Consumers seek savings but still indulge

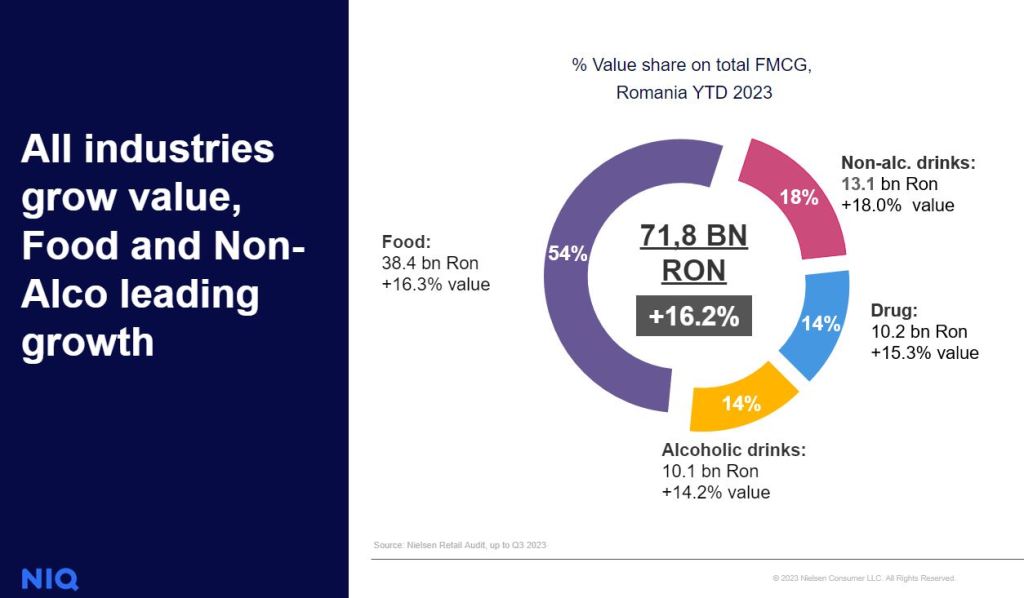

Global consumers are grappling with yet another holiday season overshadowed by the burden of a persistently elevated cost of living. While there is a deceleration in the inflation rate within the global consumer-packaged goods (CPG) sector, it has not resulted in a reduction of grocery expenses. This trend is reflected in recently released data from NIQ, indicating a decline in volume, primarily influenced by hypermarkets and traditional trade (13.4% vs 17.4% in Q2).

While prices and promotions remain crucial in consumers’ cost-saving strategies, there is a notable increase in FMCG consumption. This uptick is primarily fueled by the supermarket and discounters’ sector, which has witnessed robust growth in both transactions and basket size. This trend indicates that consumers are shopping more frequently while still managing to keep their total basket value in check.

As pricing scenarios for essential holiday products highlight the ongoing elevation of consumer expenses and the likelihood of a continued upward trend, consumers persist in employing prudent spending practices to manage their household budgets. FMCG data for Q3 reveals that Private Label products have slowed down pricing growth and continue to gain market share over branded products (18.5%). Furthermore, 75% of the Private Label categories grew in value in YTD 2023, with meat, poultry, and game categories taking the largest share (9.8%).

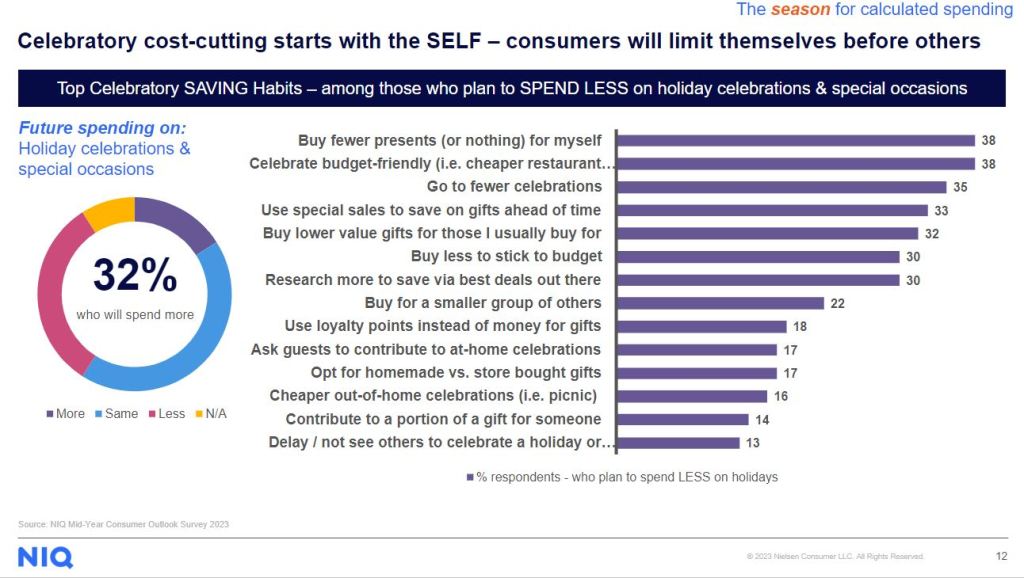

Notably, the majority of consumers are planning to adopt various strategies to maximize their monthly household budgets — even during the upcoming holiday season — although we can expect consumers to try and find some comfort in indulging. According to NIQs Mid-Year Outlook survey, 55% of global consumers will only buy what they need to avoid waste, while 17% of those who plan to spend less on celebrations will replace bought gifts with homemade options.

Iulia Pencea, NIQ Managing Director Romania, notes:

“In-home priorities prevail among global consumers, influencing purchases for socializing and gatherings. Spending is being redirected away from big-ticket, out-of-home discretionary spending, with limited funds available after utilities and groceries. Any splurging is being handled in calculated ways.”

Holiday spending trends and opportunities

Pencea also comments that several emerging trends have become apparent during the holiday season in recent years, particularly as inflation has presented challenges for families looking to indulge in extravagant spending on goods. Based on the Mid-Year Outlook survey:

- Trend 1: today’s budget-conscious shoppers may find it challenging to allocate their holiday budgets to large, last-minute spending. This and in addition to the proximity of Black Friday and Cyber Monday promo sales opportunities, display a noticeable trend toward an earlier start to consumers’ holiday preparations.

- Trend 2: 57% of global consumers surveyed by NIQ say they’ll be in the same or worse financial situation by the end of 2023. As a result, 84% are prepared to spend less, the same, or nothing on holiday gatherings and celebrations this season.

- Trend 3: Around 18% of surveyed respondents plan to increase spending on socializing and gatherings this year. This presents an opportunity for CPG companies, as the majority (58%) of those planning to spend more on socializing intend to do so by purchasing premium and quality ingredients for at-home entertainment.

- Trend 4: Recent metrics of retail sales and consumer sentiment suggest potential strength for private labels during the upcoming holidays, setting the stage for intense competition between name brands and private label products.

- Trend 5: We may see more people shopping online for holiday meals and celebrations this season. This could happen because in-store options are not growing or are even decreasing, and there is a rising interest in finding deals, which could boost online sales.

Consumers are navigating changes in their holiday spending patterns. Trends such as early holiday preparations, evolving attitudes toward gifting, considerations of life milestones, and a heightened awareness of waste accumulation are emerging in response to these challenges. Retailers and consumer packaged goods (CPG) companies find themselves dealing with a blend of selective optimism and measured spending. It’s crucial to strategically assess the upcoming surge in holiday promotions to optimize omnichannel efficiency. This proactive approach is vital to safeguard market share and profitability when holiday demand eases off.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)