When it comes to having a ‘complete view’, look also at the impact of private label.

83% of grocers said they plan to moderately or significantly increase their investments in private brands, setting bold targets for sales share growth at an average dollar share gain of 24% over the next two years

We’re already seeing CPGs battling for less and less spots, and that’s with a current 60% e-commerce penetration of private brands. In December 2022, sales of UK supermarkets own label products rose by 13.3% compared to the year prior. Meanwhile, sales of branded goods increased by only 4.7%.

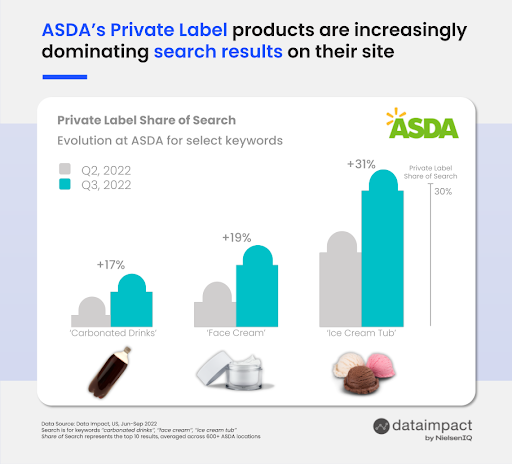

What’s more, supermarkets are adjusting online search functions to prioritize their own offerings. In the insights attached, we see how private label share of search increased between June and September at Asda (averaged across 600+ stores – true measure of search!). In September alone, the number of shoppers buying at least one Just Essentials product from Asda increased from 33% to almost two-thirds.This falls in line with FMI’s findings; 80% of retailers mentioned search prioritization as an important lever for e-commerce improvement.

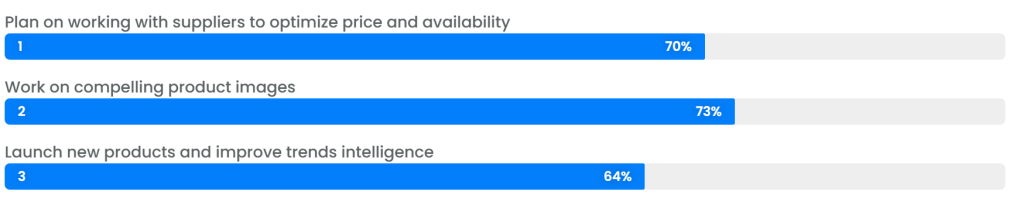

We shouldn’t expect retailers to simply just give their own brands more prominent placements. Grocers are likely to take all the necessary steps to ensure shoppers keep coming back for more, including by adopting strategies to hold onto the higher shares when the economy improves.

Some examples:

In summary, a clear message to CPGs; full category coverage is critical as supermarkets lay out their tactics to double down on profitability and seek to grab substantially more of the grocery business.

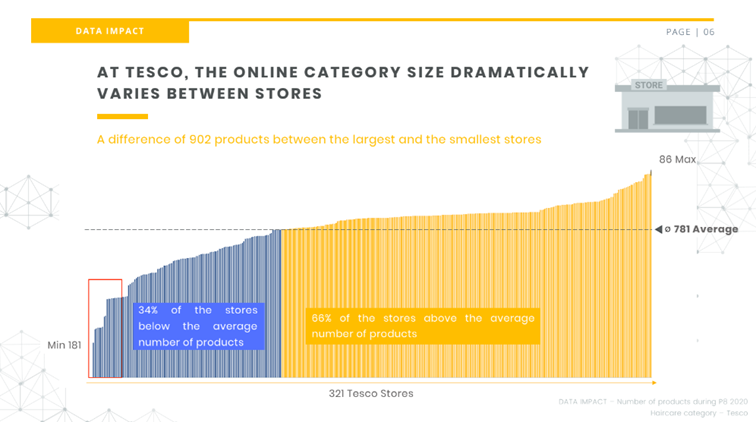

Assortments will contract and expand more readily as strategies change, channels/platforms develop, and competition becomes more fierce.

Brands need automation and new tech capacity to make accessing a complete dataset, timely, accurate and hassle free. Above all, exists the need to future proof capability amidst a more disruptive and dynamic landscape.