Consumer sentiments around product claims changed

The novel coronavirus (COVID-19) pandemic is unlike anything the world has ever experienced, and its spread is affecting consumer sentiment and purchase behavior globally.

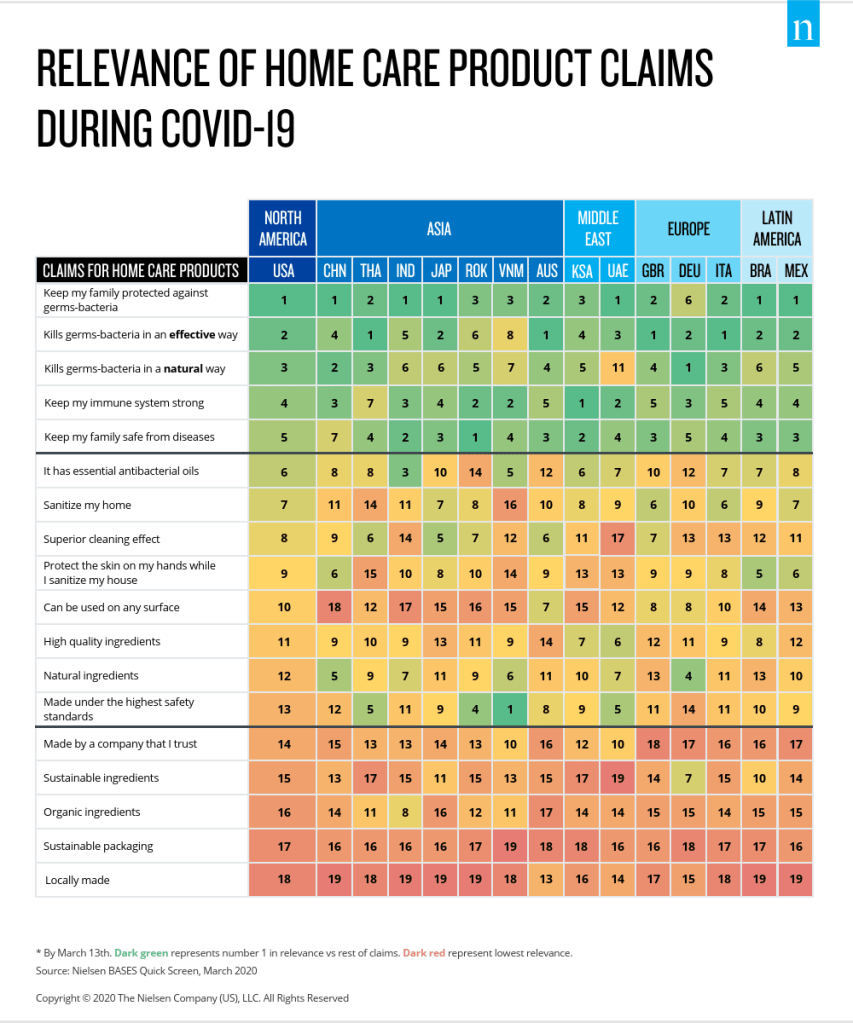

As with any pandemic, global consumers have been quick to align their spending with products and services aimed at health protection. The sentiment around staying safe and hygienic has amplified the relevance of certain product claims. Specifically, research from NielsenIQ BASES has found that consumers now believe that product claims focused on killing germs, providing immunity, and overall health promotion are more relevant than claims around naturalness, sustainability, quality, and brand.

The relevance of these claims reflects a notable shift in consumer sentiment from before the pandemic, when claims of quality and trust resonated more with consumers. The shift is not unilateral, however, as killing germs with the added benefit of doing so naturally has the strongest relevance in Germany, China, and Italy.

Consumers prioritized online shopping; premium products

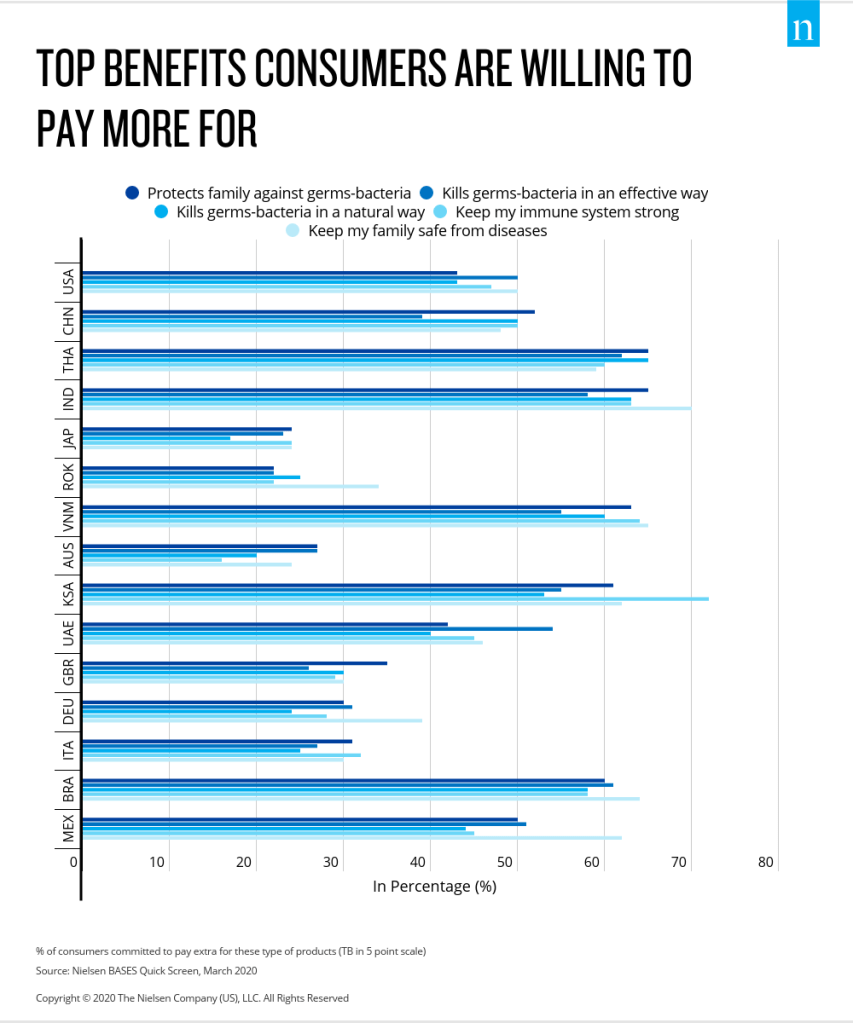

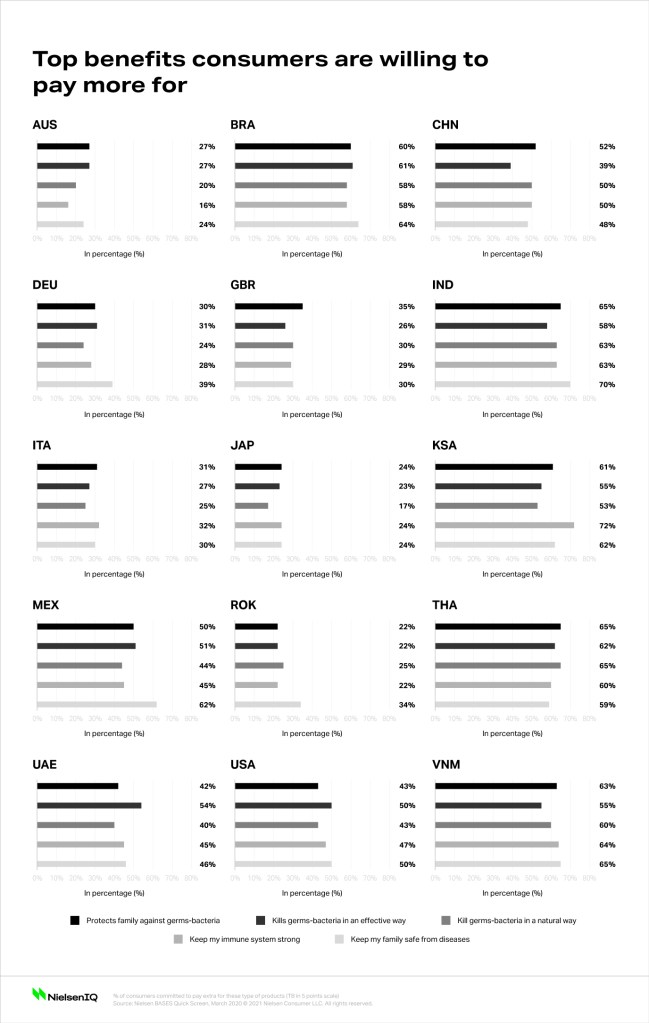

Given the importance of health and safety during a pandemic, product quality and efficacy will become key purchase drivers across many CPG categories. We also know from NielsenIQ’s global research that people are willing to pay more for products that are either unique or somehow differentiated from other options. Amid the COVID-19 pandemic, NielsenIQ BASES Quick Screen research has identified the top 5 product benefits that consumers are willing to spend more for:

- Protects family against germs and bacteria

- Kills germs and bacteria in an effective way

- Kills germs and bacteria in a natural way

- Keeps my immune system strong

- Keeps my family safe from diseases

While the commitment to pay extra varies by country, consumers globally agree that products for family safety could command a premium. Countries in the Middle East are the exceptions: consumers there are more willing to pay a premium for products that promote immune system strength and offer effective germ-killing.

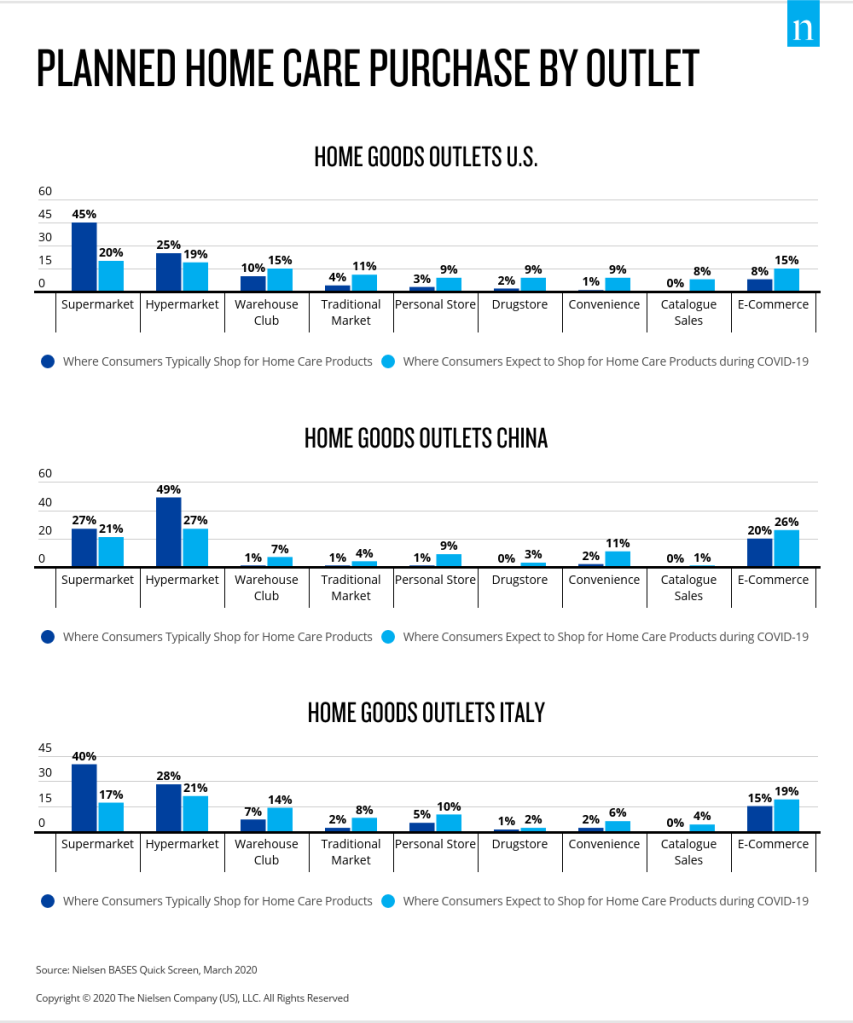

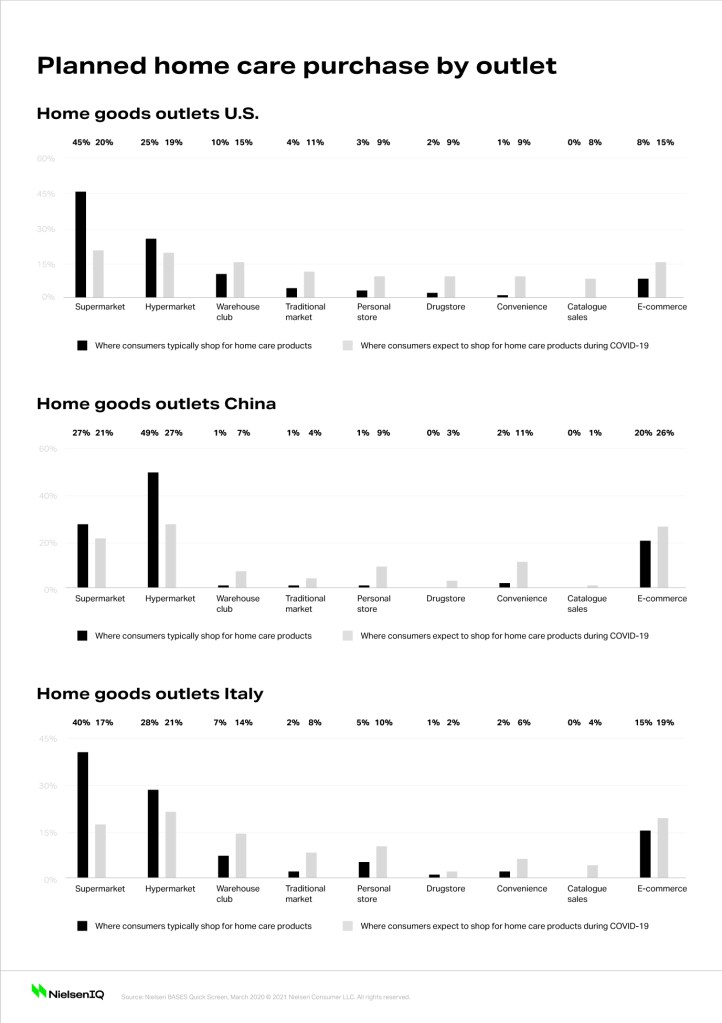

Given the stress that the pandemic is causing traditional brick-and-mortar retail operations, consumers are changing the way they shop. In fact, consumers are becoming increasingly savvy online shoppers, as online shopping sales for the week ended March 14, 2020, were 91% higher than they were a year ago. The shift is notable for home care products, as consumers across markets typically purchase them in-store at supermarkets and hypermarkets (markets that sell in bulk but don’t require a membership to shop).

Traffic at big box stores significantly below average

Given that most of the world’s consumers are abiding by restricted living guidelines (threshold 5 according to our 6 behavior threshold model), foot traffic at club and warehouse stores are significantly below averages, and will remain there for some time. Engagement at these stores was much higher when consumers were planning for the pandemic, back at threshold level 3, when shoppers were looking for bigger, value-size pack offerings to reduce their shopping trips and fill up their pantries.

The restricted living conditions that global consumers are living in mean convenience and proximity will play a bigger role in everyday essential shopping needs, and we can see how that’s playing out when it comes to where we’re making our quick purchases.

COVID-19 will shift consumer sentiments beyond pandemic

While home care products that provide protection against germs are most top-of-mind for consumers around the globe during COVID-19, the severity of the health implications of COVID-19 will likely shift sentiment about product claims beyond the pandemic. Prior to the pandemic, consumer product claim preference was increasingly focused on natural and sustainability. Time will tell whether pre-pandemic preferences return or if we see a blending of preferences.

The key for brands is to stay connected with consumer preference shifts as they happen. The pandemic has dramatically changed how consumers everywhere behave and shop, and it’s critical that brands understand how in order to ensure that their products and services meet today’s needs. The same will be true post pandemic. Organic and sustainability claims may return to the forefront down the road, but the only way to be able to adjust when the time comes is to stay informed.