The KSA & UAE Consumer Landscape

NIQ, the world’s leading consumer intelligence company, reveals insights on GCC shoppers as UAE shoppers are slightly more loyal to their brands vs KSA, and they will look for promotion of their brand choice.

The economic growth in both regions remains robust as in KSA the rate of inflation is still controlled, while in the UAE it is broad-based, driven by strong activity in the tourism, construction, and financial services sectors.

The KSA market is showing flat performance in the first half of the year after a high base of last year while UAE sees consumption-led growth.

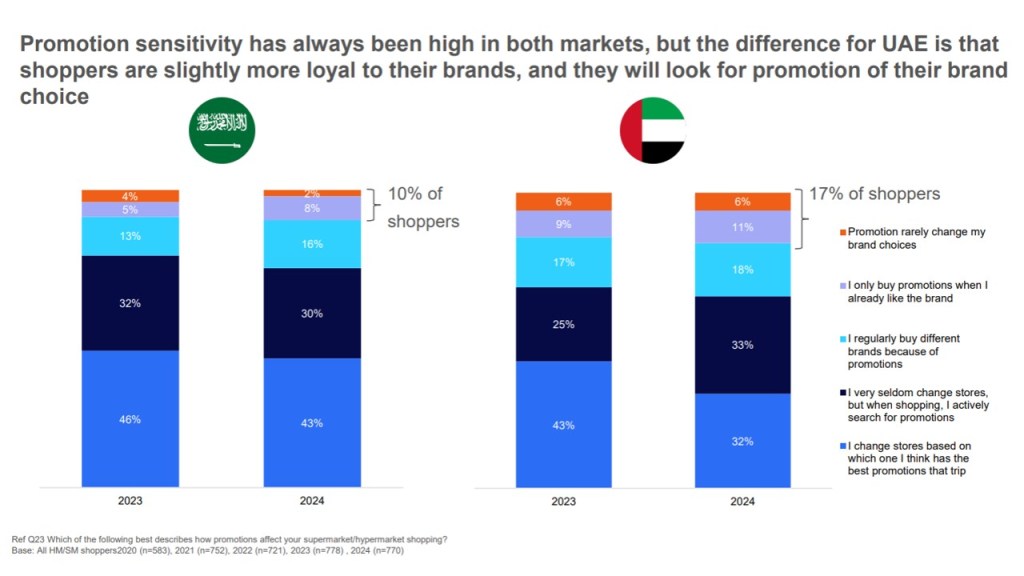

Promotion Sensitivity

While both UAE and KSA shoppers are highly promo-sensitive, UAE shoppers exhibit a slightly stronger inclination toward brand preference. This suggests that while promotions are influential, brand reputation and trust play a significant role in their purchasing decisions.

KSA’s higher promo intensity, coupled with increased efficiency, suggests that brands are strategically utilizing promotions to drive sales while minimizing costs. Temporary price reductions appear to be the dominant promo type.

While the UAE has maintained a stable promo intensity, there has been a slight decline in efficiency. Temporary price reductions have become more prevalent in recent years, suggesting a shift in promotional strategies.

Implications for Brands and Retailers

72% of shoppers in UAE and 71% in KSA claim that they are willing to pay more for quality products as they care about quality. This number has increased +4 points vs a year ago which shows the demand from consumers to look for their needs where health and wellness was one of the priorities.

Another important implication for brands and retailers is convenience. 63% of shoppers in UAE and 64% in KSA believe it is worth paying more for anything that saves time for them. More importantly, this number has gone up by almost +10 points vs a year ago. This validates the rise of smaller formats and E-commerce where these channels provide high convenience.

FMCG Segment

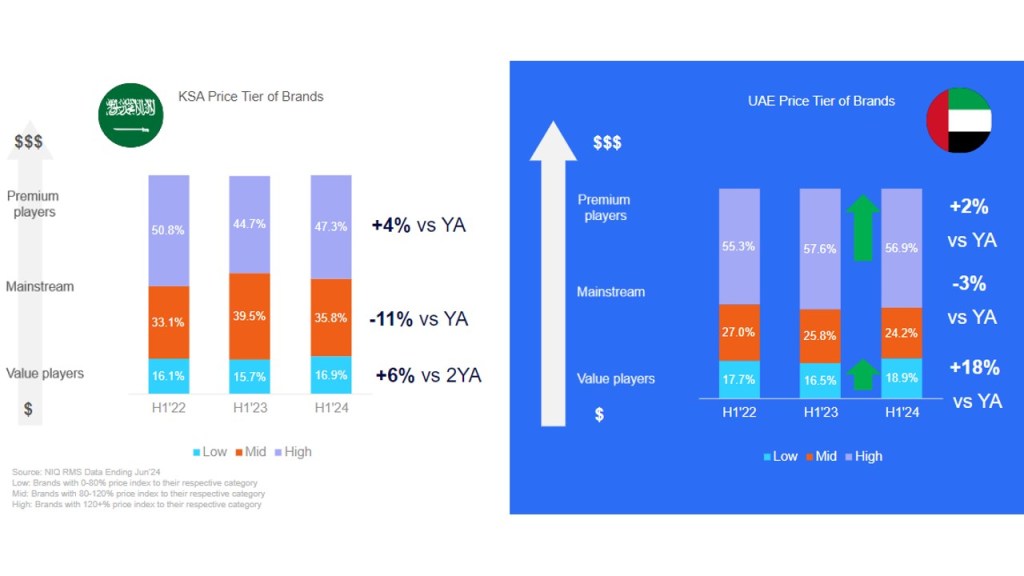

Leading the UAE market fragmented between affordable brands & premium brands. Whereas the KSA market is skewed towards mainstream brands, and this is the growth engine.

The FMCG market in KSA is characterized by a more concentrated mid-tier segment, leading to a decline in the number of brands. In contrast, the UAE market has witnessed brand growth, driven by the introduction of new brands and innovative premium offerings.

Additionally, beverages, frozen food, and dairy consistently dominate the FMCG sector in both the UAE and KSA due to their essential nature, convenience, and rising consumer demand. Conversely, the decline in categories like home care, baby care, and paper products can be attributed to shifting lifestyles, and an increased preference for online channels.

As per the recent census study conducted by NIQ, number of stores in HORECA (hotel, restaurant, cafe) has witnessed a drastic growth in 4 key cities in KSA. We have seen growth in almost all HORECA channel types whereas Coffee & Tea shops is one of the fastest growing. In line with the increasing beverage consumption, this channel type grew by +67% in last 2-3 years. This clearly shows the changing lifestyle of Saudi consumers and increasing demand for these store types.

Tech & Durable segment

The T&D market in the UAE and KSA is witnessing varied performance, with organized retail continuing to dominate as the leading shopping destination in both regions. Both markets have seen growth in the premium segment, KSA with 4% and UAE with 2% growth. Entry level segments observed similar growth.

However, mainstream portfolios are facing challenges as consumers increasingly opt for value purchases or invest in aspirational brands. In KSA, the shift towards premium brands mirrors the trend observed in the UAE, where value-oriented players are experiencing double-digit growth, up 18% compared to the previous year.

The T&D industry is experiencing exponential growth in both regions, with a notable increase in the number of active brands and products. In KSA, active brands and products have surged by 27%, while the UAE has seen a 28% rise, reflecting the industry’s focus on capitalizing on emerging growth opportunities.

Despite the growth in organized retail channels in the UAE, traditional trade remains significantly larger in KSA in terms of overall market value. However, independent retailers in the UAE TCG market are making substantial gains, signalling a shift in consumer preferences and heightened competition. As the T&D landscape evolves, businesses across the UAE and KSA continue to adapt, seeking to capture the growing demand for both premium and value-driven offerings.

Andrey Dvoychenkov, APP Cluster Leader comments: “The UAE’s diverse population and differences in disposable income have created a polarized FMCG market. Affordable brands resonate with price-sensitive consumers, while premium brands attract those prioritizing quality and luxury. In contrast, KSA’s larger population and competitive market dynamics have driven the success of mainstream brands, which offer a balanced mix of quality and affordability appealing to a broad consumer base. In addition, the T&D industry is rapidly expanding in both regions, marked by a significant rise in active brands and products.”