Constrained holiday spending persists

Consumers around the world are facing another holiday season hampered by an uncomfortably high cost of living. Although the pace of CPG inflation is decelerating around the world, this doesn’t translate to lower grocery bills, at least not yet.

The compounding impact of inflation remains—globally, the overall increase of CPG prices is over 3 times as high as 2021. And our evaluation of pricing scenarios for holiday product staples confirms that costs for consumers are already high, and likely rising.

In our 2023 Mid Year Outlook survey we asked nearly 16,000 consumers in 23 countries throughout Asia-Pacific, Europe, Latin America, the Middle East/Africa, and North America how these dynamics will impact their holiday spending. Using the data as our guide, here are our expectations on trends to watch this season:

Trend 1:

Earlier holiday shopping preparations

In a shift from last year, we expect consumers are planning to kickstart their holiday preparations earlier. In the US, for example, 56% of US consumers report that they’ll plan their shopping ahead of time.

The rationale behind this is economically driven— many people are cash-strapped and taking on more debt globally. Today’s budget-conscious shoppers may not be able to afford to allocate all of their holiday spending to large, last-minute spending. Anticipate the potential of more shoppers starting earlier, pacing their spending throughout the next few months.

This shift could see more individuals start thinking weeks and months ahead, making trade-offs around what will last or what purchases can be molded around a holiday budget spread across multiple periods of payment.

Retailers and CPGs can adapt by offering options to accommodate consumers who will be spacing out their holiday shopping. In practice, this could manifest in many ways, for instance, companies could extend the availability window of holiday assortments throughout the season and consider extending or adopting flexible return policies from now through to the weeks following holiday moments.

Trend 2:

Consumers plan to spend less on holiday gatherings

57% of consumers surveyed by NIQ say they’ll be in the same or worse financial situation by the end of 2023, showing that despite some resilience, economic optimism is still being pressured. As a result, most global consumers (84%) are prepared to spend less, the same, or nothing on holiday gatherings and celebrations this season.

These “calculated spenders” will make more thoughtful purchases and focus on keeping overall spending in check. For some, these recent socioeconomic challenges will necessitate a reset to past holiday spending habits.

There’s a growing group of consumers who are more stressed than ever before (27%), less interested in achieving certain life milestones (18%) and avoiding waste by only purchasing what they know they will use (55%). These mindsets of practical, purposeful consumption could limit year-end spending, and drive creative solutions like homemade gifts, second-hand gifting, or using everyday household essentials as holiday gifts.

This festive season, companies have the runway to innovate how their brand fits into this “do more with less” mentality, to prepare for the future, or to find affordable means to seek distraction or holiday happiness without breaking their budgets.

Trend 3:

CPG as a holiday hotspot for consumer resilience

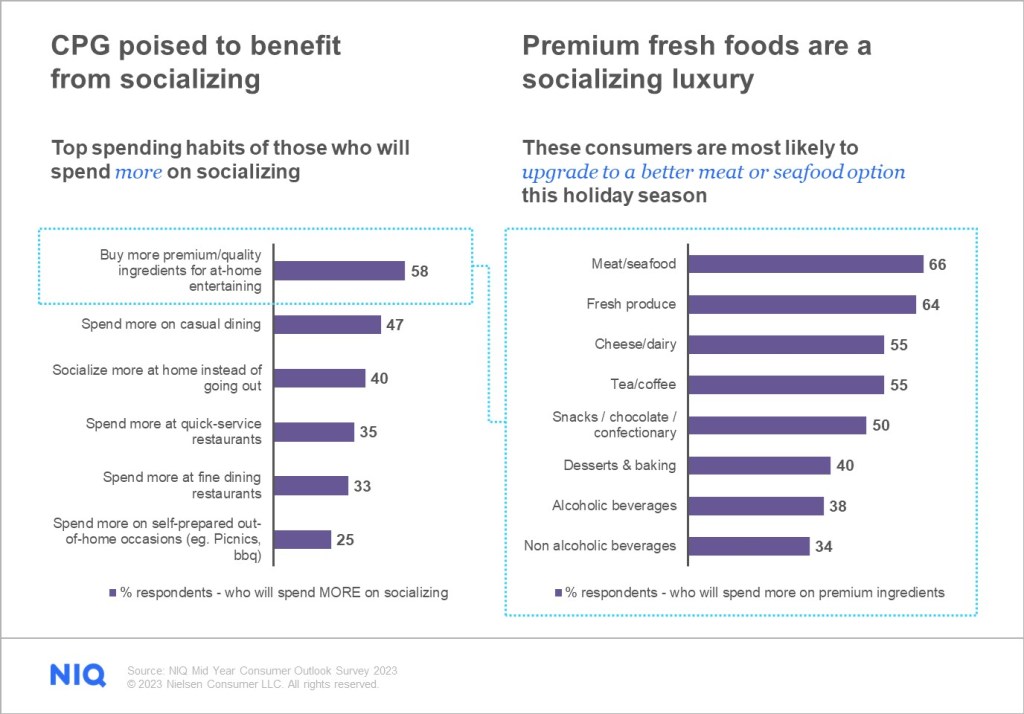

Despite prevailing cautiousness among global consumers, there is a pocket of resilience among the approximately 18% of surveyed respondents who plan to spend more on socializing and gatherings this year.

Within this group of optimistic spenders lies an opportunity for CPG companies—of those who plan to spend more on socializing this holiday season, the majority (58%) intend to do so through buying more premium and quality ingredients for at-home entertaining. This includes premium fresh foods, such as high-quality meat or seafood (66%), fresh produce (64%) and a variety of snacks, chocolate, and confections (50%).

In times like these, it’s important to leverage splurge-worthy categories alongside ideal product pairings to expand the basket of high-spending holiday shoppers. The right analytics can identify unconventional and high-potential category pairings to guide the holiday staples consumers buy and inspire additional items of interest that complement or help complete the occasion.

Trend 4:

A fierce festive showdown between brands

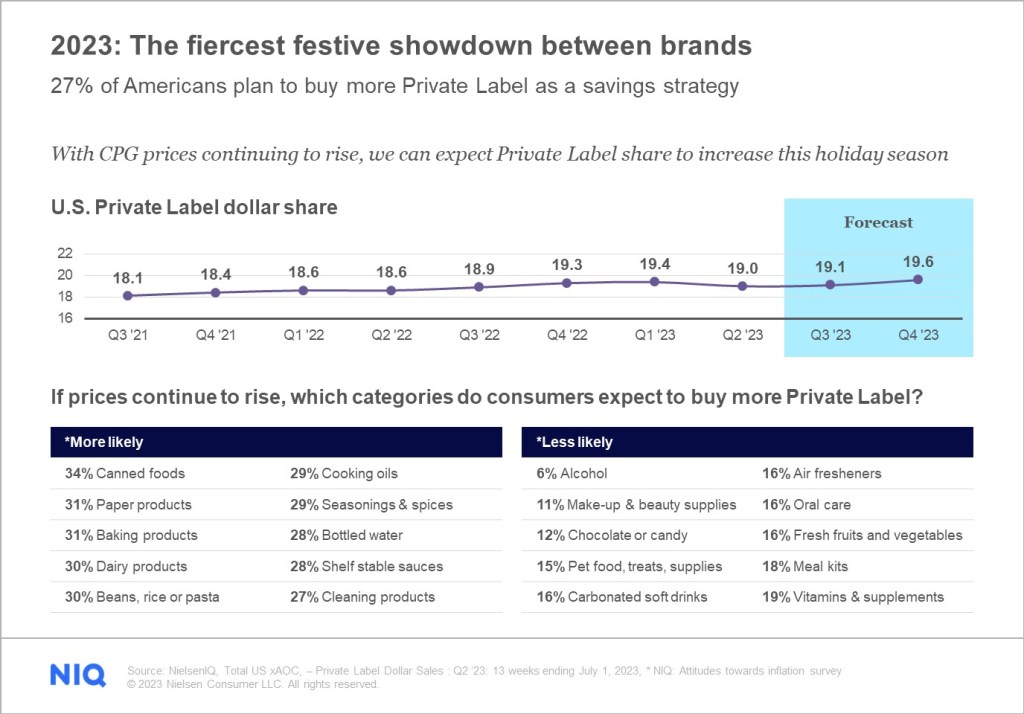

Perceptions of private label or store-branded products have warmed over the years, and the value offered has made them an increasingly viable option on the shelf. But it remains to be seen if store brands can maintain momentum during the holidays.

On the one hand, there are some CPG categories where private label products have a history of comparatively low sales during key holiday moments. For instance, private label share of snacks and candy was 2% lower than the annual average during Easter in the UK.

On the other hand, recent measures of retail sales and consumer sentiment could indicate private label strength during the upcoming holidays and a fierce battle for consumer interests across all name brand and private label offerings.

Generally speaking, many global consumers (35%) feel private labels are higher or equal quality compared to name brands, and in the US, 27% of Americans plan to buy more private label as a savings strategy. In fact, US sales measures confirm there’s been a steady upward trend towards overall private label consumption among CPG categories – where share of sales in Q2 2023 was at 19%. At the current trajectory, private label share of sales could reach upwards of 19.6% by the end of the year.

American consumers report that if prices continue to rise, they expect to buy more private label products in categories like canned foods (34%), paper products (31%), baking products (31%), and dairy products (30%), and globally speaking, consumers feel most confident in the quality of private label food staples (I.e. flour, rice) compared to other private label categories.

In the road ahead, brands should avoid trying to out-price or over-promote in order to compete. Strive to meaningfully co-exist, through demonstrating unique benefits. Will your product last longer, taste better to guests or provide more servings per unit? Alternatively, highlighting differentiated formulation or packaging are other ways to justify your purchase positioning this holiday season.

Trend 5:

Ignition of Online holiday CPG shopping

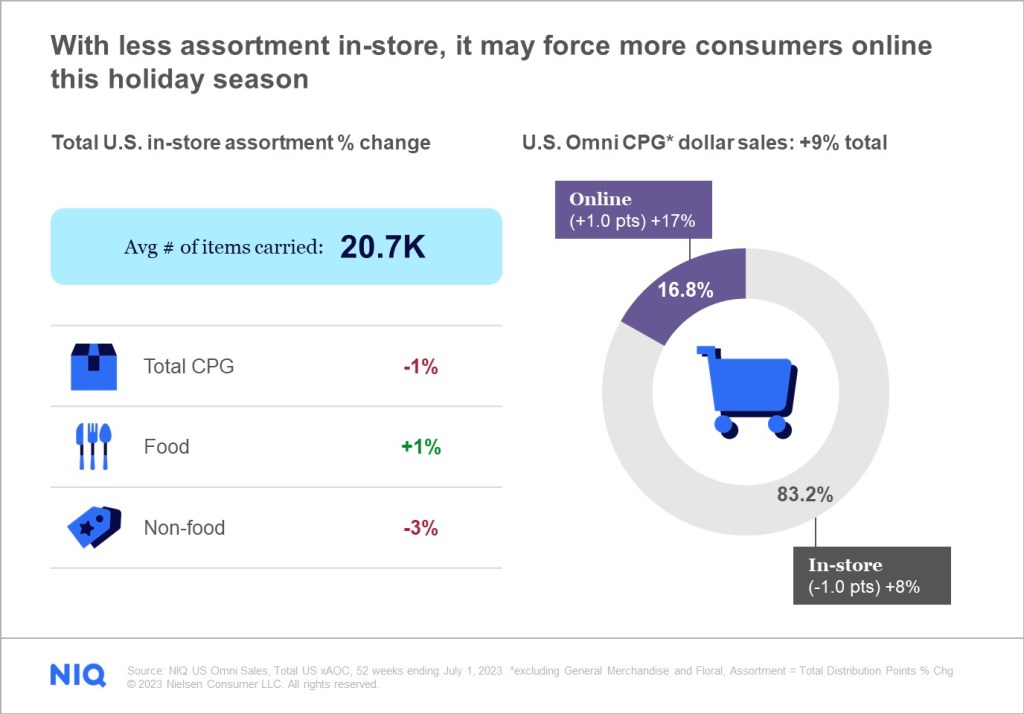

In 2022, we saw an instore sales comeback during pivotal seasonal moments while e-commerce growth stabilized in many markets. But this year, we could be headed for a resurgence in online shopping for holiday meals and celebrations. Flat or declining instore assortments and increased demand for deal shopping could reinvigorate online sales this season.

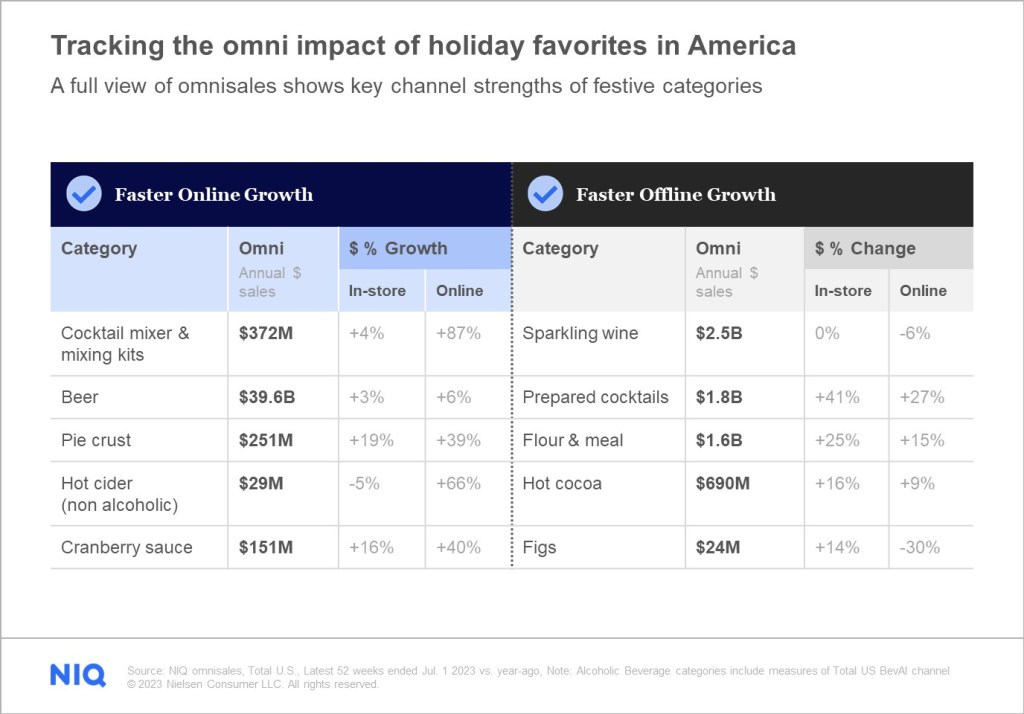

Here’s a breakdown of what holiday staples US consumers are buying across channels:

This holiday season, it’s imperative to meet consumers where they intend to shop. Knowing what consumers look for online versus offline can help guide channel assortment, pricing, and levels of promotion support. Consumers are already facing the reality of spending more for less physical volume of product. An omnichannel strategy that doesn’t match consumers’ preferences will add to the already falling volume sales across the CPG industry.

The upcoming periods of intensified holiday promotions should be carefully evaluated for omnichannel efficiency to prevent risks to market share and profitability once holiday demand subsides.

Navigating the season for saving

As consumers worldwide grapple with the challenges of rising costs of living, their holiday spending habits are shifting. Early holiday preparations, new perceptions around gifting, life milestones and accumulating waste, are just a few of the trends emerging in response to these challenges. Retailers and CPG companies have a mixed bag of selective optimism and calculated spending to deal with, but the right data can guide consumers to make the most of the upcoming holiday season.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.