A Cautious Economic Context and Price Sensitivity

Price: A Key Decision Factor

Despite a slow economic recovery, inflation and rising prices remain major concerns for consumers, directly influencing their purchasing decisions:

- 74.9% of respondents prioritize price as the most critical factor.

- Product features come next, followed by promotions, which remain an important purchase driver.

Double the Sales During Black Friday Week

In online sales, Black Friday week is twice as significant as an average week, with growth compared to last year. Sales increased by +122% to +125%, depending on the markets analyzed.

Top-performing products included:

- AR/VR glasses: +329%

- Vacuum cleaners: +185%

- Smartphones: +88%

Evolving Sales Channels: Omnichannel Remains Key for Black Friday

The growth of online commerce continues:

- Online Black Friday sales far outperformed physical stores, with a +158% increase in online unit sales compared to an average week, versus a +63% increase for physical stores.

- However, omnichannel remains essential, with 42% of consumers combining online and in-store research before making a purchase.

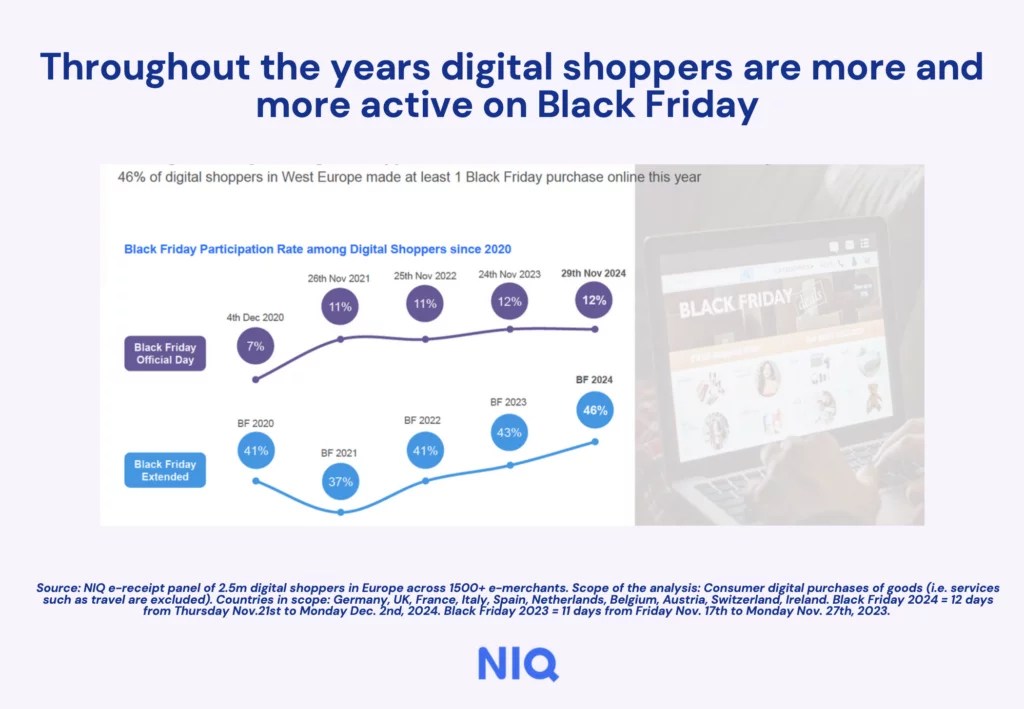

Increasingly Active Online Shoppers

Year after year, online shoppers are becoming more engaged during Black Friday. This year, 46% of online shoppers in Western Europe made at least one online purchase during Black Friday.

Amazon continues to dominate Black Friday sales, but new players like TikTok Shop are gaining traction, particularly in the UK, where the platform reached 13% penetration.

Meanwhile, platforms like Temu show signs of stabilization. Only 18% of Temu’s Black Friday 2023 shoppers returned to the platform during Black Friday 2024. This highlights the importance of a sustainable and consumer-centric strategy.

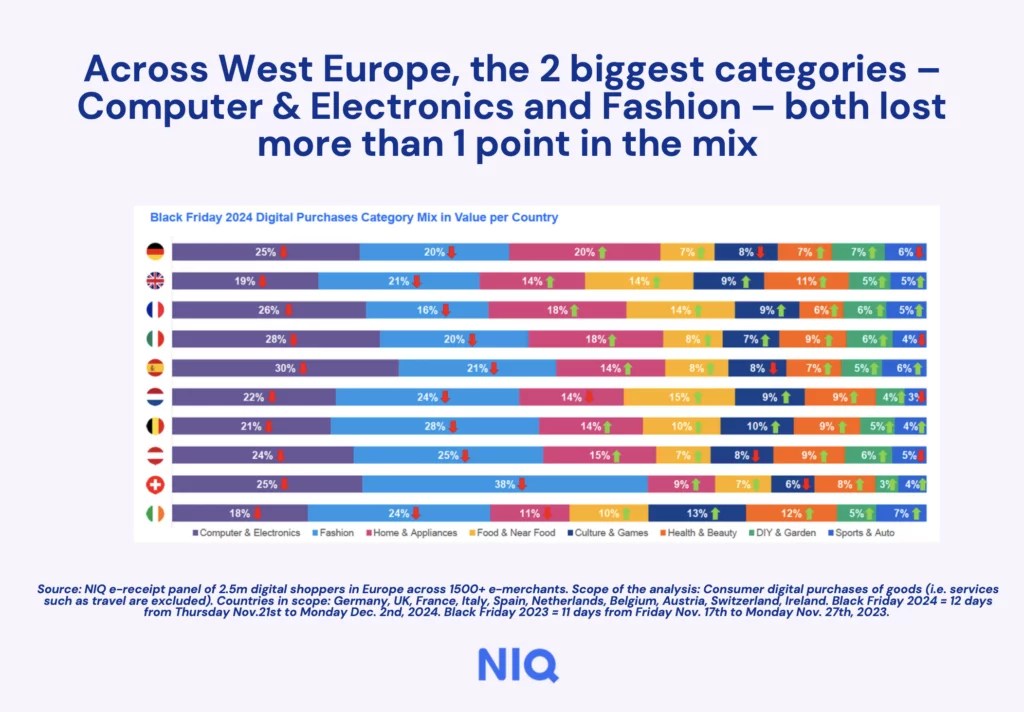

Category Mix: Which Categories Are Driving Sales?

In Western Europe, the two largest categories—Computers & Electronics and Fashion—each lost over a percentage point in market share.

Meanwhile, categories like Food & Near Food, Health & Beauty, and DIY & Garden have seen growth across all analyzed markets.

Generational and Regional Perspectives

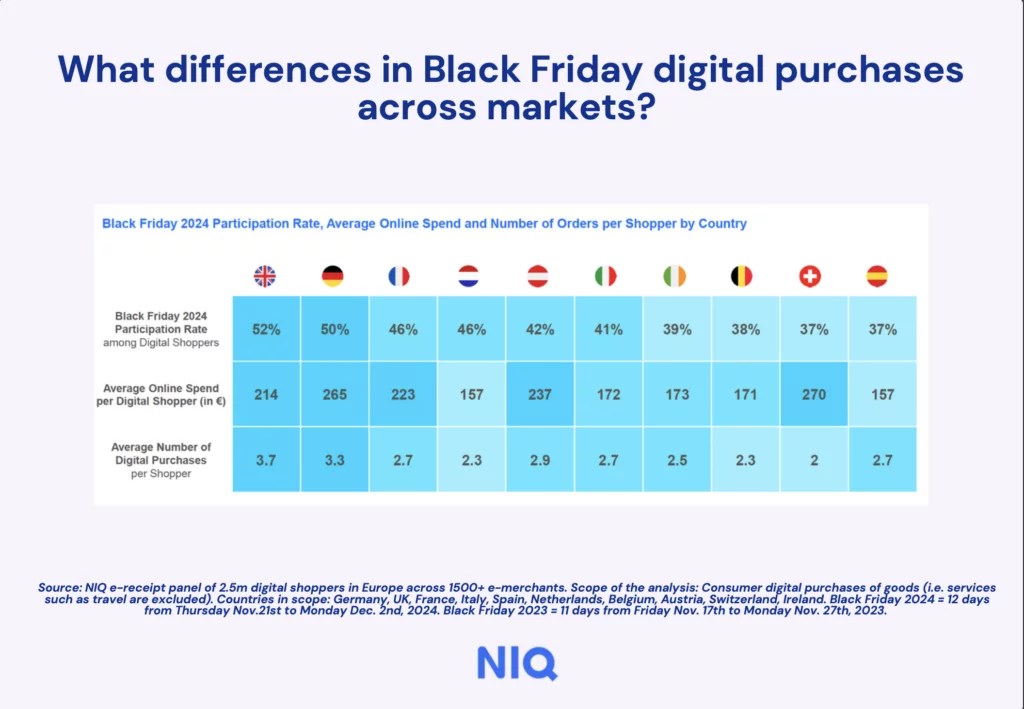

Generations Y (1980-1994) and X (1960-1979) were the most active during Black Friday, with participation rates of 53% and average spending of €251 and €218, respectively.

Germany and the UK stood out with strong digital engagement, recording the highest participation rates and average spending levels.

Recommendations for Brands

To capitalize on Black Friday, brands should adopt strategic approaches:

- Start Early: Increase product visibility starting in early November to capture consumer attention.

- Highlight Value: Showcase product quality and features to attract budget-conscious shoppers.

- Adopt an Omnichannel Strategy: Ensure a seamless experience across online and physical channels to maximize conversion opportunities.

Key Takeaways

- At the moment of purchase, 74.9% of consumers prioritize price.

- Black Friday week remains twice as significant as an average week, with sales increasing by +122% to +125%, depending on the market.

- 46% of online shoppers in Western Europe made at least one purchase during Black Friday.

The 2024 Black Friday trends underscore a growing emphasis on planned purchases, value for money, and the dominance of online channels. To remain competitive, brands must anticipate consumer needs, adapt, and implement a robust omnichannel strategy.