Shoppers seek products aligning with values

Bringing their own reusable grocery bags, recycling paper and plastics, and buying secondhand products are just a few of the ways consumers are shopping more sustainably today. Shoppers continue to seek out products that align with their values, looking for eco-friendly items that reduce their carbon footprint and conserve natural resources.

While there’s a myriad of ways manufacturers can operate more sustainably, of prominent focus is the growing trend of sustainable packaging, how it influences consumer behavior, and how it can be implemented effectively.

Sustainable packaging gains momentum

A shift to sustainable packaging has many upsides for manufacturers — it can reduce your carbon footprint, improve brand perception, increase sales, and contribute to cost savings. Socio-economic factors like government mandates, rising costs, and changing consumer preferences are driving increased demand for sustainable packaging.

In a joint study, NIQ and McKinsey found that consumers are more loyal to products with strong sustainability claims. According to NIQ’s 2023 CPG Sustainability Report, 92% of shoppers say sustainability is important when choosing a brand today.

Manufacturers are paying attention to these trends — according to the Consumer Brands Association, 20 of the largest FMCG manufacturers have committed to 100% recycled packaging by 2030.

But before you entirely revamp your packaging strategy, it’s important to consider the effect new packs will have on consumers. We conducted primary research to better understand how sustainable packaging influences brand perceptions and purchasing decisions.

Sustainable packaging trends, tested

Our shopper response testing and research focused on 3 popular strategies to better understand how these packaging changes influence consumers:

Recyclable materials: What are consumers’ nonconscious and conscious reactions to paper versus plastic packaging?

Minimalist packaging: What happens when we remove secondary packaging from premium products?

Reusable pack design: Is Doy packaging able to convey similar brand perceptions as rigid pack forms?

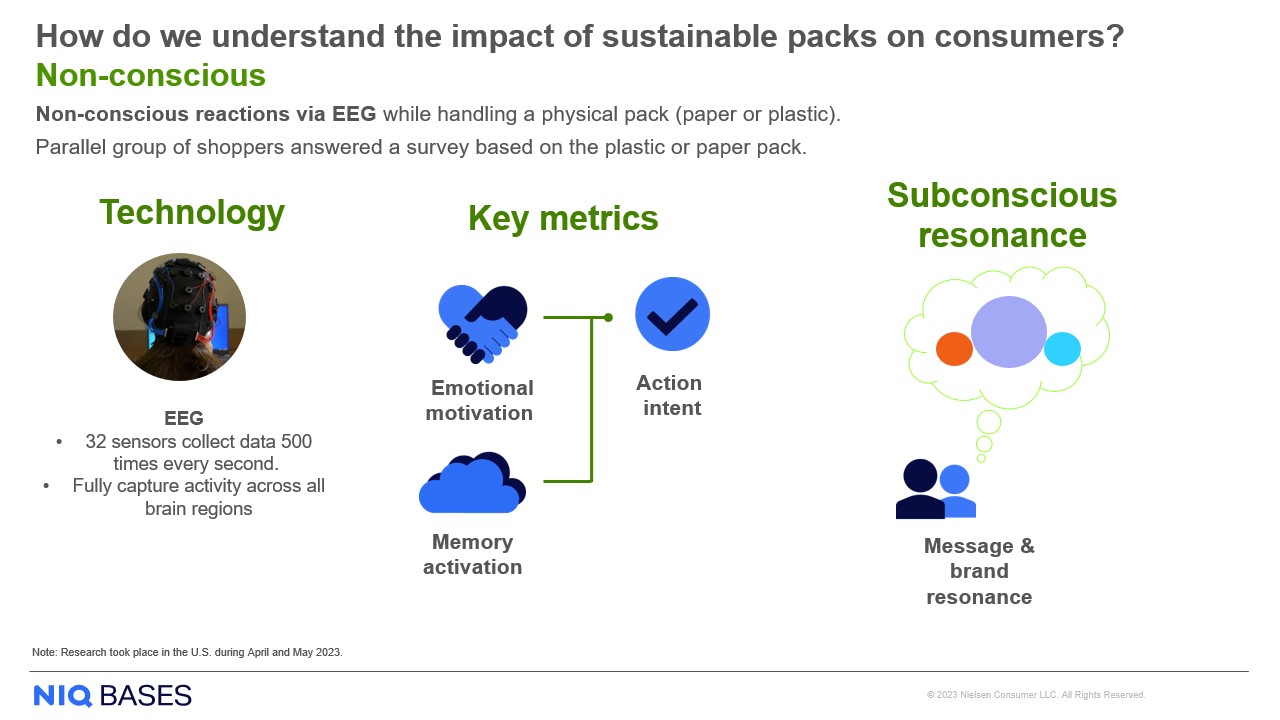

Because shoppers can’t always articulate how changes in shape, material, or pack weight influence their perceptions and decisions, we conducted electro-encephalogram (EEG) research to better understand their nonconscious reactions, examining 4 specific areas of packaging performance:

- Visual perceptions: Does the look of sustainable packs (including any eco claims) influence how shoppers emotionally engage or lean into the pack?

- Physical experience: What happens when shoppers pick up and feel the packaging? Are the new materials able to motivate shoppers? Is the experience engaging and relevant to them?

- Sustainability associations: Are brands getting “credit” for utilizing more sustainable packs?

- Quality perceptions: Do sustainable packs influence quality perceptions of the brand and product?

Let’s break down what we learned for each packaging trend

Sustainable packaging trend 1: Recyclable materials

Despite the many creative and technological advancements in green packaging products, a simple shift to more recyclable materials — like plastic to paper — is still the best way to support a sustainable economy. But does the material feel of paper packaging engage and motivate shoppers to the same degree as plastic?

For our study, we evaluated 2 brands that offer both plastic and paper options, allowing us to isolate the effect of the material. To assess category differences, we also evaluated packs in 2 categories — personal care (deodorant) and food (chocolate).

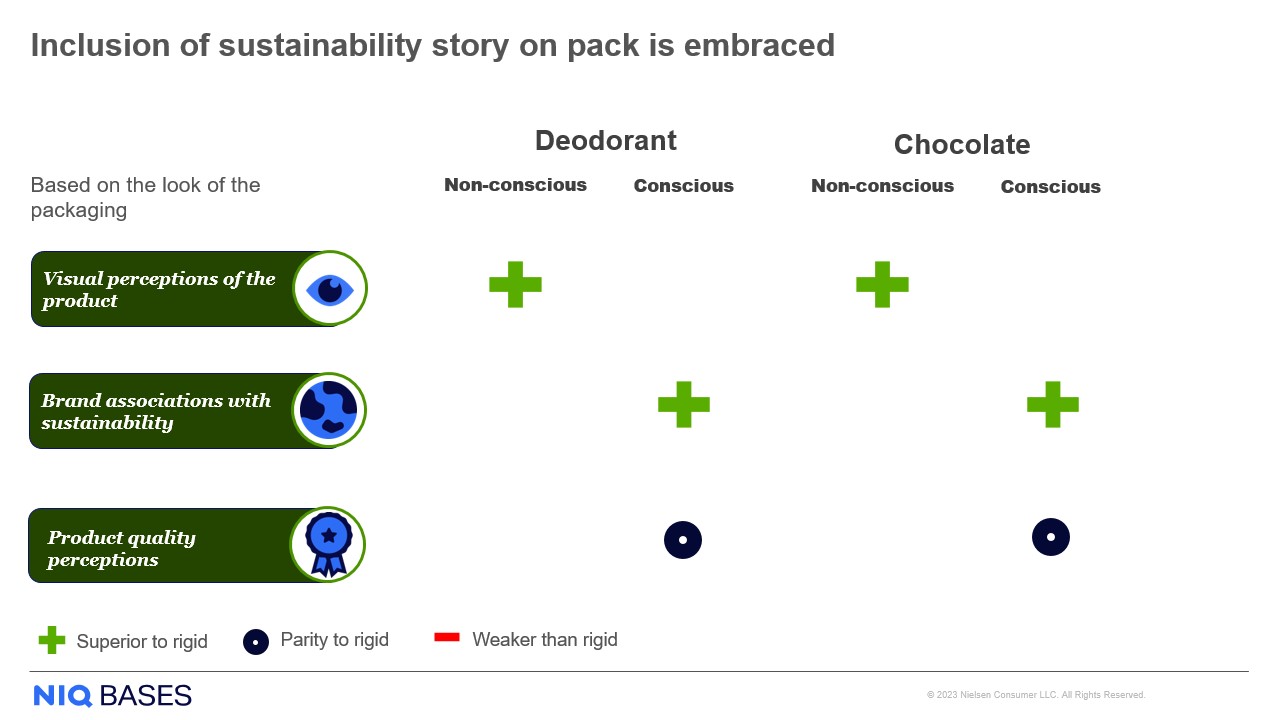

When analyzing shoppers’ nonconscious reactions, we discovered that paper packaging with prominent sustainability claims (in this case, callouts on the packaging that says, “100% Plastic Free” and “I’m paper, recycle me!”) better engages shoppers compared to the plastic option for both the deodorant and chocolate brands. These claims improve the sustainability credentials of each brand.

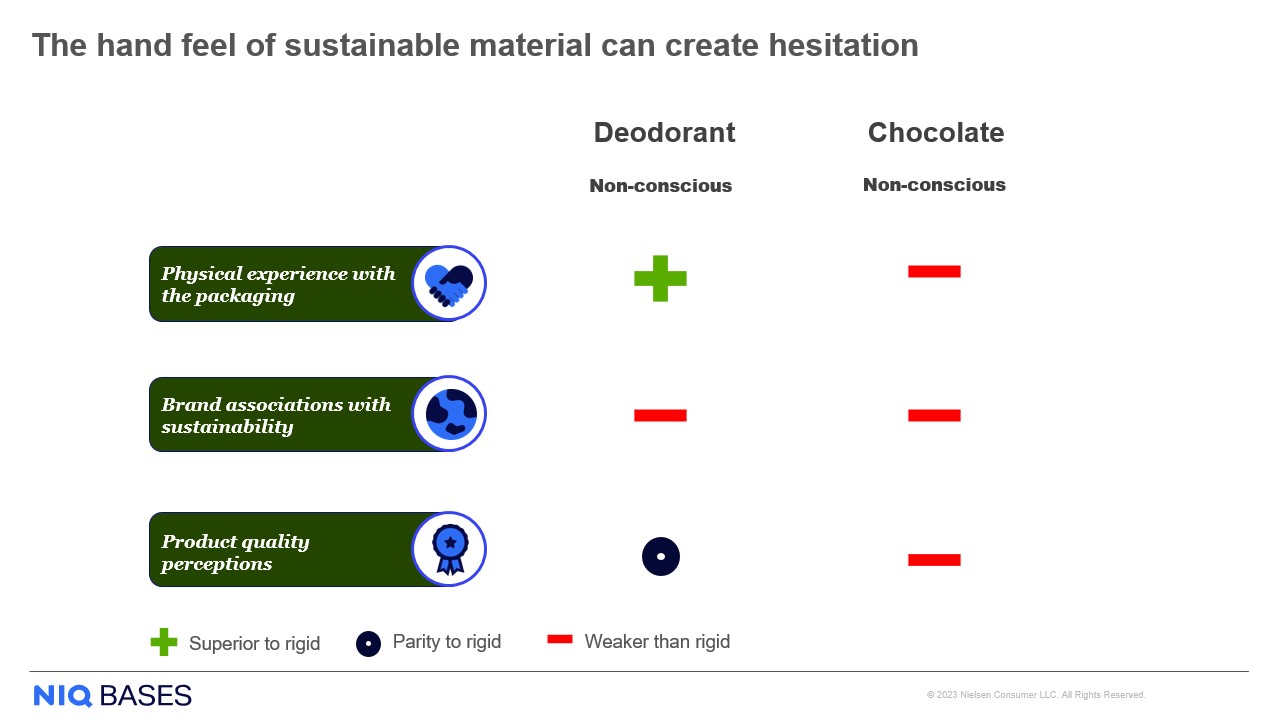

That being said, while shoppers like the idea of a more sustainable pack, materials not in line with category expectations can create hesitation. For instance, shoppers are more emotionally engaged with the paper chocolate pack, but after handling the material, they’re hesitant. The thickness, feel, and amount of material utilized influence shoppers’ nonconscious associations with sustainability and quality.

We hypothesize that the increased thickness of the paper pack is likely associated less with sustainability than the thinner, plastic packaging — less material overall may be perceived as more sustainable, even if it’s not an eco-friendly material. This possibility further reinforces the need to talk about the sustainability benefits on the pack itself, as the brain will not automatically make those associations.

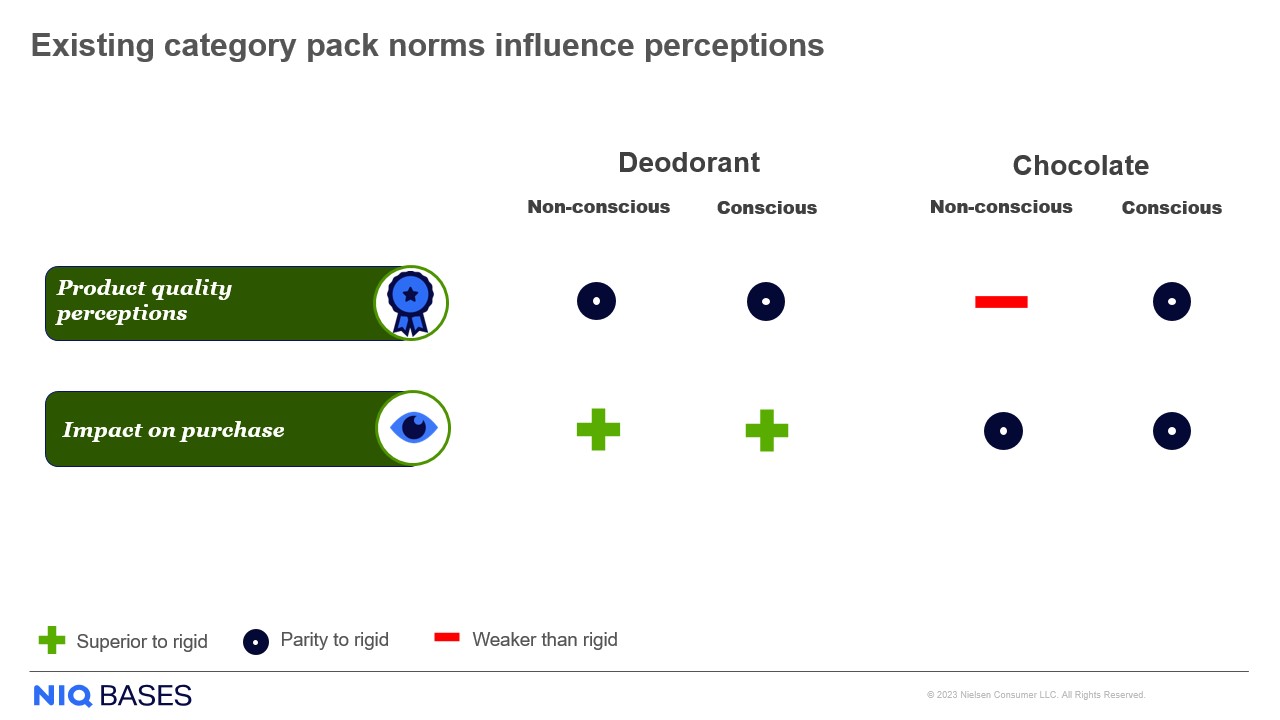

Importantly, existing category pack norms also influence perceptions. The deodorant brand didn’t have the same challenges as the chocolate brand because the solid and rigid deodorant paper packaging fits shoppers’ frame of reference for the category. Therefore, the deodorant brand was better able to capitalize on the improved perceptions to drive purchase motivation, while chocolate was unchanged despite rational upsides.

Top takeaways:

- Consumers will embrace your sustainable story, so be proud of these changes and convey the benefits on the pack. In exchange, shoppers will be proud to buy the brand.

- Ensure the execution of the new material ladders up to desired traits. The hand feel of sustainable materials can create hesitation, so evaluate packaging with shoppers prior to launch.

- Existing category pack norms influence perceptions. The look and feel of sustainable materials should fit within shoppers’ frames of reference for the category packaging.

Sustainable packaging trend 2: Minimalist packaging

Minimalistic packaging is simple and streamlined, with fewer materials and less waste. Removal of secondary packaging is one easy way manufacturers can reduce materials, improve sustainability, and reduce cost. But can this approach dilute brand perceptions, especially for premium packaging?

We evaluated a premium liquor brand that offered 2 different pack options: 1 with a secondary outer box and 1 with the primary container only.

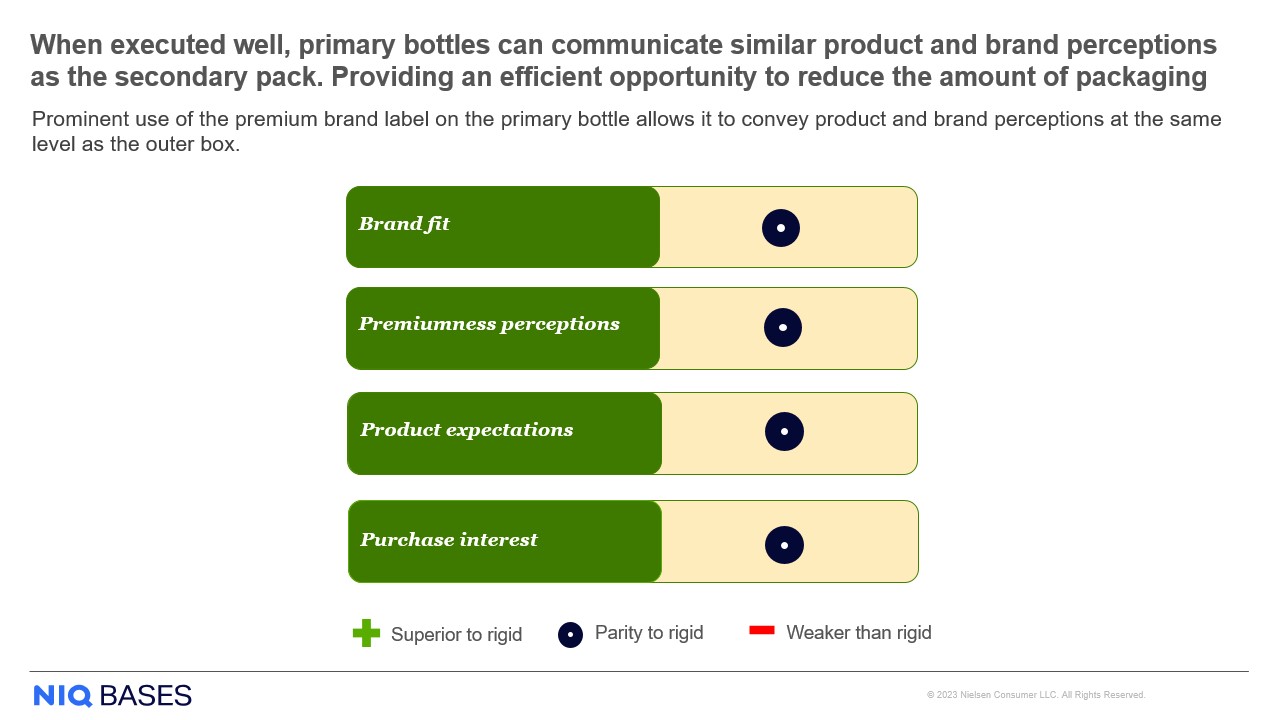

Our findings indicate that when executed well, primary bottles can communicate similar product and brand perceptions as the secondary pack. Factors like brand fit, perceptions of premiumness, product expectations, and purchase interest all maintained parity between the 2 packaging options.

Consistent and prominent use of the premium brand label on the primary bottle allows the liquor brand to effectively convey product and brand perceptions. Effects such as gold foil and brand seals also help the primary pack maintain a perception of premiumness.

Top takeaways:

- Removal of the secondary pack can be an efficient way to reduce packaging while maintaining premium and brand perceptions.

- Ensure the primary pack allows the brand logo and key assets to be easily seen.

- Lean into other premium cues on the primary pack, like embossing and label materials.

Sustainable packaging trend 3: Reusable pack design

In some specialty markets, reusable packaging helps brands defend plastic. We’ve seen an increase in refillable packaging options, like Doy (i.e., stand-up pouch) refills, available in the market. But can Doy refills maintain the brand and product perceptions of traditional rigid packs?

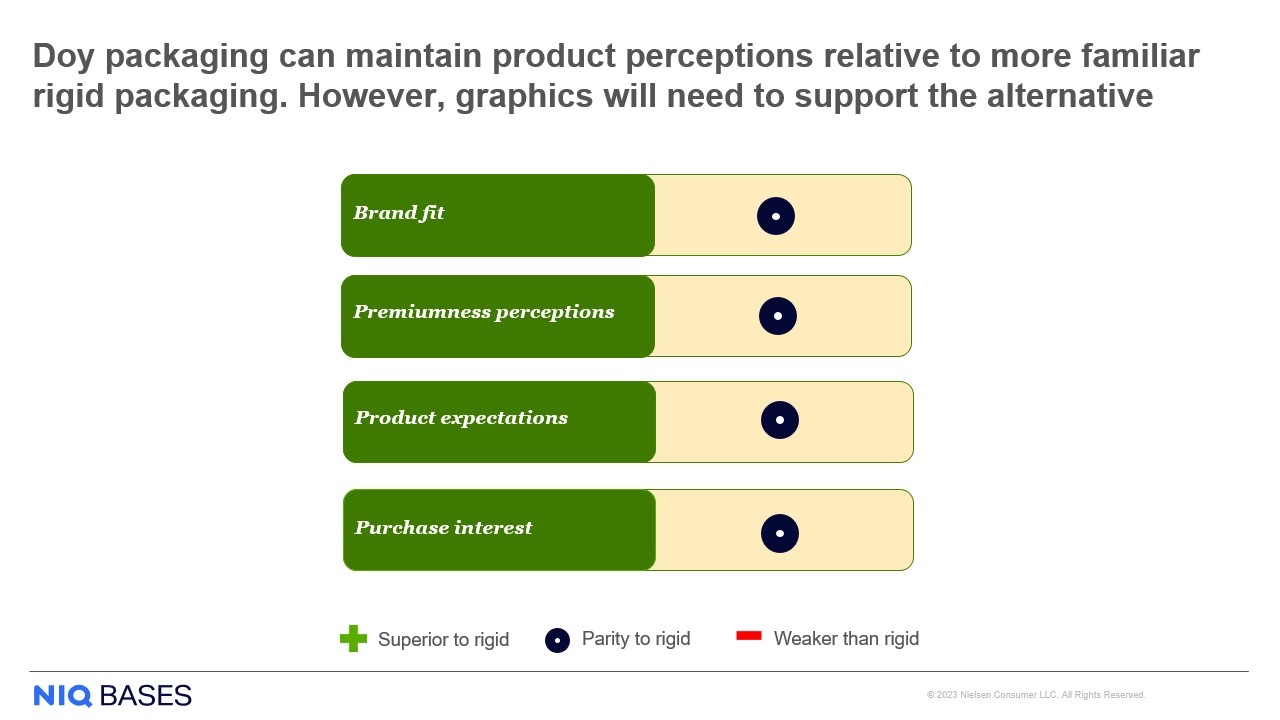

For this scenario, we evaluated a popular laundry detergent brand that offered both rigid and Doy pack options and discovered that, when executed well, Doy refill packaging can communicate similar product and brand perceptions as rigid packaging. In this case, Doy’s use of the laundry detergent’s iconic and familiar brand logo helps the pack maintain product perceptions. Removing the iconic bottle shape did soften brand fit; however, all other product perceptions (including factors like quality, trust, and effectiveness) remain the same.

We also found that shoppers do not automatically make the connection between Doy refills and caring about the environment without overt claims, highlighting once again the importance of calling out sustainability efforts directly on the packaging to help shoppers better understand the benefit of new pack forms.

Top takeaways:

- Doy packaging can maintain product perceptions relative to more familiar rigid packaging. However, graphics need to support the alternative pack form.

- Ensure other visual assets like branding, color, and graphics are emphasized on Doy packaging to help shoppers overcome the loss of familiar pack shapes and forms.

- Add sustainability claims to packaging to help shoppers quickly understand the environmental benefits of Doy packaging.

Make a positive impact on your business and the planet

As manufacturers embrace the necessity of change and commit to more eco-friendly practices, sustainable packaging is an important step to reduce waste and protect natural resources. By better understanding consumer behavior, you can level up your sustainable packaging strategy to not only reduce your carbon footprint and lower costs but execute in a way that drives sales and enhances brand perceptions.

View the latest consumer sustainability trends webinar

To get the Full View™ of sustainability trends, including consumer buying behavior that reveals new pathways to growth, view our recent webinar on demand.