CPG inflation rate continues to drop

The U.S. government announced today that the Consumer Price Index (CPI) dropped in December to 6.5% from 7.1% in November, giving consumers some reprieve from inflation.

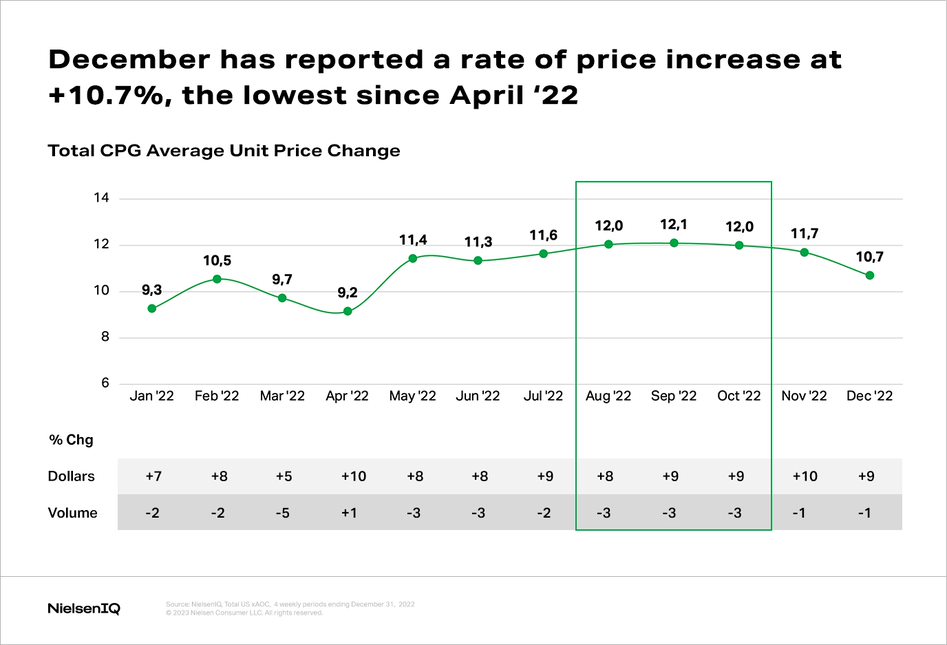

December, which is the top month for CPG retail sales, also saw the rate of CPG unit price increase slow when compared to past months to 10.7%, down one point from November, and the lowest rate since April ‘22.

This year is shaping up to provide some relief from CPG inflation as price increases continue to drop month to month, though inflation is still painfully high for consumers.

Consumption is still determined by prices

CPG sales growth continues to be fueled by rising prices as unit consumption is down slightly when compared to last year. Consumers may be spending more—December reported a 9% lift in dollar sales—but unit consumption dropped by 1%.

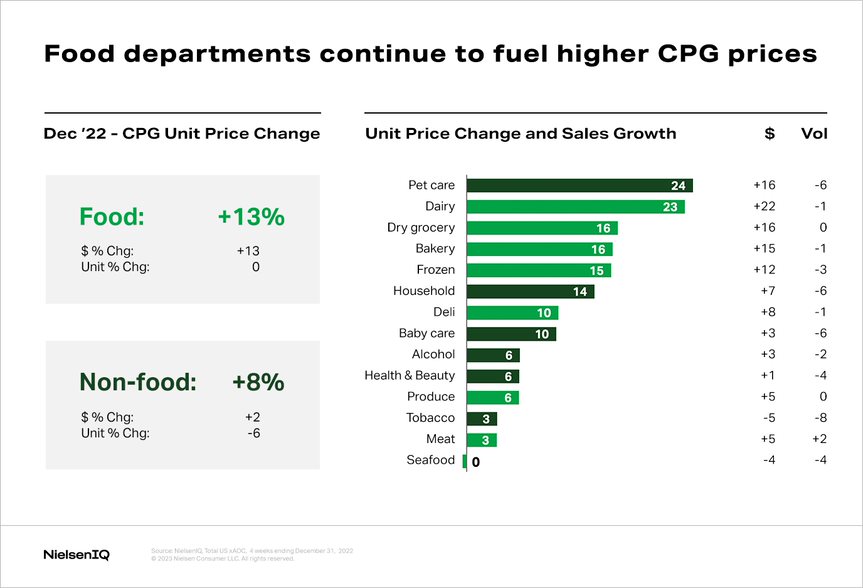

Declining consumption remains a concern for the industry as consumers focus their spending on the essentials. Food inflation is still leading the charge at 13% with consumption holding at 0% change after previous monthly declines. However, non-food prices increased by 8%, forcing consumers to pull back with a 6% decline in unit sales.

One of the contributing factors fueling fewer items being sold is the shift to larger sizes—25% of Americans are buying larger sizes as a savings strategy to get a lower cost per use. Categories with longer shelf life will continue to motivate this shift.

Across the board rising prices

Very few categories are immune to rising prices. Inflation continues to hit all areas of the store, primarily driven by food departments—in December, the largest reported increases were in dairy by 23% compared to last year, dry grocery by 16%, bakery by 16%, and frozen by 15%.

For non-food departments, the top three increases were in pet care by 24%, household by 14%, and baby care by 10%.

As a result, consumers are scrutinizing their purchases with 32% reporting they are sticking with the essentials and buying less.

Continued focus on savings

Value for their money is a growing trend for U.S. consumers, with a majority feeling like the country is already in a recession. Private label brands, which on average provide a 14% savings versus national brands, captured 19.3% of the consumer wallet for CPG sales.

As prices rise, so does the growth of private label, reporting an increase of 15% in December, outpacing the total market growth of 9%. With 38% of Americans selecting private label goods as a savings strategy, we can expect continued share growth.

Consumers have also shifted where they are spending their dollars with 38% of shoppers seeking out stores with lower prices. Value-based retailers’ sales jumped by 11%, capturing 42.3% of CPG sales. Varying assortment across retail channels is more important than ever to sway decisions—if items are the same, the lowest price will continue to win.

Despite consumers’ obvious need for deals, promotional sales continue to trend slightly higher than the total market growth (12% versus 9%). With 50% of shoppers willing to stock up when their brand is on sale, promoted prices will be a key basket driver for retailers.

But for some shoppers (29%), promotions are the deciding factor as they report they will only buy what is on sale.

As higher-than-average inflation continues to linger, promotions will remain a key motivator in deciding where to shop and what to buy.