What is retail media?

Retail Media & eRetail Media

Retail media includes all the advertising offers made by retailers and marketplaces during the consumer’s purchase journey.

The concept is not new – in-store advertising has been around for a long time. But with the advent of digital technology and the collection of shopper data, it has been transformed. Retail media has become more powerful, for brands and retailers alike.

Often omnichannel, it encompasses :

- In-store retail media: simple point-of-sale advertising – the strategy is simple: we place physical advertising at the point of sale and at various touch points along the purchasing path (posters, displays, billboards, shelf flags).

- Digital retail media (or e-retail media): advertisements are placed on retailers’ e-commerce sites and marketplaces – again, at different points along the online purchasing path.

With online retail media, we accompany consumers throughout their online browsing experience

Digital retail media consists of placing advertisements along the consumer’s browsing path. Branding, persuasion, conversion: we personalize the message broadcast according to the stage the buyer is at – from the search for information to the act of buying.

Retail media, an opportunity for brands and retailers alike

- For retailers: it’s a new source of revenue, enabling them to increase their sales thanks to their audience and their knowledge of their customer base. At the same time, they offer their customers an optimized, personalized shopping experience thanks to relevant advertising. This is both a source of revenue and a lever for customer loyalty and satisfaction.

- For brands: by being present in the right place at the right time, retail media enables them to convert more and improve their ROI.

In short, retail media enables retailers to monetize their audience – and brands to boost sales.

Omnichannel: a necessity for industry players

The Research Online Purchase Offline (ROPO) effect has grown considerably in recent years. With ROPO, customers go online to find out everything they need to know about a product (comparisons, customer reviews, technical descriptions) before buying it in a physical store. With e-commerce, customers have become more demanding and better informed, searching in real time for information on the products that interest them. But they remain attached to physical stores.

A hybrid, omnichannel purchasing path that is now firmly rooted in consumer habits.

➡️ Online visibility can have a positive effect on offline conversion.

The different digital retail media formats

On e-commerce sites and marketplaces, we find :

- Display: the most classic format, digital display on a partner site – in the form of a video, or horizontal and vertical banners.

- Product recommendation: this responds to the e-shopper’s need for personalization and boosts the average shopping basket.

- Search: this involves optimizing the presence of commercial offers on search engine response pages.

- Retargeting: we target an Internet user who has expressed an initial interest in a product – without actually purchasing it – and send them an advertising message on a third-party site.

In-store e-retail media formats are also used:

- Retailers’ mobile apps: product scanning, in-app payment – they streamline the shopping experience while providing shoppers with relevant offers.

- DOOH screens – Digital Out Of Home: broadcast campaigns on connected screens.

Internet users can also be targeted via video ads on social media.

Market evolution: From retail media to e-retail media

From traditional to digital media

Digital has turned the retail media sector on its head. More and more buyers are shopping online, which has had a profound impact on the way brands promote their products.

The digitization of the buying process means more points of contact with consumers. Drive-through, home delivery, self-scanning, in-store mobile applications and loyalty cards: we have much more customer data. Data that enables us to understand consumers’ buying behavior, preferences and habits.

The result? More targeted, personalized messages that correspond to the real needs of shoppers – who are offered a smoother shopping experience that meets their expectations.

In short, e-retail media delivers the right message, to the right target, at the right time.

The need to adapt to an evolving market

Interest in retail media is growing. Traditional advertising agencies have understood the importance and power of shopper marketing, and are structuring themselves to adapt to the market and meet their clients’ demands in terms of media plans.

More and more retailers are forging partnerships with agencies. The latest is Carrefour and Publicis, who have announced the creation of a new entity: Unlimitail. This is a strategic agreement between several retailers, including Kingfisher France, Groupe Galeries Lafayette and Showroomprivé. To date, Unlimitail has over 120 million consumers and 1.5 billion page views per month.

Retail media data: fine-tuning and personalizing the customer experience thanks to 1st party data

Retail media enables brands and retailers to push precise messages to consumers, throughout their purchasing journey. Messages are personalized according to the consumer and the stage they are at in the sales tunnel.

Fine-tuning and personalization of the customer experience made possible by previously untapped elements: 1st party data.

Exploiting first-party data

1st party data is collected directly by retailers and marketplaces from their customers – on their physical sales sites, or online following a user’s visit to a site. Thanks to a consumer’s interactions on an application, a website or in a store via a loyalty card, they translate his or her behaviors, actions and interests; for a particular brand, category or product. (Shopping cart, location, product type, buyer profile, loyalty card, purchase mode, purchase frequency, delivery mode, etc.).

We leverage transactional, declarative and behavioral data – online and offline, to obtain powerful insights and highly granular audiences, and then improve retail media campaigns.

First-party data and personalization

In-store advertising for yoghurt targets no one in particular. Or everyone at once. In e-retail media, we know that a given consumer has already bought dairy products from a given brand – so it makes sense to push products from that same brand, or from a competing brand.

First-party data makes it possible to target the buyers with the most potential. Buyers see more relevant ads, in line with their buying intentions, at the very moment they were planning to make a purchase – which increases the chances of conversion.

Precise KPIs to optimize their ROI, adjust their marketing strategies and maximize the impact of their advertising spend.

Foxintelligence: a better understanding of the market and more effective retail media campaigns

Foxintelligence is the leading European consumer panel. It brings together 1.5M e-shoppers and has been designed to give brands and retailers a precise view of their market and their online consumers thanks to exclusive real-time data.

Case study: the case of a brand

For a brand, allocating its retail media budget in a methodical way can prove difficult. There are many players on the market. They promote their solutions, their 1st party data and the benefits they can bring to the brand in question. But without visibility of the market as a whole, it’s impossible to allocate retail media investments in a data-driven way, and get maximum ROI out of them.

For example, a high-tech brand can use Foxintelligence to better understand its competitors’ category sales, then prioritize the retail media players, categories and products that are key to it – and de-prioritize those that represent too little potential.

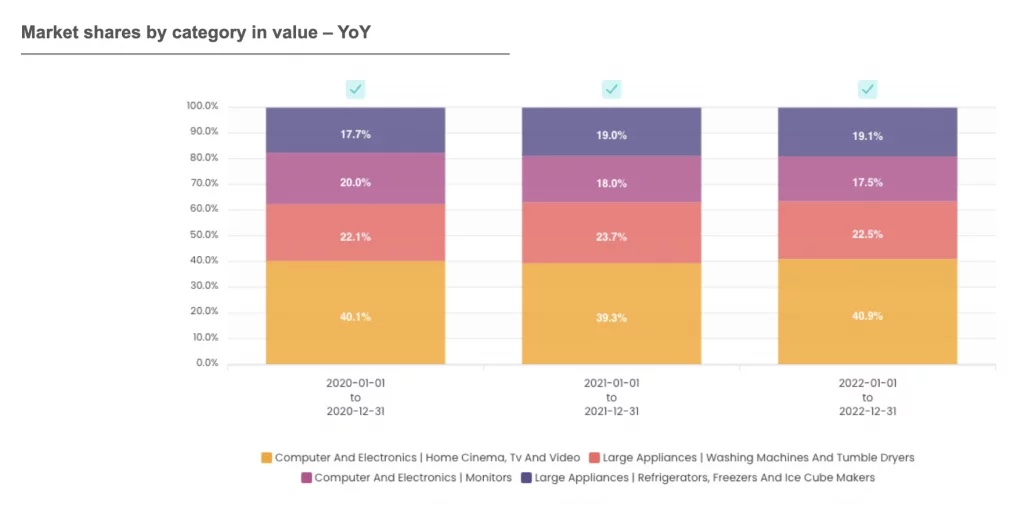

➡️ On the Foxintelligence platform, it is possible to analyze market share by category, in terms of both value and volume. Here, for example, the “Home Cinema, TV and video” category accounts for 40% of the “Computer & Electronics” category’s market share by value. Within this category, the market shares of the “Monitors” and “Refrigerators” categories are almost equivalent. However, market share of the 1st category has been declining over the last 2 years, while the share of the 2nd category is increasing.

In addition to betting on “Home Cinema, TV and video,” which represents 40% of the category’s market share, the brand can decide to allocate budget to the Refrigerators category, since it is the one that has seen the biggest uplift since 2020.

(This data can be downloaded from the Foxintelligence platform).

To determine which brand(s) it is investing its retail media budget with, the same high-tech brand can analyze the online market shares of the various brands in the “Computers & Electronics” category..

➡️ Looking at which brands are capturing the most market share, and how they have evolved since the start of the year, we can see that Amazon and Boulanger are in the lead. Even if their market share is falling, to the benefit of Rakuten whose market share tripled between January and April 2023, they are still in the lead.

At the same time, the brand can analyze value sales by gender and generation, to define the profile of consumers with the most potential.

Brands depend on data from retailers. Without Foxintelligence, their only option is to trust that data.

With Foxintelligence, instead of investing their media budget with no real visibility – or on the basis of non-transactional data – brands can optimize their investments in a very precise way: based on the market as it exists today, thanks to data updated in real time.

Key facts

- With Foxintelligence, you can deliver the right message, to the right target, at the right time.

- With Foxintelligence, retailers can monetize their audience – and brands can boost sales.

- With Foxintelligence data, brands invest their media budgets optimally

- 1st party data helps personalize the customer experience

- Growth depends on consumer data