Preferences of the cost-cautious consumer

As consumers have become more careful with their spending and are looking for strategies to cope with price increases, private labels are becoming a more significant consideration than normal.

NielsenIQ data shows that food and grocery costs are the biggest concern for two-thirds of global consumers, closely followed by fuel prices and utility costs, which also rank as major sources of concern. This is giving rise to a more cautious consumer who is watching their everyday spend. In fact, 79% of consumers are more conscious about their spending, according to the June edition of the NielsenIQ Consumer Outlook.

Consumers are seeking smart options like product promotions or cheaper goods to save costs. Besides promotions, the most common money-saving tactic is to stop buying certain categories like non-essential, premium products with 26% of consumers identifying this as a way of saving. Alternatively, 20% of consumers seek private label products as retailer-owned brands are perceived to offer favorable prices.

Private label share around the globe

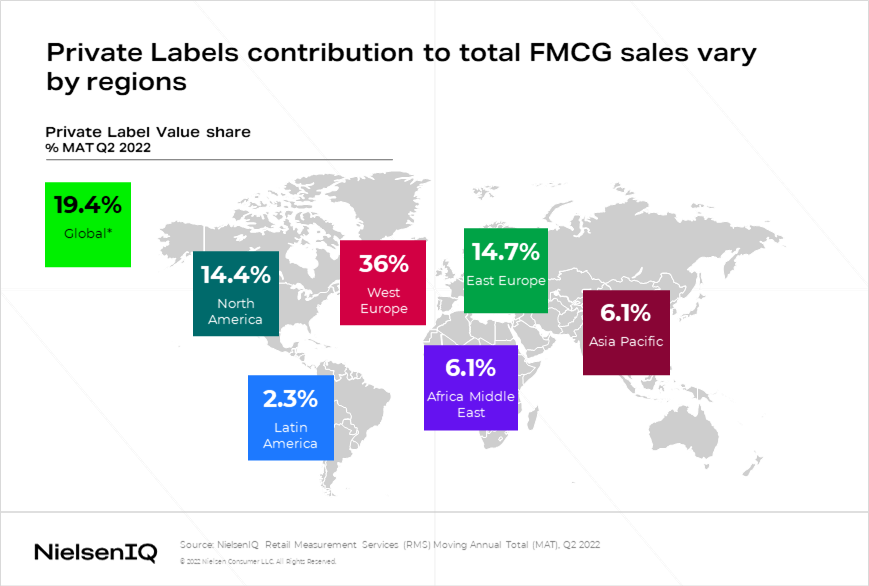

Globally, private labels account for 19.4% of overall FMCG value sales. However, the slice of share can vary greatly by region.

Private labels enjoy an unquestionably positive trend in Europe. In this region, the discounter format is a leading retail channel, selling major private labels against serving top manufacturer brands and a key consumer need—value for money.

In Western Europe, private labels account for 36% share, however, they are experiencing a stagnating trend. The top markets ranked on share globally come from these countries:

- Switzerland (52%)

- UK (44%)

- Spain (42%)

- Belgium (38%)

What’s interesting is that in the Netherlands private label items show even higher price increases than branded items.

Data from NielsenIQ Retail Measurement Services shows that in Eastern Europe the private label share reached 14.7% in Q2 of 2022 and it’s growing significantly quarter by quarter. Most of the markets in the region have a private label share above the global average, like Slovenia (32%), Hungary (29%), Turkey (29%), and Poland (21%). Discounters are amongst the most popular channels in these markets, so this trend is driving the sales growth of retailer brands.

In the Asia-Pacific and Africa and Middle East regions, private labels have a moderate share of 6.1% of the total FMCG sales numbers.

As Traditional Trade stores are dominant in many markets in these two regions, this is not surprising. It’s also worth noting that Asian consumers usually favor regional brands over private labels in most countries. Although, there are a few markets where retailer labels manage to post sales above the global average including Australia (22%), South Africa (19%), and Hong Kong (16%).

In Latin America, we see a small contribution (2.3%) of private labels to the overall FMCG share. But we are seeing significant growth in private labels and their share is quickly taking up a bigger part of the sales pie.

Private label surge as a response to rising inflation

Looking at Q2, private labels showed an increased value of sales growth at 3.5% globally compared to Q2 2021. The global number is driven by certain regions where private labels are more favored like Latin America and Eastern Europe. In these regions, we saw double-digit growth numbers of 27.4% and 18.1%, respectively.

In both regions, the strengthening of discounters and shopper preference for private labels is driving this growth. Consumers are also adjusting their shopping baskets by spending only on essential categories while cutting down on some non-essential items.

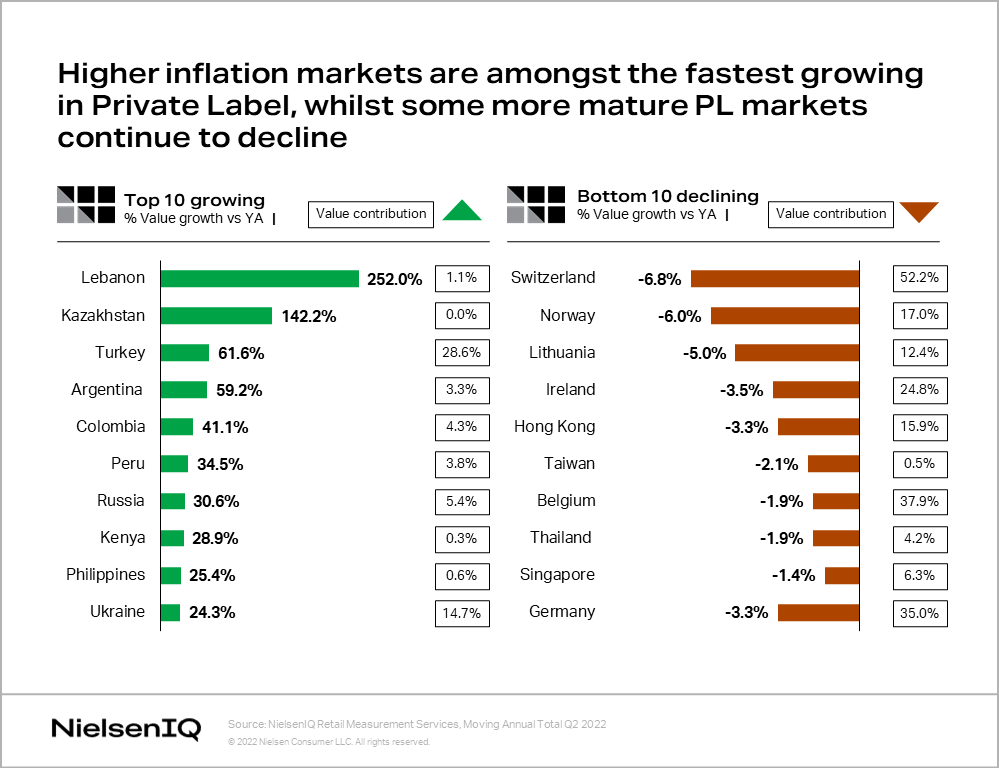

As previously notes, inflation has had a noticeable impact on private labels. We see that some of the higher inflation markets are among the fastest growing in private labels as well.

The growing significance of private labels in Turkey (61.6%; annual inflation rate 78.6%, June 2022) and Argentina (59.2%, inflation rate: 64%) are a clear indication of inflationary pressures at play. We can expect similar tendencies in other markets considering rising inflation around the world as a way of consumer adaptation in the face of heightened inflation.

Households are becoming smarter with their spending and seek to cut costs in ways that make it more challenging for retailers and manufacturers to meet shoppers’ saving needs amidst economic hardships, supply chain disruptions, and geopolitical conflicts.

We are likely to see retailers and manufacturers make hard decisions to reduce cost pressures that could easily lead to a rearrangement of the FMCG market. Seeing a clear picture with precise data and having access to speedy insights have never been more important.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)