Consumers change how they spend their money

Although inflation is decelerating, reaching 10.3% in the year’s second quarter, consumers have evolved due to the inflationary pressure accumulated after more than a year of record price increases. Uncertain about the future, consumers view this inflation deceleration with caution and continue to be very calculated with their budgets to withstand further devaluation of their incomes. As a result, 90% of consumers globally are changing how they spend their money, with the most common changes being cutting discretionary spending, adhering to a predetermined budget, seeking the best prices, delaying major expenses, and investing and saving for the future.

Romania sees FMCG sales growth

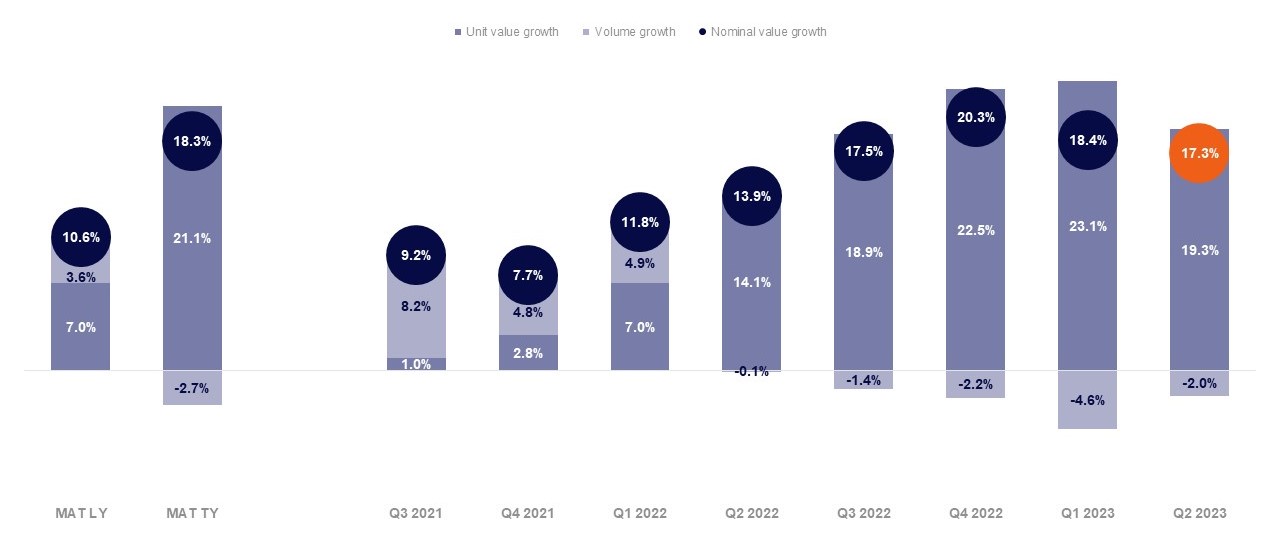

According to NIQ’s Retail Audit data, FMCG sales in Romania grew by 17.3% in value in Q2 2023 compared to the same period last year. At the same time, the second quarter of the year is marked by a decrease in volume decline (down 2.0% in Q2 2023, compared to a decline of 4.6% in Q1 2023) that characterized the previous quarters, as well as by a slowed-down price growth (+19.3% in Q2 2023, compared to +23.1% in Q1 2023).

Across Europe, the FMCG market has evolved similarly to Romania in the past 12 months, with an average value growth of 9.2%, a volume decrease of 2.3%, and a price increase of 11.5%.

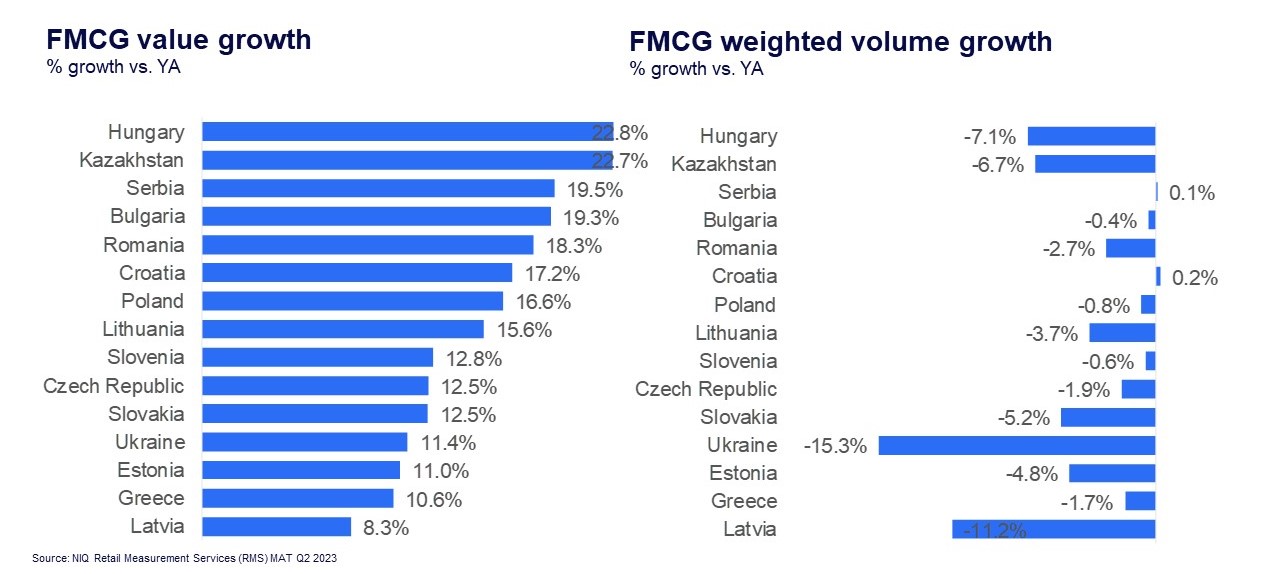

In comparison with countries of the same region, Romania ranks 5th in terms of value growth (18.3%) over the past 12 months, surpassed by Hungary with a growth of 22.8%, Kazakhstan (+22.7%), Serbia (+19.5%), and Bulgaria (+19.3%). However, in Q2 2023, Romania’s growth of 17.3% was only surpassed by 3 countries: Ukraine (+43.7%), Hungary (+18.4%), and Croatia (+17.6%). None of the countries in the region have recorded consumption growth, and Romania is among the countries with the smallest volume losses (2.7%), compared to Latvia with a decline of 11.2%, Hungary (-7.1%), or Slovakia (-5.2%), for example.

Growth for FMCG market baskets

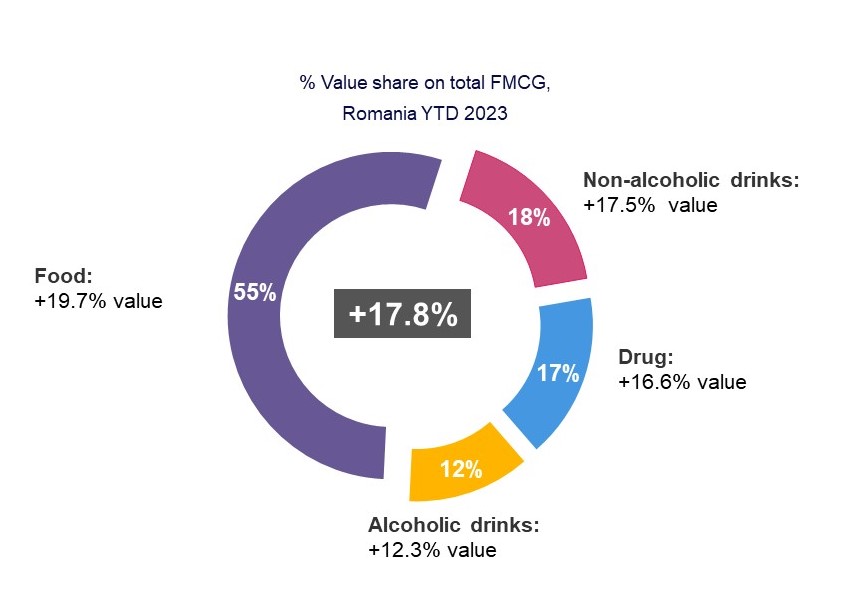

All product macro-categories are experiencing significant value growth in the first half of the year. The highest growth is in the food category (19.7%), representing over half of Romania’s total FMCG market basket, followed by non-alcoholic beverages, which saw a value growth of 17.5%. Non-food products are increasing in value by 16.6%, while alcoholic beverages are growing by only 12.3% due to a portion of consumption shifting towards the hotels, restaurants, and cafes sector.

Over three-quarters of product categories increased in value in the first half of the year, while only 32% also grew in volume. Top categories that grew by over 10% in value included beer, carbonated beverages, fresh meat, water, cheese, coffee, snacks, chocolate, sweet biscuits, dairy products, vegetables, bread, household products, and spirits. However, none of these categories grew in volume, except for fresh meat (+6.8% in volume), while the rest of the categories stagnated or experienced volume losses.

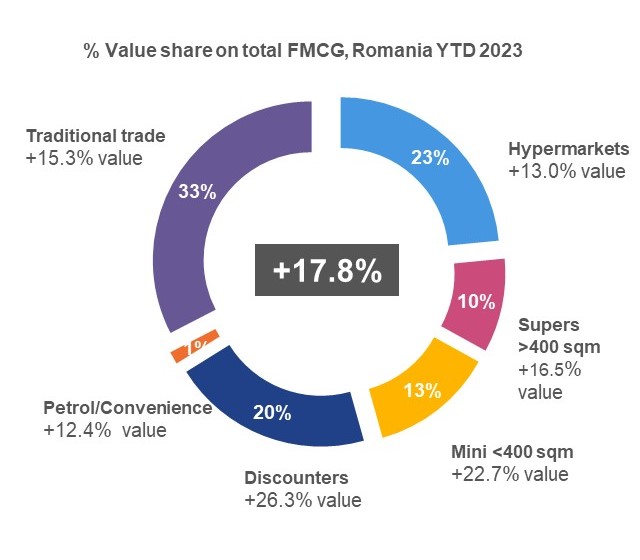

The channel with the highest growth: Discounters

Consumers’ shift towards a more pragmatic and calculated purchasing attitude is reflected in the growth dynamics of retail channels. Therefore, the channel with the highest growth in the first half of 2023 was the discounters (26.3% in value), followed by smaller formats — mini-markets (+22.7%) and supermarkets (+16.5%). Traditional trade increased in value by 15.3%, while hypermarkets recorded the slowest growth, at 13.0%. A notable trend in the year’s second quarter is the change in consumption patterns in hypermarkets and supermarkets: despite the average shopping basket value in hypermarkets remaining relatively constant regardless of inflation (-0.6% compared to Q2 2022), the number of transactions increased by nearly 10%. Compared to the same period last year in supermarkets, shopping basket value increased by 9%, and the number of transactions increased by 5.8%. This consumption pattern indicates consumers’ tendency to make more frequent store visits in an effort to control the value of their shopping baskets.

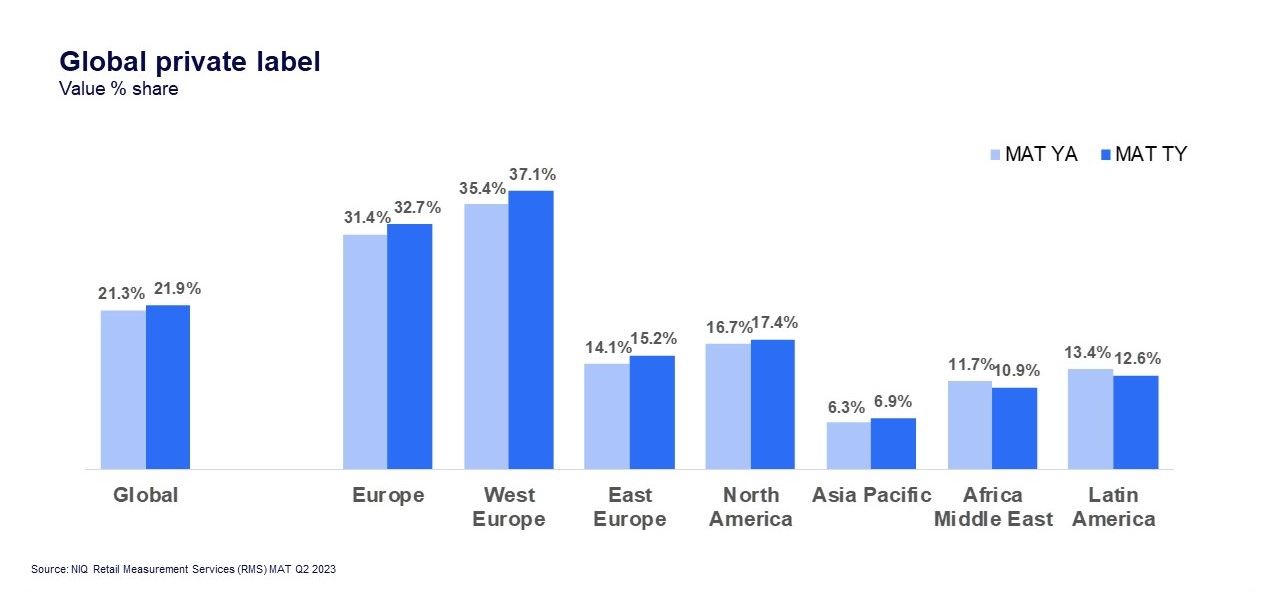

Private labels gain market share

Another method Romanian consumers use to cope with inflation is turning to private-label brands. The upward trend of private labels continues in Q2, with their market share gaining an additional 0.7 percentage points compared to the previous year, now representing 19.3% of Romania’s total FMCG market. Private-label products in the non-food category experienced the most impressive growth this quarter, increasing by 2.7 percentage points. Although private labels are growing in importance in Romania, they are still below the European average, representing 32.7% of total sales; however, they are above the Eastern European average of only 16.2%.

Online FMCG continues to increase

Online FMCG trade monitored by NIQ saw a significant value growth of 20.4% in the year’s second quarter. Most of the online trade is occupied by non-food products, which grew by 25.5%, and food products, which experienced a value growth of 14.1%. Alcoholic beverages increased in e-commerce by 25.2%, while non-alcoholic beverages grew by 21.3%. While the e-commerce market had not experienced significant fluctuations since the end of the pandemic, the peak value growth of this market was reached in Q2 2023.

Promotions gain traction in Q2 2023

Promotions in Romania have also increased again in Romania in Q2 2023, accounting for 24% of total sales (+3.9 percentage points). All modern trade channels have introduced more offers to the market in 2023 than in the previous year; however, the promo efficiency has decreased for all product macro-categories, except for alcoholic beverages, whose promotions had an efficiency of 77.1% in Q2 2023 (compared to 76.6% in Q2 2022).

Companies must adapt and remain relevant

As consumer prices for consumer goods continue to rise in the second quarter of this year, already overlapping with the inflation that began the previous year, 15.6% of global consumers are considering the need to spend more on consumer goods in the next 12 months, despite inflation deceleration. Additionally, 32% of global consumers state that they have already begun to prefer purchasing from discount-type stores and buying promotional products.

Even in the current context of inflation deceleration, consumers remain skeptical and calculated due to the high budgetary pressures they have faced in recent years. Therefore, the end of 2023 will likely be marked by increased efforts from companies in the FMCG industry to adapt to market changes and remain relevant to consumers.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)