- Grocery spend to hit £10bn in the two weeks leading up to 21st December1

- In-store FMCG sales grew (+5.7%) overtaking online sales (+0.6%) as shoppers actively look for discounts on the shop floor

- Health and beauty products saw the second strongest growth (+6.9%) of all super categories while sales fell (-3.8%) for beer, wine and spirits.

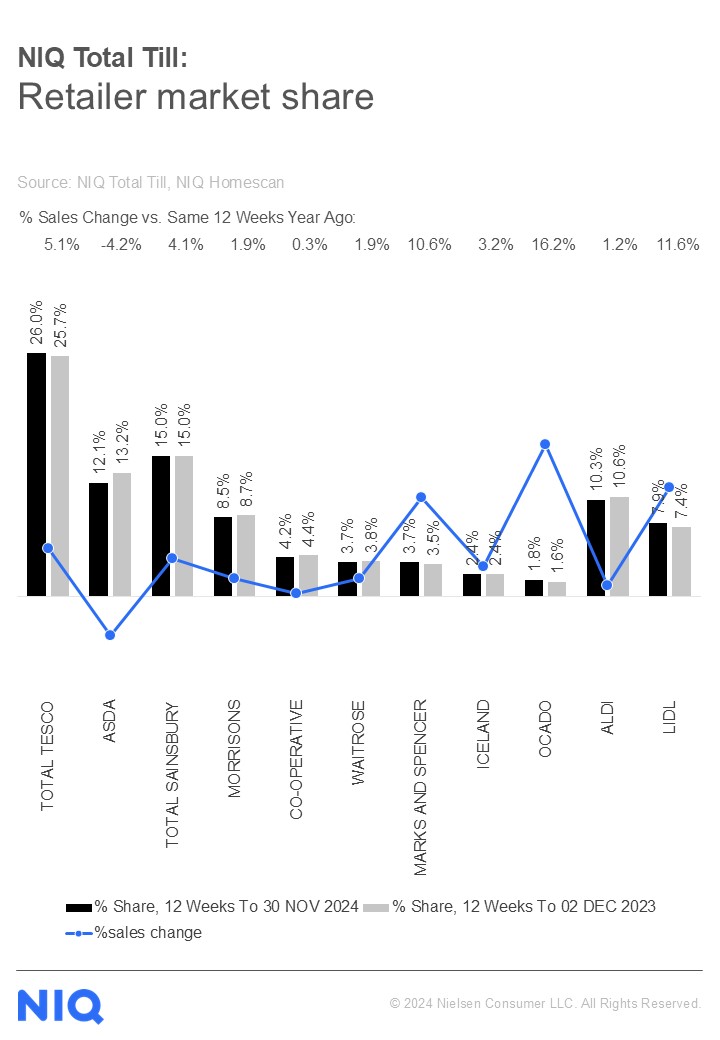

- Ocado (+16.2%) still leads the pack in retailer growth over the last 12 weeks while Marks & Spencer (+10.6%) and Tesco (+5.1%) maintain momentum.

London, 11 December 2024: Total Till sales growth steadied at UK supermarkets (+3.7%) in the last four weeks ending 30th November 2024, down from 4.0% in the previous month, according to new data released today by NIQ. This slowdown in growth is likely due to milder weather, Black Friday distraction and shoppers holding out until early December for the big Christmas shop.

NIQ data also reveals with shoppers actively looking for discounts, over the last four weeks there was a boost to visits to stores (+5.7%) ahead of online shopping occasions (+0.6%). As a result online share of FMCG was at +13.1% compared to last year +13.4%.

Savvy shoppers capitalise on promotions

The percentage of sales purchased on promotion increased to 25% from 24% in October.2 Shoppers are seeking out savvy ways to save money and retailers and brands are hoping to drive incremental sales and basket spend through both more in-store promotional activity and increased loyalty app discounts. ‘Personalised Savings’ is thought to have unlocked this discretionary spend with 38% of households set to use vouchers and points saved up for their Christmas groceries this year.3

Black Friday also coincided with payday at the end of the month, seeing value growth sustained at the Grocery Multiples in the last week of November. Shoppers cashed in on higher ticket priced items while on promotion, such as 25% off six bottles of wine and beauty and gifting offers. However, this likely resulted in holding back spend on other items such as storage cupboard food, frozen and household basics where growth was flat.

Health and beauty wins out

In terms of category growth, NIQ data shows that the Health & Beauty category experienced an uplift in sales (+6.9%), likely helped by Black Friday discounts. However, beer, wines and spirits (BWS) continue to struggle as value sales fell (-3.8%) and there was no corresponding increase in unit sales (-2.5%) compared to a year ago.

Looking ahead to Christmas celebrations with family, NIQ data reveals that 50% of shoppers still expect to dine with turkey while 22% opt for chicken, with beef following at 20%. And 12% opting for vegetarian or vegan alternatives.3

Ocado leads the pack

In terms of retailer performance over the last 12 weeks, Ocado (16.2%) remains the fastest growing retailer, with little between Lidl (+11.6%) and Marks and Spencer’s growth (+10.6). Tesco maintains healthy sales growth (5.1%).

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “Sales are going to accelerate in the two weeks up to the 21st December. The biggest single week will be week ending 21st December with £6bn being spent at the grocery multiples, which is a third of the 4 weekly spend in one week. Food retailers can prepare for this late rush starting next week as shoppers will be looking for fresh food, centre pieces for the dinner table and last-minute gifts, including a trade up to premium items”.

Mike Watkins adds: “Last year with food inflation at 7% (BRC NIQ SPI), volumes fell in December 2023 however, this year NIQ expects volume growth of around +1%. Even with 50% of households saying it is important for them to make savings on their Christmas groceries this year, 66% still expect they will spend the same or more than last year (NIQ Homescan Survey) and 38% intend to use points or vouchers saved up. So there are reasons to be cheerful”.

Table: 12-weekly % share of grocery market spend by retailer and value sales % change.

Notes

Unless otherwise stated all data is NIQ Homescan Total Till

1 NIQ Scantrack Grocery Multiples

2 NIQ Homescan FMCG

3 NIQ Homescan Survey November 2024

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together the two industry leaders with unparalleled global reach. Today NIQ has operations in more than 95 countries covering 97% of GDP. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com