The pet category is already feeling the impact of CBD

Cannabis is poised to be the next big opportunity in the U.S. consumer packaged goods (CPG) market. That opportunity, however, isn’t limited to just human consumers. Given the love that consumers have for their pets, the cannabis opportunity, particularly with respect to cannabidiol (CBD), is just as big.

In 2018 alone, regulated adult use cannabis retailers in California, Colorado, Nevada, and Washington rung up $9.4 million in pet product sales. And given the expected $2.25 billion-$2.75 billion in sales this year, we expect pet care to account for a notable portion of the growing total.

The regulatory environment pertaining to the hemp-based CBD market is evolving, but our sales projections account for the uncertainty around various pending FDA rulings.

CBD, a non-psychoactive compound derived from the marijuana plant, is gaining wide acceptance with U.S. consumers for treating an array of common ailments, including pain, anxiety, and sleeplessness. CBD isn’t a fit for all categories, but it will have a big impact on a handful, including health & beauty, coffee, tea, candy, and pet care.

It’s nearly impossible to not see the impact that CBD is having on the CPG industry, which is broadening its appeal beyond consumers who have been aware of hemp-based CBD well before now. That broadening appeal bodes well for pet owners, as U.S. consumers are increasingly thinking of—and shopping for—their pets as true family members, which means they’re growing mindful of what they buy for them. Notably, U.S. consumers spent $33 million on pet food with human-grade products over the past year.

It will take time for CBD to become more mainstream in the pet category, but the impact is already starting to mount. According to the 2020 Pet Industry Green Paper, jointly published by NielsenIQ and Headset, almost three-fourths of current CBD consumers have pets, and almost one-fourth of U.S. pet owners already use CBD for themselves, their pets, or both.

From a retail perspective, the future is bright for CBD-related pet products. U.S. pet care sales were up about $800 million last year, and we know that consumers are willing to pay more for products and services that are differentiated from other options. These attributes bode well for CBD pet products: they are differentiated and they cost more.

Pricing opportunities for pet CBD products

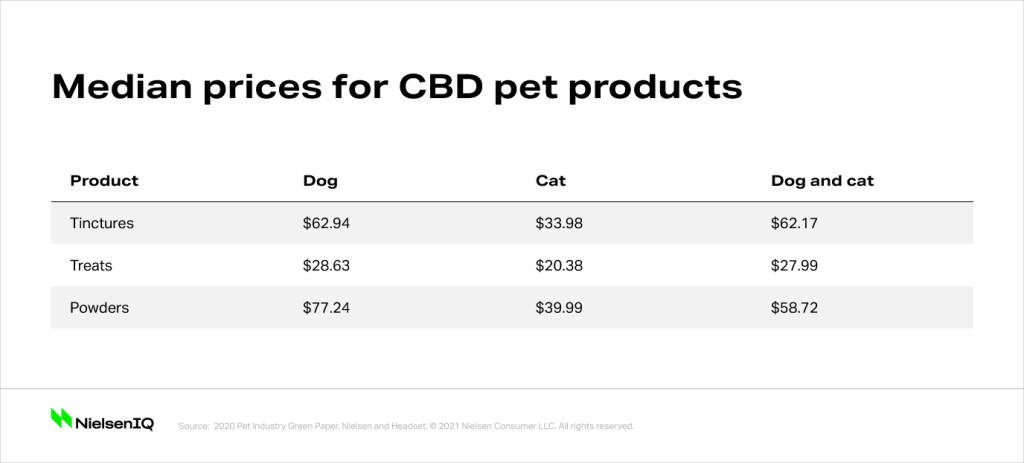

Across the array of products in the hemp-CBD realm, tinctures (plant material dissolved in ethanol), powders, and gels have the highest median selling points. As with traditional supplements, prices increase as potency, purity, and quantity increase. For example, consumers can buy a 330 mg bottle of dog formulated full-spectrum CBD extract including 100 mg of active CBD oil for as low as $24.99. That potency is typically recommended for small breeds. For larger breeds and larger animals, such as horses, consumers can expect to pay as much as $220 for products with 1,200 mg of active CBD oil. Comparatively, U.S. online retailer Chewy.com sells a 180-count chewable multi-vitamin for dogs for less than $14.

In looking at hemp-CBD opportunity across the two most common household pets, there is greater pricing and sales opportunity for dogs than cats. That opportunity is primarily based on animal size, as dosages and potencies are typically lower for smaller animals.

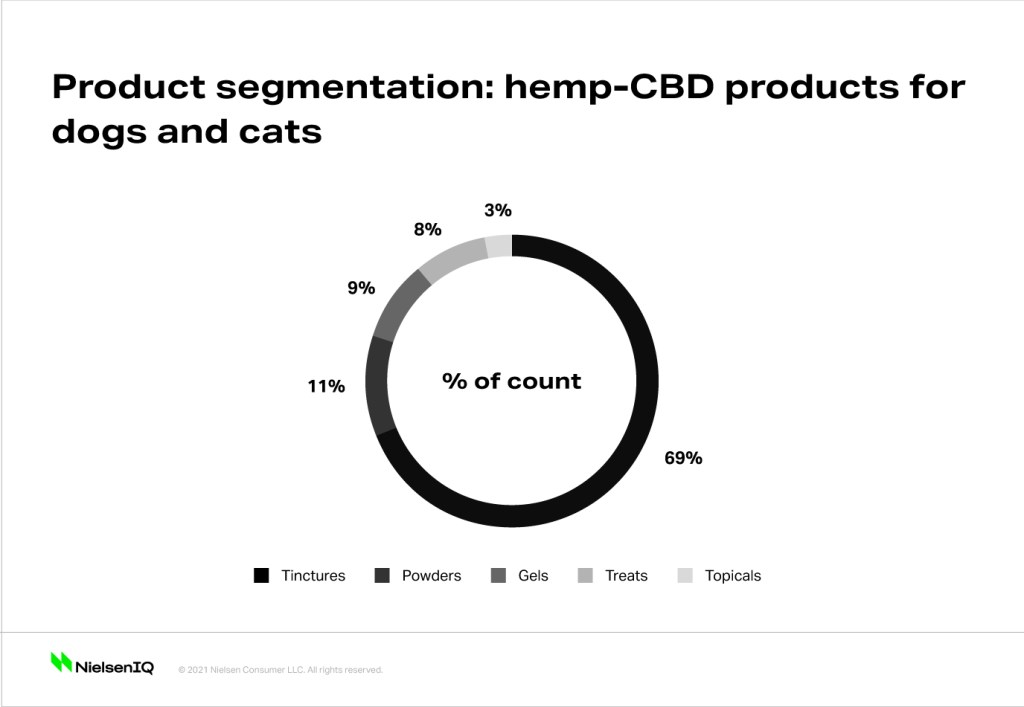

To date, tinctures account for nearly 70% of the hemp-CBD pet products researched for the Pet Industry Green Paper, which suggests greater opportunity across powders, gels, treats, and topicals.

Regardless of animal, breed, or product, hemp-CBD will be a significant disruptor in the pet category. CBD pet products will represent 3%-5%of all hemp CBD sales in the U.S. by 2025, and the category boasts one of the highest in the CPG industry (37%). Said differently, there’s significant upside in the CBD space, which should be welcome news for manufacturers and retailers alike.