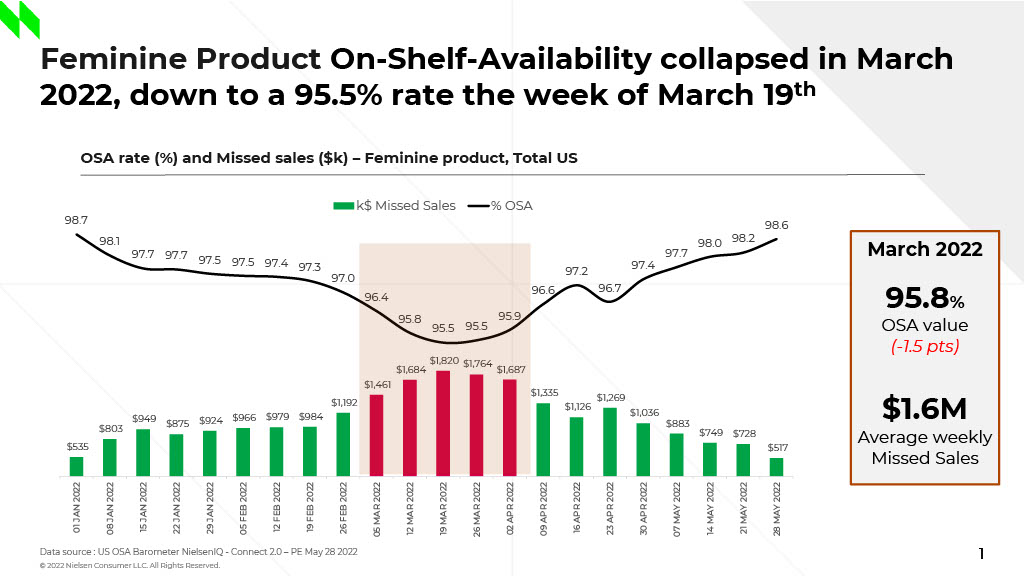

Feminine products collapsed in March

Feminine products hit their lowest availability in the middle of March with just a 95.5% OSA rate across the U.S.

As the chart notes below, the average OSA rate for March was 95.8%, leading to an average loss of $1.6 million in sales.

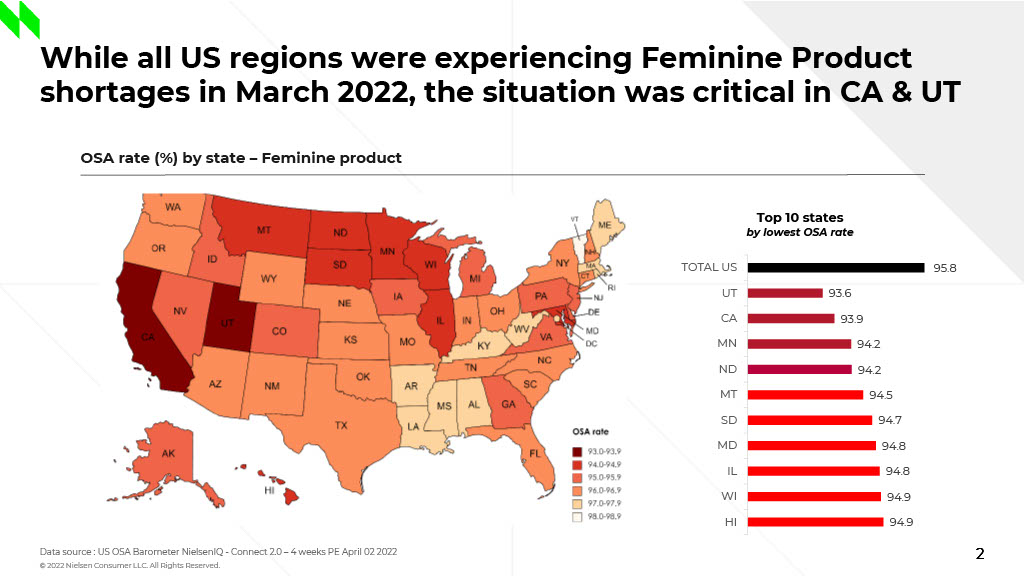

Hardest hit regions

Though OSA across the U.S. has rebounded since March, similar to the baby formula shortage that continues to frustrate parents across the country, not all regions have been affected similarly.

The following states were hit especially hard in March:

- Utah, 93.6% OSA rate

- California, 93.9% OSA rate

- Minnesota, 94.2% OSA rate

- North Dakota, 94.2% OSA rate

Inflation and supply chain issues

Though rates have rebounded since March, manufacturers and retailers noted recently that certain areas may still face a shortage of feminine products.

The reasons behind the shortage vary, from outbreaks of the Omnicron variant of the coronavirus earlier in 2022 that slowed production and hurt inventory, to staff shortages, and the rising cost of materials needed to produce tampons and pads.

As a result, NielsenIQ data shows that average prices rose 9.8% for tampons and 8.3% for a package of menstrual pads this year through May 28.