China’s digitalized CPG market is truly omnichannel

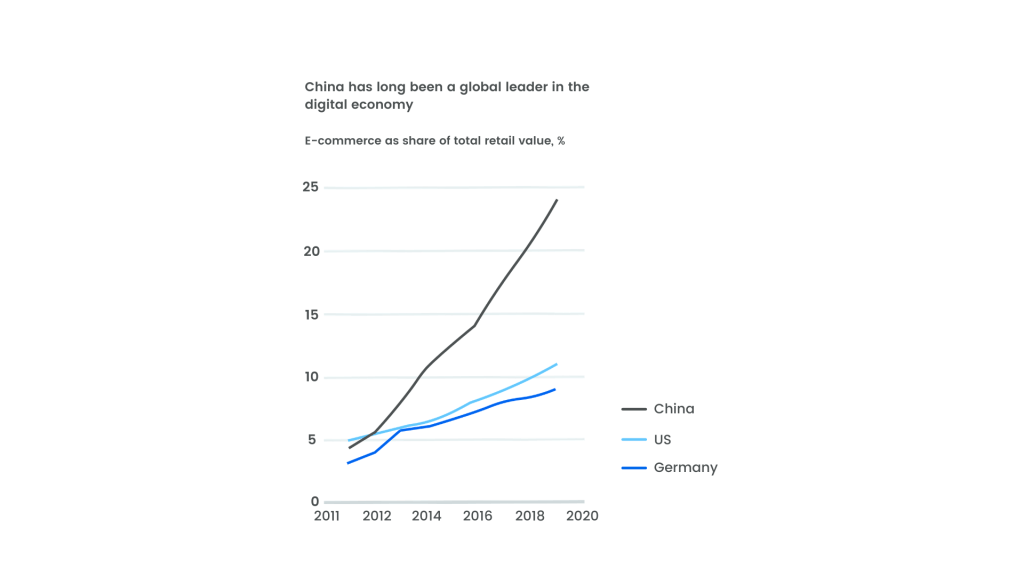

There are many examples that illustrate how the omnichannel shift will repeat in the US and Europe. One that is partially established is the penetration of the smartphone. Before the pandemic, mobile payment penetration in China was already triple that of the US. One effect of this has been social commerce being more common with digital word of mouth as an important driver of sales.

Emerging technologies will make efficient local fulfillment more common. JD, the Chinese ecomm giant, currently analyzes and determines the closest source for inventory, be it offline or a warehouse.

Virtual and augmented reality are also making inroads into the shopping experience in China, with high consumer enthusiasm and uptake.

The acceleration of the ecommerce ecosystem due to Covid

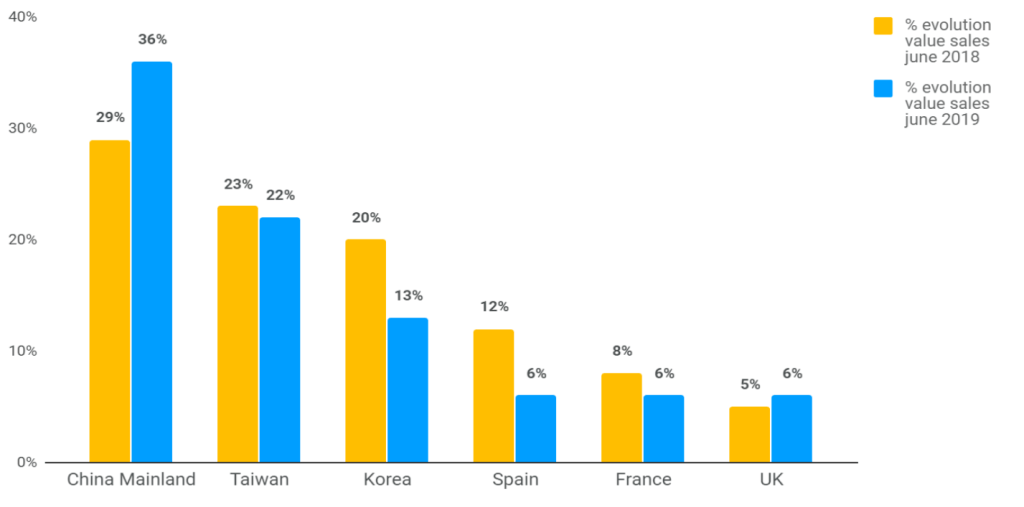

As mentioned, the pandemic has prompted the creation of new digital solutions for companies and consumers obliged to physically distance, driving growth of the “stay-at-home economy”.

China is more recovered from the recent COVID-19 epidemic than other countries, and it’s evident that a growth in online activity does not necessarily translate into growth in profits. Adapting to omnichannel has been expensive for CPG companies and transforming supply chains and internal organization to accelerate decision making and remove silos is not without costs, yet is essential to remain competitive.

Egrocery retail in post-pandemic China

One pre-existing trend that has accelerated in China is different from the West: an increase in the frequency of grocery purchases. In the US and Europe, frequency has declined while basket size has increased. Post-Covid, this may change as online purchasing becomes more habitual and the digital shelf optimized in the West.

Ultra-fast delivery has become essential in China and consequently, the need for small, local market delivery hubs has too, reminiscent of the urban click & collect points in France.

Supply chain management that traces the origins of food has become useful for younger consumers in particular in China, who are increasingly interested in the provenance and quality of their groceries, while yet not being as interested in organic foods as European shoppers.

About 55 % of Chinese consumers are likely to continue buying more groceries online after the peak of the crisis

McKinsey

CPG and digital B2B platforms

A particularity of China’s retail environment is that a significant portion of the market belongs to independent grocers. An opportunity has been seized upon by major players like Alibaba’s LST and JD’s XTL. They have created a digital B2B CPG space. By building on the success of their B2C ecommerce platforms, they are connecting independent stores directly with suppliers.

Digital B2B offers a one-stop service platform to small grocery retailers which is more convenient and efficient than interacting with sales representatives from multiple manufacturers and distributors. Inevitably, this will gradually make the whole CPG retail ecosystem more efficient.