Higher consumption headlines the India FMCG industry for Q3’23

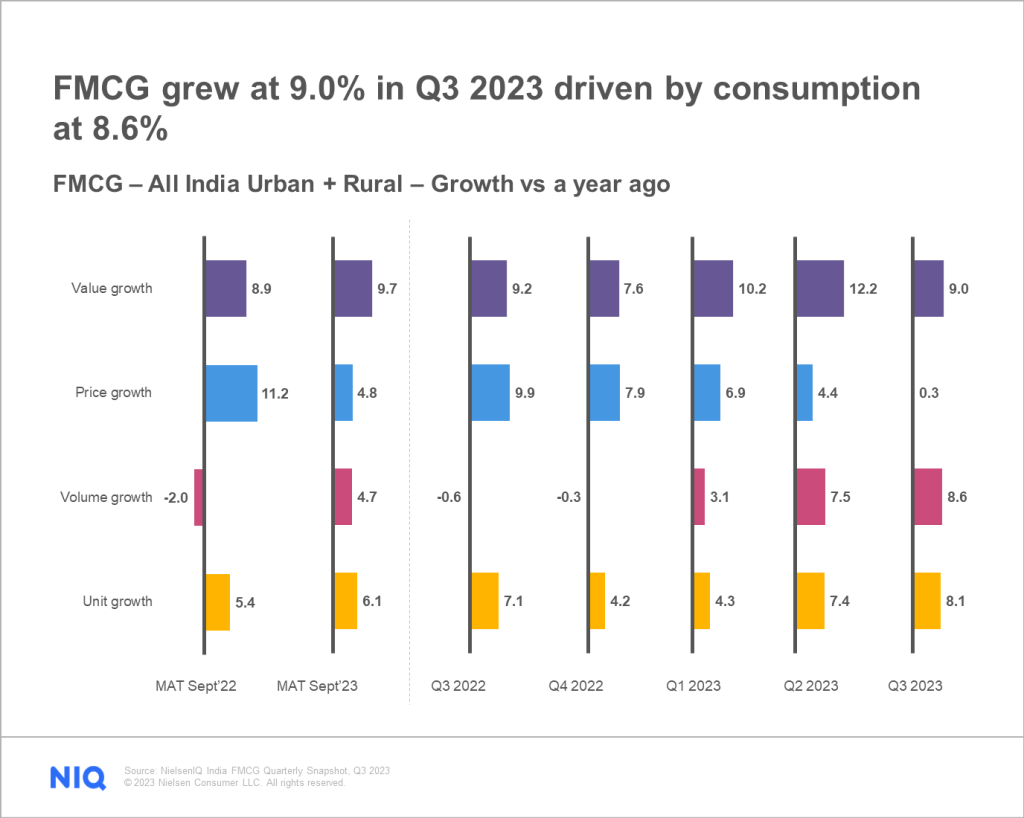

India’s FMCG industry saw a +9% value growth in the third quarter of 2023, fueled by volume growth. This indicates positive consumption patterns in India as inflationary pressures ease and price increases slow down compared to the previous quarter. These shifts helped increase the spending power of consumers, especially those in rural markets where consumption has increased across categories. Categories including impulse foods have shown strong growth, habit-forming categories such as Biscuits, Tea, Noodles, and Coffee, recovered growth in Q3 2023.

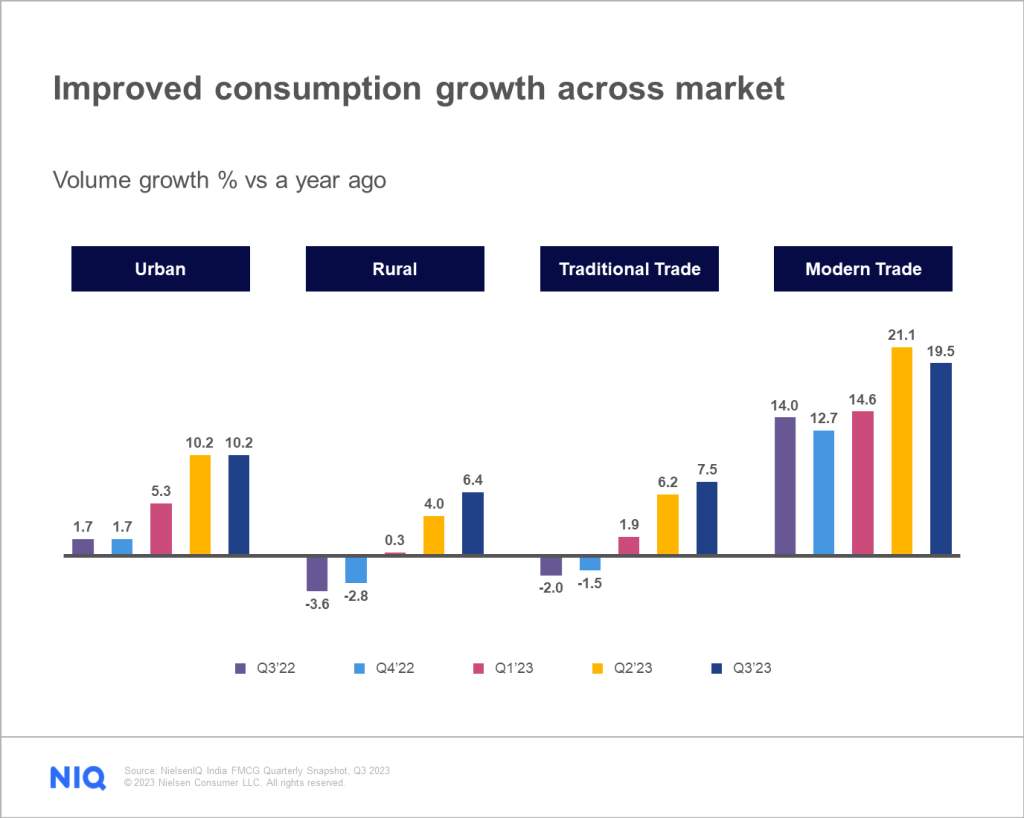

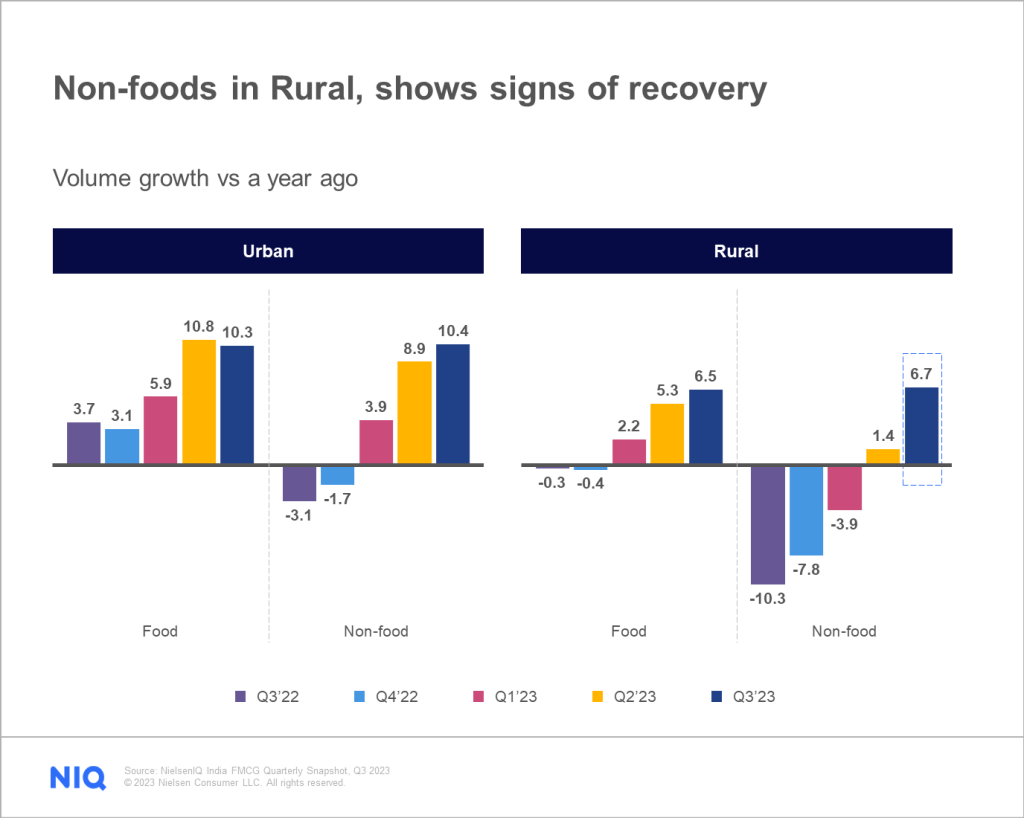

As Rural Markets continue to recover, there are signs that consumers are beginning to spend more on non-essential categories. NIQ data shows an increase in overall consumer spend for discretionary categories such as Personal Care and Home Care Products. Urban markets on the other hand are maintaining a stable rate of consumption growth.

When we look at the retail space, Modern Trade is experiencing a robust double-digit growth at +19.5%, while Traditional Trade is also on the rise with consumption growth improving to +7.5% in the third quarter, an improvement from +6.2% in the previous quarter.

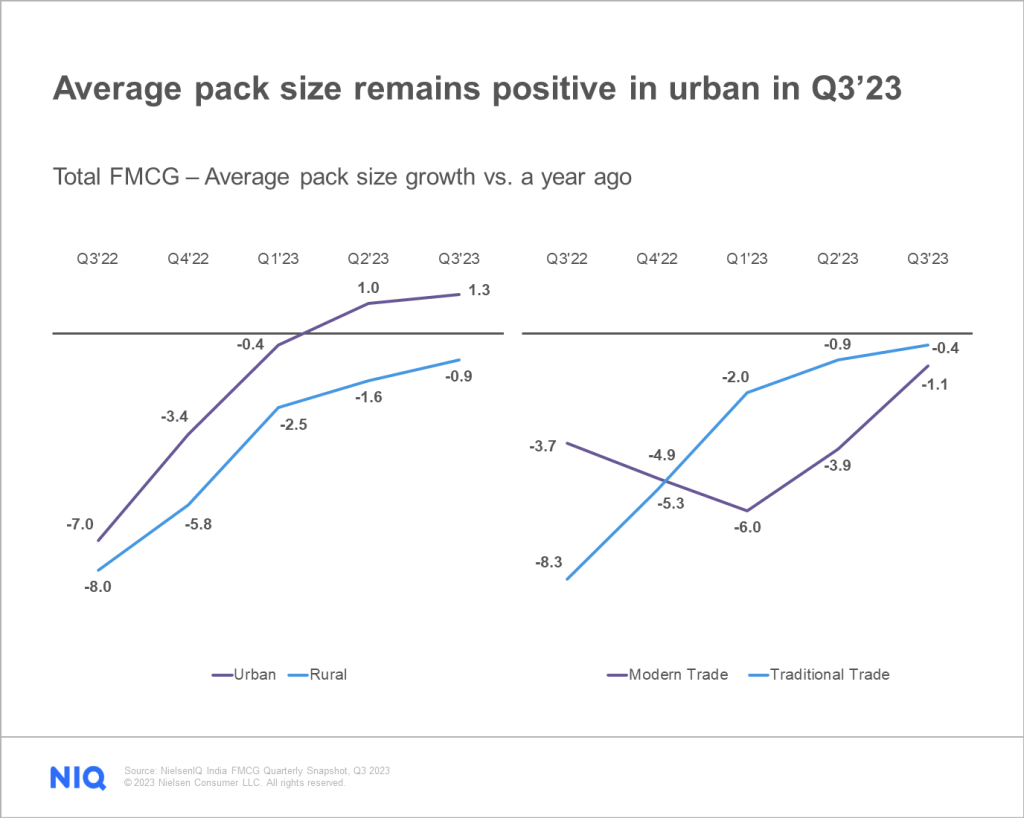

In terms of average pack sizes, Rural Markets purchased smaller pack sizes. Urban markets on the other hand had their average pack size growth turn positive in the previous quarter, and this trend continues for the third quarter of 2023. Overall, the average pack size growth continues to be positive across all zones in India except for the East.

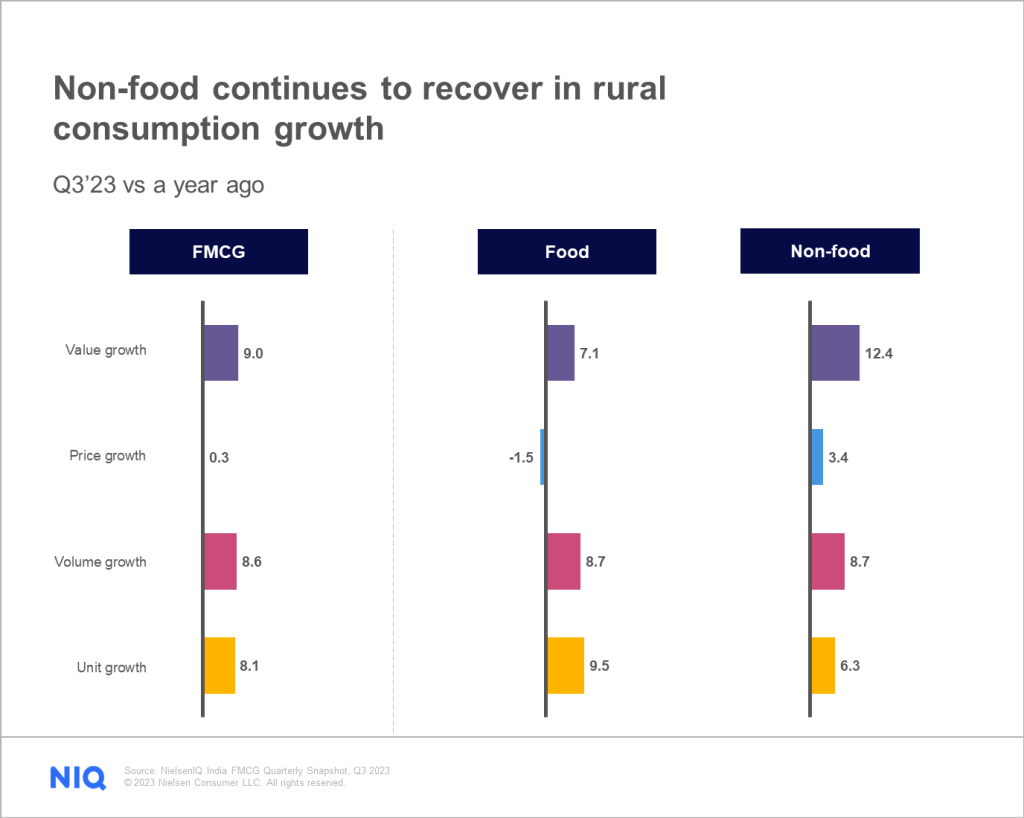

Non-food categories growing faster

Both Food and Non-food sectors are contributing to the growth in consumption in the Indian FMCG market. In the third quarter of 2023, the Food sector grew +8.7% compared to the same period last year. Similarly, the Non-food sector also exhibited a growth rate of +8.7% over last year, a significant increase from the +5.4% growth of the previous quarter. This growth has been primarily driven by Impulse (Salty Snacks, Chocolates, Confectionary) and Habit-Forming (Biscuits, Tea, Coffee, etc.) categories

The improvement in the Non-food category can also be attributed to an increase in Rural consumption growth of +6.7% in the third quarter of 2023. The Rural Markets also saw volume growth for Personal Care categories turning positive. Urban markets also saw improvement in the Non-food sector with consumption growth of+10.4% in the third quarter of 2023, up from +8.9% in the previous quarter.

Value growth for small manufacturers growing faster than large manufacturers

Looking at the broader FMCG industry, small manufacturers are experiencing faster growth rates in Non-food categories when compared to their Large counterparts. While for the Food category, Large players are growing faster in volume than small players.

Renewed optimism across India bodes well for the festive season

Unlike other APAC markets where growth was driven by price increases, India’s FMCG growth was fuled by higher consumption. Price growth has slowed while inflationary pressures have eased. With both the Urban and Rural markets facing a positive trajectory, and an increasing willingess to spend, this renewed optimism bodes well for the festive season. With the opportunities ahead of us, ensure your brand is backed by trusted data and an optimized strategy for growth.

Get the full picture of India’s FMCG industry

To navigate the shifts in the retail landscape, you need the most accurate and trusted data in the industry. Book a meeting with us to see how we can help you make data-backed decisions for your business.