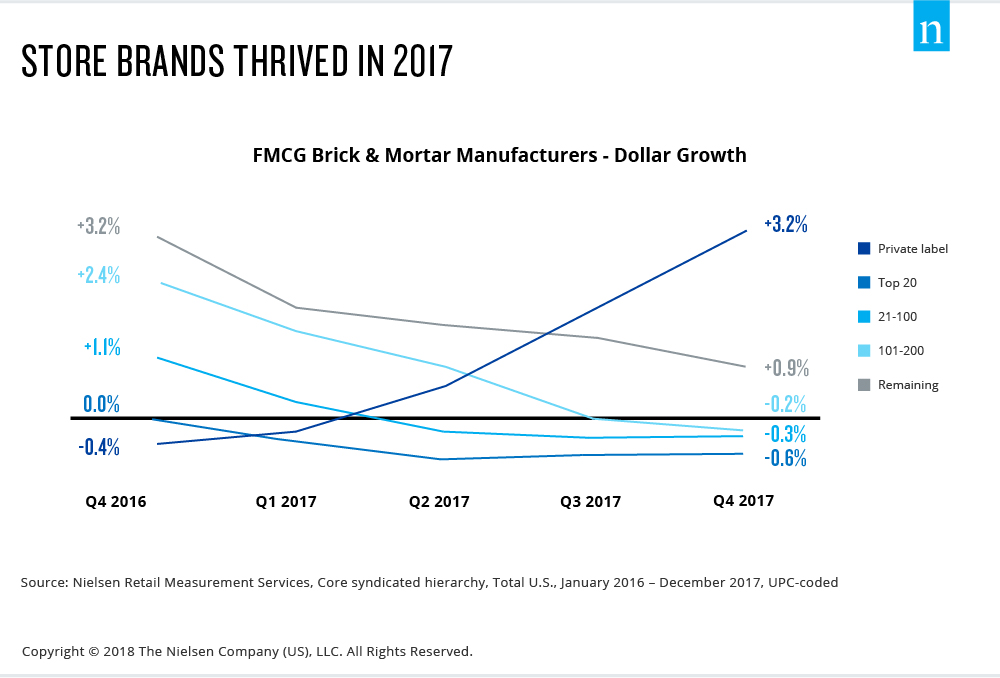

Store brands were posting dollar growth of more than 3x the rate of branded products by the end of 2017

The U.S. manufacturer landscape has been dynamic over the past year. Retailer-branded, private-label products have surmounted stigmas of value and quality. And as a result, we’ve seen a complete reversal in growth trajectory compared to manufacturer branded items.

Compared with the closing quarter of 2016, when private label was trending negatively, store brands were posting dollar growth of more than 3x the rate of branded products by the end of 2017. But this doesn’t spell the end for manufacturers; it just signals heightened competition and the need to evaluate all levers for growth in 2018, price points included.

Beyond any individual channel, store branded products continue to redefine their importance to retail, and drove growth throughout 2017. Thriving at +3% in dollar sales year-over-year, sales of private-label products eclipsed $125 billion across FMCG brick-and-mortar outlets. But not all private-label products are driving growth at the same rate, and not all branded products are experiencing declining sales.

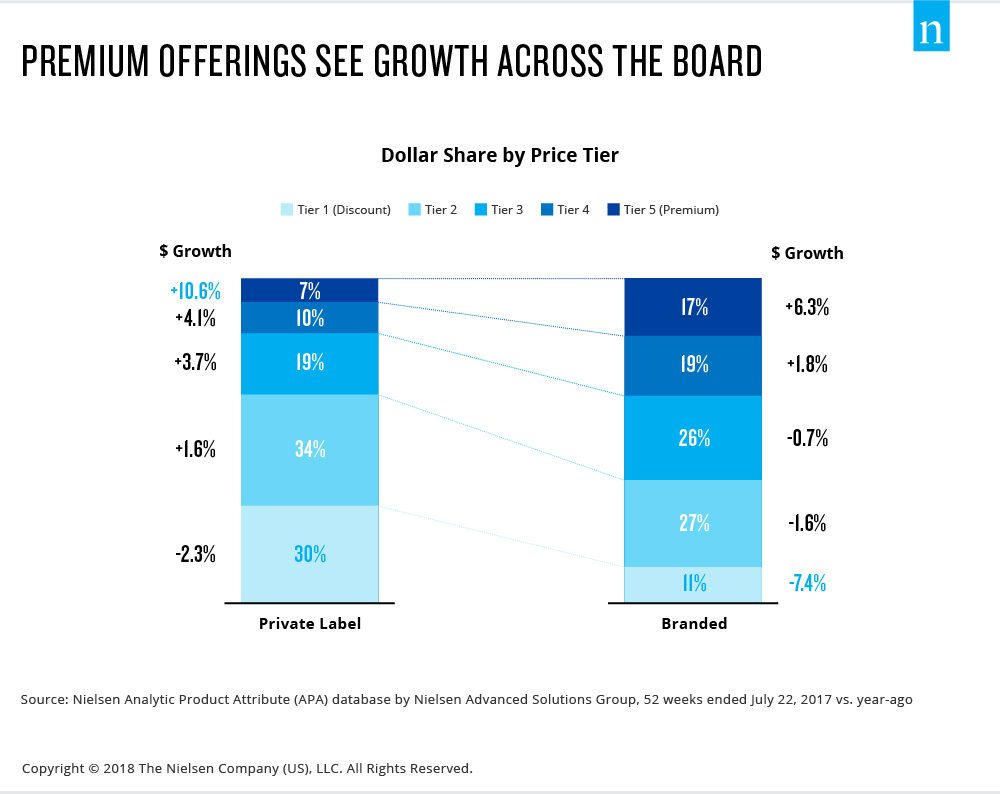

When dissected by price tier, it’s clear that premium products are winning across the board. Analyzing individual UPC price points, we created a five-tier distribution that isolates the most premium- and discount-oriented groups of products. Through this, it becomes clear where opportunities lie for both manufacturers and retailers. For store brands, discount offerings represent over 60% of revenue; however, the most value-oriented products have struggled to keep pace compared to double-digit dollar growth of premium products. Across branded product sales, premium tiers are sustaining more than one-third of dollar volume and are driving the most growth.

Where manufacturers, of both name brands and private labels, can cater to consumer demand for gourmet and grandiose products, they can hit the sweet spot where the lowest-cost brands are missing the mark.

For additional insight, download our latest Total Consumer Report.