All five measures rise led by major purchase

intentions jumping five points

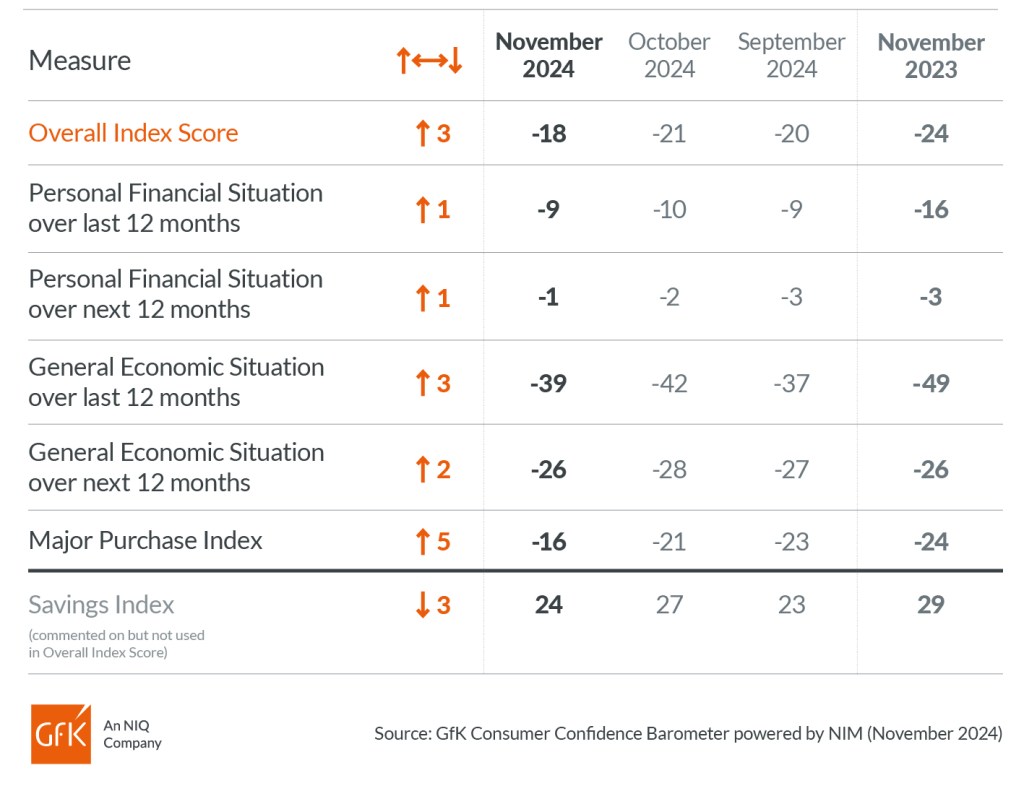

London, November 22nd, 2024 – Long-running Consumer Confidence Index increased by three points to -18 in November. All measures were up in comparison to last month’s announcement.

Neil Bellamy, Consumer Insights Director, NIQ GfK, says: “Consumer confidence has improved by three points in November to reach -18. There was evidence of nervousness in recent months as consumers contemplated the potentially worrying impact of the UK Budget at home, and even the implications of the US presidential election. But we have moved past those events now. The biggest change this month is in major purchase intentions, an important measure that has jumped five points from -21 to -16 in the run-up to Black Friday next week. The other four measures, covering personal financial expectations and the wider economy, have registered small increases too. But while 2025 is just around the corner and the New Year often brings optimism, it’s too early to expect significant further improvements in the consumer mood. As recent data shows, inflation has yet to be tamed, people are still feeling acute cost-of-living pressures, and it will take time for the UK’s new government to deliver on its promise of ‘change’.”

UK Consumer Confidence Measures – November 2024

The Overall Index Score increased by three points to -18 in November. All measures were up in comparison to last month’s announcement.

Personal Financial Situation

The index measuring changes in personal finances during the last year is up one point at -9; this is seven points better than November 2023.

The forecast for personal finances over the next 12 months is up one point at -1, which is two points higher than this time last year.

General Economic Situation

The measure for the general economic situation of the country during the last 12 months is up three points at -39; this is 10 points higher than in November 2023.

Expectations for the general economic situation over the next 12 months are up two points at -26; this is the same as November 2023.

Major Purchase Index

The Major Purchase Index is up five points to -16; this is eight points higher than this month last year.

Savings Index

The Savings Index has decreased three points to +24; this is five points lower than this time last year.

About the survey

- The UK Consumer Confidence Barometer is conducted by GfK.

- This month’s survey was conducted among a sample of 2,001 individuals aged 16+ in the UK.

- Quotas are imposed on age, sex, region and social class to ensure the final sample is representative of the UK population.

- Interviewing was conducted between 30th October – 15th November.

- The figures contained within the Consumer Confidence Barometer have an estimated margin of error of +/-2%.

- The Overall Index Score is calculated using underlying data that runs to two decimal points.

- The press release dates for the remainder of 2024 are: December 13th. Dates for 2025 are: January 24th; February 21st; March 21st; April 25th; May 23rd; June 20th; July 25th; August 22nd; September 19th; October 24th; November 21st; December 19th.

- Any published material requires a reference to GfK e.g., ‘Research carried out by GfK.’

- This study has been running since 1974. Back data is available from 2006.

- The table below is an overview of the questions asked to obtain the individual index measures:

| Personal Financial Situation (Q1/Q2) | This index is based on the following questions to consumers: ‘How has the financial situation of your household changed over the last 12 months?’ ‘How do you expect the financial position of your household to change over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse) |

| General Economic Situation (Q3/Q4) | This index is based on the following questions to consumers: ‘How do you think the general economic situation in this country has changed over the last 12 months?’ ‘How do you expect the general economic situation in this country to develop over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse) |

| Major Purchase Index (Q8) | This index is based on the following question to consumers: ‘In view of the general economic situation, do you think now is the right time for people to make major purchases such as furniture or electrical goods?’ (right time – neither right nor wrong time – wrong time) |

| Savings Index (Q10) | This index is based on the following question to consumers: ‘In view of the general economic situation do you think now is?’ (a very good time to save – a fairly good time to save – not a good time to save – a very bad time to save) (Commented on but not included in the Index Score) |

About the GfK Consumer Confidence Barometer powered by NIM

There is no other consumer research project with the longevity, rigor, and reliability of GfK’s Consumer Confidence Barometer (CCB). Each month since January 1974, it has provided a snapshot of how UK consumers feel about the crucial economic topics today and their outlook for the next 12 months. It has provided insight into the UK’s thinking through boom and bust, the Brexit vote, and most recently the coronavirus pandemic. Since October 2023, GfK has been cooperating with the Nuremberg Institute for Market Decisions (NIM), GfK’s not-for-profit founder, on the Consumer Confidence Barometer. The aim of the cooperation is to provide even more in-depth analysis of the reasons behind shifts in consumer confidence. GfK’s high-quality survey methodology and rigorous processes have not changed so there is no impact on the CCB dataset and trends. This is the background to the sourcing in the release, ‘GfK Consumer Confidence Barometer powered by NIM’.

About GfK

For over 89 years, we have earned the trust of our clients around the world by solving critical questions in their decision-making process. We fuel their growth by providing a complete understanding of their consumers’ buying behavior, and the dynamics impacting their markets, brands and media trends. In 2023, GfK combined with NIQ, bringing together two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights – delivered with advanced analytics through state-of-the-art platforms – GfK drives “Growth from Knowledge”.

About NIM

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface of academia and practice. NIM examines how consumer decisions change due to new technology, societal trends or the application of behavioral science, and what the resulting micro- and macroeconomic impacts are for the market and for society as a whole. A better understanding of consumer decisions and their impacts helps society, businesses, politics, and consumers make better decisions with regard to “prosperity for all” in the sense of the social-ecological market system. The Nuremberg Institute for Market Decisions is the founder of GfK. For more information, visit www.nim.org/en