Impact of Inflation on Consumer Behavior

Amid rising inflation, concern about increasing food prices has become a constant for 5 out of 10 Latin American consumers. This situation has led to a change in shopping habits, where seeking more economical alternatives is a priority.

The growth of Fast-Moving Consumer Goods (FMCG) in Latin America has been mainly driven by price increases, with a 9.3% increase compared to a 2.4% growth in volume. This reflects that consumers are buying fewer products but paying more for them.

Growth of Private Labels in Latin America

In this context, consumers have changed their shopping habits, seeking alternatives to better manage their spending. In our recent survey, Mid-Year Consumer Outlook: Guide to 2025, consumers stated that their main strategies to ensure their budget performance are “buying any brand that is on promotion” (with 51% in Colombia) and “switching to a lower-priced option” (with 43% in Chile).

This explains how private labels, which refer to products or product lines developed and marketed by a retailer or distributor under their own logo, have been one of the major beneficiaries of this change, establishing themselves as a viable solution for Latin American consumers.

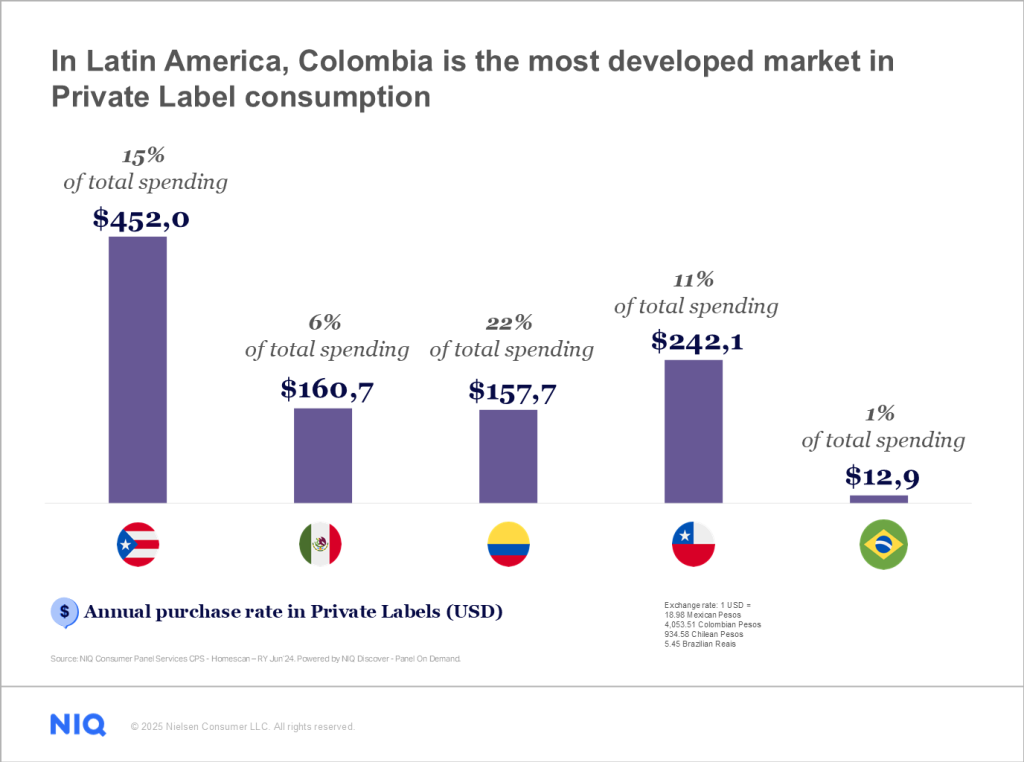

Private labels are gaining ground in Latin America with a growth of 14.2% in value, surpassing the 5.6% global growth, according to the Private Label Study in Latin America by NielsenIQ Consumer Panel Services (CPS) – Homescan. Currently, 9% of total consumer spending in the region is allocated to private labels, and 2 out of 10 purchases include at least one product from these brands. This growth is due to the perception of quality and value they offer, making them an attractive option for those looking to save without sacrificing quality.

“Private labels not only offer an economical option for consumers but have also democratized access to quality products across all socioeconomic levels,” says Luis Gradilla, CPS Leader at NIQ Latin America. “This phenomenon reflects a clear trend in the evolution of consumption in the region.”

Penetration of Private Labels and Preferences by Country

In their quest for expansion across the region, private labels have already achieved near-total penetration in several countries: 99.7% of households in Puerto Rico, 99.6% in Mexico, 99.4% in Chile, 99.2% in Colombia, and 48% in Brazil. Colombia stands out as the most developed market in terms of spending on private labels, allocating more than 20% of annual spending to these products. In contrast, Brazil allocates only 1% of its annual spending to private labels.

When considering spending on private labels by Socioeconomic Level (SEL), performance varies by country. At the regional level, the High Socioeconomic Level allocates 9% of its spending to these brands, the Medium Socioeconomic Level 8%, and the Low Socioeconomic Level 7%. Analyzing by country, in Puerto Rico, the Medium Socioeconomic Level spends the most on private labels, while in Colombia, the High Socioeconomic Level spends the least. In Mexico and Chile, spending is more balanced across different socioeconomic levels. In Brazil, despite being the country with the least development of private labels, the High Socioeconomic Level allocates a higher proportion of its spending to these products.

Category Preferences in Private Labels

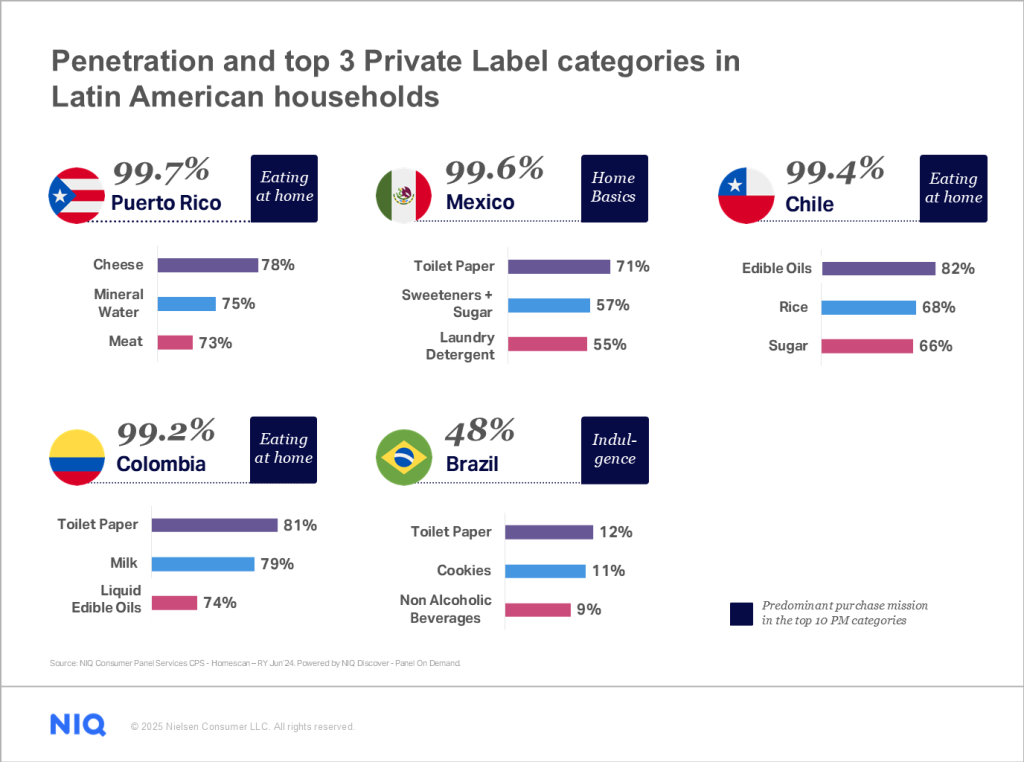

According to the consumer panel study, Latin American households primarily buy private label products for their Basics Basket, but with different shopping missions depending on the country. In Puerto Rico, Chile, and Colombia, “Eating at Home” categories are prioritized within the top 10 private label products. In Mexico, “Home Basics” categories are the most important, while in Brazil, “Indulgence” categories are prioritized.

Thus, private labels have performed better in key categories such as Toilet Paper with a penetration of 71% in Mexico, 81% in Colombia, and 12% in Brazil. Edible Oils reach 82% in Chile and 74% in Colombia. In Puerto Rico, Cheese stands out with 78%, while in Mexico, Laundry Detergents reach 55%. In Colombia, Milk has 79% of household consumers; in Chile, Rice reaches 68%, and in Brazil, Private Label Cookies have 11% of household consumers.

Although inflation has driven the shift towards private labels, Latin Americans have not stopped consuming indulgence products, as is the case in Brazil with Cookies and Alcoholic Beverages, or in Mexico with Cookies and Snacks, prioritizing essential foods but not giving up small pleasures.

“This study confirms that private labels are playing a key role in the daily lives of Latin American consumers, allowing them to better manage their budget in the face of inflation without compromising the quality of the products they purchase. With their sustained growth, these brands will continue to gain prominence in households across the country,” concludes Gradilla.

Understanding the Private Label Consumer

Enhance your strategy with our Consumer Panel. Complete the form if you would like a meeting with our team to acquire the study with actionable insights by country.