The CPG Omnishopper

61% of total CPG shoppers in Canada have made at least 1 purchase online, yet traditional brick & mortar grocery remains the top sales channel – accounting for nearly half of total CPG sales.

However, each Canadian demographic cohort has their own preference for the channels they rely on (and it largely depends on their cultural background). While ¾ of Canadians are true Omnishoppers, some embrace online more than others.

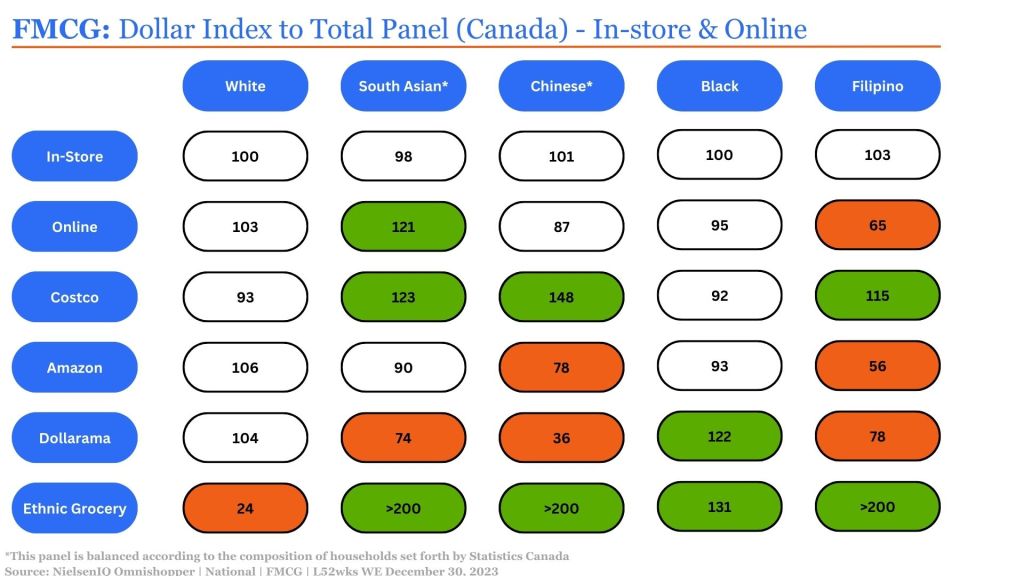

When analyzing the online spending habits of various ethnic groups, it becomes evident that South Asians have a higher index of online spending, whereas Filipinos tend to shop more at Costco and ethnic grocers. While all ethnicities show an over-index towards shopping at ethnic grocery stores, there are variations with other banners.

For instance, Costco has a higher index with South Asians, Chinese, and Filipino shoppers, and it is well-developed across all groups. Amazon, on the other hand, is more concentrated among White, South Asian, and Black demographics, while Chinese and Filipino consumers’ under-index.

Considering where these demographics prefer to shop is vital when crafting strategies to connect with consumers, inform assortment selection, and optimize marketing across channels. To do so effectively, brands must consider the unique backgrounds and shopping behaviours that drive Canadians today.

Healthcare: Does it work in an omni environment?

Online channels are of critical importance to the healthcare sector – accounting for 17% of total product sales. That’s twice the overall importance seen across all product categories.

As consumer shopping habits evolve, healthcare brands must recognize and embrace the significance of digital platforms to reach customers effectively. By leveraging online channels, brands can not only increase visibility and reach, but build brand loyalty and establish a competitive edge in the industry.

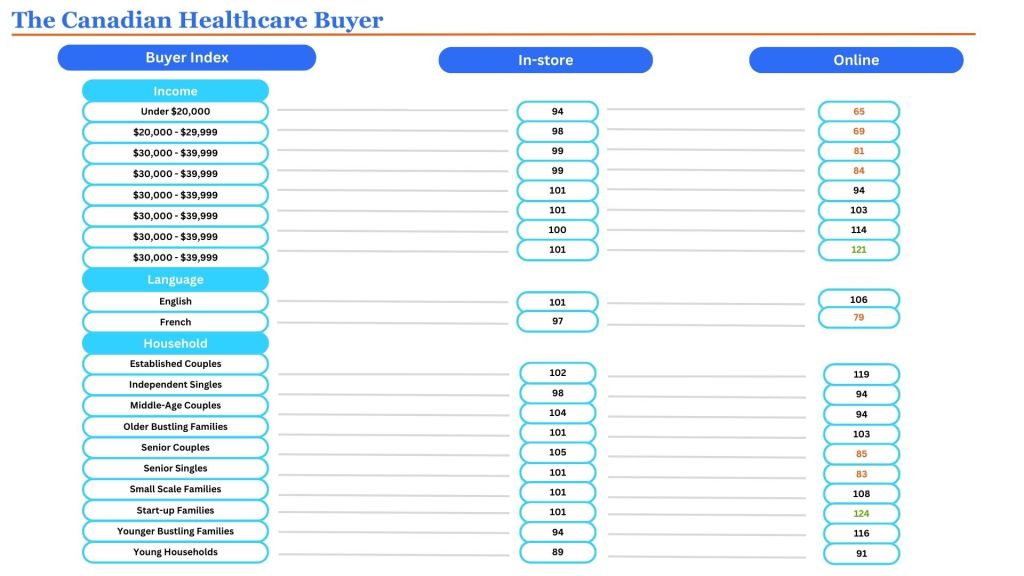

- High-income, English-speaking, and young families are more inclined to shop for healthcare online, possibly due to the convenience it offers for busy households.

- Lower income Canadians, French speaking, and seniors face more barriers to accessing online services. Understanding the barriers for these groups can pave the way for strategic growth.

Healthcare requires a truly omni approach to ensure equitable access for all groups of consumers. A deep dive into understanding access barriers (French-speaking consumers, for instance) will aid in creating a unique experience and capture new demographics for optimal growth.

Food: The Omni Challenge

Food still relies heavily on traditional channels, with 59% of total sales occurring through traditional grocery retailers. While some consumers turn to warehouse clubs and mass merchandise channels for food, these are underdeveloped.

- To boost sales in channels beyond traditional grocery, brands must consider the unique shopping preferences that exist for consumers today to effectively approach assortment, price, and promotion.

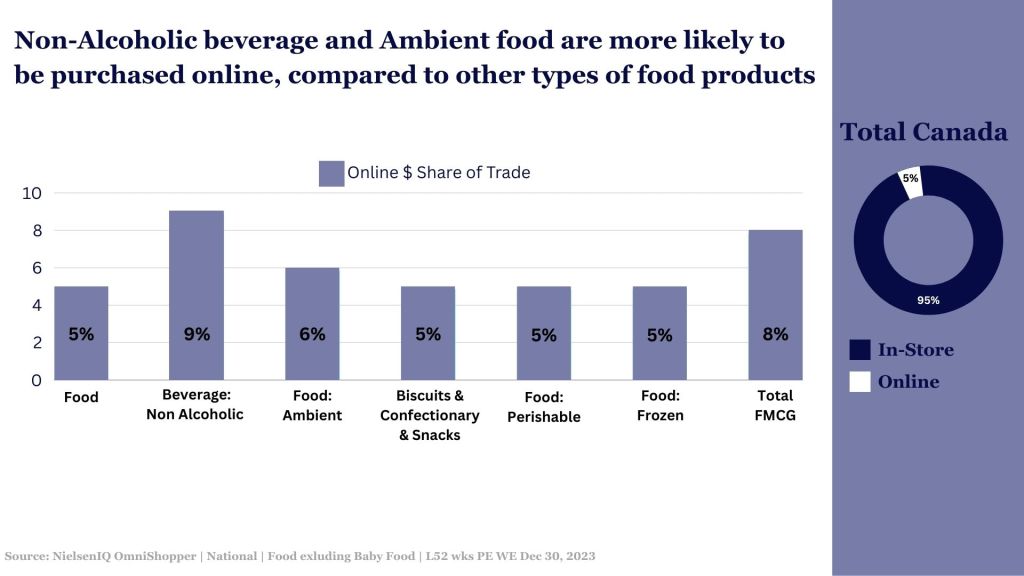

- Although traditional outlets have traditionally served the food industry well, it is important to note that certain categories have a higher online presence compared to the total CPG industry. Brands need to pay close attention to the digital space and adapt their strategies accordingly to capture the online market for those key categories.

Consider: The distinction between categories that perform better in-store and those that excel online underscores the importance of a nuanced approach to strategy development. For categories like non-alcoholic beverages and shelf-stable food that are over indexed online, brands should prioritize providing a compelling online user experience to capitalize on the digital market potential. By tailoring their online channels to meet consumer preferences and needs, brands can effectively drive sales growth and enhance customer engagement in these categories.

Online Dominance: How to reach consumers

The online channel presence in Canada’s consumer market is significant. With 61% of Total CPG shoppers in Canada having made at least one purchase online.

As e-commerce grows as a key avenue for consumer spending, brands must develop robust online strategies to effectively cater to the needs of the digital Canadian consumer.

When it comes to online sales, Amazon dominates the Canadian marketplace.

From the 8% of total online share in the market, Amazon represents 3%. Additionally:

- Amazon accounts for 41% of total online CPG sales in Canada.

- Out of total trips made to online shopping retailers, 62% were for Amazon, which translates to 17 virtual trips per year.

- 82% of Amazon shoppers are making repeat purchases. Amazon shoppers make a repeat purchase within 18 days, compared to a 21-day gap for other online channels.

It’s clear that Amazon is top of mind for the online shopper today – but what categories are shoppers gravitating toward on Amazon?

- There are three dominant groups: health care products, pet food, and personal care products. These categories are in high demand as they’re needed regularly or require a set schedule. For instance, consumers generally have an idea of how long a bag of pet food lasts and can set up subscriptions to save on costs while enjoying the convenience of doorstep delivery. This is also true for products like vitamins and skincare.

- Amazon’s success in capturing a larger share of the online market can be attributed to offering Subscribe & Save options and free delivery through their Prime memberships

- Healthcare – specifically first aid and medical supplies – ranks higher on Amazon than online. For businesses operating in the health & wellness space, this underscores the opportunity to capitalize on Amazon’s reach and popularity by optimizing your online presence

- Healthcare brands who aren’t on Amazon in this category should consider tapping into the power of this online channel. It is essential for healthcare brands to continue to adapt to changing consumer shopping patterns and habits by exploring the vast potential of online marketplaces like Amazon

Excited to explore further?

To truly captivate the Canadian consumer, embracing a comprehensive omnichannel strategy is paramount, particularly as online platforms become more popular. For an in-depth exploration of the Canadian Omnishopper, don’t miss out on our recent on-demand webinar—watch it here to stay ahead of the curve.