Gradual price growth fuels double-digit value sales increase

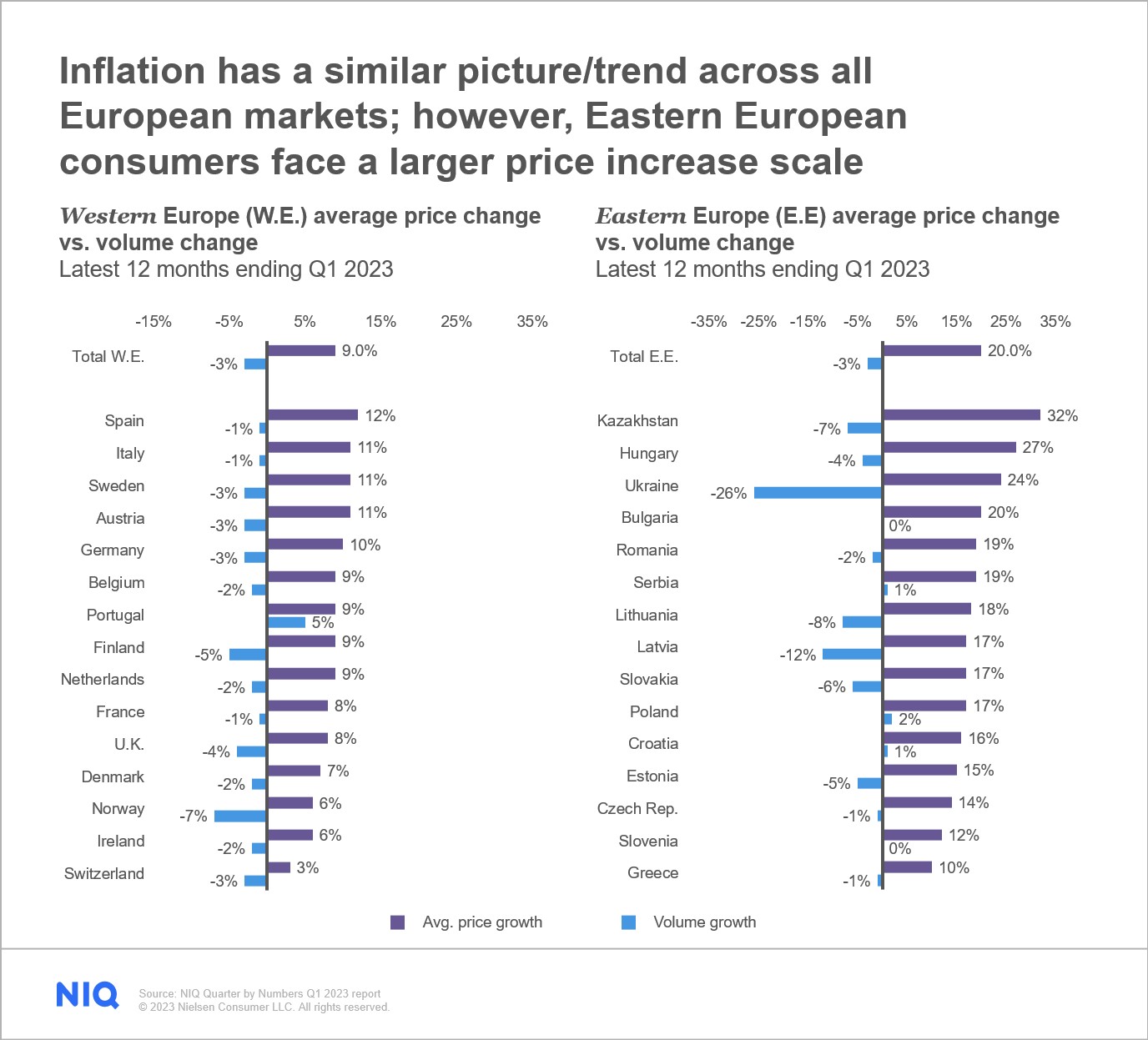

The FMCG sector in Europe experienced remarkable growth in the first quarter of 2023, with Eastern Europe leading the charge at a 17.6% increase. This surge was primarily driven by gradual price growth, compensating for the negative unit volume sales trend observed since mid-2022.

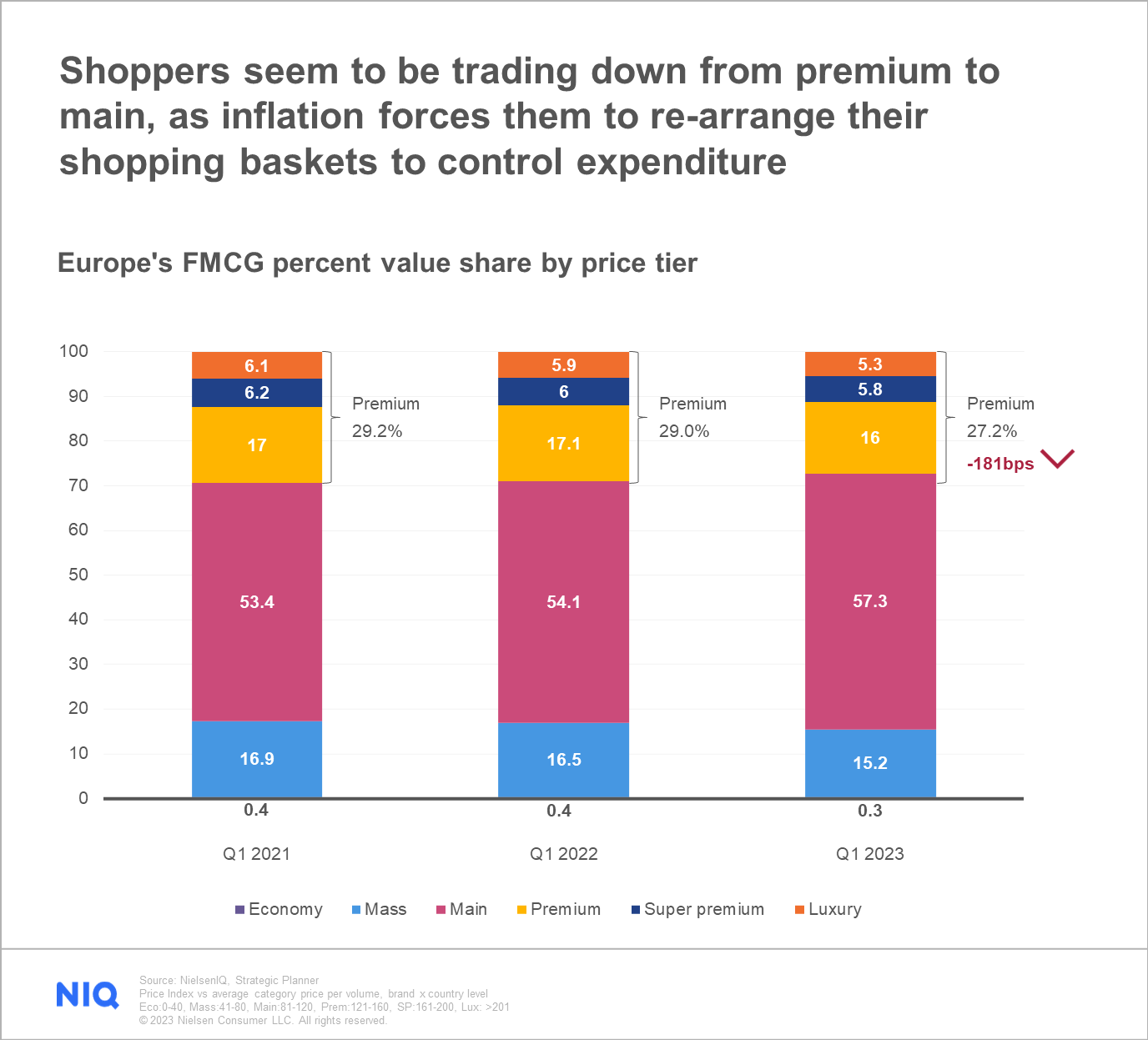

With inflation being a major concern for both consumers and company executives, gradual price growth played a pivotal role in driving FMCG sales in Eastern Europe. The cost-of-living crisis has significantly impacted consumer confidence, with increasing food prices being the top concern for 44% of European consumers. As a result, shoppers are shifting their preferences from premium to more affordable options, favoring discount stores that offer a better value for money.

Eastern Europe’s channel dynamics

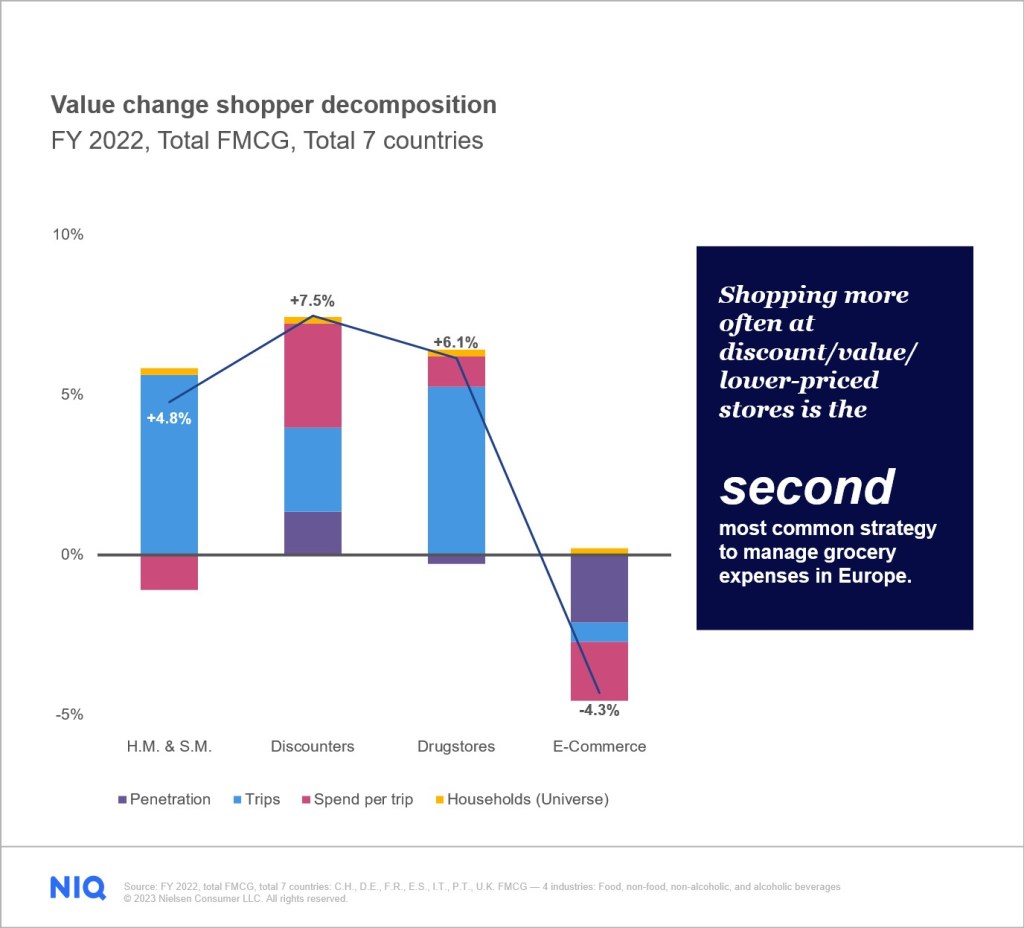

While hypermarkets (H.M.) and supermarkets (S.M.) continue to dominate, discounters have emerged as the winners in the current scenario; meanwhile, e-commerce’s growth has slowed as the pandemic recedes. European consumers are shifting their shopping behavior, showing a preference for discount stores and private-label products. Additionally, they are making more frequent visits to grocery stores but are reducing the size of their baskets, focusing on purchasing only essential items.

Rising costs make discounters popular with consumers

To cope with the rising cost of living, consumers turned to discounters, which provided more affordable options and attracted cost-conscious shoppers seeking budget-friendly purchases. The overperformance of discounters was primarily driven by increased spend per trip, making them a more important shopping destination in the current environment.

Discounters have become market leaders in Poland, with nearly 1 in 4 Polish złoty (PLN) spent on FMCG products at these stores. This has led to more than a 25% increase in channel value for the latest quarter. Discounters were also the only channel maintaining a positive volume trend for food and drug categories. This trend has also driven the growth of private labels, surpassing other manufacturer groups and increasing their market share by 1 percentage point.

Private labels gain traction despite a price increase trend

Private labels (P.L.) have experienced remarkable growth in Eastern Europe, as consumers perceive them as less expensive alternatives to name brands, simultaneously gaining a reputation for increased quality. The acceleration of private labels persists in line with consumers’ focus on value for money, presenting a double pace of growth compared to the total market. In the past 6 months, 93% of shoppers claimed to buy P.L. brands. Of that, 33% claimed to increase P.L. buying due to the better value for money and improved quality.

It is evident that Eastern European consumers are changing their purchasing behavior in response to inflationary pressure. In Q1 2022, we began observing a larger share of private label sales, which has since skyrocketed in Hungary, Slovenia, the Czech Republic, and Slovakia to now contribute to being at least one-quarter of the value of unit sales.

Private labels have also experienced remarkable growth in Eastern Europe, with a share increase across all super categories, including health and beauty, food/grocery, beverages, and home care. Retailers are optimizing their assortment by prioritizing private labels to secure margins and cater to cost-conscious consumers. Additionally, private labels are driving the bio and eco narrative in the food categories, presenting further growth opportunities in the home care sector.

Economic stratification impacts consumer behavior

In the face of inflationary pressures, consumers are reevaluating their shopping habits to control overall expenditure. The cautious middle consumers have become crucial for retailers and brands as they make strategic decisions about premium and value price tiers, private labels, convenience, and product range.

Given the uncertain and distressing times Eastern European shoppers face, as indicated by the latest regional shopper trend surveys, retailers and manufacturers must recognize and navigate shifts in shopper attitudes and behavioral changes. The right price strategy and positioning will remain key to winning in the market for 2023, with a focus on value for money.

Innovative strategies for FMCG players

To thrive in the evolving FMCG landscape, both retailers and manufacturers must embrace innovative strategies that address the changing channel dynamics. Successful innovative strategies consist of the following:

- Modernize loyalty schemes: Retailers should update their loyalty programs to cater to the evolving needs of consumers, focusing on convenience, better experiences, and omnichannel shopping options.

- Study incrementality and adapt portfolios: Manufacturers need to analyze incrementality and adapt their product portfolios per channel and retailer. Exploring different channels can help them maintain their market presence amid rationalization efforts.

- Prioritize private labels: Retailers should continue prioritizing private labels as they offer flexibility to adjust to increased costs while maintaining a relevant price gap compared to branded products.

- Optimize portfolio efficiency: As ranges contract, category leaders should prioritize core brands while still catering to consumer needs. Understanding what is indispensable versus replaceable for consumers is crucial for weathering the storm.

Make bold decisions with superior data

Leverage our trusted and comprehensive data and insights to help you turn ideas into impactful strategies for what lies ahead.