Double-digit growth and lots of opportunities

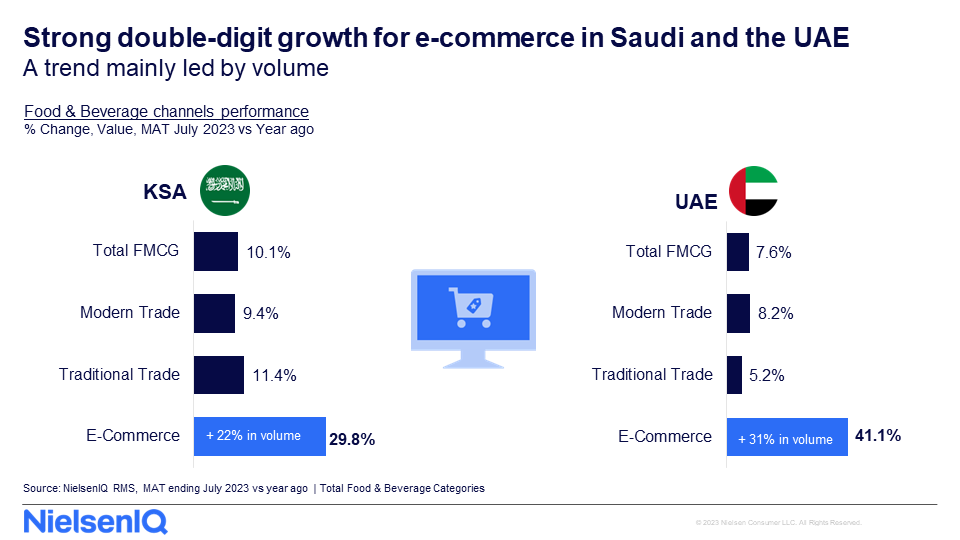

Food and beverage sales continue to show value growth across every channel over the last 12 months. But in this altered shopping environment, one channel achieved a standout performance within the retail markets of the Kingdom of Saudi Arabia (KSA) and the United Arab Emirates (UAE): e-commerce.

Despite facing significant price hikes averaging 3% and 5%, respectively, over the past three months, both nations have recorded strong e-commerce growth rates of 17% and 24%.

The UAE witnessed the highest online value growth in the snacking category, while in the KSA, the personal care segment took the lead. This resilience and adaptability of e-commerce underscores its enduring appeal and versatility in the face of economic challenges.

These insights stem from the latest NielsenIQ analysis of the region’s key FMCG data up to the end of August 2023. The study reveals intriguing developments in the KSA and the UAE markets, reflecting both challenges and opportunities for businesses operating in the region.

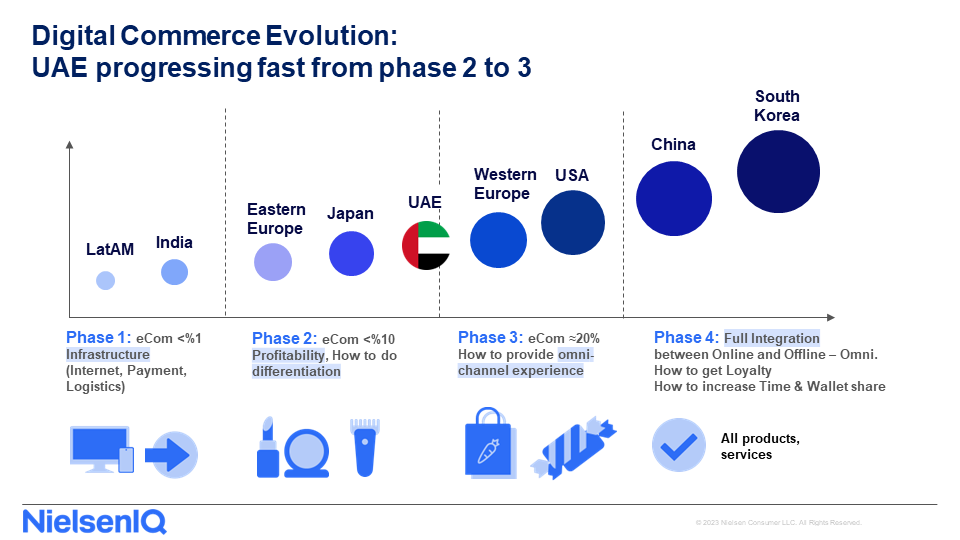

Speaking at the recent Future Food Forum in Dubai, NielsenIQ GM Arabian Peninsula & Pakistan Andrey Dvoychenkov underlined the online journey he has observed in the region and stressed; “E-commerce in the UAE is jumping from one phase of its development to the next… without even looking back.”

Modern trade sector under pressure

In contrast to the e-commerce sector’s performance, the Modern Trade (MT) sector has shown signs of gradual deceleration, indicative of a growing sense of price sensitivity among consumers.

In the KSA, a substantial 69% of categories in Modern Trade witnessed an average price increase in the last 3 months vs. last year. This number is even higher at 78% in the UAE. This means that even if inflation continues to slow down in both markets, consumers are feeling the impact of rising prices across a wide range of products.

One of the most notable trends during this period was the decline in consumption, as volume sales declined by –0.4% in the KSA and –0.7% in the UAE. But in this inflationary environment, consumers are also willing to pay more for the attributes that matter to them. Their interest focuses on products made of natural/organic ingredients that provide a balance between health benefits and taste.

Promotions and private label on the rise

Despite the challenges posed by rising prices, promotions remain a significant factor in the region, with the latest NielsenIQ Barometer Report highlighting that Temporary Price Discounts (TPR) still dominate promotions.

In the UAE, promotions accounted for 33.5% of the total FMCG value in July 2023, but showed a lower overall weighting in overall sales, pointing to potential shifts in consumer behavior. Promotion efficiency in the UAE is still a concern, highlighting the need for more effective marketing strategies.

In the KSA, promotions accounted for 40% of the total FMCG value sold in July 2023, indicating a continued reliance on discounts to drive sales. According to the latest NielsenIQ Mid-year Consumer Outlook 2023 survey, 97% of Saudi consumers have changed the way they shop for FMCG (versus 95% globally). This has seen them adopting a range of strategies to manage their spending. The three top consumer saving strategies are buying whichever brand is on promotion (29%), shopping more often at discounters (32%) and focusing on essentials (26%).

The analysis also highlighted the staying power of private labels in the KSA where many consumers are managing costs by turning to store brands. More than a third of consumers think store brands usually are good value for money while 30% consider them a viable alternative to name brands.

Looking ahead

Overall, it’s clear that the FMCG landscape in the KSA and the UAE is experiencing significant shifts, with rising prices and declining consumption challenging businesses operating in the region. While promotions remain an essential strategy, businesses must navigate the delicate balance between discount-driven sales and maintaining profitability.

In these dynamic times, businesses must adapt swiftly to changing consumer behaviors and market conditions. The recent trends in the FMCG sector in the KSA and the UAE underscore the importance of understanding the fine balance between pricing strategies and consumer satisfaction for both manufacturers and retailers.

“Against the backdrop of an e-commerce boom, the question for brands is how to differentiate themselves from their competitors,” says Dvoychenkov “Beyond hard tactics namely price and promotions to meet the needs of wallet-constrained consumers; client satisfaction must be the goal of every player. This necessitates a refocus on soft tactics around products themselves, which include texture, packaging, special ingredients, the ‘brand story’ and the overall client experience to make the in store journey a joyful experience.”