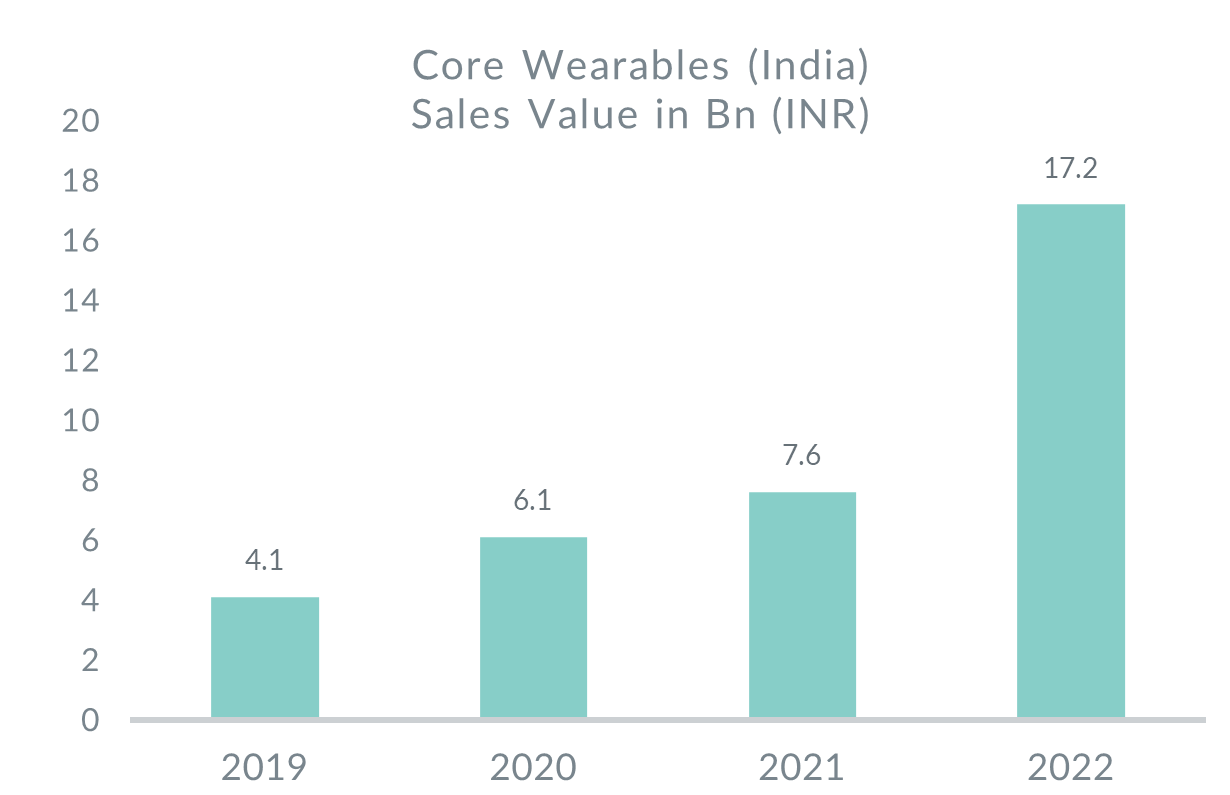

The Core Wearables industry is on the rise, with the offline retail core wearable market experiencing a remarkable 125% revenue growth in 2022 compared to 2021 as per GfK Market In. In 2022, the Core wearables market’s revenue is four times that of 2019.

Source: GfK Market Intelligence Offline Point-of-Sales Data, Period: Jan-Dec

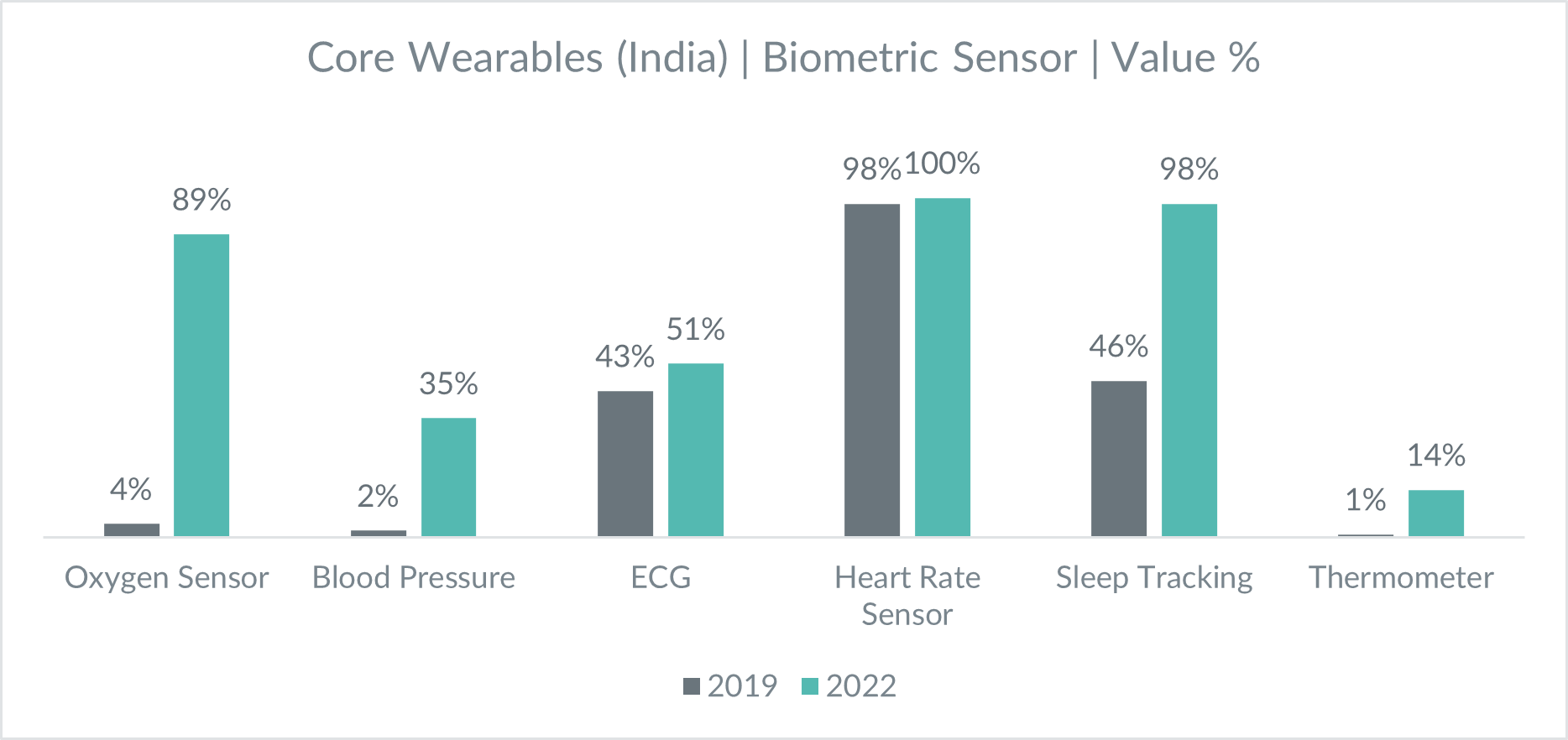

Fitness tracking not only provides insights into our everyday activity data but also serves as a motivator, encouraging us to set higher fitness goals for walking or exercising. Over 95% of these devices boast features like heart rate sensors and sleep tracking, with oxygen sensors seeing the fastest growth following the pandemic. Many devices also have user apps that allow consumers to share their fitness goals and achievements within closed user groups, fostering healthy competition.

An underlying theme of preventative healthcare products or devices has shown an upward trend and is a testament to the growth of sensors like blood pressure and ECG monitoring devices since 2019. While wearable tech may not match the accuracy of medical-grade equipment, monitoring some of these features can help detect anomalies early.

Source: GfK Market Intelligence Offline Point-of-Sales Data, Period: Jan- Dec

The paradigm shifts in the core wearables product mix

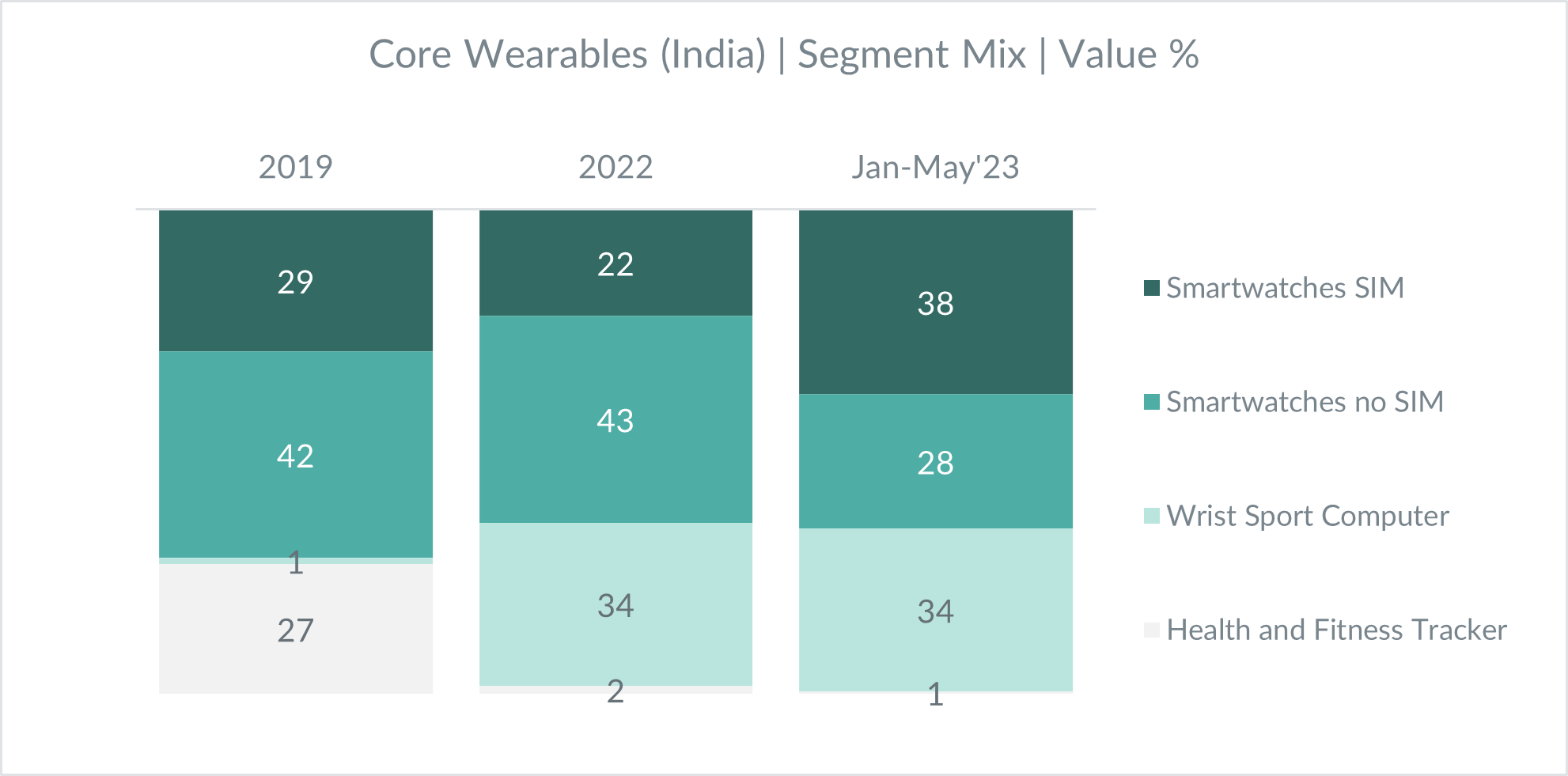

The consumer preference for wearables has led to a shift in the core wearables product segments. Market growth is primarily driven by entry-level devices, predominantly wrist sport computers, featuring digital displays, watch-based designs, and various activity sensors. These devices usually lack integration with a SIM card.

The market has shifted from fitness bands/trackers to smartwatches and wrist sports computers. Within Core wearables, the wrist sports computer’s value mix has increased from 1% in 2019 to 24% in 2022. In the first five months of 2023, 66% of total revenue came from the smartwatch segment, while 34% came from the wrist sports computer segment.

Source: GfK Market Intelligence Offline Point-of-Sales Data

The changing retail footprint of the wearables market

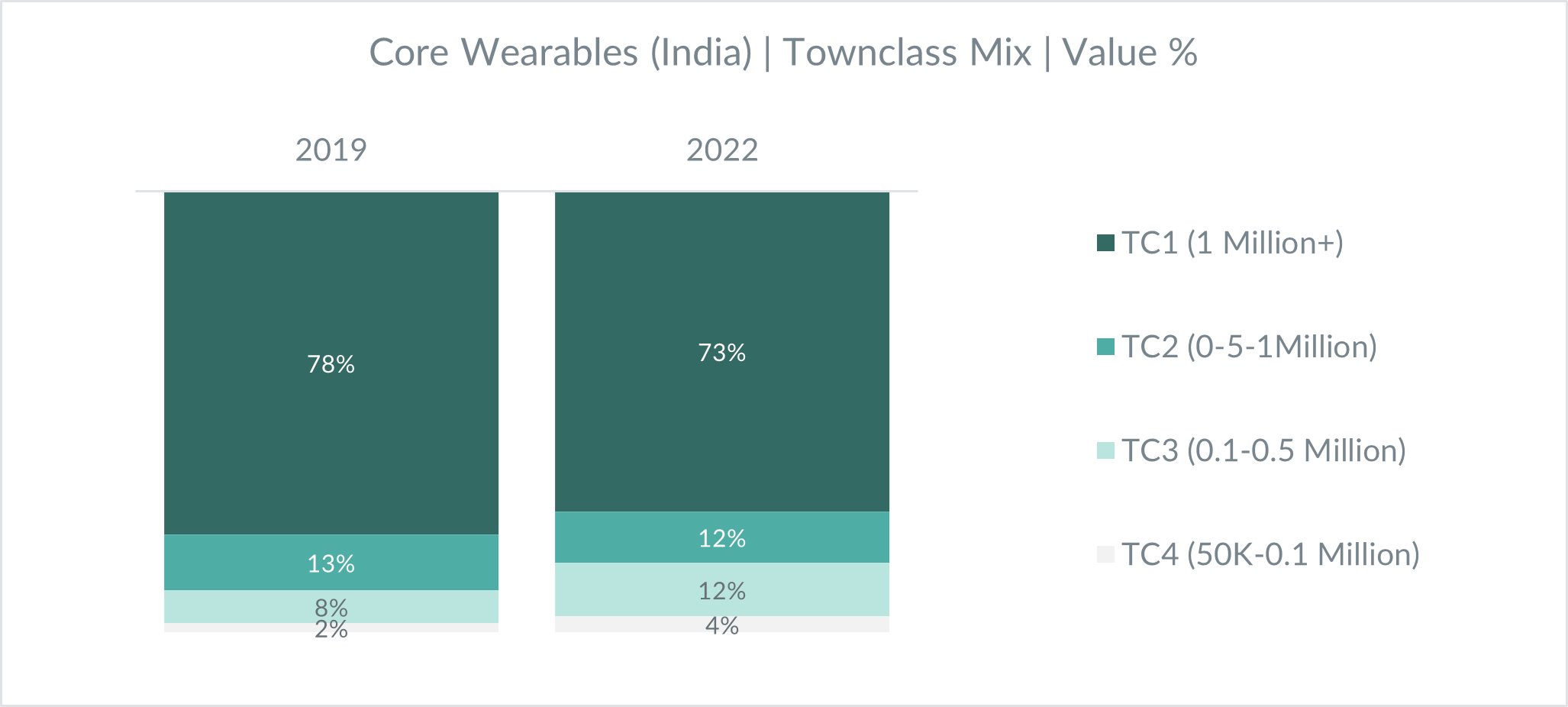

The changing consumer preferences and lifestyle have also influenced the retail landscape in the offline market. Distribution of wearable devices has shown a fourfold growth since 2019, driven by penetration into towns beyond the top metros. Tier 3 & 4 towns with a population size of <5L have exhibited higher growth in the last three years, although top towns with a population size of >10L still contribute to 73% of revenue.

Source: GfK Market Intelligence Offline POS Data, Period: Jan- Dec; Town Classes are classified by population size as per the government Census of 2011.

Innovations on the horizon: What is next for wearable technology?

Looking ahead, with the wealth of data collected and analyzed from these devices, there is an opportunity for brands to personalize and offer various interdependent products and services unique to each individual. Advancements in technology and design may lead to more creative form factors, such as “watch buds,” combining two wearable tech devices into one.

The market for smart rings is also a promising upcoming trend. Smart rings, discreet and lightweight, could provide very accurate tracking of SPO2 and heart rate.

Health and wellness play integral roles in consumers’ lives. Brands that capitalize on this trend and focus on creating products to improve consumers’ mental and physical well-being have a good chance of succeeding. It is not just about the device; the entire experience, ecosystem, and services will not only drive initial interest but also maintain long-term consumer engagement in wearable tech.