State of the nation: Czech Republic

Since 2022, rising prices have reshaped the fast-moving consumer goods (FMCG) industry in the Czech Republic, affecting consumer attitudes, priorities, and purchasing behaviors. This shift lead to decreased demand and sales across various sectors, including food and drugstore categories.

Overall inflation in the Czech Republic was 7% in September 2023, an improvement from 17.5% in January. As inflation rates fell, consumer confidence increased, thanks in large part to low unemployment rates. A recovery and return to positive volume growth could be on the horizon.

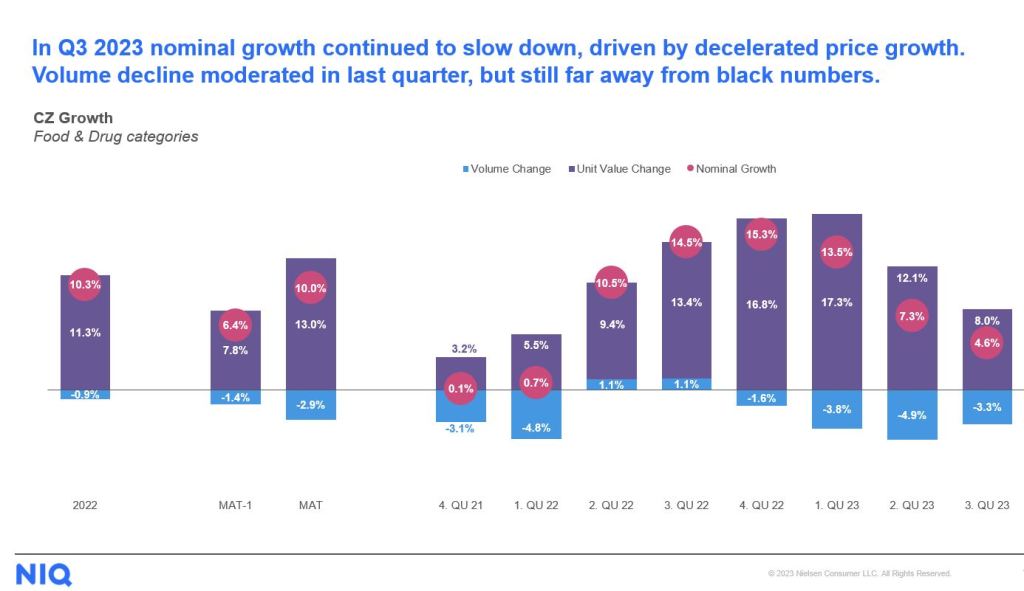

Although the decline in sales of food and drugstore items slowed to 3.3% in the third quarter (compared to nearly 5% in the second quarter), consumers still prioritized cost-saving. This mindset, carried over from the first half of the year, stems from a 23% increase in FMCG prices since the pandemic’s onset until the end of 2022. Real wages lagging behind inflation have led to a decrease in purchasing power, with Czechs experiencing one of the most significant drops in real wages in Europe, following Hungary, and Latvia.

Not surprisingly, the vast majority of Czechs (93%) adopted a range of measures to save and maintain control over their household budgets.

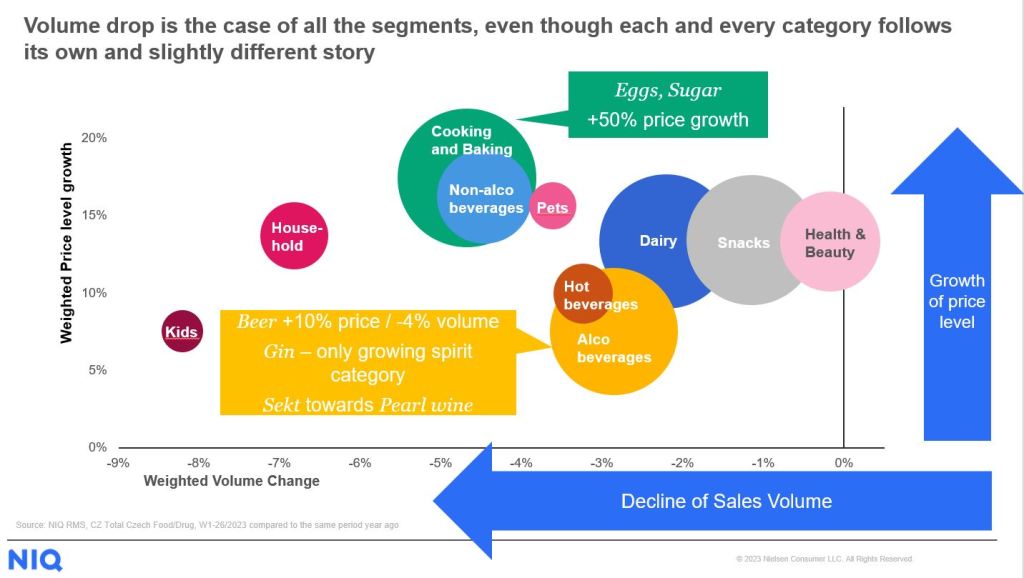

Czechs continued to limit the quantity of purchased goods, especially in categories focused on children and household care. Part of this decline is associated with the war in Ukraine, as these categories were purchased in increased quantities for charitable campaigns in 2022. The impact of Covid-19, specifically the relaxation of heightened cleanliness and hygiene demands during the pandemic, also played a role. However, decline occurred across categories:

Czech shoppers still favor discount stores, which experienced more than 15% revenue growth year-on-year growth. This trend aligns most European countries. However, unique to the Czech Republic is the popularity of cross-border shopping in Poland, mainly due to more favorable prices. As Romana Duníková, NIQ Customer Success Leader for the Czech Republic, Slovakia, and Hungary, comments: “As our data confirms, it’s not uncommon for prices in Poland to be by one-third or more favorable. This is evident in examples such as baby diapers, dairy products like cheese or yogurt, or cigarettes. It’s no wonder that Czechs, who are not far from the border, venture there not only for cheaper fuel but also to replenish supplies.”

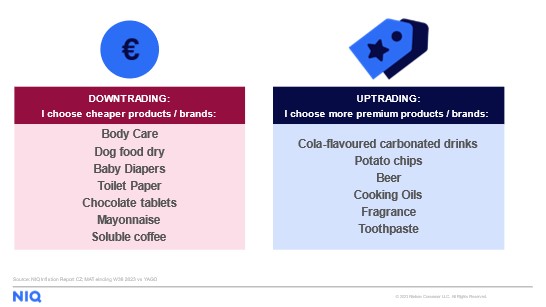

Czechs also continue to transition to cheaper products and brands, especially in drugstore categories, such as body care, dry dog food, or baby diapers. In the food segment, a similar trend is observed, for instance, in soluble coffee. However, in other categories, despite the inflationary environment, Czechs are opting for more premium products. This is noticeable, for example, in categories like beer, potato chips, or carbonated cola beverages.

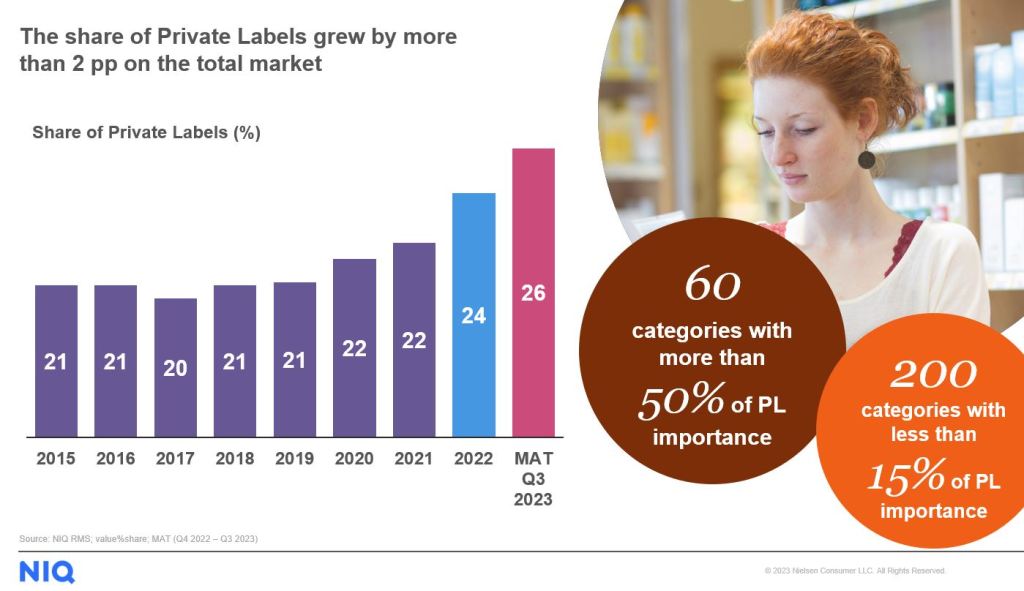

When it comes to cheaper alternatives, retail private labels are often the preferred choice. The majority of Czechs confirm that they buy more private labels than before, with two-thirds considering them a cheaper alternative to branded products, and roughly half already having positive experiences with them. Concerns about quality or unclear origin serve as barriers for about a quarter of Czechs when it comes to purchasing private labels. However, these concerns are less significant than the reasons why Czechs actively seek private labels.

Jakub Špika, NIQ Director of Retail Collaboration for the Czech Republic, Slovakia, and Hungary, summarizes the impact of the approach to private labels against the backdrop of inflationary reality: “After several years of provate label market share stagnation (around 20-21%) we have seen dynamic growth in the last two years. Currently, private labels account for 26% of all food and drugstore sales in the Czech market. However, there are significant differences between categories. We have a whole range of categories with more than 50% importance of private labels, but also an even larger number where the share of private labels does not reach 15%.”

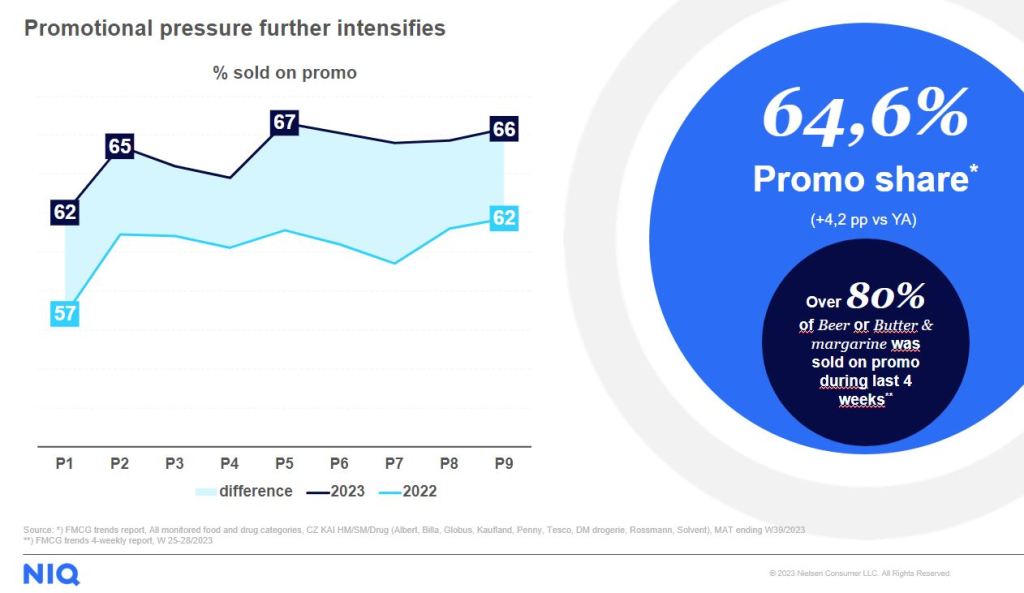

The most commonly employed strategy to save money is, not entirely surprisingly, shopping during promotional events, utilized by more than 80% of Czechs. Karel Týra, Managing Director of NIQ for the Czech Republic, Slovakia, and Hungary, adds: “The national passion for promotions has reached new heights, with almost 65% of purchases in Czech supermarkets and hypermarkets over the past year made on promo. There are even categories like Beer or Butter, where the promo pressure overcame 80%. This indicates that, for many consumers, promotional prices have become the new standard.”

Looking to the future, there is somewhat cautious optimism. Inflation is expected to continue to decelerate, and come closer to the central bank’s long-term inflation target in the next year. This could help reduce concerns and gradually increase food consumption.

But even with an optimistic inflation outlook for next year, consumers in 2024 will spend 30-40% more on the same goods than they did in 2021, before an inflation hike came to the Czech Republic—some will continue to apply their cost-saving strategies.