Second-hand and Refurbished: What Drives Online Shoppers?

Bargain Shopping

Motivations to turn to second-hand products are multiple, but the financial aspect comes first. For e-shoppers, there’s a double advantage:

- They buy second-hand and save money.

- They sell what they no longer use and make money.

This proves even more relevant in times of rising prices. Second-hand sites address the problems of a diminished purchasing power, along with consumer demand for goods at knock-down costs.

Bargain Shopping

Motivations to turn to second-hand products are multiple, but the financial aspect comes first. For e-shoppers, there’s a double advantage:

- They buy second-hand and save money.

- They sell what they no longer use and make money.

This proves even more relevant in times of rising prices. Second-hand sites address the problems of a diminished purchasing power, along with consumer demand for goods at knock-down costs.

Second-hand Shopping for a Conscious Living

Activism comes in close number two as a motivation: to commit to buying only preloved products is to move away from overproduction and overconsumption.

Consumers’ awareness is on the rise, and more and more of them feel concerned by environmental issues: they know that producing their favourite Levi’s jeans costs the planet more than 1540 gallons of water. Once they realize that they can find a second-hand pair at half the cost for them and zero impact on the earth’s natural resources, it’s a no-brainer. And it’s even more true with tech products: by acquiring refurbished devices, they reduce the high environmental debt while saving massively.

The second-hand market is booming because it responds to these new consumer trends: spending less and buying more.

The Second-hand Market Is in Full Bloom Democratization

Preloved Shopping: No Longer a Matter of Generations

When you buy second-hand and refurbished products, you act for the environment. An awakening that lifts taboos and prejudices against used-item purchases: far from a mere trend, the second-hand market is here to last, and in full expansion.

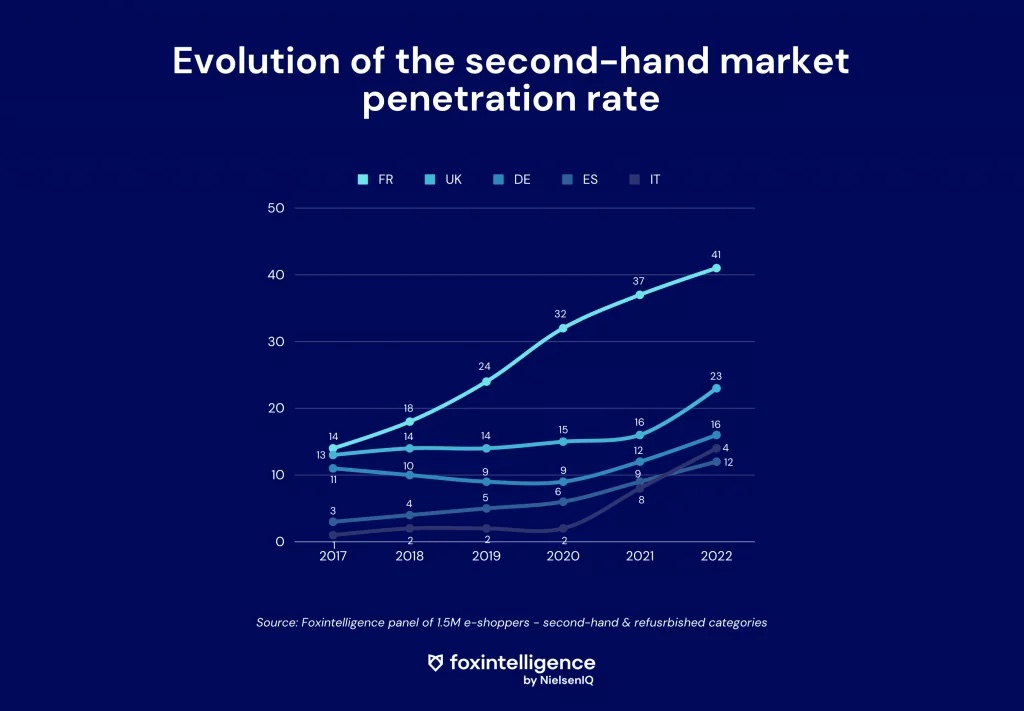

A movement that is confirmed throughout the EU5, particularly in France, where the market penetration rate has tripled in 5 years: from 14% in 2017 to 41% in 2022.

However, this new situation didn’t happen over a few days: buying second-hand had to become socially acceptable. Today, it’s considered a valued mode of consumption across all classes and generations.

And contrary to popular belief, young people aren’t the only ones buying preloved; not any more.

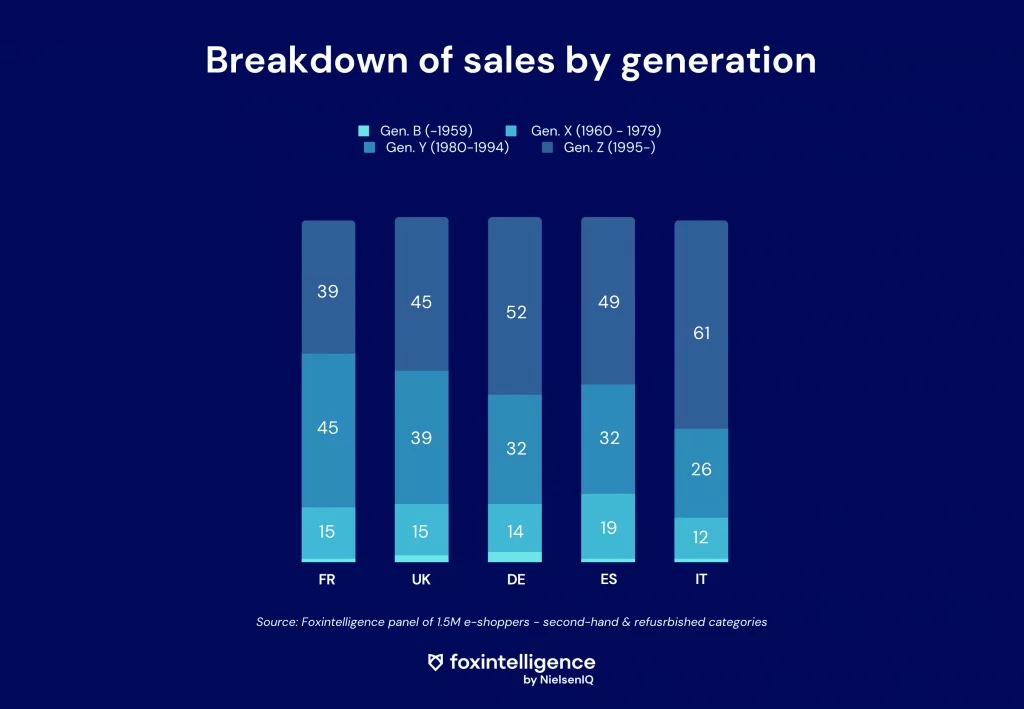

The generational splits show that we can’t dismiss the weight of other generations in the phenomenon. The Gen X (1960–1979) represents 15% of buyers in France – up to 19% in Spain – . One in five second-hand Spanish shoppers are Gen Xers, a number that makes them a significant part of the market.

Second-Hand and Refurbished Market: Retailers Must Embrace It or Die

Second-hand and refurbished products – consumers increasingly want to partake in a circular economy.

This constitutes growth opportunities for retailers. Several avenues open before them:

- Take-back products policies: like Kiabi which recently opened its own second-hand platform. User-friendly too: you can resell all the clothes you no longer wear whether Kiabi or not. Sell a pair of jeans for €10 and receive €10 or get a €12 Kiabi voucher. Ditto for the buyer who will receive a €2 voucher to spend on the brand’s website for their €10 purchase.

- Buyback and reconditioning: Smartphones, tablets, game consoles: Boulanger buys back your Tech devices in exchange for a voucher valid in all its stores. You can either bring your product to the store or send it to their dedicated site. Then, the company will recondition the product and will sell it … for a second time.

To keep their market value, there’s no other choice than to embrace the full spectrum of second-hand retail. All lights are green for retailers and marketplaces as well: in our present macroeconomic context, the circular economy has become an obvious choice for consumers. Even more: it has become a key purchase criterion.

Buying Used = Buying Less?

In France, the UK, Italy and Spain, second-hand shoppers aren’t buying less, far from it: the frequency of preloved fashion purchases exceeds the ordinary fashion market. The attraction of bargain prices is real and drives e-shoppers to buy more.

German buyers go against the grain, as their buying habits place purchases of new items at 3 to 1 for second-hand. In fact, the second-hand market is struggling to take off on the German market, where Vinted’s market share stalls in 2022.