A rapid reshaping of consumer spending dynamics

If there is only one wave of the virus, the OECD projects that employment in the U.K. will fall by 4.6% in 2020 and grow by only 2.1% in 2021. This would push overall unemployment to a record high of 11.7% by the end of this year. In a second-wave scenario, unemployment in the U.K. could reach 14.8% by the end of 2020. Projections like these clearly highlight that consumers will need to recalibrate their spending habits. In other words, we may still be eating more meals in our homes, but what we eat and how much we’re able to afford will change, and that change may last years. And it won’t just be food. Consumers will completely reassess what goes in their shopping basket. As jobs dry up and young people are forced to stay at home with their parents for years longer than planned, the household shopping dynamic will change. We’ll see millions of new multigenerational households. People will delay marriages and having children. In short, life will get pushed back. And so will purchases. Consumers will buy their first big-ticket items like homes, cars, even appliances, later in life.

Earlier this year, as the full impact of COVID-19 was taking hold, the NielsenIQ Intelligence Unit identified a rapid reshaping of consumer spending dynamics. Put simply, the polarized spending environment will include “constrained” and “insulated” spenders, each of whom will spend according to their specific scenarios. In the early days of the pandemic, constrained spenders were newly unemployed, such as travel and hospitality workers. Insulated spenders were often retired or working in corporate roles that shifted to working from home as global movement restrictions came into play. But as we look down a clear path of long-term economic recession, the meaning of polarized spending is shifting. For example, insulated spenders may tighten their belts to be fiscally practical to weather the uncertain times ahead.

COVID-19 has had an economic impact on everyone

Importantly, the economic impact of the recession will likely affect both the “haves” and the “have nots,” even as the World Bank and the OECD point to a growing wealth divide. Research conducted in Australia by NielsenIQ found that 39% of those we classified as “insulated” earned AUD $100,000 or more annually, while those in the “constrained” segment with the same income level sat at 31%.This highlights that even high earners will be constrained and that the wealth gap will widen, which means brands and retailers will need to navigate product portfolios and pricing accordingly. The COVID-19 pandemic is forcing a global recalibration of priorities for countries, businesses, and individuals. For many consumers, it will mean an ongoing recalibration of lifestyles and meaningful changes in what they expect from brands and the retailers selling them. And that means brands and retailers will need to serve consumers differently and in the context of low confidence levels for economic recovery. Consider the likely shift toward demand for more value-for-money products. On the one hand, large multi-packs may offer the best value, but they may be out of reach for people short on cash. Cash-strapped consumers may be forced to buy smaller pack sizes, and brand loyalty across categories may fade.

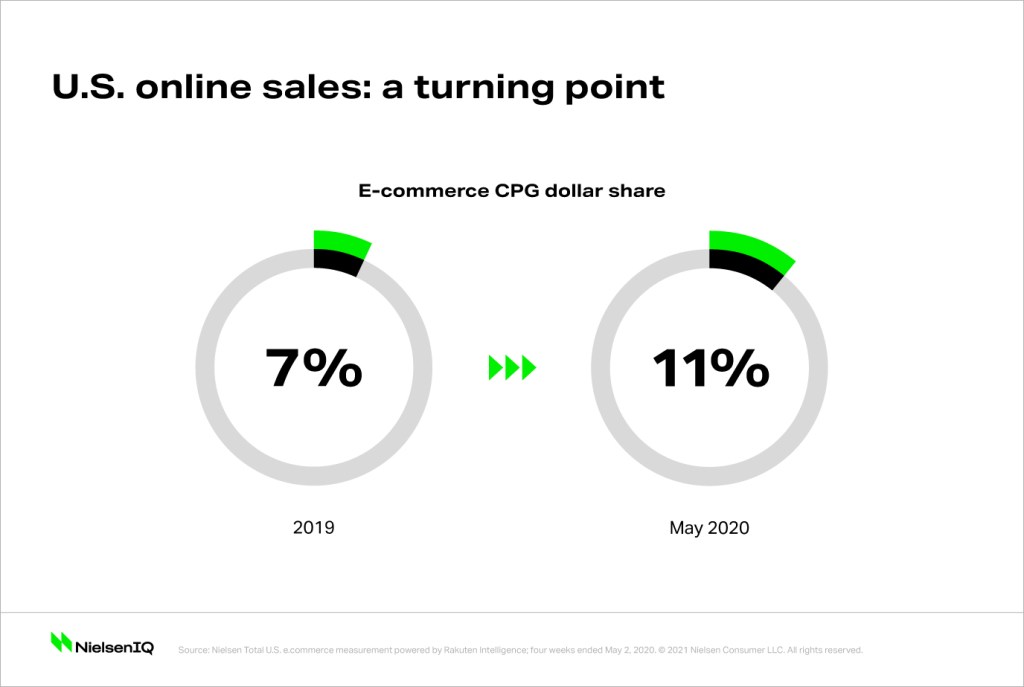

Consequently, FMCG manufacturers are reassessing their portfolios to adjust. Similarly, retailers are reconsidering how to stay relevant to consumers who will have rapidly changing consideration sets. In the past, they could have performed these kinds of assessments with relatively ample time for testing. That is no longer the case. Changing retail channels are a case in point. Online adoption has taken just weeks to get to a tipping point that would have otherwise taken years. The U.S. offers a case in point with a 4% bump.

Whatever the channel, getting assortment and pricing right will be key. So too will packaging and brand claims. Consumers are looking for clear claims that highlight the benefit of the product. Not surprisingly, there is strong demand at all price points for products offering health benefits, such as immunity-boosting capabilities or germ-killing powers. Wherever brands sit in the price spectrum, it will be critical that they shift as consumers reconcile their wallets with their shopping baskets. Keeping pace with those reconciliations will be another essential.