Resilient growth amid polycrisis

The concept of polycrisis, highlighting potential adverse effects caused by global system interactions, has garnered attention. However, it often underestimates the resilience of the global economy and political systems to mitigate these shocks. Multiple third-party organizations, such as the Asian Development Bank and the World Bank, expressed optimism about the Asia Pacific (APAC) economy.

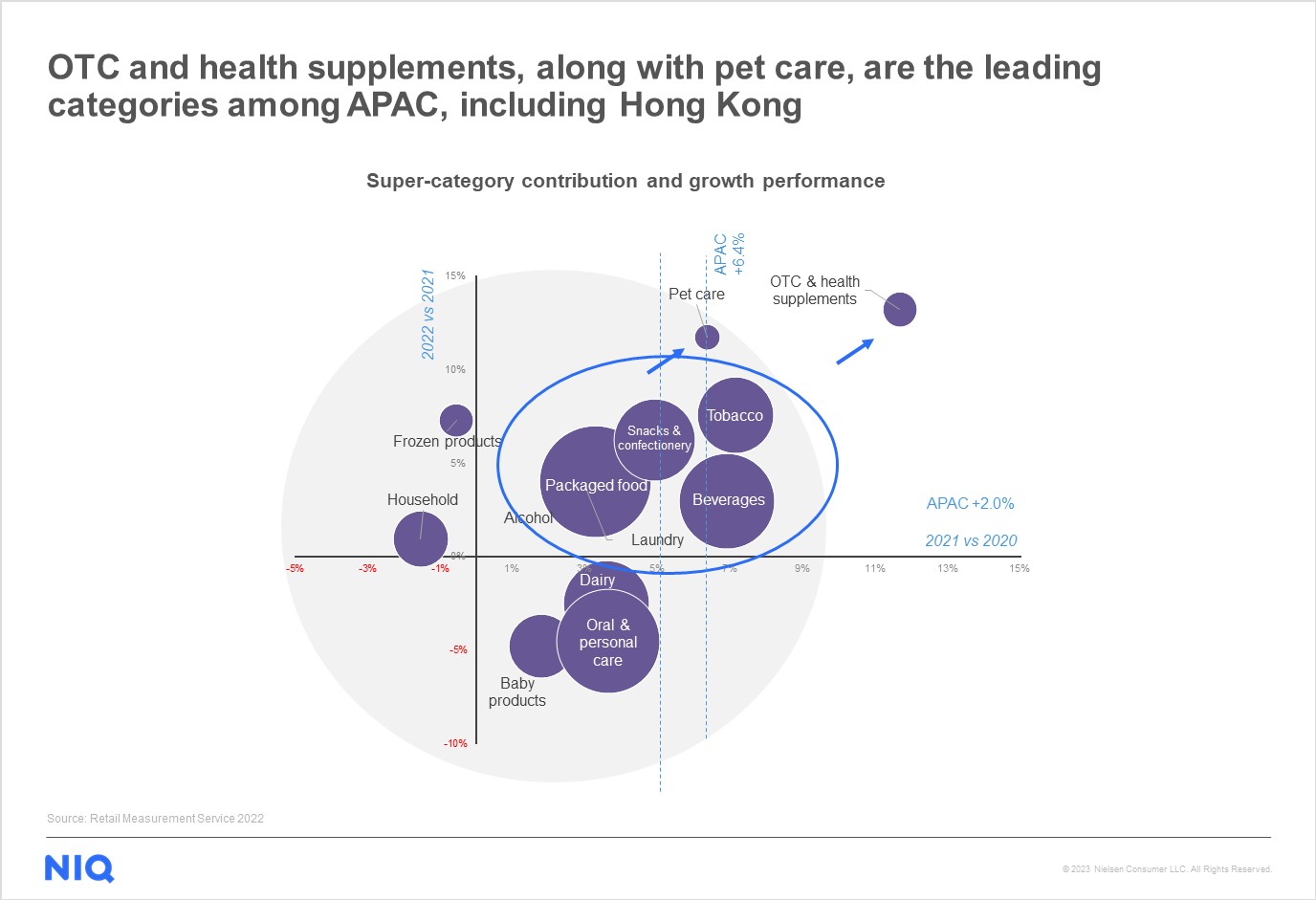

Hong Kong’s FMCG market reflected a positive 1.8% growth in 2022 compared to a challenging 10% decline in 2021. Over-the-counter (OTC) and pet care categories took the lead, fueling the sector’s resurgence. Moreover, pricing trends showed a positive movement with a 4% nominal price increase, especially in the food and laundry product segments. While most categories experienced month-on-month growth, promotional levels slowed as the industry focused on protecting margins, with a 5% decrease in the volume of products sold on promotion in 2022 compared to 2021. The optimism seen at the end of 2022 was slightly dampened in the first quarter of 2023, but the FMCG industry in Hong Kong remains resilient with opportunities for those seeking them.

A stronghold for premiumization

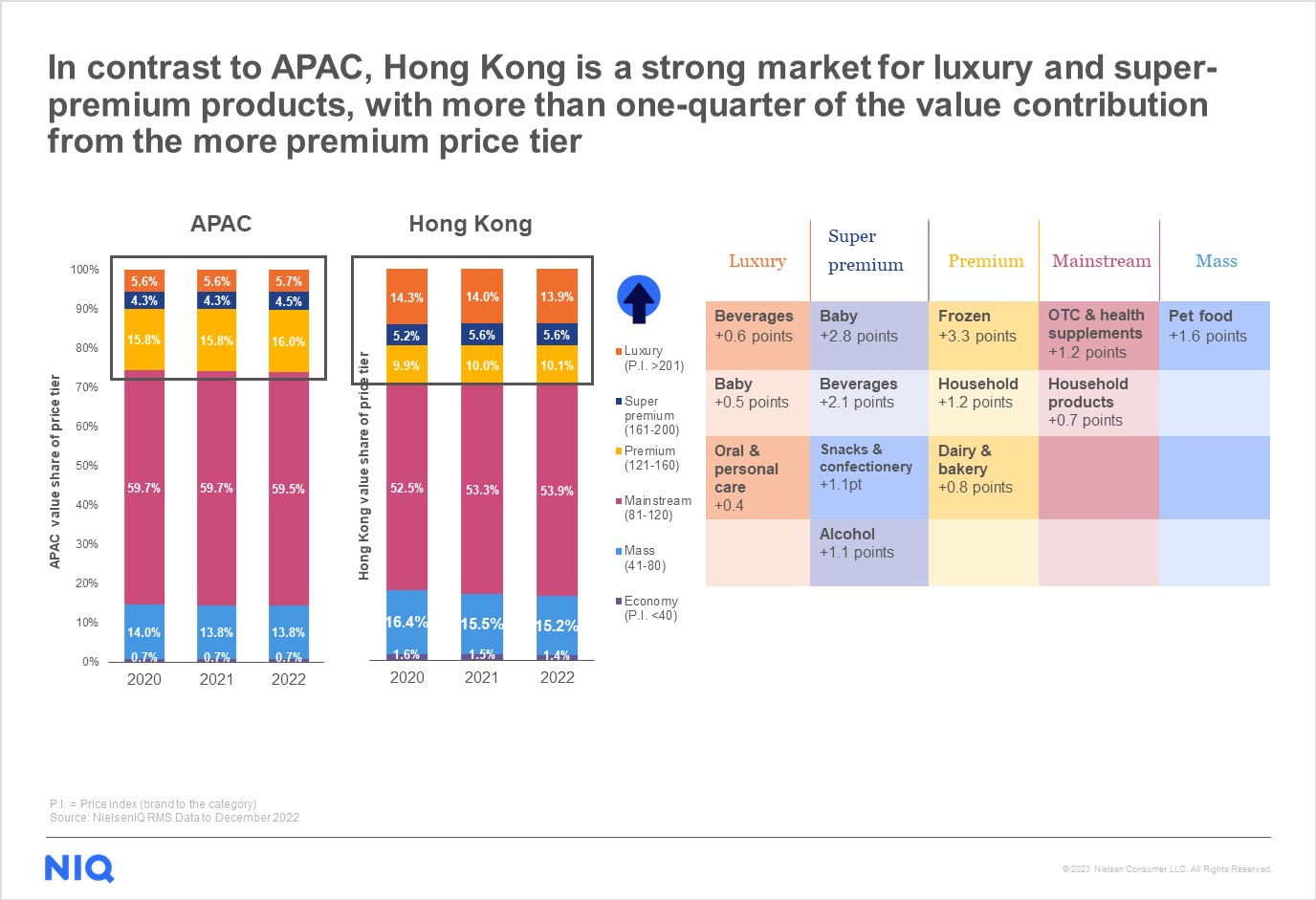

Hong Kong demonstrates strength in the luxury and super-premium categories, accounting for over a quarter of the FMCG value contribution from premium price tiers. This high proportion of luxury and super-premium segments instills confidence in the market’s potential for premiumization, setting it apart from the broader APAC region.

In a survey gauging Hong Kong shoppers’ response to a 10% price increase in FMCG products, it is evident that consumers in Hong Kong exhibit strong brand loyalty, reducing the inclination to switch to cheaper alternatives. Even amid price increases, they remain loyal to their preferred brands, with 10% of shoppers showing increased interest in loyalty programs.

There are certain attributes that the consumer would pay a premium for. Health is an essential consideration for consumers, with preferences for low sugar (40%) or no sugar (31%) in beverages and low sugar/salt in packaged food (38%). In non-food categories, consumers seek added functionality and convenience solutions. Whitening (37%) is an important factor when purchasing oral and personal care, and efficacy (58%) is what consumers would pay a premium for when purchasing household care products.

Innovation is key to winning with premiumization. In this regard, brands should focus on health, convenience, and sustainability, addressing consumer concerns, making products easy to use and access, and aligning with environmental values.

FMCG thrives with tourist dynamics and premiumization

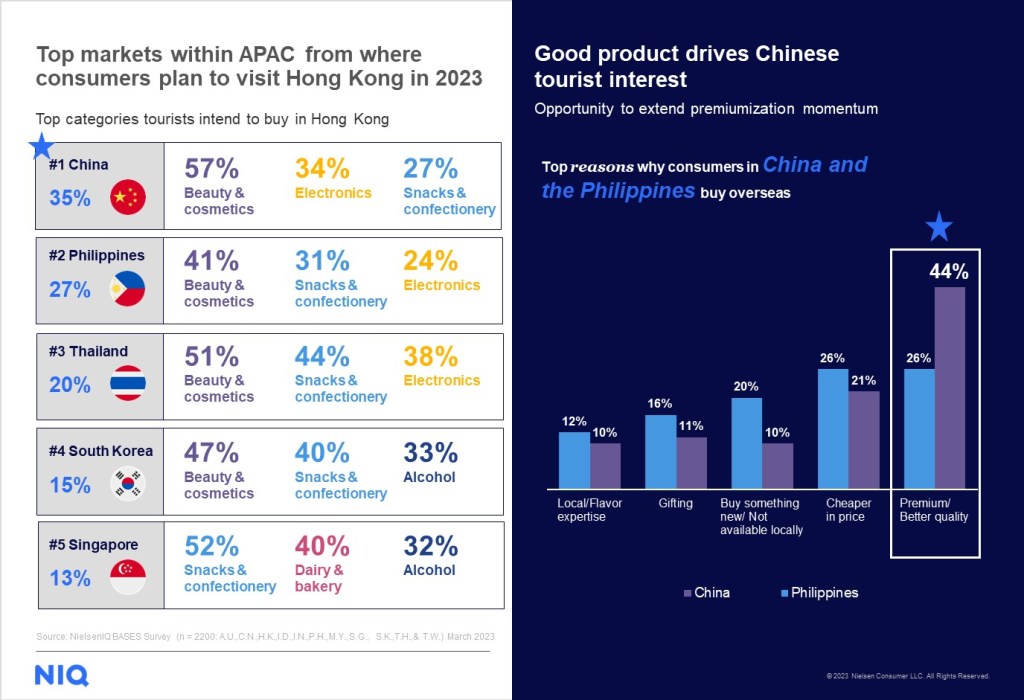

Tourism plays a crucial role in shaping the dynamic consumer landscape in this market. While tourists from China continue to be the primary visitors to Hong Kong, there is a notable increase in tourists from Southeast Asian markets. Understanding their specific product interests becomes vital. NIQ’s Retail Measurement Service (RMS) data from Q1 2023, reveals changes in tourist preferences, with infant milk formula losing its prominence with tourists while skin and health-related products are gaining significance, notably skin moisturizer, which is driving positive momentum.

Chinese and Filipino tourists prioritize high-quality products during their visits, with 44% of Chinese tourists and 26% of Filipino tourists seeking premium or better-quality products in Hong Kong. To cater to their preferences, FMCG brands need to adjust product assortments, utilize online channels, and understand preferred shopping districts for an enhanced shopping experience to drive growth.

The choice of shopping districts varies depending on the category. Tung Chung is a focal point for health products, while traditional districts like North District excel in necessity goods like shampoo.

Looking ahead, the reopening of borders presents an opportunity, as 81% of APAC consumers express their intention to travel abroad. To capitalize on this trend, brands should focus on offering premium products tailored to the preferences of shoppers, particularly Chinese and Filipino tourists.

Rising in-home consumption and online channels

Despite travel abroad resuming, in-home consumption continues to thrive. Changing lifestyles and work-from-home arrangements have significantly influenced consumer behavior, leading to substantial growth in FMCG consumption, with a 10% increase in value and frequency compared to pre-Covid levels. So, it’s crucial for brands to stay focused on domestic demand and keep pushing forward within the local market.

Premium supermarkets have thrived by catering to the need for quality ingredients and offering enhanced dining experiences. Additionally, the rise in in-home cooking has driven consumer demand for categories like frozen meat, frozen seafood, instant noodles, and pasta.

We’ve observed another interesting dynamic in households, where online and other emerging channels are gaining importance, reflecting the growing demand for diverse options. As consumers continue to save on their travel budgets and look for the best deals, this behavior might become a habit, leading to a sustained preference for these channels. The explosive growth of the online channel in 2020 and 2021 further highlights consumers’ desire for shopping diversity.

E-retailers have maintained steady performance with improved omnichannel penetration, while e-commerce has also shown consistent growth. However, the penetration of e-retailers is increasingly challenged by a strong omnichannel push.

Leverage insights to drive growth

Innovation, premiumization, tourist dynamics, and in-home consumption are key trends shaping the consumer and retail landscape in Hong Kong. FMCG brands should leverage these insights to drive growth. By focusing on innovation in health, convenience, and sustainability, brands can meet consumer demands in this dynamic market. Capturing the opportunities presented by international travel, understanding tourist preferences, and adjusting product assortments can drive growth opportunities. Additionally, catering to the growing in-home consumption trends and diversifying distribution channels will contribute to sustained success. Hong Kong’s evolving consumer landscape offers immense potential for FMCG brands willing to adapt and stay ahead of consumer preferences.

Get the Full View™ of Hong Kong’s FMCG industry

Navigate the shifts in consumer behavior and retail landscape with the industry’s most accurate and trusted data. Book a meeting with us to see how we can help you make data-backed decisions for your business.