Temu, the New Competitor for Shein, AliExpress, and Wish

In the ever-evolving world of eCommerce, players are competing to win over consumers. The simplest solution: lower prices.

Like Shein (the leader in ultra-fast fashion), AliExpress, or Wish, the Pinduoduo group has launched its fast shopping platform. Temu was born in the United States last year. The Chinese company entered the American market in September 2022.

A few months later, Temu made a stunning entry into the European eCommerce market, particularly in Italy:

Temu is the second most ordered eCommerce site in terms of volume and third in terms of value.

In just a few months, Temu has become a serious competitor for Shein, Wish, and AliExpress. This popularity is owed to its very aggressive marketing and the clever integration of shopping and gaming on the platform.

Aggressive Marketing

Earlier this year, the brand ran a $7 million advertisement during the Super Bowl halftime. Its slogan was “Shop like a billionaire.” With discounts of up to -90%, you can buy everything without breaking the bank.

On social media, Temu lures new consumers with sponsored posts and numerous partnerships with influencers. To attract new customers, the brand offers free items to users who promote the app on their social networks, encouraging their friends and followers to become customers too.

Ultra Fast Fashion, Shopping, and Gaming

To differentiate itself from its competitors, Temu pushed the envelope further: on the app, shopping and gaming coexist seamlessly. There are several games with increasingly attractive rewards: discounts, free items, “gifts” that encourage customers to place new orders.

It’s the very definition of “shopatainment,” a blend of shopping and entertainment. Shopatainment + fast shopping: Temu reshapes the online fashion market and ensures customer engagement and loyalty.

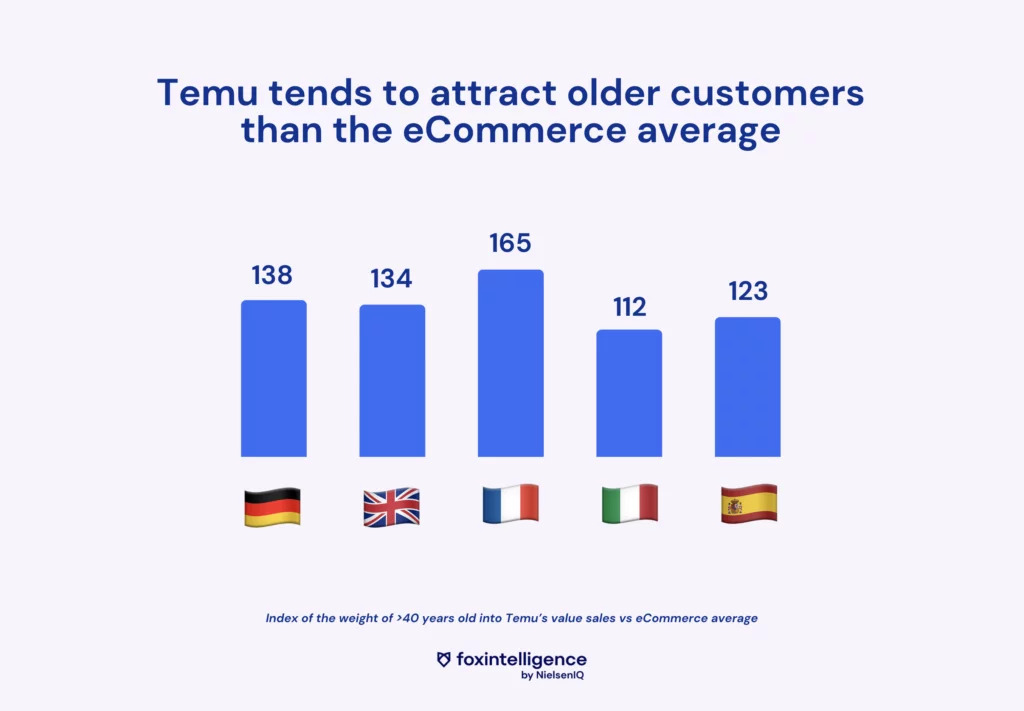

Temu Attracts Older Consumers Than Average

Feeding virtual fish to win a pair of earrings? Contrary to appearances, Generation Z is not Temu’s primary target.

In France, the percentage of customers over 40 years old in Temu’s revenue is 65% higher than their representation in the overall eCommerce market.

Temu, a Competitor for Shein?

Temu’s arrival in Europe has resulted in a loss of market share for several players.

- In France, Temu’s largest customer overlap is with Kiabi, Shein, and Aliexpress.

- In Italy, it’s Wish, Manomano, and AliExpress that are most affected by Temu’s entry into the market.

- In the UK, AliExpress, Bon prix, and Apo discounter.

- In Spain, Miravia, Kiabi, and Etsy.

Overall, Shein and AliExpress are losing the most market share to Temu.

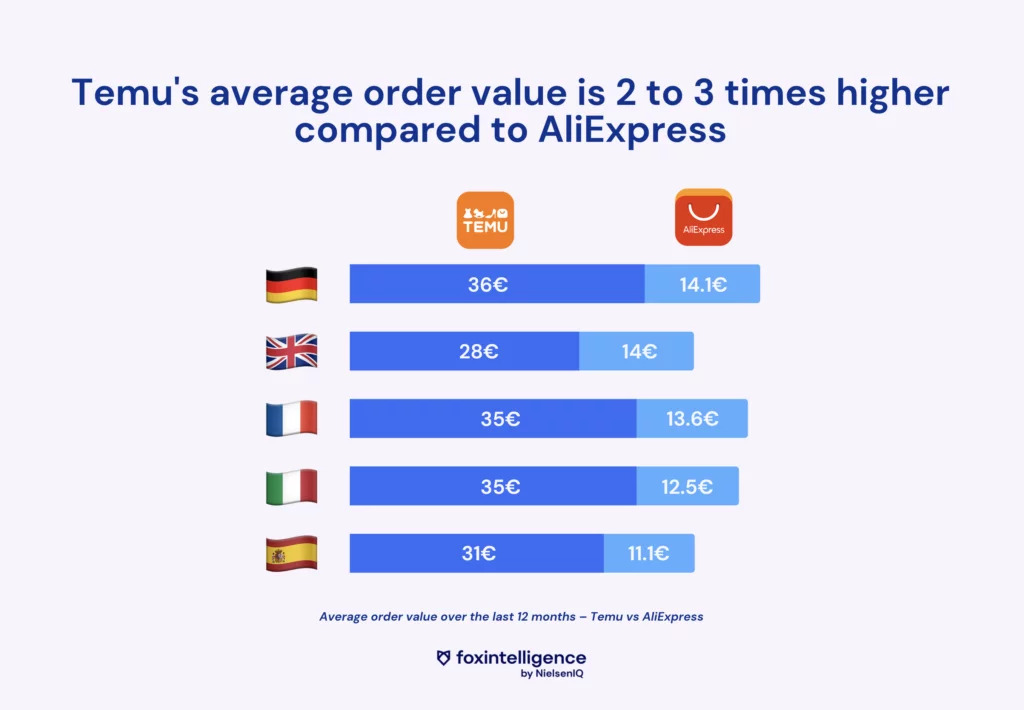

An Average Basket 2 to 3 Times Higher Than AliExpress

In France, the average basket size is 35€ for Temu, compared to 13€ for AliExpress. These figures are consistent across all analyzed European countries: consumers spend on average 2 to 3 times more on Temu’s site than on AliExpress.

♻️ What About Social and Environmental Issues? 🪴

With a business model based on selling products at ultra-competitive prices, shipping packages across continents, and a potentially addictive aspect, Temu is not reconciling the textile industry and the environment.