In recent years, India has experienced a significant shift in weather patterns, with unpredictable and extreme weather events becoming more frequent. These shifts have had a profound impact on various sectors, including the cooling appliance market. The demand for cooling appliances, such as air conditioners, refrigerators, and fans, has witnessed notable fluctuations, prompting both manufacturers and consumers to adapt to these new realities. This article aims to delve into the market trends of cooling appliances in India, focusing on how the unpredictable weather has shaped the industry landscape.

The impact of rising temperatures and increased demand

India’s changing climate has led to soaring temperatures, especially during the summer months. Heatwaves have become more intense and prolonged,

making cooling appliances a necessity rather than a luxury for many households. As a result, the demand for air conditioners, refrigerators, and fans has surged as people seek respite from the scorching heat. In response, manufacturers have introduced more energy-efficient and technologically advanced cooling solutions to cater to the growing consumer need.

Unpredictable weather challenges the cooling appliance market, but growth signals resilience

Unpredictable weather fluctuations had a direct impact on the cooling appliance market in India this year. Unexpected rainfall during February, March, and April, which is atypical for this time of year, led to a significant 16% volume loss of air conditioners during the January 2023 to March 2023 quarter compared to the previous year. This unseasonal weather resulted in reduced demand for air conditioners during what is typically a peak sales season.

Despite this setback, it is important to note that the market has shown strong growth in past years. The compound annual growth rate (CAGR) for the AC market from fiscal year 2019 to fiscal year 2022 stands at an impressive 12%.in terms of volume and 14% in terms of value. However, GfK Weekly POS Intelligence indicates a positive trend in demand starting from week 14 (i.e. the first week of April). To illustrate this, let’s consider the week-on-week demand comparison between 2022 and 2023 for the first 22 weeks in terms of volume growth.

Until week 10 (i.e., 1st week of March) the demand graph remained relatively stable, following the typical trend of the AC market surpassing the previous year’s performance. However, from week 10 to week 14, we witnessed a noticeable downward trend attributed to unexpected rainfall.

The influence of rainfall on cooling appliance demand is evident during this period. Consumers showed reduced interest in purchasing cooling appliances due to the prevailing weather conditions. However, the market regained momentum from week 14, indicating a positive shift in demand.

Resilient Growth in the Refrigerator Market: Adapting to Challenges and Embracing Consumer Demands

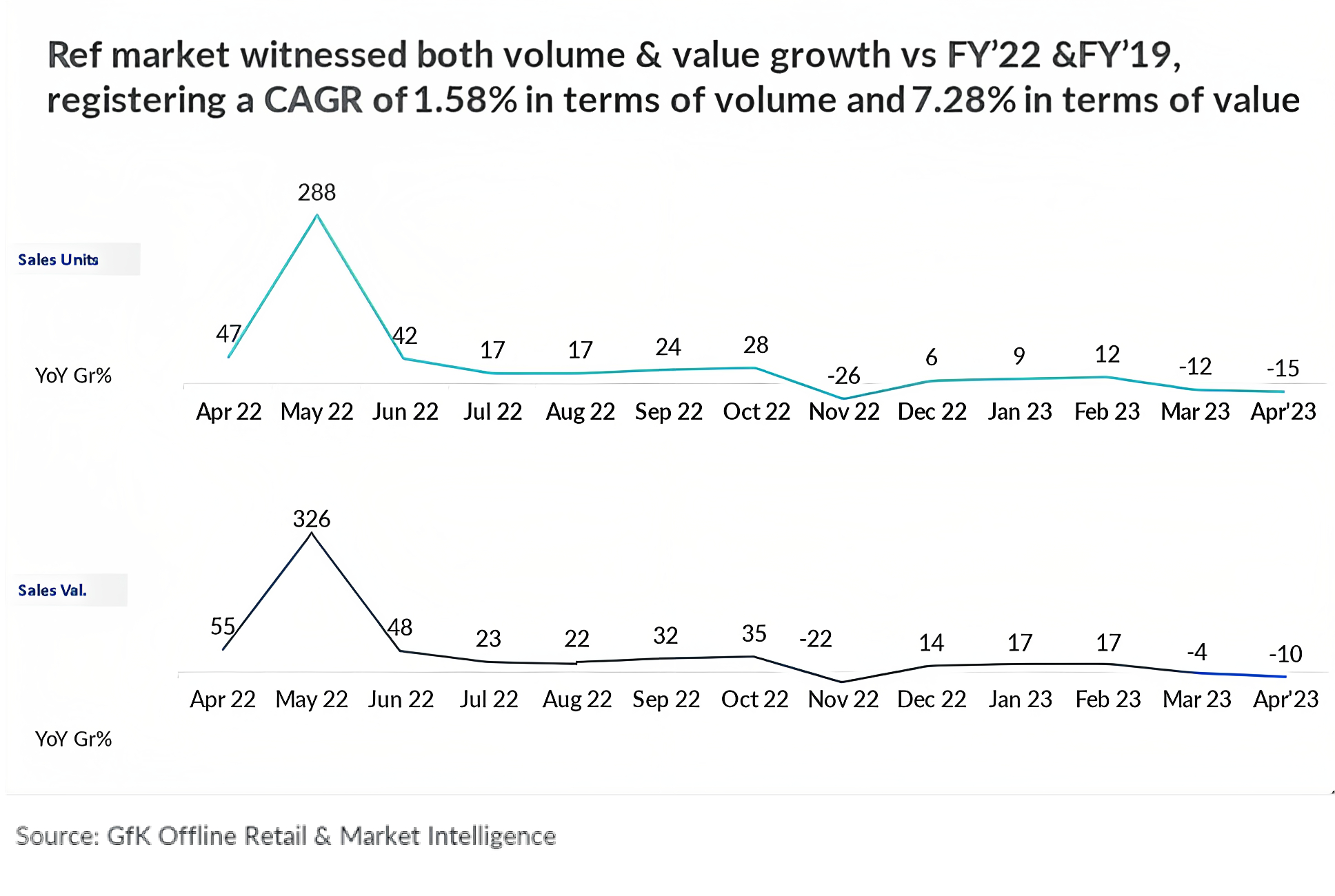

Despite the challenges faced by the air conditioner industry, the refrigerator market has shown resilience and growth. The refrigerator market witnessed both volume and value growth compared to the fiscal year 2022 and fiscal year 2019, registering a Compound Annual Growth Rate (CAGR) of 2% in terms of volume and 7% in terms of value. This growth can be attributed to various factors, including changing consumer lifestyles, increased disposable income, and a greater emphasis on food preservation. Refrigerators have become essential household appliances, ensuring the freshness and longevity of perishable items.

However, it’s important to note that the refrigerator market also experienced a year-on-year growth rate decline of -4% in March and -10% in April 2023 in terms of Value and -12% and -15% in terms of Volume. This decline can be attributed to the unexpected rainfall and the resultant shift in consumer purchasing patterns during that period. The temporary setback highlights the market’s vulnerability to external factors and the need for adaptability in the face of unpredictable weather conditions.

Emerging Trends: Growing Demand and Organized Channel Momentum in Lower Town Classes

In addition to the market trends discussed, it is noteworthy to highlight the growth in the lower-town classes of India. Town Classes 2 and 3 have emerged as the fastest-growing segments in terms of consumer demand for cooling appliances. Furthermore, the organized channel has gained significant momentum in these lower-tier towns.

This trend is particularly evident in the sales data, with air conditioners and refrigerators witnessing impressive value growth in the organized channel. When comparing the years 2019 and 2022, air conditioners experienced a remarkable 72% increase in value, while refrigerators saw a notable 65% growth in Town Classes 2 & 3.

The emergence of the organized channel in these lower-tier towns signifies improved accessibility and availability of cooling appliances. Consumers in these areas now have access to a wider range of products, competitive pricing, and better after-sales services, contributing to the overall growth of the market.

Energy Efficient-conscious consumer behavior

As awareness about climate change and environmental sustainability grows, consumers are becoming increasingly conscious of their ecological footprint. This shift in consumer behavior has influenced the cooling appliance market in several ways. Energy efficiency has become a paramount factor for consumers when choosing cooling appliances. In response, manufacturers have developed eco-friendly products that consume less power while delivering optimal cooling performance. In addition, the adoption of green refrigerants and the integration of smart technology in cooling appliances have gained traction, allowing users to monitor and control their energy consumption more effectively.

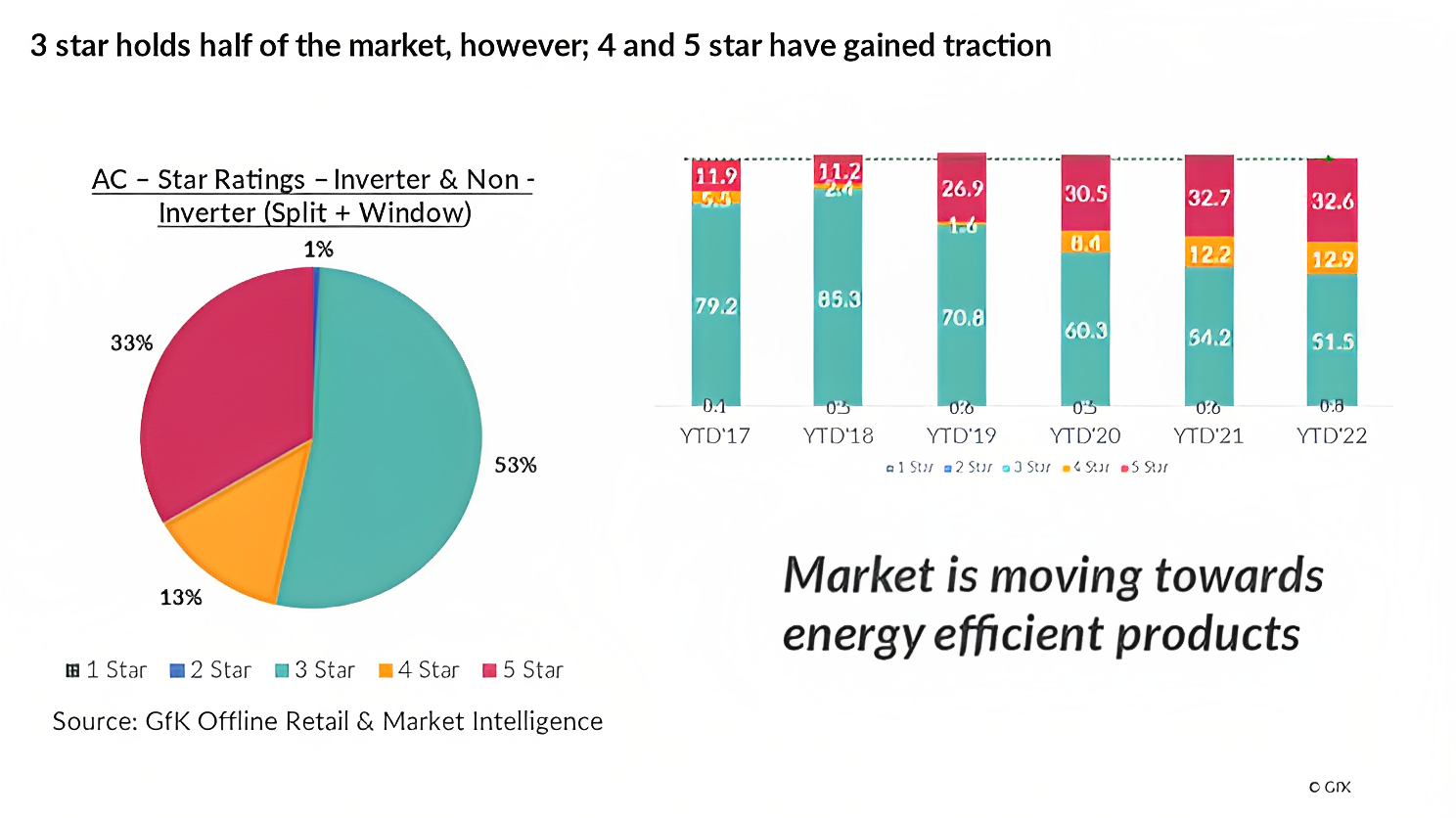

From the graph below, which is a combined graph of inverter and non-inverterx of both Split and Window AC’s, it is evident that 3-star ACs continue to hold the largest market share, capturing half of the market. However, there is a noticeable trend of increasing traction for 4 and 5-star ACs year on year.

Consumers are increasingly inclined towards higher star-rated ACs due to their superior energy efficiency and cost-saving benefits. The environmental consciousness and awareness of energy conservation have contributed to the growing demand for more energy-efficient cooling solutions.

The shift towards 4 and 5-star ACs signifies consumers’ willingness to invest in products that not only provide effective cooling but also align with their sustainability goals. These higher Star-rated ACs, with enhanced energy-saving features, help reduce electricity consumption and minimize the environmental impact.

Technological advancements and innovation:

The unpredictable weather patterns have pushed manufacturers to innovate and develop new technologies to meet the evolving needs of consumers. IoT (Internet of Things) integration and smart features have become prevalent in cooling appliances, enabling remote control, energy monitoring, and personalized cooling settings. Furthermore, advancements in compressor technology and the use of sustainable refrigerants have improved the overall efficiency and environmental impact of cooling appliances.

Outlook: The Resilience and Innovation of India’s Cooling Appliance Market

The cooling appliance market in India is subject to the influence of unpredictable weather patterns. The industry has faced challenges due to unexpected rainfall, which temporarily impacted the demand for air conditioners. However, the market has shown resilience and is gradually recovering.

Technological advancements have played a crucial role in meeting consumer needs and improving the energy efficiency of cooling appliances. Integration of IoT technology and smart features has enhanced user experience and enabled better energy monitoring and control.

To ensure a sustainable future, the industry and consumers must continue to prioritize energy efficiency and environmental consciousness. Government initiatives and policies play a crucial role in promoting sustainability and supporting the development of eco-friendly cooling appliances.

Overall, the cooling appliance market in India is adapting to the challenges posed by unpredictable weather conditions. Manufacturers are innovating to meet consumer demands, and consumers are increasingly making environmentally conscious choices. With continued efforts towards energy efficiency and sustainability, the market is poised for growth and a greener future.