- The last four weeks saw Total Till sales grow (+5.3%) but underlying growth at 3% as unit growths plateau over last few weeks

- Price conscious shoppers turn to scratch cooking to save money, boosting value growth (+6.8%) to the fresh food category, with shoppers seeking opportunities to elevate at-home dining experience, with increased sales for fresh dips, gravy, cream and custard

- Brits returned to stores to seek out savings with in-store visits up (+5.2%) on last year.

London, 5 February 2025: Total Till sales grew at UK supermarkets (+5.3%) in the last four weeks ending 25th January 2025, up from +3.6% recorded in December, according to new data released today by NielsenIQ (NIQ). With a better outlook on food inflation (+1.6%)1 compared to last year (+6.4%), there was good unit growth of +0.9% at the Grocery Multiples. However, growth slowed after the new year.

January is typically a time of year for a healthy reset for consumers, and NIQ data shows 12%2 of British households purchased meat-free substitutes in the last four weeks. Whilst this is a small drop from 14% last year, shoppers have not cut back on healthy diets with double-digit growth in freshly prepared fruit (+16%) and fresh veg accompaniments which grew by +9%. Meat, fish and poultry was the fastest growing super category (+9.1%) as shoppers sought to cook protein-rich meals as part of New Year diets. This was followed by petcare (+8.3%) and dairy products (+6.8%).

In addition, NIQ data shows that half of all UK households now say they cook from scratch every day or most days, with around 16% doing so more due to the rising cost of living. The impact of this shift in behaviour marks a spike in demand for easy hacks to speed up or elevate the dining experience, with a boost in sales for fresh gravy (+28%), fresh dough and pastry (+18%), fresh dips (+15%) and fresh cream and custard (+14%).3

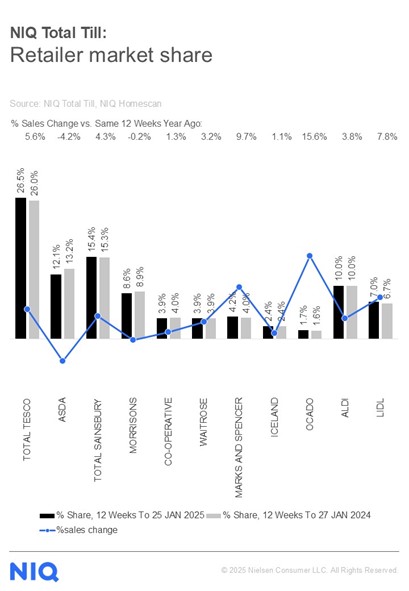

In terms of retailer performance, Ocado led with a sales growth of +15.6% compared with the same period last year. This was followed by Marks & Spencer (+9.7%) helped by its bigger store formats motivating shoppers to add more items to their baskets as well as its dine-at-home deals. There was also continued growth at the discounters Lidl (+7.8%) and Aldi (+3.8%) with both retailers gaining new shoppers and more store visits.

Mike Watkins, Head of Retailer and Business Insight at NIQ said: “The lift to grocery sales in the last four weeks was helped by the timing of the New Year, with a proportion of sales coming from the new year festivities which was week ending 4th January (+10.0%)3. However, after this, weekly growth in January was slightly lower. Whilst overall Total Till sales growth was higher than December, the underlying trend is closer to +3% which is the average growth in the most recent three weeks.”

Watkins adds: “NIQ Homescan data shows that the cost of living is still firmly consumers’ number one concern at the start of 20254. Shoppers are looking to save money and eat healthier leading to a growing trend in scratch cooking, which is one of the key behaviours driving the strong unit growth (+2%) and value growth (+6.8%)3 in fresh food categories in the last four weeks.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change.

Notes

Unless otherwise stated all data is NIQ Homescan Total Till

1 BRC NIQ SPI

2 NIQ Homescan FMCG

3 NIQ Scantrack Grocery Multiples

4 NIQ Homescan Survey Nov 2024

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together the two industry leaders with unparalleled global reach. Today NIQ has operations in more than 95 countries covering 97% of GDP. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com