Double-digit growth continues for India’s FMCG

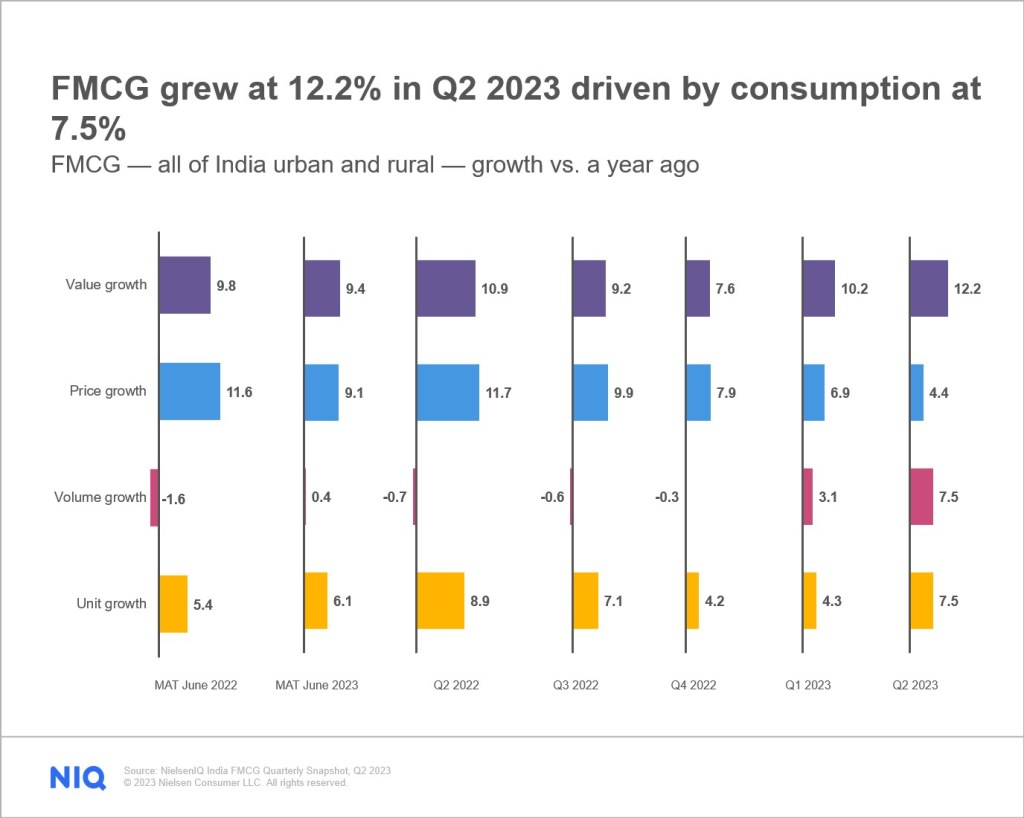

The second quarter of 2023 in India can be considered the best quarter in a year and a half, with the FMCG industry observing a value growth of 12.2%, which is 2% higher than the previous quarter and 1.3% higher than the same period last year. According to NIQ’s Q2 2023 FMCG Snapshot, the growth in the industry has been driven by higher consumption as inflationary rates soften coupled with a reduction in price increases. The overall drop in price growth has positively impacted consumers. It is driven by the food categories, which are anticipated to be mirrored in the build-up to the festive season.

Urban and rural markets are both looking up

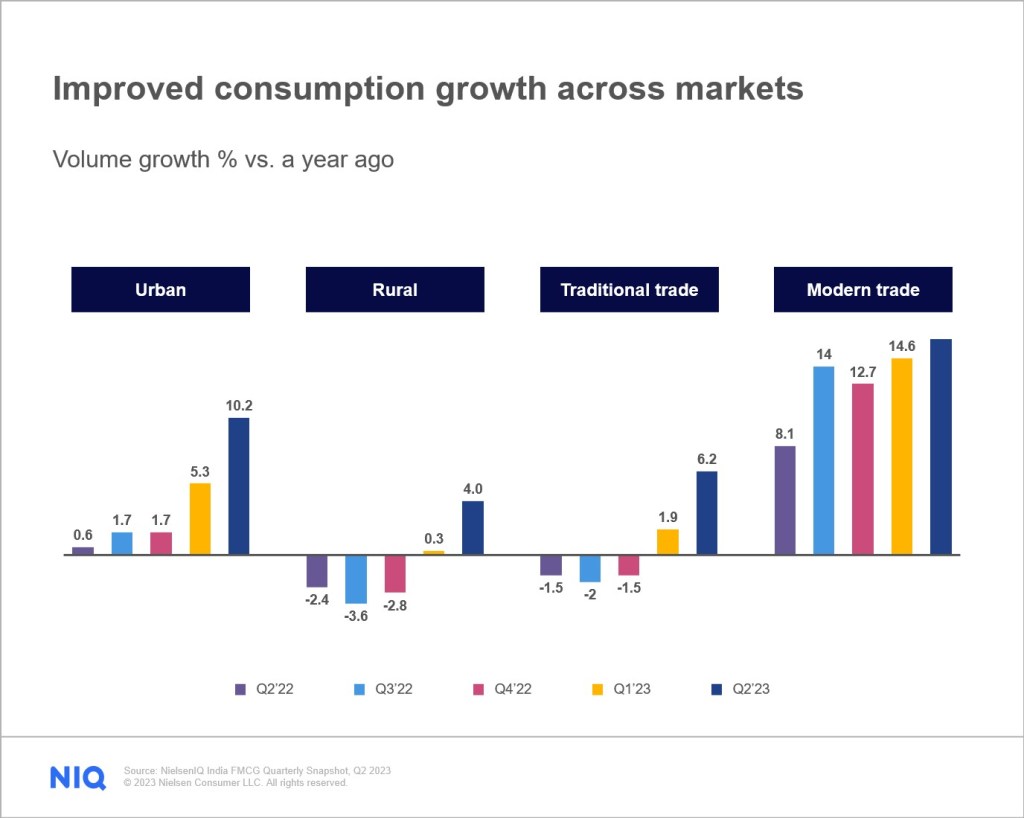

Both rural and urban markets are looking up in terms of growth, and even though rural growth is staggered, it experienced a 4% growth rate compared to the previous year. The urban market has also been continuing its positive momentum and has doubled its growth from 5.3% in Q1 of 2023 to 10.2% in Q2.

When we look at the retail space, modern trade continues to see double-digit consumption growth at 21.2%, while traditional trade sees an improvement from 1.9% in the first quarter to 6.2% in Q2 of 2023.

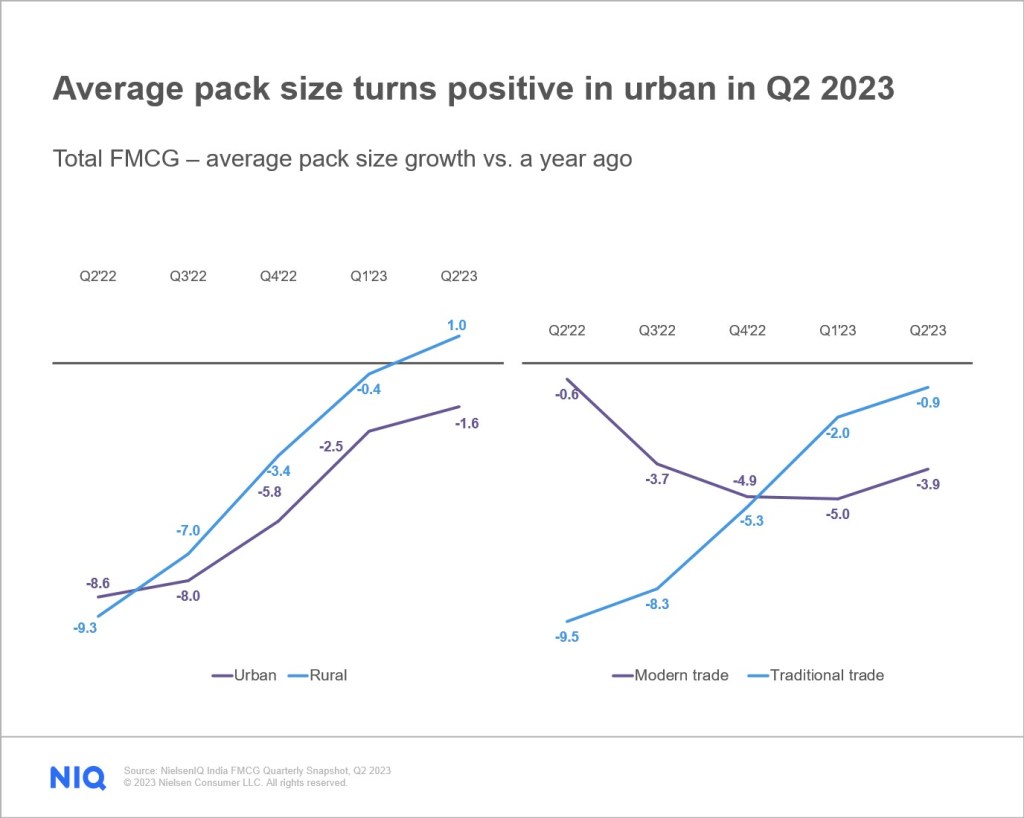

The double-digit consumption growth has been driven by unit growth across urban, rural, modern trade, and traditional trade, with smaller pack sizes leading this growth. Despite seeing an upward trend for average pack size growth, it remains negative across markets except for urban markets. At this point, it is very important for brands to ensure they have the right assortment and pack sizes for their products.

Food continues to drive growth while non-food recovers in rural

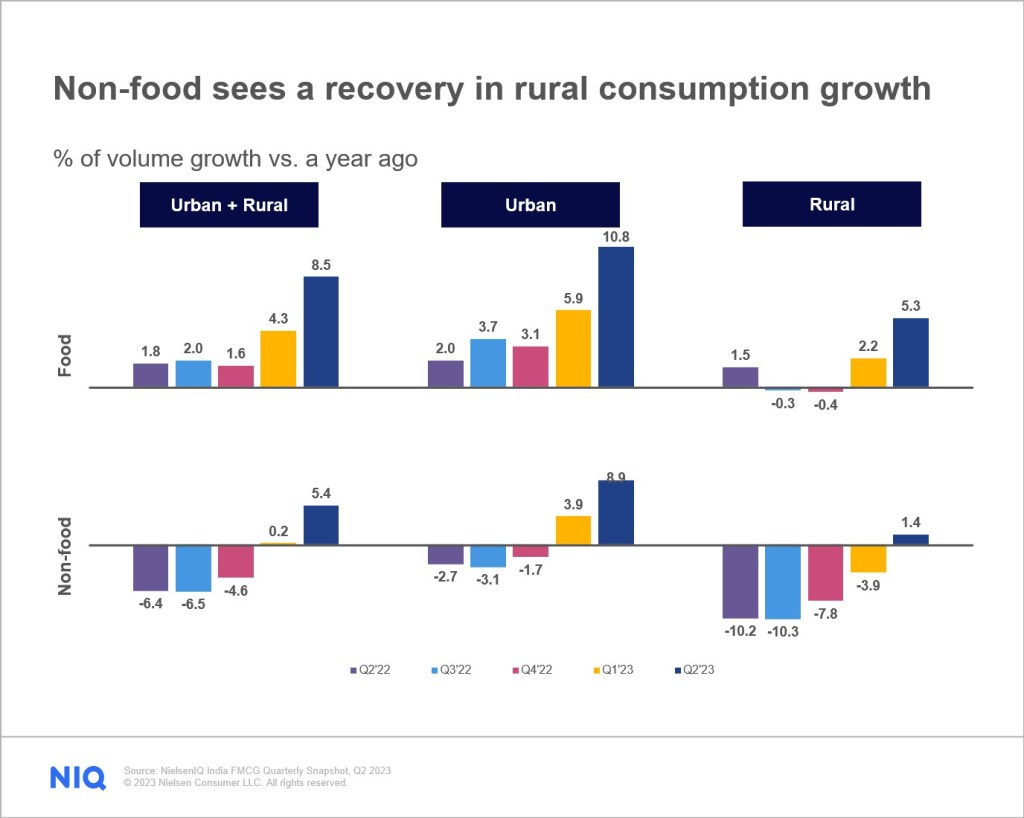

The food categories continue to drive consumption growth for all of India at a rate of 8.5% compared to a year ago and up from 4.3% in the first quarter of 2023. Driving the overall growth in the food sector are staples and impulse categories, and consumers have been leaning back towards habit-forming categories in cities and metros.

The non-food categories also improved in terms of consumption growth, with a rate of 5.4% compared to a year ago in Q2 2023 (up from 0.2% in Q1 2023). The improvement can be attributed to the rural consumption that grew 1.4% in Q2 2023 (up from -3.9% in Q1 2023). Home care categories drove this growth, while personal care continues to see a decline in rural markets. Non-food also continues to see an improvement in urban markets, with consumption growth of 8.9% in Q2 2023.

Small manufacturers are driving overall growth

At an overall FMCG level, small manufacturers are driving the value and volume growth. The rural markets have led this; however, in urban markets, the volume growth has been at par for both large and small manufacturers. Small manufacturers have also been witnessing growth ahead of large manufacturers in the non-food categories, while large players are driving consumption growth in food.

Overall a positive outlook for FMCG in India

With both urban and rural markets looking up in terms of growth and the softening of India’s inflationary rate, we can anticipate more positive momentum in the second half of the year. Consumers are also looking to be more confident with their spending, especially in the build-up to the festive season. With the opportunities ahead of us, ensure your brand is backed by trusted data and an optimized strategy for growth.

Get the Full View™ of India’s FMCG industry

To navigate the shifts in the retail landscape, you need the industry’s most accurate and trusted data. Book a meeting with us to see how we can help you make data-backed decisions for your business.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)