Much to the regret of English football enthusiasts, the European Cup decided not to go home, but has opted for a trip to the southern region of Europe and has landed in Rome. We can certainly say that competition was fierce on but also off the pitch where, within the B2C consumer landscape, manufacturers and (r)etailers gave their best to attract consumers and persuade them to buy their products. Undoubtedly you will be able to name a few of the promotional campaigns that were launched before and during the tournament. While a lot of products received their time in the spotlights, the product that received the biggest attention was the TV.

Should this come as a surprise? Certainly not. When analysing TV sales as from 2015, we can conclude that in the years where a World Cup or European Cup was held, TV sales always peaked in the first half of the year. In the below chart, you will notice that the growth in units, sales value, and the average price is remarkably higher in 2016, 2018 and 2021. Especially the double-digit growth of 2021 was unexpected given the strong performance of 2020 that can be partly explained by the fact that 26% of the TV buyers stated that they bought a new television sooner than planned due to COVID.

So what has driven this growth? Is a new TV now more appealing as the COVID restrictions keep people at their homes? Yes without a doubt! The Euro Cup, Tour de France and the Olympic Games have probably given consumers more arguments to invest in a new television as well. Let me state that these are assumptions. What I can say based on facts are the insights from GfK’s Consumer Insights Engine studies showing that having a second or third TV is on the rise, while upgrading an existing television is gaining momentum as well. And last but not least, innovations have led to affordable televisions with enormous screen sizes, not accidentally the most important product feature for TV buyers, making the threshold for purchase much lower.

All Brands: What drives initial triggers to the purchase journey? (Survey Data)

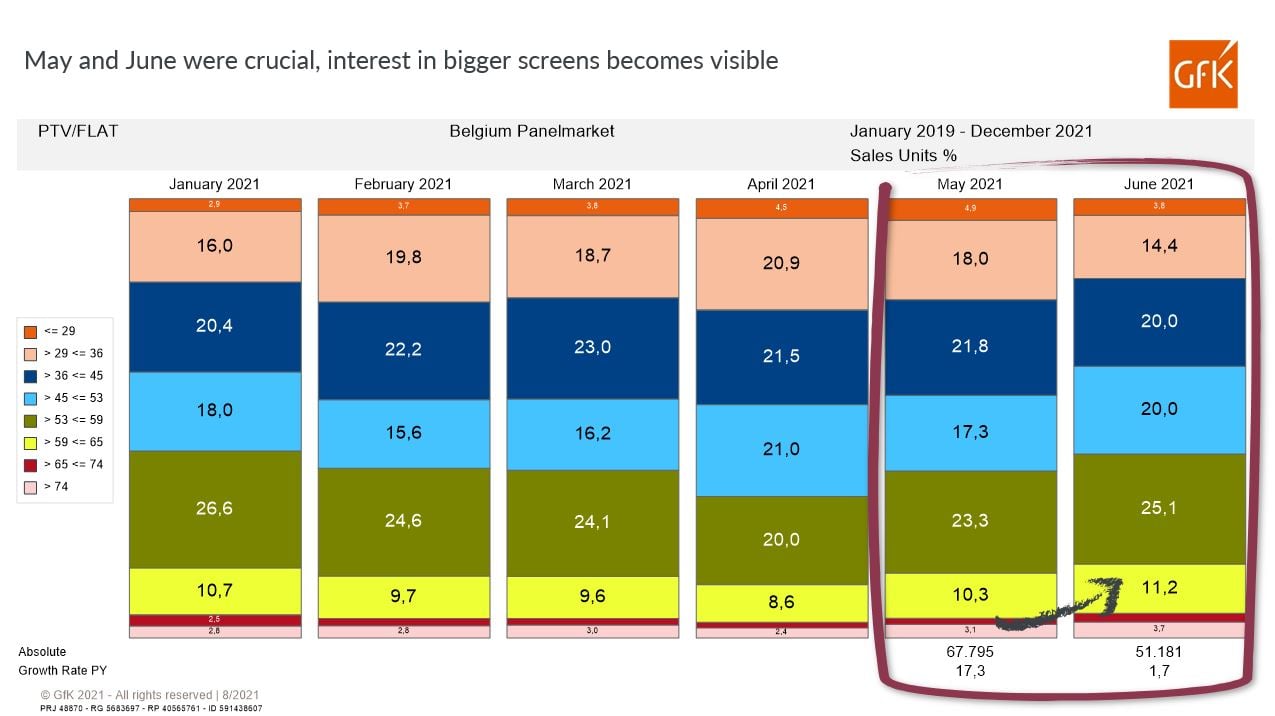

Based on the units sold per month, we can say that May and June were crucial for all those with ambitious plans. In that period, around 75% of the products were sold at a discounted price which highlights that the war for the consumer had begun. Another finding that jumps out is that the interest in screens bigger than 59” has picked up in May and June, while the units sold in the above 74” segment, strangely enough, outperform the result of inch sizes 65 to 74.

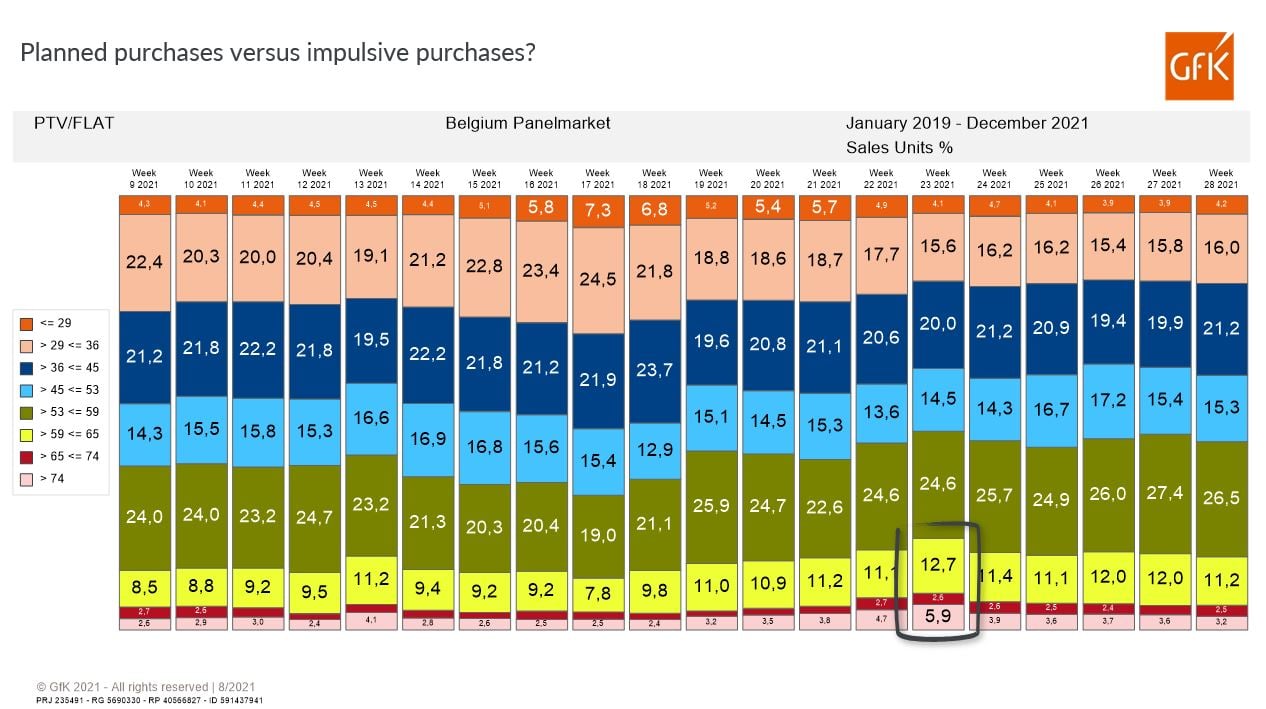

When we dig a little deeper and zoom in on weekly data, we can conclude that sales exploded as from week 18 and continued until week 27 with the exception of week 24 and 25, being the first two weeks of the Euro Cup, where sales dropped to the level of the weeks before week 18. Presumably, this shows that some consumers have planned their purchase ahead of the tournament and waited for the right product offering to come along – with a sensational peak of screens above 59” in week 23, one week before the start of the Euro Cup – while other consumers were triggered in week 26 and 27, which may implicate a more impulsive purchase for whatever reason.

Now that the Euro Cup has gone to Italy and the Olympic Games near their end, we wonder how TV sales will evolve in the second part of 2021. Will we keep the double-digit growth or will the growth be flattened out due to a saturated market? We would be happy to hear your thoughts about that and discuss further.

Article written by Kristof Vervekken

If you have questions or you would like to hear more, please feel free to contact kristof.vervekken@gfk.com.