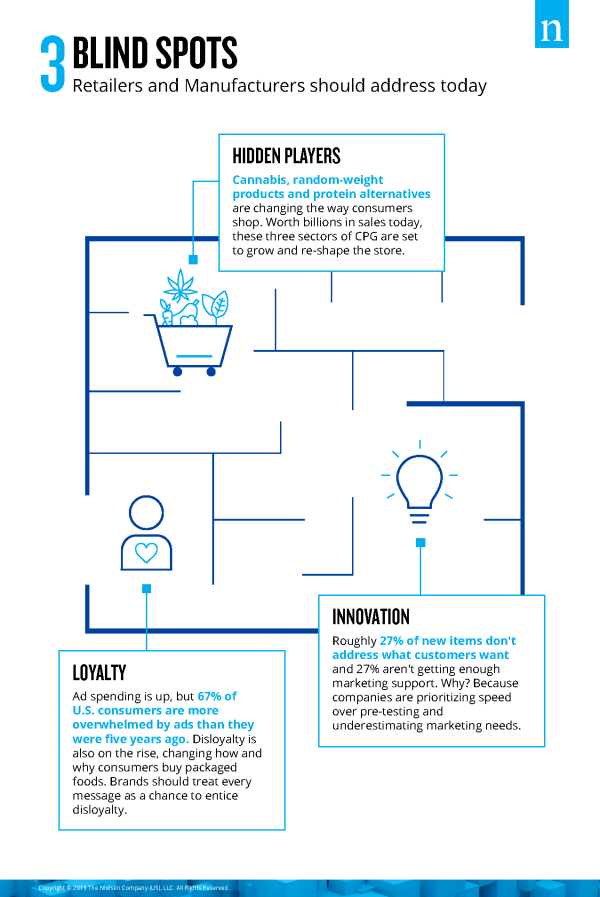

Among the many facets of change, perhaps none is more daunting than the need to not fall behind or get caught off guard. So what are the big “watch-outs” that consumer packaged goods (CPG) manufacturers and retailers need to be mindful of among the many that might not carry as much weight over the long term? While we could list many, we’ve identified three blind spots that we believe should be top of mind given the long-term nature of the implications involved.

Your ad spend can’t buy you loyalty

When you think about marketing, you’d be hard-pressed to think of a more desired outcome than consumer loyalty. Loyalty has always been a treasured commodity, but now that consumers have anything and everything they desire at their fingertips, it’s far less prevalent than it used to be. In fact, 46% of global consumers say they’re more likely to try new brands than they were just five years ago.

In some respects, traditional advertising efforts do some good in fighting off disloyalty. The U.S. and Europe account for approximately 80% of the NielsenIQ-estimated worldwide ad budget, and consumers in these two regions are the least open to trying new things. But marketers need to understand that consumers don’t want to be bombarded with corporate messages. In the U.S., for example, 67% of consumers say they’re more overwhelmed by ads than they were five years ago. That tells us that we could be nearing a breaking point—the point at which advertising stops having a positive effect on consumption.

So as the disloyalty tide rises, brands need to throw out the old advertising playbook and use every messaging opportunity to encourage disloyalty. Disloyalty, or the tendency to switch brands, is where the opportunity is today, and it’s where manufacturers and retailers should be focused.

So how do brands re-focus? According to NielsenIQ research, earned presence is more likely to influence brand switching than traditional paid investments. Said differently, brands should open themselves up to social engagement and interaction—invite feedback. Brands have been talking about feedback loops for years, but they rarely capitalize on the real-time feedback that social media delivers. That’s not to say they should abandon traditional messaging, however. Advertising is still a part of the “reach” journey, but multi-layered trust building tactics are vital and carry more weight long term.

Cannabis is no longer hiding in plain sight

We’ve all heard the term hiding in plain sight. And perhaps a year or so ago, we might have been able to apply it to the cannabis market. Today, cannabis isn’t in hiding, but its value and impact on the CPG market has yet to fully take shape.

We estimate that legalized cannabis sales in the U.S. totaled $8 billion last year. In just a few short years, however, last year’s cannabis sales will seem minuscule. Not only are additional states opening up for legalized cannabis business in 2020, the brand landscape in the cannabis space is exploding. Hundreds of emerging brands are seeking to capitalize on the growth opportunities, and those opportunities are broad with relevance across a large cross-section of categories.

Importantly, there’s quite a bit to consider with respect to cannabis, specifically because it’s a broad term that covers products that can be classified into one of two groupings, depending on whether they’re derived from the marijuana plant or from the hemp plant. Legal constraints for use and sale vary by retailer, state, and even city, but we expect legalized sales to eclipse $40 billion by 2025. That means CPG players need to do more than prepare: They need to understand the demands of cannabis-interested consumers before the gates open to even broader assortment, distribution and messaging.

Get the innovation right

Choice is one of the greatest attributes of today’s consumer landscape, and it raises the stakes for any manufacturer or retailer vying for consumers’ patronage. And sadly, many are approaching the challenge by simply adding more noise to the retail market.

Unfortunately, just shy of one-third (27%) of new launches globally don’t address something consumers actually want. That doesn’t stop brands, however, from pushing billions in marketing dollars toward these non-viable new products. Meanwhile, another 27% of new products that are viable fail because brands don’t support them with adequate marketing.

Manufacturers and retailers are doing this to themselves. In the need for speed, they’ve lost touch with the fundamentals of successful product development. “Agile” has become the new it word across many industries, including the CPG market, but when brands opt for agility over accuracy, it hurts the bottom line. Instead of flying blind and hoping for the best, brands need to get back to pre-testing new innovations and investing in post-launch learnings that follow any launch.

Testing and learning aren’t inhibitors to agility. They’re facilitators.