Outdoor market: Equipment Sales in Europe

Outdoor enthusiasts primarily aim to get closer to nature, be in the open air, admire landscapes, and reap all the benefits that nature provides.

Engaging in outdoor sports also offers an escape from the hustle and bustle of the city, an opportunity to go green, and a moment of well-being, even spirituality for some.

However, these activities come at a cost and require the purchase of equipment: gear, clothing, shoes. The trend towards outdoor sports represents a potential for the outdoor activity equipment market.

In Europe, there is a rising trend in outdoor sports.

Sales in the cycling category are on the rise in France, Germany, and Italy. The camping category is also on the rise in the five analyzed countries, with a record in the UK: a 6.5% increase in the category over 2 years.

Sales of fishing equipment are also on the rise in all countries, except in the UK.

Indoor and urban sports, on the other hand, are losing momentum.

In France:

- The fitness category has lost more than 7 points between 2021 and 2023.

- The skate and skateboard category has also decreased by over 3 points.

These two categories are also on the decline in Italy, Germany, the UK, and Spain.

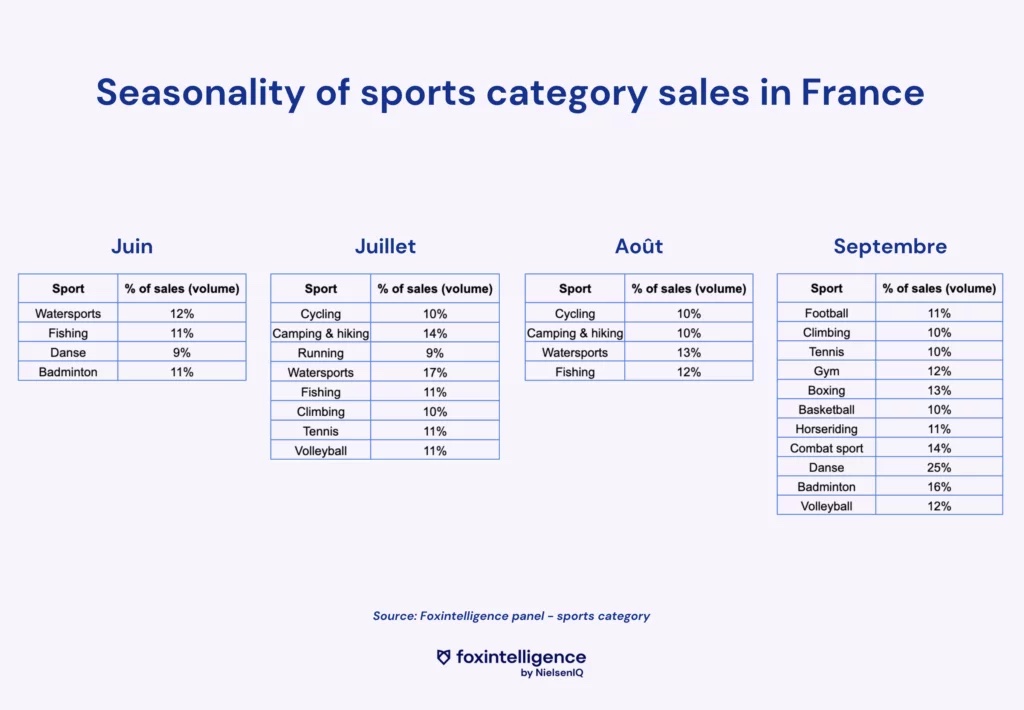

Seasonality of Outdoor Equipment Sales in France

The sale of outdoor sports equipment is subject to strong seasonality.

In France, in June, water sports equipment accounted for 12% of sports equipment sales volume, and fishing equipment accounted for 11%.

In July and August, cycling and camping & hiking categories generate the most sales.

In September, there is a return to indoor activities and team sports: football, climbing, tennis, gym, boxing, basketball, with no outdoor sports in the top 10 categories of the most sold articles during the back-to-school season.

The sports market is highly dependent on the seasonality of activities.

The Second-Hand Market in the Outdoor Industry

The trend toward outdoor activities aligns with environmental consciousness. Outdoor enthusiasts prioritize environmental conservation in the natural environment where they engage in their activities.

Actions like waste collection, measures to avoid disturbing wildlife and flora, and the use of biodegradable soaps reflect this awareness, which extends to the purchase of sports equipment. Several platforms have entered the market for second-hand outdoor products, such as Everide. A French startup, Everide allows precise categorization and searching for products, setting it apart from generalist actors like Vinted.

In the sports market, there is a relatively heterogeneous percentage of second-hand purchases among the analyzed countries:

- In France, 92.9% of purchases are new, and 7.1% are second-hand.

- In Spain, 94.5% of purchases are new, and 5.5% are second-hand.

- In Italy, 96.8% of purchases are new, and 3.2% are second-hand.

- In the UK, 91.6% of purchases are new, and 8.4% are second-hand.

- In Germany… 98.3% of purchases are new, and 1.7% are second-hand.

Trends to Note in the Outdoor Market

Decathlon: Growth Through Services?

To complement and diversify its traditional offerings, Decathlon offers:

- A sports equipment rental service: e-shoppers can choose the equipment, rental duration, and the store to pick up rented products.

- Decathlon Occasions: a dedicated website for buying and selling second-hand equipment.

- Decathlon Workshops: some stores offer customers equipment maintenance and repair services.

Lidl, Your Outdoor Equipment Specialist

Lidl recently launched its e-commerce site in France. In the top 10 articles with the highest sales value on the Lidl.fr site, mainly cycling articles can be found in the sports and leisure category.

It is also noted that 30% of buyers on Lidl.fr in the sports and leisure category had never made an e-commerce purchase in this category before.