A major shift in competition

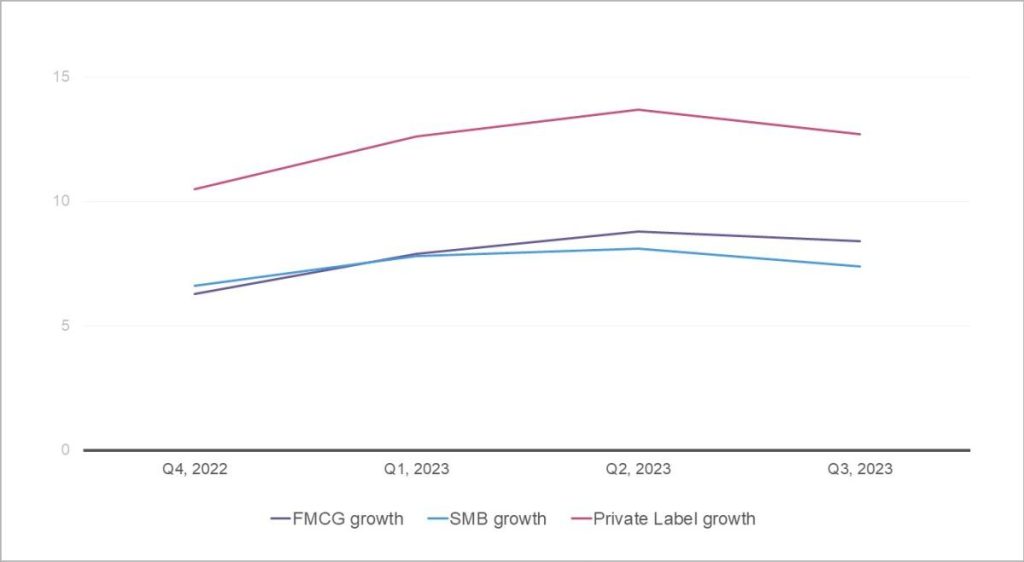

Right up to Q3 2022, both private label and SMB brand growth stayed close to the global FMCG value median. Right after, in Q4 2022, the picture started to change—private labels were gaining ground.

By 2023, private labels had grown so much that they were competing with manufacturers of all sizes, becoming a strong contender for SMBs. While the growth trajectory for private labels might have fluctuated between a couple of percentage points, it remained consistently above the FMCG market growth rate.

So, what happened and how did their position in the market make this shift? A deep look into the data provides a two-part story: the readiness for the opportunity, and the opportunity itself.

Private labels prepared

Private labels were born from a recognized opportunity. Early on, retailers recognized the consumer’s growing need for affordable options, and since they owned—and could capitalize on—shelf space, private labels were set up for success.

Growth only came when they started paying attention to the data, watching consumer buying behavior, and understanding the real need: finding a balanced combination of affordability, quality, and innovation.

With the post-pandemic reality becoming clearer, retailers worked to improve the quality and packaging of their private-label product offerings.

Consumers took notice of savings opportunities in the current inflationary climate and pivoted to private labels in droves. With the rest of the product mix fulfilling their needs (quality, availability, etc.), there was no deterrent for consumers to make the switch.

The opportunity took shape

To recap, NIQ’s Economic Divide research segments consumers into five distinct groups based on how their financial situation has been impacted in response to recent economic and societal pressures. The chart below shows where consumers fell over the past year of this study.

So, it begins to make sense that across the globe, 39% of consumers self-identify as “Cautious” spenders, those who have not been impacted financially by recent events but remain cautious with spending.

In today’s socioeconomic climate, even the most financially flexible may feel the pressures of rising prices.

Consumers have been able to adapt to the delicate state of the world today largely because jobs have been plentiful, but should employment rates be challenged, we could see a huge tear in the fabric of consumer confidence globally. Astute leaders should tune into the growing financial polarization across the next 5 years and align portfolios, pricing, product, innovation etc. to the growing spectrum of spending power and spending strategies.

Innovate, but don’t reinvent the wheel

Though growth rates do not match those of private labels around the world, the resilience and agility of SMBs put them at a great advantage to compete.

Local or small brands have the same advantage as private labels when it comes to perception, as 47% of consumers find local or small brands to be more cost-effective than large brands.

“There are two major components to a successful growth strategy for an emerging brand. The first is the consumer. Understanding your target market—and keeping tabs on their changing needs and influences—will have to stay front and center all the time,” noted Andrew Criezis, Global SMB President.

“The second component is the product mix, albeit not in its entirety and not all the time. The spotlight will shift according to what needs attention now or will need attention in the very near future. A continuous audit of the product line and range, pricing strategy, distribution plan, positioning, and promotion will uncover what requires your attention.

It might seem overwhelming, but the answers, the opportunities and the trends are no mystery – given that a business is backed by the right data.”

For 2024 and beyond, ensuring your brand’s CPG sales aren’t lost to private label brands and other competitors requires a good grasp on the types of data a business should be collecting. Retail data, consumer insights data, and marketing data provide insight into a brand’s own marketing efforts. Retail and consumer insights combine to provide a holistic view of the brand, category, and competition.

The final call to action for small and medium-sized businesses around the world is to include private labels in your benchmark list. They’re not just here to stay, they’re here to grow.

Fuel your growth

Learn how your business can access market, category, and channel data.