The global state of evolved consumers

Since our last consumer outlook update at the beginning of the year, the consumer landscape has shifted slightly. Though consumers remain pressured by economic conditions like the prolonged cost-of-living crisis, they have become calculated spenders who have developed evolved habits to cope with adversity.

An array of prolonged pressures have shaped calculated spending, as consumers evolve their habits aligned to recent inflation deceleration. But the compounding effects of years of disruption continue to keep consumers bracing for what’s ahead.

To help to answer the question of what’s ahead in the next 12-18 months, we’ve employed 3 levels of investigation that considers macro-economic conditions and forecasts, the current consumer landscape and spending intentions, and watch-outs within the industry for retailers, manufacturers and brands.

From this analysis, we highlight 5 emerging global trends that the CPG industry should be aware of moving forward and provide lead indicators and growth guidance to forecast shifts before they happen.

Recognizing the inflationary long haul

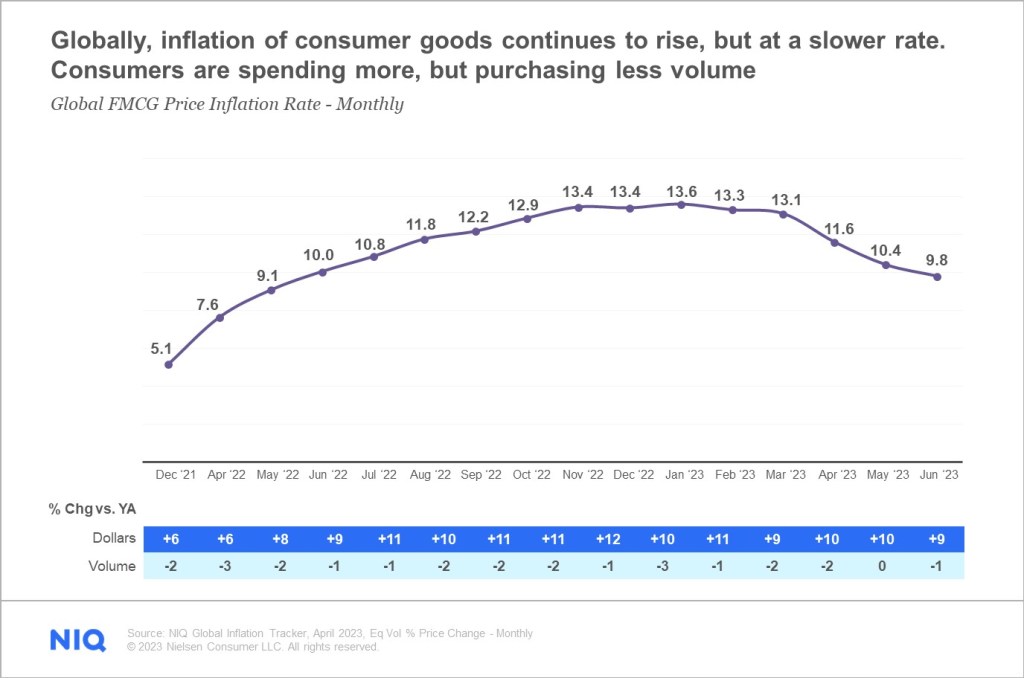

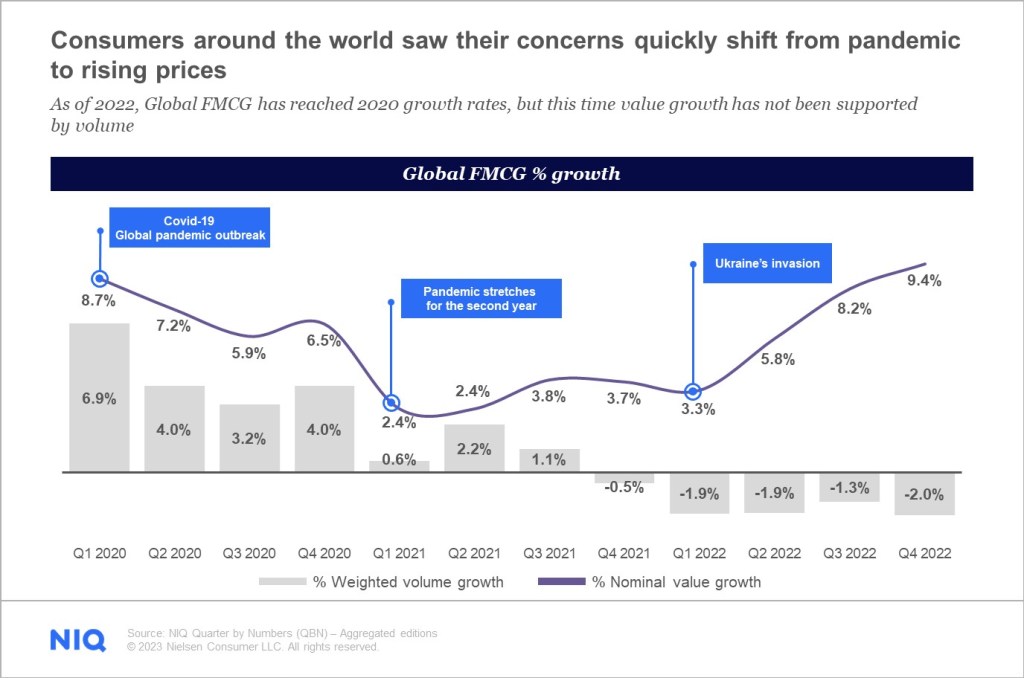

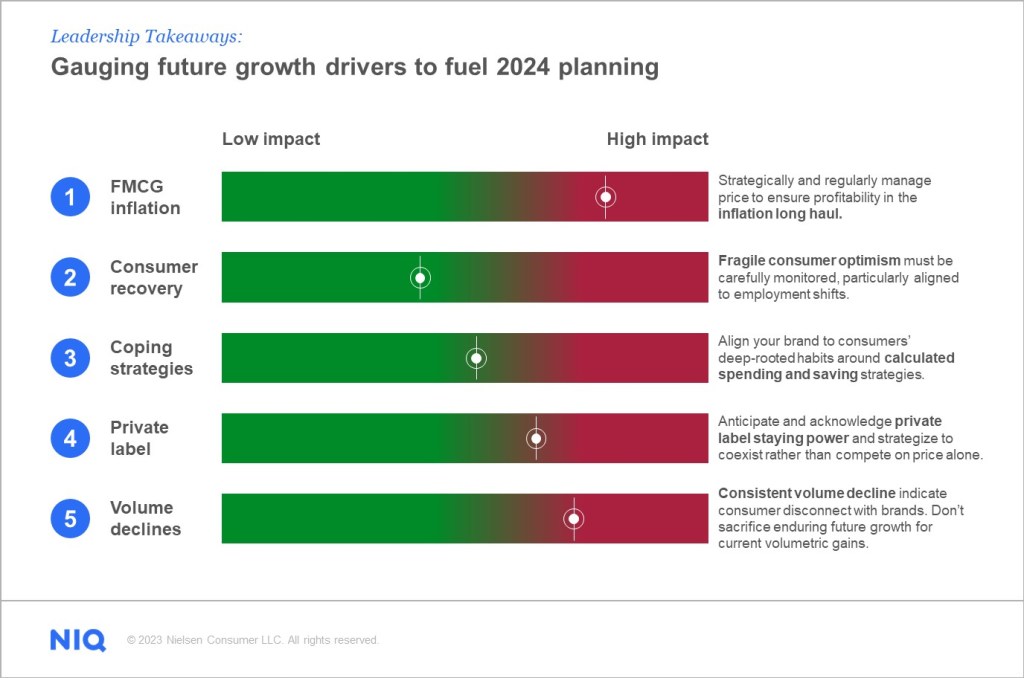

Global inflation has hit record highs in the last two years and although inflation percentage increases are forecasted to slow, it’s important to remember that what we’re seeing is more of a deceleration than a decline. Prices have continued to rise, just at a slower pace than the spikes we’ve seen in the last 18 months.

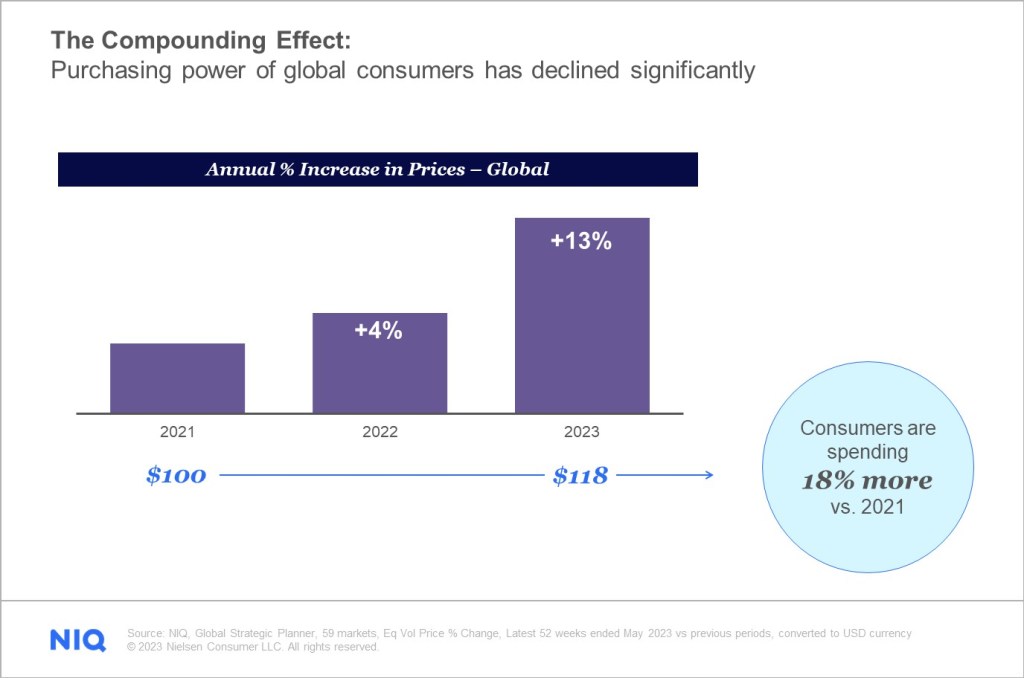

The simple reality for many is that the prolonged and compounding effects of inflation means that consumers are spending more for less volume. 78% of respondents said they’re worse off due to the increased cost of living (vs. 74% in January 2023). Because prices of goods have increased so drastically in the last two years, consumers globally are spending 18% more than they did in 2021 for the same basket of products, further decreasing their spending power.

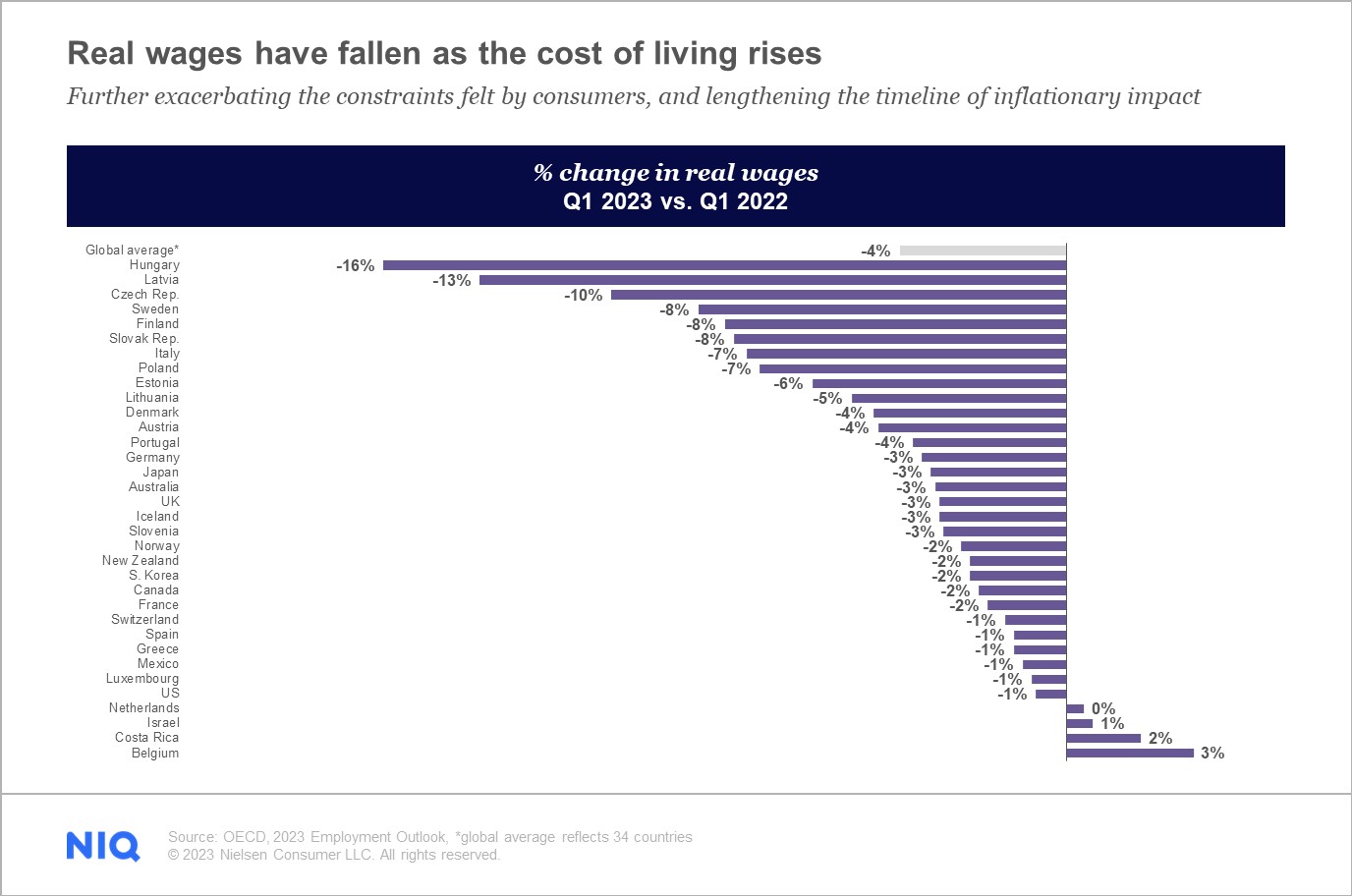

Additionally, real annual wage growth around the world has not kept pace with inflation, making it even more difficult to keep up with the cost of living. This is especially true in Fast Moving Consumer Goods (FMCG) and grocery inflation. These products are specifically sensitive to weather events and transportation obstacles that are likely to remain a factor driving inflation in the future.

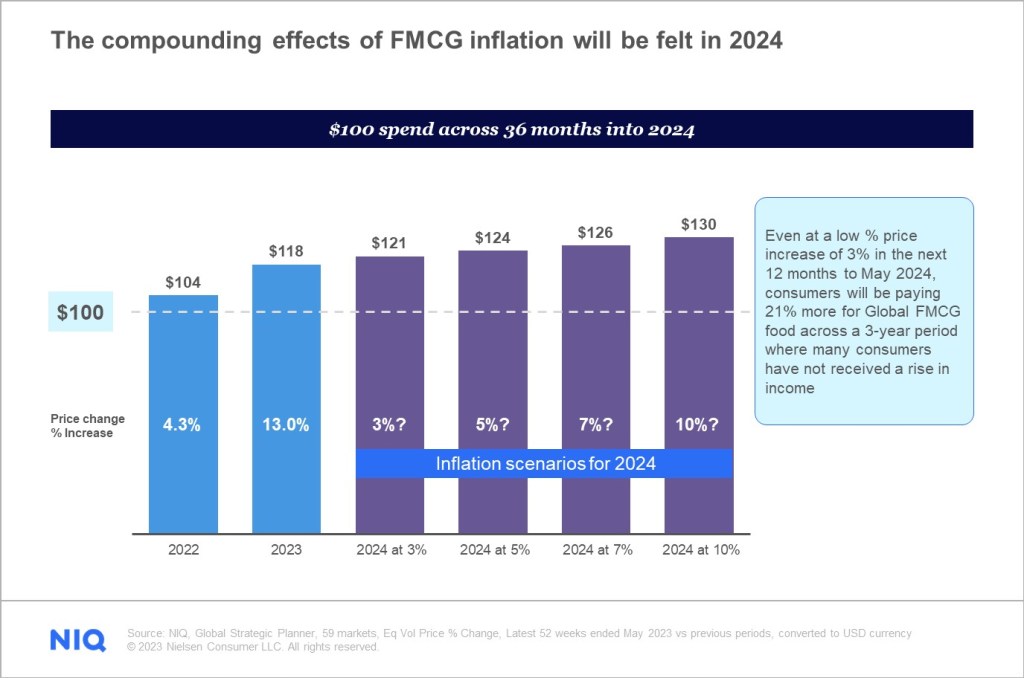

FUTURE INDICATOR: Even if price increases in the next 12 months to May 2024 remain at a conservative 3%, consumers will ultimately be paying 21% more for Global FMCG food across a 3-year period where many consumers have not received a commiserate rise in income.

In the short term, FMCG brands should temper all avoidable price increases, as many shoppers may be forced to take drastic actions with their budgets. In the long-term, industry players might want to consider what the key areas of cost growth are, and if these areas are likely to go away. There are numerous industry leaders that are re-engineering their value chain to operate more efficiently in an eco-system that is likely to be pressured by extreme weather events, energy cost fluctuations, labor shortages, sustainability legislation and increased disruption.

About the survey

NIQ’s Global Mid-Year Consumer Outlook 2023 survey was conducted between June and July 2023, polling nearly 16,000 online consumers in 23 countries throughout Asia-Pacific, Europe, Latin America, the Middle East/Africa, and North America. The sample includes consumers who often make shopping decisions on behalf of their households and agreed to participate in this survey. Sample has quotas based on age, gender and cities/regions for each country. This survey is based only on the behavior of respondents with online access. Internet penetration rates vary by country.

Start your roadmap to growth with this global readout of top findings from NIQ’s Mid-Year Consumer Outlook 2023.

Consumers coping with the cost of living

For many, the challenging eco-system of the last 3 years has given way to a new uptick in consumer resilience, as people have developed unique coping mechanisms and grown accustomed to constant challenges. Across the next 12 months we will see continued and heightened focus on budgeting, value, and tradeoffs as resilient consumers double-down and fine-tune the approaches that have worked for them so far.

Multiple consumer data points paint a picture of recovery and optimism. 19% of global respondents report that they experienced job or income loss but feel they are back on track. And a further 65% are optimistic that their financial position will be improved by the end of 2023, which is a very healthy display of confidence considering the economic pressures that still linger around the world.

Consumers are coping, but harsh realities still persist

Where do you believe your household finance situation will be by the end of 2023 compared to today?

6%

Significantly worse

17%

Somewhat worse

35%

Unchanged

30%

Somewhat better

13%

Significantly better

Source: NielsenIQ 2023 Mid-Year Consumer Outlook Survey

Even though we are experiencing high cost of living challenges, the silver lining has been the job market, with unemployment expected to continue at the lowest levels seen in the last 15 years. Additionally, we’re seeing the re-opening of borders and tourism is rebounding, bringing some relief after years of diminished travel.

FUTURE INDICATOR: Consumers have been able to adapt to the delicate state of the world today largely because jobs have been plentiful, but should employment rates be challenged, we could see a huge tear in the fabric of consumer confidence globally. Astute leaders should tune into the growing financial polarization across the next 5 years and align portfolios, pricing, product, innovation etc. to the growing spectrum of spending power and spending strategies. Innovation will continue to be important, regardless of cost-pressures. Retailers could benefit from traffic-generating offers in key categories, while manufacturers could target dis-loyal and highly promiscuous brand shoppers with differentiated offers.

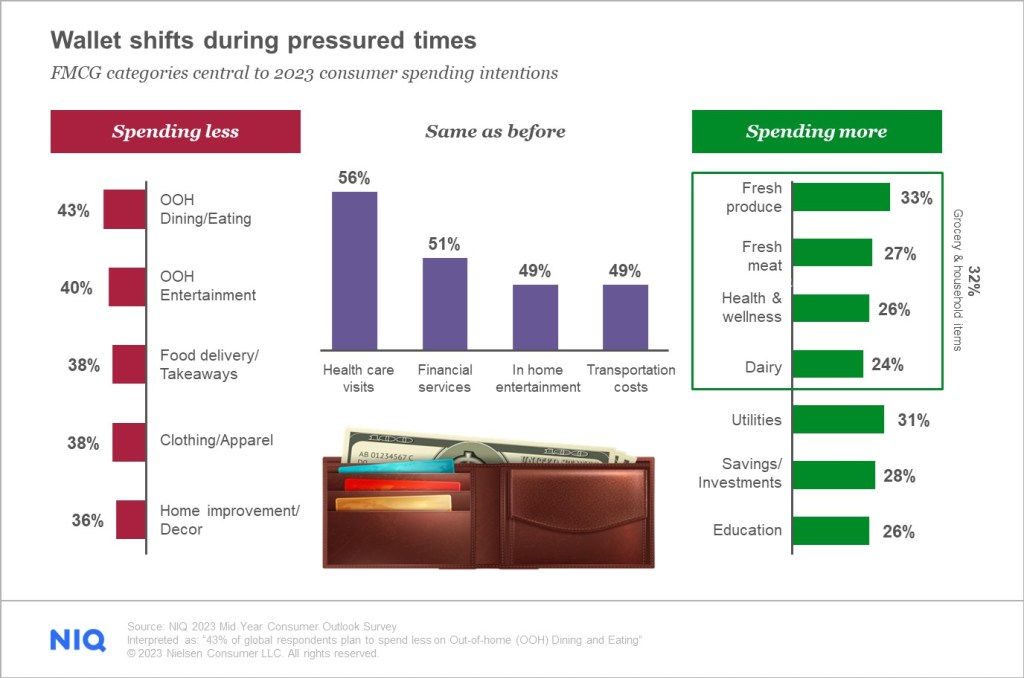

The era of calculated spending

All forms of discretionary spending have come under close consumer scrutiny, as they assess their cost-of-living challenges. In-home priorities will prevail across the next 12 months as consumers continue to focus on the basics and extend the purchase patterns that dominated and helped them cope through the last 3 years. There is an expectation that necessities such as groceries, utilities, rent/mortgage, and transportation costs will take up a bigger part of wallet spend in the coming year. To offset those costs, many consumers will plan to spend less on out of home dining and entertainment, holidays, clothing, and appliances. Beyond this high-level redirection of spending, consumers are calculating returns and benefits even within each category of spending, seeking maximum value from every purchase.

32% of global respondents intend to spend more on groceries in the next 12 months which is the biggest area of increased spend followed closely by utilities. When spending and managing their wallets, 32% go to discounters or value retailers more often, 32% have stopped buying certain products to focus on essentials while 32% buy whatever is on promotion. In the prolonged cost of living battle, the sentiment of continued, conscious calculated spending prevails.

FUTURE INDICATOR: The market and consumer conditions over the next 12 months will continue to be highly pressured. While consumers will occasionally splurge on luxuries, these decisions will be extremely calculated. Industry leaders should double-down on value-centric strategies, while maintaining a locked focus on consumer and sales dashboards. Keep a close eye on early signals that your pricing, promo and distribution efforts are not winning in a marketplace that is expected to be highly dynamic.

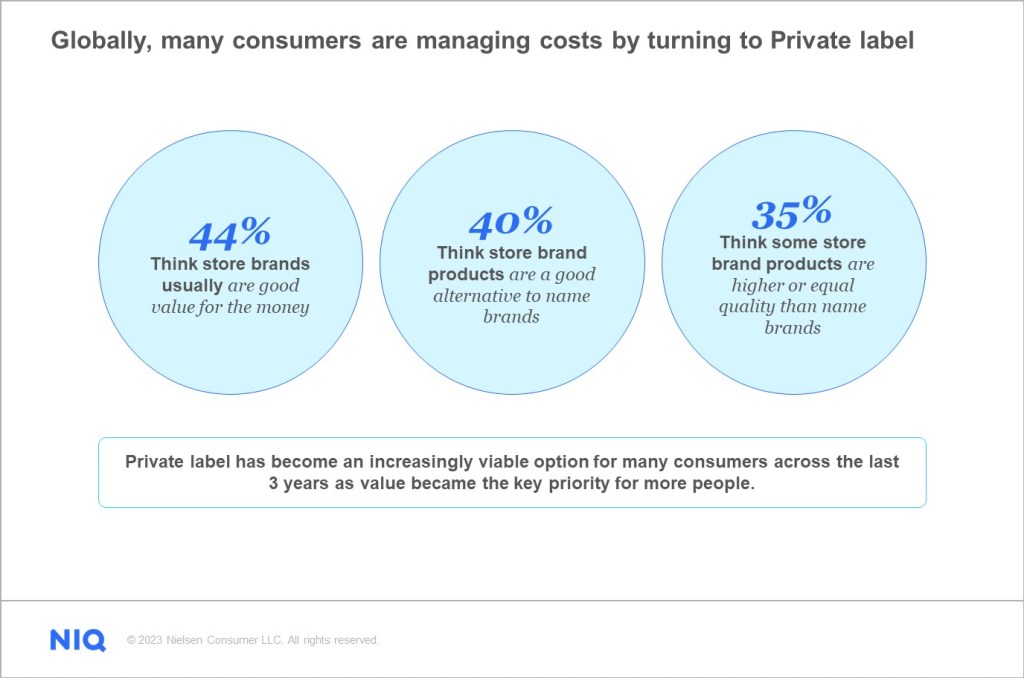

Private label staying power

Private label staying power has been evident across the last 24 months as they have in most cases outpaced the sales growth of other brands in the market. Consumer perceptions of the quality of private label products have warmed over the years, and the value offered has made them an increasingly viable option on the shelf. At the current trajectory, private label share capture could be 25% of all grocery sales within 10 years, presenting unique challenges and opportunities to those who recognize this emerging tectonic shift.

FUTURE INDICATOR: It is essential for industry players to recognize that private label products will be an increasingly important part of grocery dynamics in the long term. The appropriate approach forward depends largely on the dynamics within your offerings, but two strategies prevail. Differentiation, innovation and finding unique space away from the “cheaper alternative” is one strategy worth considering. Additionally, collaboration within the retailer and manufacturer relationship has also been a proven, winning approach to align on evolving strategies with private labels in mind. Some of the benefits for collaborative retailer-owned private labels include the potential for category captaincy and gaining an early view on assortment and category changes.

Growth beyond price

Another challenge of global concern across the next 18 months, is that consumers continue to spend more for less volume. While sales growth has been strong and heavily driven by inflation, the actual volume of products being sold has been eroded in most regions for consecutive quarters. As an emerging concern for industry players and financial analysts alike, companies need to acknowledge and nurture this trend before consumer habits are formed around a limited volume of products.

“It’s no surprise that as the cost-of-living rises, the demand for deals increases. But companies shouldn’t be hasty to meet this demand. As the prevalence of promotions surges, it’s critical to maintain a brand’s value to consumers – resisting the urge to excessively promote to regain lost market share” says Lauren Fernandes, Global Director of Thought Leadership, NIQ. “And the time to justify your efficacy, value proposition and position ‘beyond price’ is now. Already, in the last two years, value sales growth is up 15% globally, and volume has declined by 3%. Consumption rates have softened due to a pressured consumer environment – a worry for leaders and shareholders. The right data can inform a strategy that helps brands drive incremental consumption occasions using growth levers beyond price alone.”

FUTURE INDICATOR: It will be tempting to get aggressive with promotions to win back share, but this will likely sacrifice your future growth. Promote with a purpose to grow your business profitability while maintaining margins. This strategic approach to volume and pricing tradeoffs may need to be a priority for numerous companies that have seen product consumption trail off recently.

Managing cost of living challenges into 2024

As retailers and manufacturers plan for 2024 and beyond, it’s important to monitor future growth drivers, their impact, and develop strategies to succeed in this evolving marketplace. Understanding how consumers will react to the five emerging global trends outlined above and having strategies in place to help them manage their cost of living challenges will be essential to finding growth moving forward.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.