In a challenging economic landscape, value sales have held steady largely due to inflation-driven price increases. However, as UK consumers tightened budgets, volume growth in 2023 struggled. Fast forward to 2024 and we are beginning to see improvements, but this fragile volume growth remains inconsistent – highlighting continued caution among consumers who face prolonged financial uncertainty. The current year-to-date (YTD) UK unit sales show a modest increase of just 0.6%, illustrating the slow rebound.

Consumer sentiment reflects this cautious approach. While 50% of consumers report being significantly impacted by the rising cost of living, many expect conditions to worsen over the next few months. Grocery savings are a key focus, with over a third of consumers aiming to cut back on expenses, often by switching to lower-cost brands.

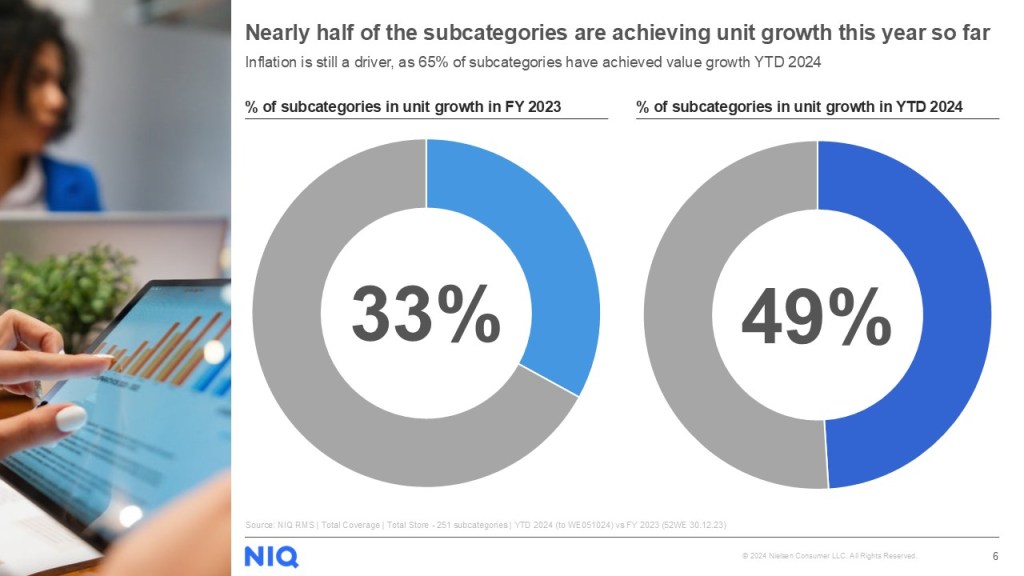

However, there are promising signs. In January 2024, only 33% of product subcategories were experiencing growth; now, nearly half show year-to-date improvement. This shift highlights gradual progress, with branded goods starting to recover, partially aided by promotions. But sustainable, long-term strategies are essential for driving lasting volume growth across sectors, especially as 51% of subcategories remain in decline.

Private label (PL) is experiencing long-term growth in the UK, driven by discounter strength, shopper acceptance, and category-specific shifts. Aldi and Lidl’s £1.3bn PL growth over the past year shows discounters are no longer “alternatives”—they’re core competitors. Traditional grocers like Tesco and Sainsbury’s are responding with increased promotions, though brands must leverage insights to maintain profitability amid this structural change.

Inflation’s influence on PL remains complex. Data suggests shoppers may switch to PL when price gaps widen, but brands can still win with targeted strategies. For example, branded options in healthcare retain share due to trust, even as costs diverge. This emphasizes the importance of understanding shopper preferences within each category and tailoring brand positioning accordingly.

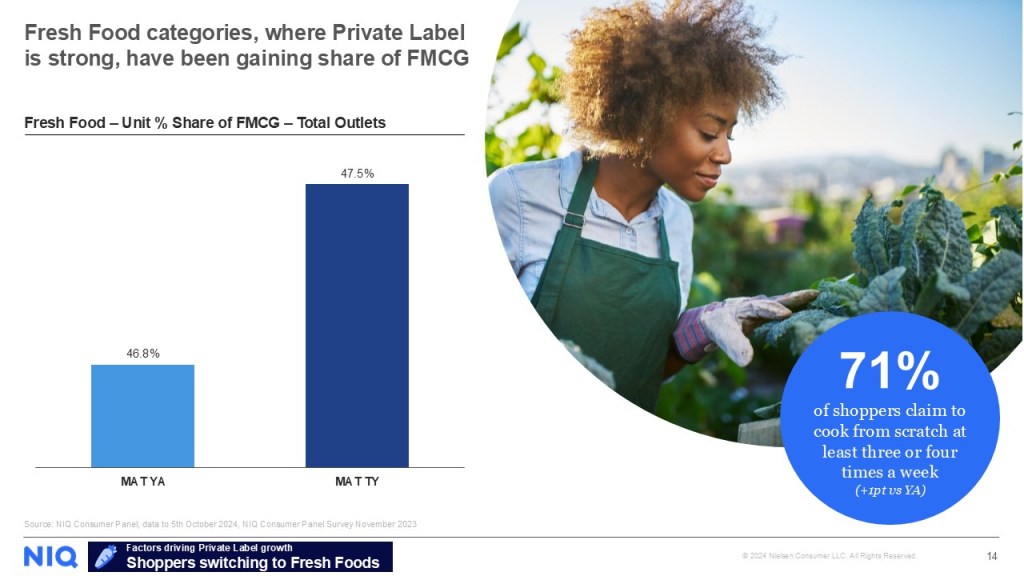

Fresh food is a growing focus, especially as shoppers embrace scratch cooking for health and budget reasons, benefiting PL’s stronghold in meat, produce, and other fresh categories. Concurrently, premium PL ranges are gaining traction—Tesco and Sainsbury’s lead with increasing share, while Waitrose’s No. 1 line grows above 8%. As PL quality perceptions improve (54% of shoppers view PL as equivalent to brands), brands need a clear USP to defend their position.

Key demographic insights challenge assumptions: affluent and younger households increasingly buy PL, though young shoppers still view it as a budget choice. Brands can use this to build future loyalty as disposable incomes rise, communicating why they’re worth the investment.

For brands, the strategy centres on differentiation: build brand equity, optimize range, and enhance both mental and physical availability. Understanding category-specific dynamics will be essential in this evolving landscape. Retailers’ success now relies on balancing branded and PL offerings to meet diverse consumer needs, with both brands and PL needed to create category value.